PeopleImages/iStock via Getty Images

With State Street (NYSE:NYSE:STT) trading at a price-to-book value of 1.0x, the company is starting to look like an intriguing investment at its $67.03 share price offering investors the opportunity to get a piece of the fees charged in the asset management industry. Currently trading at 9.4x P/E, State Street has shown good profitability over the past decade and has returned plenty of cash to long-term shareholders in the form of dividends and share buybacks as this article will discuss. Since I last wrote about State Street back in October 2019, the company has returned 28.7%, increasing its dividend and ROE over the time period.

Latest Q1 2023 Results

State Street’s latest Q1 2023 results show the tough market environment we are in with EPS down 3% year-over-year. The EPS decrease was being driven by lower fee revenue (9% decrease) but partially offset by higher net interest income. State Street’s fee revenues are driven by their assets under administration, so market valuation weakness feeds into this part of State Street’s revenue (significance of segment to be discussed later). The company kept expenses under control in the inflationary environment with expenses only up 2%.

Despite the banking industry turmoil, State Street continues to look strong financially with ROE of 9.3% and CET1 ratio of 12.1% in the latest quarter. This strong capital ratio allowed State Street to return $1.5 billion of capital in Q1 2023 to shareholders consisting of $1.25 billion in common stock repurchases and $212 million of dividends. As one of the stronger banks in the current market environment, State Street assisted in providing $1 billion of liquidity to a U.S. financial institution in concert with a number of other large U.S. banks during Q1 2023.

Introduction to the Company

State Street is a global investment asset custodian as well as asset manager, which means that revenue is primarily driven by fees being charged based on the amount of assets under custody (AUC) and assets under management (AUM). In addition, the company also has net interest income revenue stemming from its client lending operations. The company’s relationships built through servicing their clients investment needs also allows for other cross-selling business avenues such as foreign exchange, securities financing, and software and processing fees which further help diversify the revenue base.

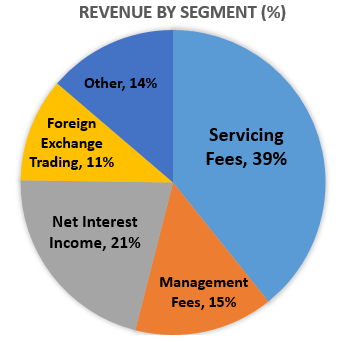

As can be seen in the below graph’s segmentation of State Street’s revenue the company’s bread and butter is its servicing fees, which are earned on the AUC for providing investment services to institutional investors, such as clearing, settlement and payment services.

State Street’s Revenue Breakdown (compiled by author from company financials)

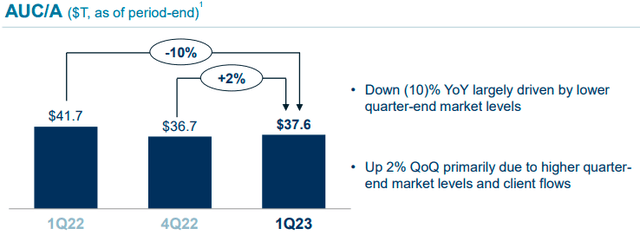

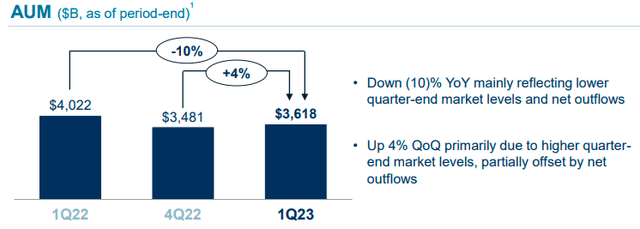

As of Q1 2023, State Street had $37.6 trillion (yes, that’s right… trillion) AUC and $2.9 trillion AUM. These asset figures are affected by both market-level movements and net new client wins.

Q1 2023 AUA at State Street (from Q1 2023 investor presentation)

The company is also present in the growing exchange-traded funds space through its SPDR product lines of ETFs. State Street’s SPDR S&P 500 (SPY) ETF is one of the oldest ETFs in the world and currently has around $380 billion in AUM. SPY also used to be the largest and most actively traded ETF in the world, but with privately owned Vanguard’s S&P 500 ETF (VOO) now having around $820 billion in AUM, SPY is definitely not the largest anymore and probably not the most actively traded either. State Street lost the lead in the ETF space due to its higher fees, such as SPY’s management expense ratio of 0.09% compared to only 0.03% for Vanguard’s S&P 500 ETF.

Q1 2023 AUM at State Street (from Q1 2023 investor presentation)

As is natural, State Street is also currently experiencing some competition and investment service/management fee pressure, which management is attempting to offset by net client wins and various cost management strategies ranging from tech automation to labor reduction. The company is attempting greater cost efficiencies to make up for the competitive pressure on fees so the 2% rise in expenses for the quarter was good news in this inflationary environment.

Profitable but Cyclical

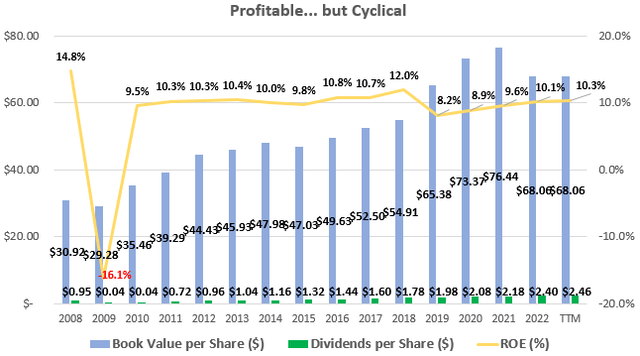

Going all the way back to 2008, the company has achieved average return on equity (ROE) of 8.7%, which includes its one unprofitable year during the financial crisis. The company’s revenues are highly tied to market valuations so a changing market cycle has short-term implications for the company but can also present buying opportunities for contrarian investors.

While this level of profitability is below my rule of thumb of 15% ROE, State Street’s shares are currently trading at book value, which makes an investor’s adjusted ROE quite favorable at these prices, as will be discussed further later. These return figures since 2008 allow me to be confident that, in my opinion, the company is able to maintain and continue to increase its intrinsic value in the future over market cycles.

Profitability and Growth at State Street (compiled by author from company financials)

On the growth side, book value per share has grown from $30.92 in 2008 to $68.06 in its latest quarter, which, when combined with the dividends paid out from equity, has averaged growth of 8.3% annually and further supports the ROE average. The decrease in book value in the latest couple years is not due to poor performance at the company but rather the mathematical effect of State Street repurchasing their shares at much higher values than the price-to-book value as calculated from the financials.

Dividends and Share Repurchases

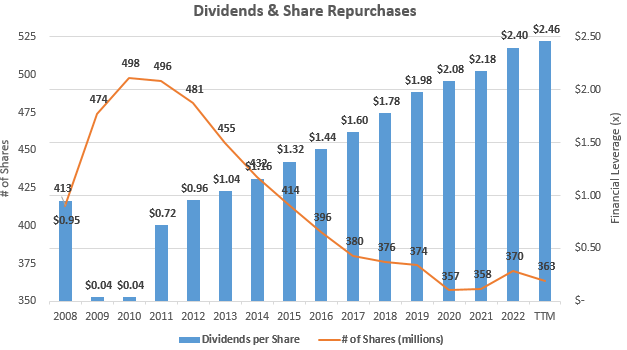

The number of outstanding shares at State Street has been on a bit of a roller coaster since 2008, as it needed to issue shares during the financial crisis like many financial service companies. However, since 2008, the company has still managed to decrease its outstanding shares by 12.0% from 413 million to 363 million in the latest quarter, for an annual average of 0.8% per year.

Share Repurchases and Dividends at State Street (compiled by author from company financials)

If we exclude the financial crisis and look at share repurchases since 2010, State Street has repurchased 27% of its shares from 498 million in 2010 for an annual average of 2.5% per year. Along with State Street’s current 3.7% dividend, that indicates total shareholder yields around 6.2%. Share repurchases by management show capital budget discipline and management’s faith in the long-term prospects of the business so are something I expect to see from a strong management and board when appropriate.

Potential Long-Term Shareholder Returns

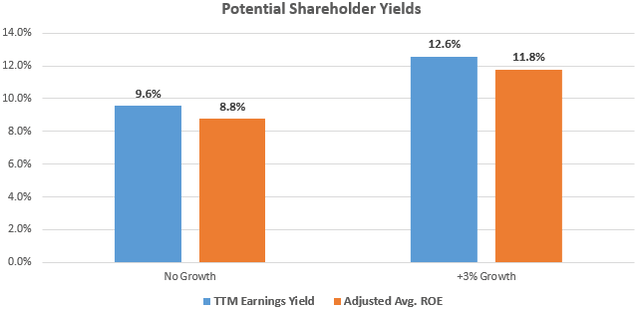

I also always like to examine the relationship between average ROE and price-to-book value in what I call the Investors’ Adjusted ROE. This relationship is especially important for cyclical companies, and is something I consider similar to Shiller’s CAPE ratio but a little simpler to calculate, in my opinion. It examines the average ROE over a business cycle, and adjusts that ROE for the price investors are currently paying for the company’s book value or equity per share.

With State Street earning an average ROE of 8.7% over the past decade and shares currently trading at a price-to-book value of 0.99x when the price is $67.03, this would yield a similar adjusted ROE of 8.8% for an investor’s equity at that purchase price, if history repeats itself. This is right around the 9% that I like to see, and adding a 3% growth rate to represent the company growing alongside GDP could increase this potential total return up to 11.8%.

Earnings Yields Summary (compiled by author from company financials and market data)

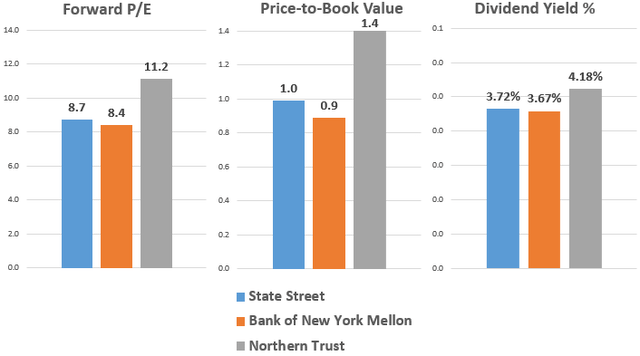

Looking across competitors in the industry, State Street’s valuation is in the middle of the pack based on its forward P/E, P/B, and dividend yield. As can be seen below, Bank of New York Mellon (BK) also looks to be an intriguing investment with the lowest forward P/E and P/B. That competitor is now down 22% as well from 52-week highs while Northern Trust (NTRS) is down a whopping 36% but still the most expensive of the peer group. I have owned both State Street and Bank of New York Mellon in the past and have written about the latter as well back in October 2020. Both companies are likely to take a place in a diversified position within my portfolio again.

State Street Valuation vs Competitors (complied by author from Morningstar market data)

Takeaway

State Street is a strong company to buy on a cyclical swing in the markets so is one contrarian investors should keep an eye out for. The company has done a great job of returning cash to shareholders through both dividends and share repurchases. Its lending business looks to play a smaller part of the business and is healthy with a CET1 ratio of 12.1%. While the company’s average ROE of 8.7% since 2008 is only adequate, being presented with the opportunity to buy this globally important company at book value is intriguing, and I will start to nibble away at current valuations.