Alerting residence consumers to new listings. Serving to patrons make an all-cash supply. Shopping for homes outright. There was no scarcity of actual property startups arriving lately, promising to overtake the enterprise of shopping for and promoting properties.

This week, two extra entered the fray in Seattle, each saying they can provide a leg as much as patrons navigating a fierce sellers’ market: the power to purchase a brand new residence earlier than they promote their previous one.

Knock, a startup based in 2015, gives mortgages and bridge loans, which patrons can use to cowl a down fee on their new home, plus as much as six months of mortgage funds on their previous home and funds to get the previous home prepared for itemizing.

That makes a purchaser “aggressive with money patrons,” CEO Sean Black stated in an announcement. The corporate fees a price of 1.25% of the brand new residence’s buy value.

Orchard, a brokerage, gives a barely completely different mannequin: The corporate buys a consumer’s new home with money, making their supply extra engaging to a vendor, then sells the previous residence.

“Money is all the time king,” stated Hilary Britton, the corporate’s regional gross sales supervisor in Seattle.

The shopper pays a 5% to six% itemizing price for the sale of the previous residence, plus a day by day holding price for the time spent residing within the new home earlier than the previous one sells.

Each firms supply ensures if the previous residence doesn’t promote.

Knock and Orchard be a part of native startup Flyhomes, which gives the same service. Knock is launching in a handful of different Western Washington markets, too, together with areas round Bellingham, Bremerton and Olympia. Orchard not too long ago launched in Portland.

In Seattle’s tight housing market, brokers say would-be sellers typically hesitate to listing their previous residence for concern they gained’t be capable to discover the proper new home in time.

“We now have a stalemate, a logjam in our market,” stated Chris Ranch, a Federal Manner-based Keller Williams agent who plans to assist purchasers use Knock’s service.

Patrons who might as soon as safe a home with a contingency that the deal would shut as soon as they offered their very own home have a far tougher time doing that right this moment.

“There are such a lot of patrons which might be in a position to make a proposal not contingent on their residence promoting that for individuals who do have a house to promote, attempting to get that provide accepted … is extraordinarily troublesome,” Ranch stated.

But it surely’s not clear how lengthy that can final.

House costs and competitors have skyrocketed for the reason that begin of the pandemic, as low rates of interest drew patrons into the market. But most economists count on the market to start to chill down this 12 months, pushed partly by quickly rising rates of interest.

That might tamp down the necessity for particular merchandise that assist patrons compete or increase the danger that householders aren’t in a position to promote their previous residence for the worth they anticipated.

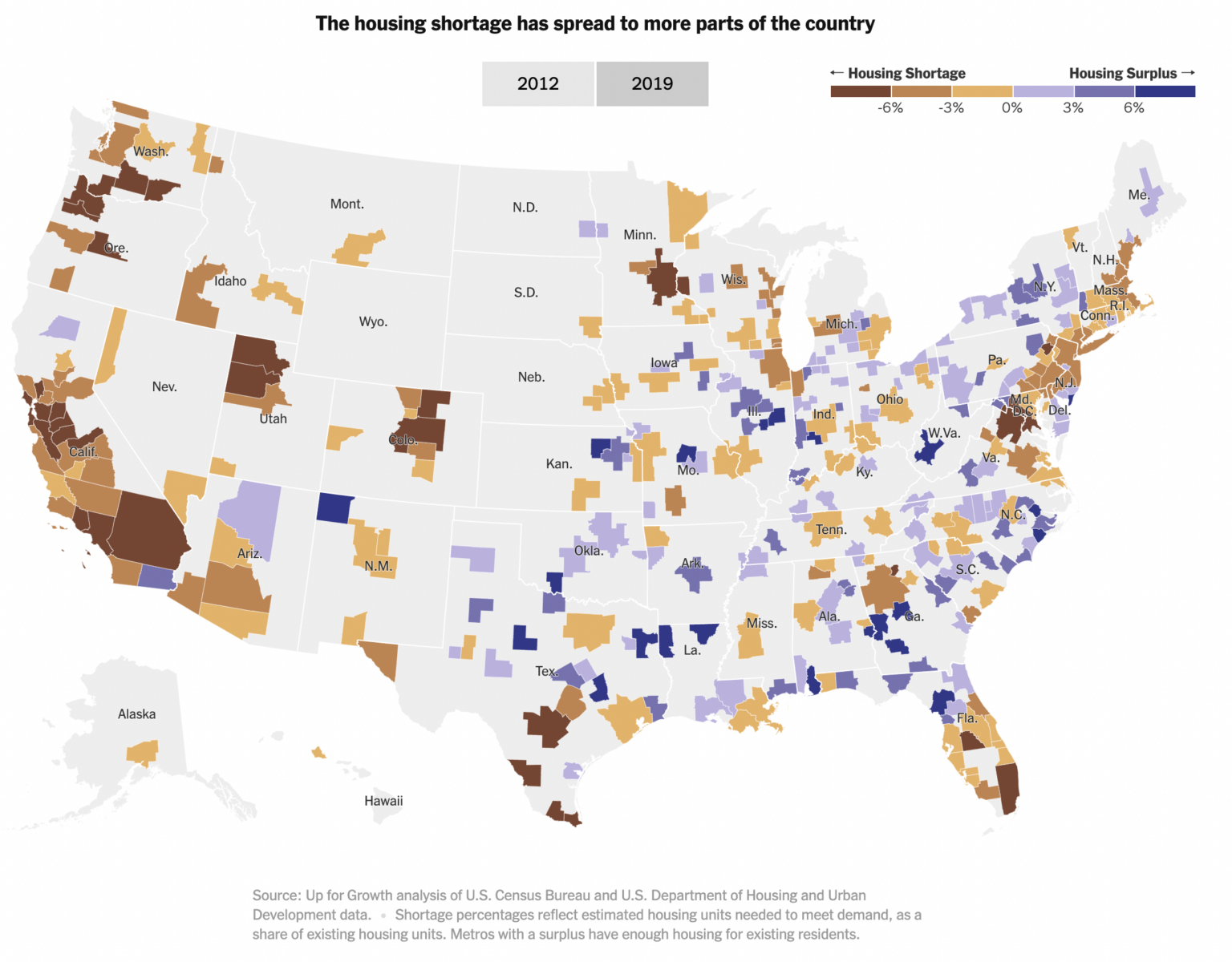

For now, stock is slim. Final month, it will take lower than two weeks to promote all of the properties on the market in King, Pierce and Snohomish counties, in response to the Northwest A number of Itemizing Service. The itemizing service considers 4 to 6 months a “balanced” market.

“The market has been frenetic. That may’t keep it up,” Windermere Chief Economist Matthew Gardner stated. “However it’s nonetheless provide starved.”