Galeanu Mihai/iStock via Getty Images

By Sam Peters, CFA

Market Should Pivot to Value Leadership

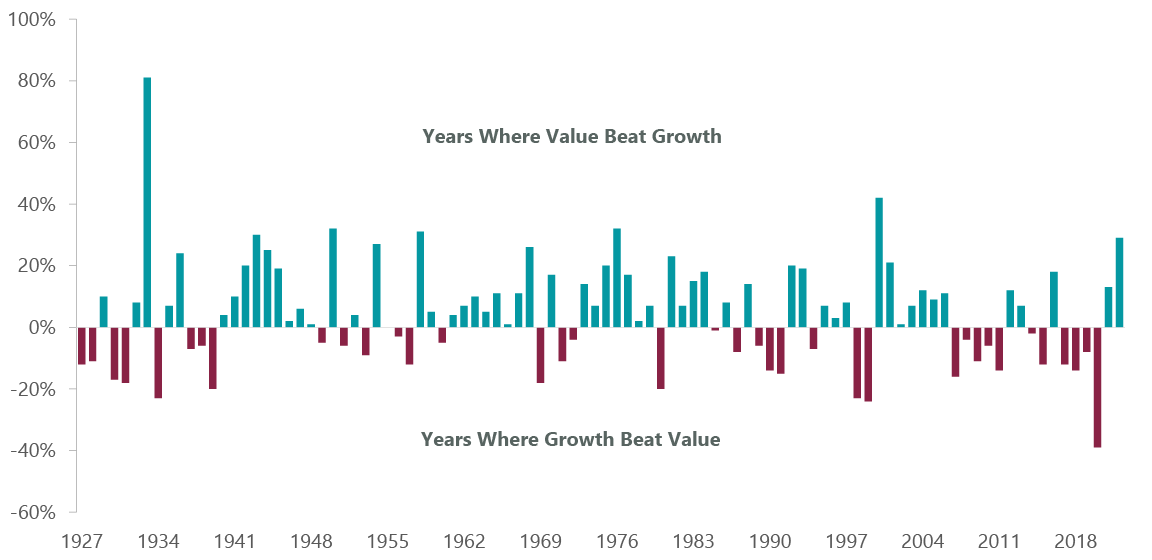

Despite an uptick in growth’s performance during the first quarter of 2023, value’s strong two-year outperformance supports our view that we are in the nascent stages of a new, value-dominant market cycle. To truly appreciate these opportunities, it is helpful to illustrate where we are in the cycle and what that means for investors.

Over the past century, value investing has historically outperformed growth, on average, by 4.4% according to Professor Ken French. While this can serve as another supporting argument for long-term value investing, it hides the reality that long-term market performance comprises a series of five- to 10-year market cycles where leadership and outperformance rotate between growth and value.

Exhibit 1: A Century of Cycles

As of December 31, 2022. Source: Ken French Data Library. Performance is calculated as the difference in annualized, one-year returns between the lowest 30% price-to-book of NYSE securities and highest 30% price-to-book of NYSE securities (plus NYSE Amex equivalents since July 1962 and Nasdaq equivalents since 1973).

For example, the bursting of the tech bubble in 2000 proved to be the end of the late 1990s growth cycle, as investors who had piled into high-profile Internet startups pivoted away from long-duration, high-growth stocks into tangible commodity and materials companies and looked overseas for opportunities in the emerging economies of Brazil, Russia, India and China. This largely persisted until the Global Financial Crisis [GFC] in 2008 and global central bank injections of liquidity into markets resulted in a pivot back to growth. Low interest rates and cheap capital then helped support the rising market dominance of the FAANG stocks.

We see the COVID-19 pandemic as the same kind of pivotal moment for markets that began the reversal to value leadership. With value stocks reaching historic lows in valuation relative to growth by early 2020, the volatility of the pandemic combined with rising inflation and interest rates have created an environment where value stocks thrive. While history shows that within these arcs there will be short-term fluctuations in leadership (i.e., quarters where growth outperforms in a value cycle and vice versa), we believe we are still in the early stages of an era that will be characterized by higher inflation and interest rates than the past two decades. Conditions are ripe for a strong and persistent value cycle.

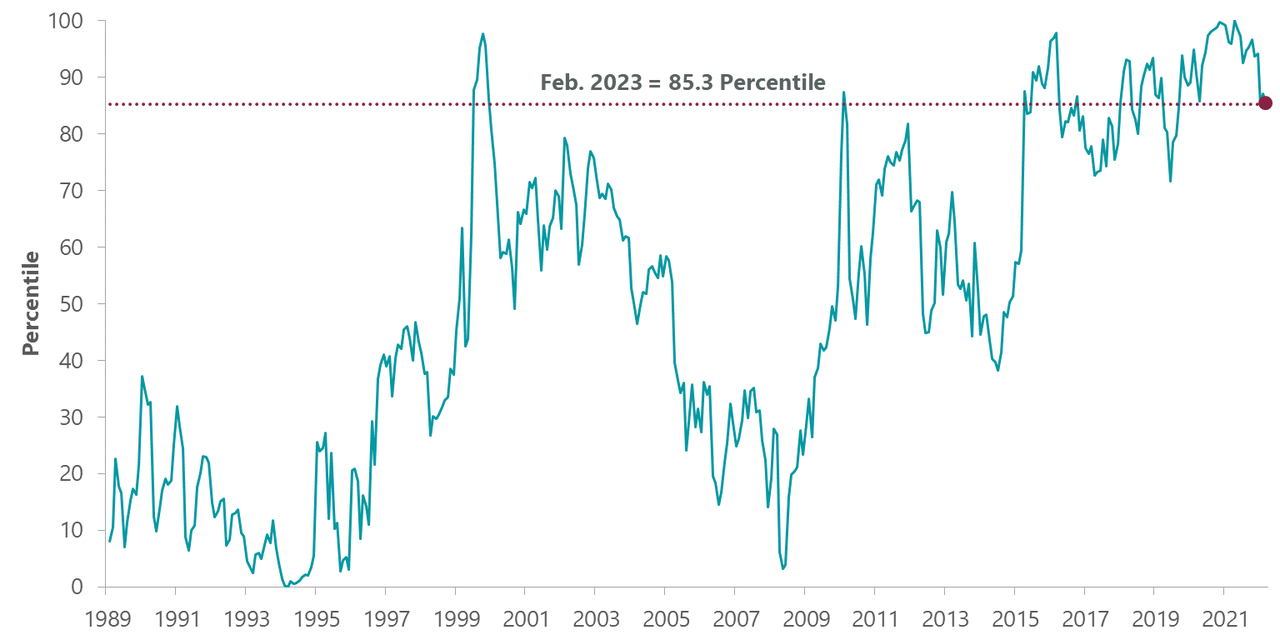

The other indicator of an early-stage value cycle is the start of a rebound in valuation spreads. One of the common factors of new market cycles is that whatever goes on to lead performance starts off extremely cheap. As the 2000s tech bubble burst, value was in the 95th percentile in history. It would go on to reach near parity with growth by 2008 and the beginning of the GFC. Likewise, in 2008, the FAANG stocks that would go on to dominate started their growth cycle extremely cheap as the value of growth reached highs. Prior to the COVID-19 pandemic, the fervor surrounding growth caused the valuation spread between growth and value stocks to reach an all-time high. However, even with value’s strong performance the last two years, the valuation spread between growth and value stocks remains at historic highs, having rebounded from the 100th percentile in 2020 to only the 85th percentile as of early 2023.

Exhibit 2: Spreads Remain at All Time Highs

As of February 28, 2023. Source: ClearBridge Investments analysis. The US Large Cap universe is defined as the union of the Russell 1000 Index, MSCI US Index, S&P 500 Index and S&P 400 Index. Hypothetical value composite includes five value measures: book-to-price, earnings-to-price, forecast earnings-to-price, sales-to-enterprise value and enterprise value-to-free cash flow; spreads are measured based on ratios. To construct industry-neutrality, the value spreads are constructed by comparing the aforementioned value measures within each industry, which are then aggregated up to represent an entire portfolio. Spreads are constructed from value (top 30th percentile), Neutral (31st to 70th percentile) and growth (bottom 30th percentile) using GICS industry neutralized value ranks. The value spread and percentile is calculated using the average of the ratio of the Growth to Value portfolios using the five value measures.

Compared to the recent value cycles of 2000 and 2008, the outperformance by value over the past two years represents only the tip of the iceberg. As investors recognize there is no return to the pre-COVID growth cycle, value stocks will shift toward historically normalized levels, creating compelling opportunities for investors.

Although value still has a way to go to catch up to the substantial returns that growth delivered over the last decade, we believe the COVID-19 pandemic fundamentally changed current market conditions and set up value for outperformance. We believe value’s recent performance, historical precedent, current macroeconomic conditions and unsustainably low valuation spreads are all strong supporting arguments that we have entered a strong value cycle that still has a long way to go.

Sam Peters, CFA is a Portfolio Manager and co-manages the Value Equity Strategy and the All Cap Value Strategy, and has over 30 years of investment experience. Sam earned a BA in economics from the College of William & Mary and an MBA from the University of Chicago. He received the CFA designation in 1997.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.