NicoElNino/iStock by way of Getty Pictures

In basketball, it’s arduous to win video games in case your group solely shoots three-pointers or solely focuses on protection. Immediately, some traders may be making the identical mistake and solely focusing their fairness portfolios solely on offense or protection. Pondering if it’s time so as to add in commodities? Ought to they begin eager about Treasury Inflation-Protected Securities, or TIPS? Ought to they begin digging within the yard for oil? Like in basketball, being balanced could result in extra profitable outcomes. A technique to assist obtain this stability: issue investing.

Look To Rating With Worth

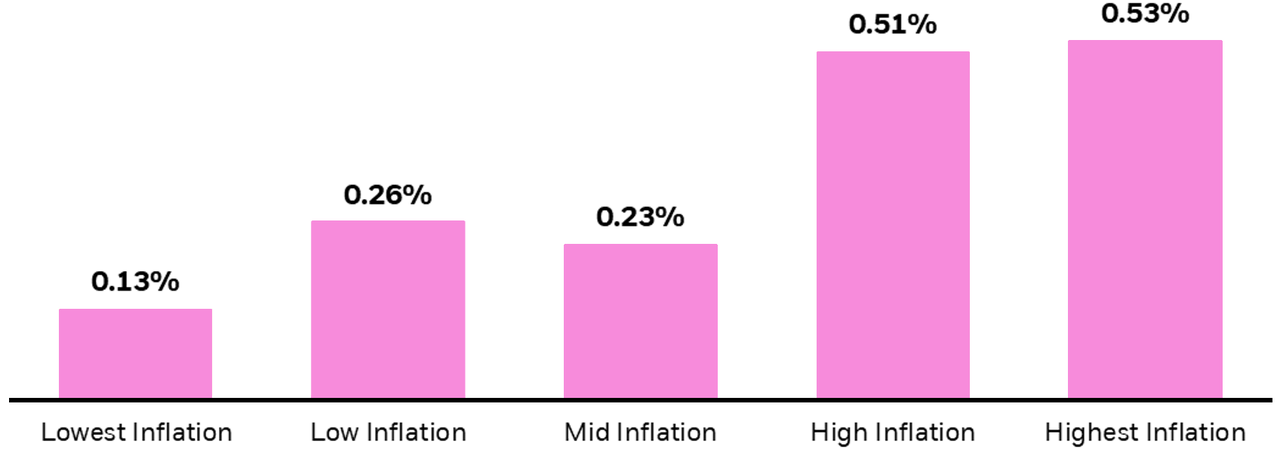

Amid rising inflation and rising rates of interest, we imagine worth firms — companies which can be priced low cost relative to their fundamentals — could also be poised to rally. To check this idea of worth shares being a greater hedge for inflation than progress, BlackRock analyzed knowledge going again to the Nineteen Twenties and located that traditionally this certainly has been the case.

Common month-to-month outperformance of worth vs progress throughout varied inflation regimes since 1926

Supply: BlackRock with knowledge from Kenneth R.French Knowledge Library and Robert J. Shiller. Knowledge from 7/1926 to 10/2021. Knowledge makes use of the CRSP universe which incorporates all firms included within the U.S. and listed on the NYSE, AMEX, or NASDAQ exchanges. Inflation is decided by utilizing YoY adjustments in CPI and breaking into quintiles. “Worth outperformance” represents the efficiency of worth shares minus progress shares as outlined by the Fama and French HML analysis issue (excessive e-book to cost minus low e-book to cost). Previous efficiency doesn’t assure future outcomes.

Protection (Can Assist) Win Championships

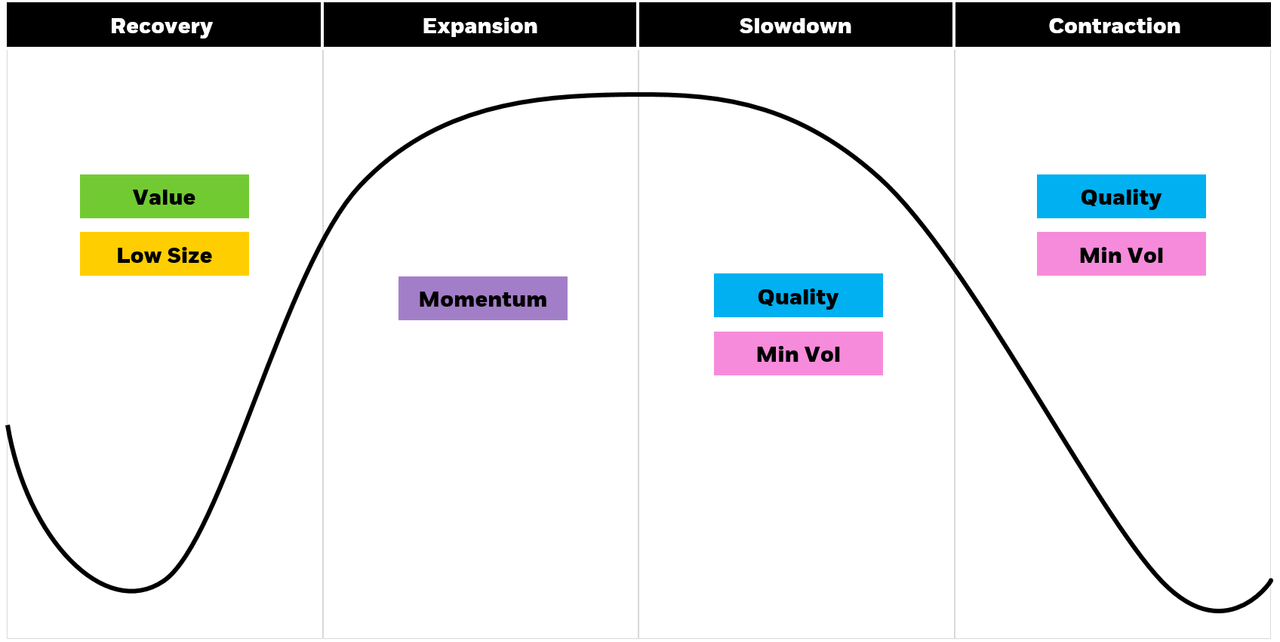

As geopolitical tensions have elevated, we expect traders can search to navigate uncertainty by pairing worth with extra defensive, high-quality exposures. High quality supplies a pure ballast to pro-cyclical worth as the 2 elements are usually negatively correlated — high quality has tended to outperform when worth underperforms, and vice versa. This demonstrates the potential diversification good thing about pairing worth and high quality shares.

Demonstrating Issue Cyclicality

For illustrative functions solely.

Firms with robust stability sheets and secure earnings can present resiliency amid opposed financial situations. Merely put, high-quality companies have traditionally fared higher when markets had been unstable1, or the enterprise cycle was maturing2. For inflation, high quality firms can flex their pricing energy to fight rising enter prices, which we imagine is a bonus relative to conventional worth ballasts akin to progress.

For risk-averse traders, rising pressure from the battle between Russia and Ukraine has brought about a flight to perceived secure havens like US treasury bonds and money. However timing the market may be very tough:

Leveraging minimal volatility as a part of a long-term core can assist traders keep within the sport when the photographs aren’t falling and volatility creeps again into fairness markets. Minimal volatility fairness methods intention to climate the ups and downs of the market higher as they have an inclination to carry extra low volatility shares, and shares with low correlations for diversifying potential. When it is arduous to attain, generally one of the best offense is an effective protection. Minimal volatility can assist traders keep invested within the fairness market.

Abstract

Increased inflation, an financial reopening, and rising charges, could also be a tailwind for the worth issue. However identical to a basketball group doesn’t wish to include solely three-point shooters, barbelling worth publicity with a extra defensive issue, like high quality or min vol, could give traders the chance to remain within the sport and seize a possible worth rally.

1 Supply: BlackRock as of 12/31/21. Refers to potential danger discount through the Chinese language Market Crash as Jun 2015 – Aug 2015, 2018 Vol Spike as Feb 2018 – Mar 2018, and the Covid-19 Disaster as Feb 2020 – Mar 2020. High quality is measured by the MSCI USA Sector Impartial High quality Index.

2 BlackRock as of 12/31/21, with knowledge from Refinitiv, IBES, IDC, and NBER, as of March 31, 2021. High quality efficiency refers back to the extra return of high quality shares over the Russell 1000 Index. “High quality” is outlined as the highest quintile of shares ranked within the Russell 1000 Index utilizing a proprietary analysis display that assesses firms on working and capital allocation high quality. “Maturing enterprise cycle” refers to Midcycle durations, that are calculated by splitting expansions into halves and recessions into halves, with midcycle being the primary half of the enlargement section.

Funding entails danger. The 2 primary dangers associated to mounted earnings investing are rate of interest danger and credit score danger. Usually, when rates of interest rise, there’s a corresponding decline out there worth of bonds. Credit score danger refers back to the risk that the issuer of the bond won’t be able to make principal and curiosity funds. There could also be much less info accessible on the monetary situation of issuers of municipal securities than for public firms. The marketplace for municipal bonds could also be much less liquid than for taxable bonds. A portion of the earnings from tax-exempt bonds could also be taxable. Some traders could also be topic to Various Minimal Tax (AMT). Capital positive aspects distributions, if any, are taxable. Index efficiency is proven for illustrative functions solely. You can not make investments immediately in an index. Previous efficiency isn’t any assure of future outcomes.

This put up initially appeared on the iShares Market Insights.