Enjoyable dialog in Barron’s about Steering Purchasers Away From Dangerous Investing Errors. Douglas Boneparth of Bone Fide Wealth, Jennifer Li of EP Wealth Advisors, and yours actually.

We focus on anticipating and thwarting the dangerous habits the place traders hurts themselves:

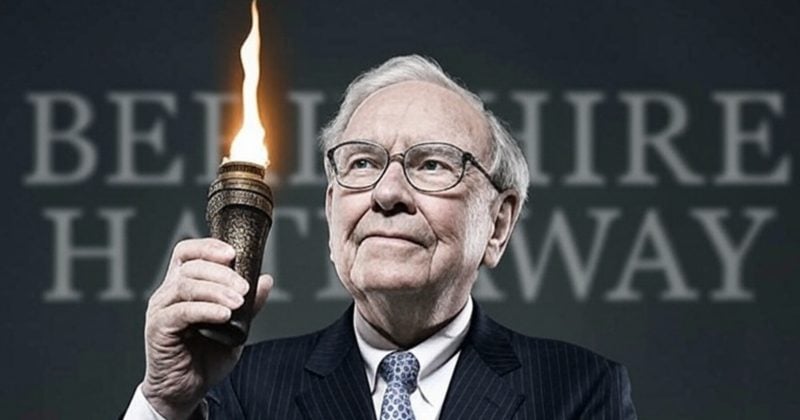

“Avoiding dangerous selections lies on the coronary heart of How To not Make investments, a brand new ebook by Barry Ritholtz, the founder and chief funding officer of Ritholtz Wealth Administration, a monetary planning agency with $5.6 billion in property beneath administration. Ritholtz stated that the ebook attracts inspiration from main funding minds reminiscent of Charles Ellis, the founding father of consulting agency Greenwich Associates and the previous chairman of the Yale Endowment, and the late Charlie Munger, a vice chairman at Berkshire Hathaway and Warren Buffett’s longtime sidekick. Each traders, says Ritholtz, subscribed to the view that “we’re all higher off if we simply make fewer errors.”

Plenty of good recommendation from the trio.

Test it out right here.

Supply:

How Subsequent-Era Advisors Steer Purchasers Away From Dangerous Investing Errors

A key function of a monetary advisor is to forestall purchasers from making rash choices throughout risky markets.

By John Kimelman

Barron’s Could 01, 2025