Mananya Kaewthawee/iStock through Getty Photos

Final Thursday morning we revealed our article “As Unhealthy Is It Will get,” and to this point that has confirmed to be true.

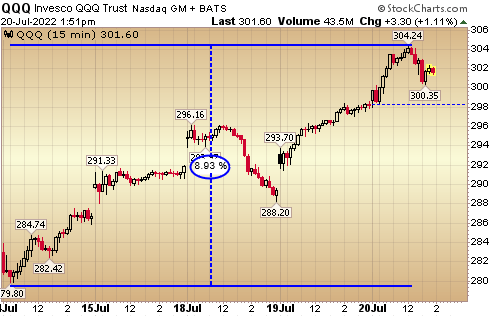

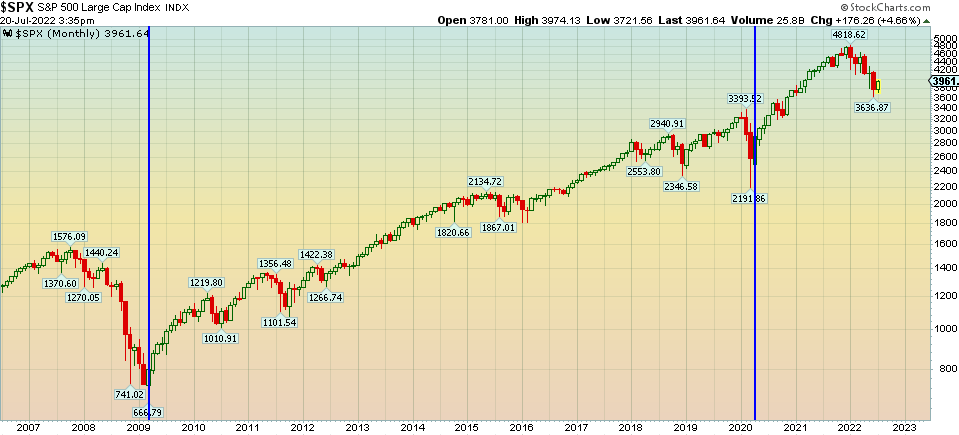

Thursday marked the close to time period lows and as I write this, the S&P is up virtually 7% trough to peak and the Nasdaq up virtually 9% trough to peak:

stockcharts stockcharts

If we glance to the Financial institution of America World Fund Supervisor Survey from this week, we see that almost all managers are positioned “afraid of losin’” and as such, can not win.

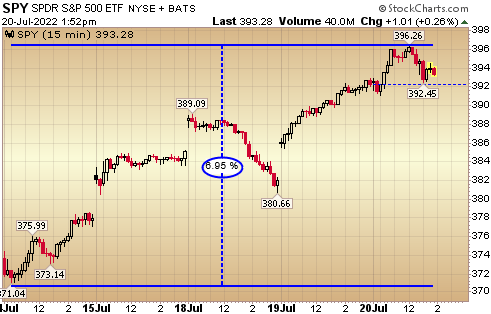

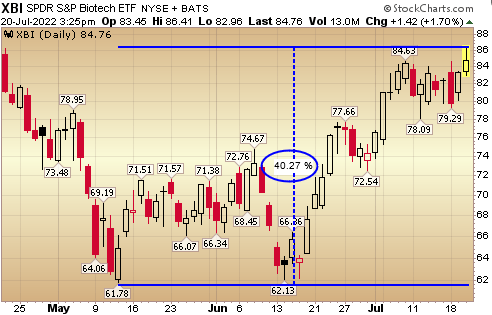

The “exhausting roads” are stepping in at occasions like these when others are promoting within the gap. We noticed it with China shares bottoming in March. We noticed it with Biotech bottoming in Could. We could now be seeing it with the final indices in July.

stockcharts stockcharts

We imagine these tendencies are simply starting and that the final indices could also be subsequent. As we steadily remind viewers on our weekly videocast, “amateurs deal in absolutes, professionals deal in chances.” Proper now, the chances counsel (however don’t assure) higher days forward for the indices.

Listed here are the important thing measures of sentiment we’re this week – in addition to how the most important managers are positioned:

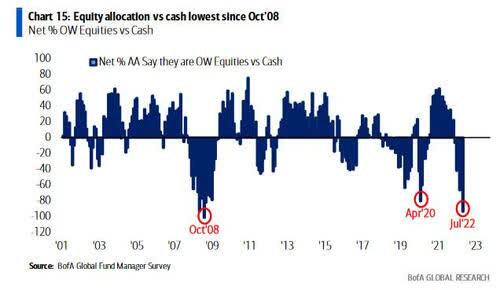

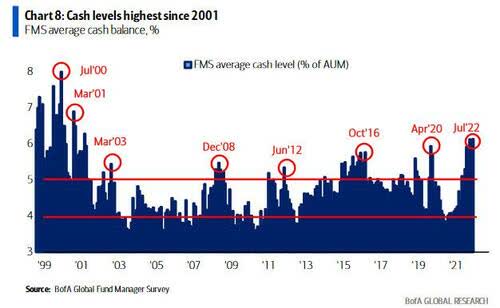

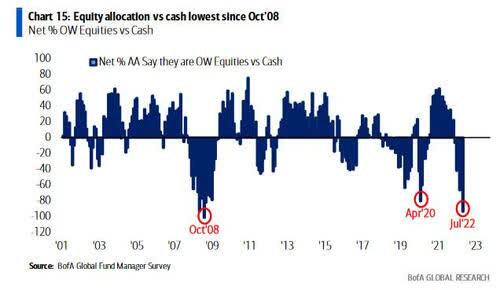

BOFA

Lowest fairness allocation because the GFC and Pandemic. Bears will say that the S&P fell one other 30% (briefly) after the October 2008 lows. They’re the identical of us who had been bearish from 2009-2014 and missed a monster bull market.

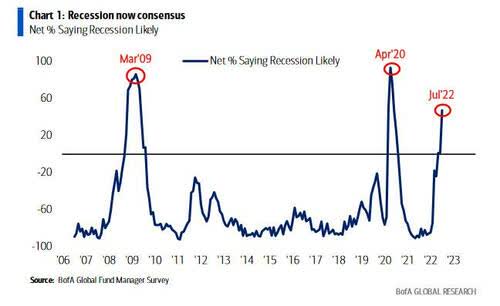

BOFA

Everybody now believes we’re going to have a recession. Have a look at the final two occasions recession consensus was this elevated and what the inventory market did subsequent:

stockcharts

Right here’s the key: they had been proper. We did have recessions in each cases, however the market is a discounting mechanism and priced it in forward of time. The market rallied properly earlier than the recession was “declared.”

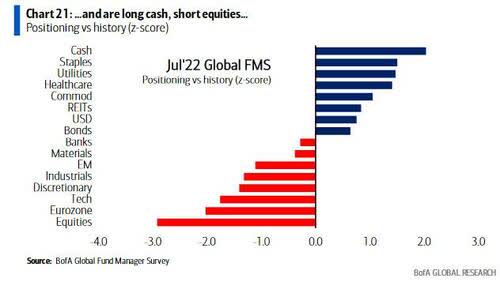

BOFA BOFA BOFA

Managers’ largest place is money. Highest because the 9/11 terrorist assaults. All of this cash shall be panicking again into the market as shortly because it panicked out as soon as the tide turns.

Nobody is positioned for any excellent news at current (Geopolitical, Earnings, Inflation). When one thing clicks, everybody shall be ready for the subsequent “shoe to drop” and miss it – simply as most missed the pandemic lows in 2020 after we put this observe out a few days earlier than the low.

Yahoo! Finance

On Friday I joined Seana Smith, Rachelle Akuffo and Dave Briggs on Yahoo! Finance to debate my inventory market outlook. Because of Taylor Clothier, Jeff Cohen, Seana, Rachelle and Dave for having me on.

Right here had been my Present Notes:

–U of M Shopper Sentiment at 51.1. Since 1980, final 3x it dropped beneath 58, it marked the lows in sentiment and peak in inflation. Avg S&P positive aspects 12 months later had been +20.87%.

-Fed does wish to “scale back demand” however they don’t wish to destroy the economic system. They promised $47.5B in Quantitative Tightening in June. They solely did $7.5B (and had been web patrons of Treasuries). GOAL: Jawbone TOUGH on inflation, however elevate as little as attainable to bide time till commodity rollover exhibits up on the money register for shoppers.

Beige E-book confirmed indicators of a slowdown in demand and elevated danger of recession.

Waller: “Market individuals searching for 100bps in July getting forward of themselves. 75bps get us to impartial in July”

Fed can’t go 100bps right into a slowdown with out breaking issues (see current rise in jobless claims to 244k).

Whether or not FED will succeed or not is dependent upon how shortly not too long ago weakened commodity costs will present up in Shopper Costs.

1. CPI and PPI couldn’t have been any worse. It’s backward trying. Oil, Copper, Corn, Soybeans, Cotton, platinum, Cocoa have all collapsed.

2. Earnings proceed to carry up in the intervening time. Would you moderately promote 10 hamburgers at $10 or 8 hamburgers at $15. Firms nonetheless passing by way of price. Earnings have come down in REAL TERMS by staying regular in NOMINAL TERMS with 8%+ inflation. $250 for 2023 = $230 (with out inflation). The large “estimates takedown” has already occurred in actual phrases.

3. Common hourly earnings within the jobs report had been manageable- operating at 3.7% annualized.

4. Must be in teams that can do properly in a slower development surroundings transferring ahead: Biotech: (XBI up ~32% since Could lows). With a half dozen multi-billion greenback biotech takeouts in current weeks, “animal spirits” are again for the sector. Drug approvals on faucet as FDA normalizes. Worth Tech: META (11.9x 2023 eps), AMZN (down 40%) and so on

EARNINGS:

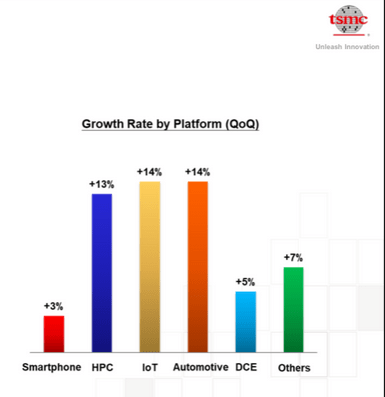

TSM: Beat on High Line, Backside Line and Raised Steerage. Good look on Auto Chips (+14% yoy) which suggests scarcity abating = glut of recent automobiles coming will collapse New/Used automotive costs (key element in CPI)

TSMC

JPM: As shortly as offers dried up, they’ll come again big as soon as market stabilizes. “Shopper/Company stability sheets in nice form. No cracks but.”

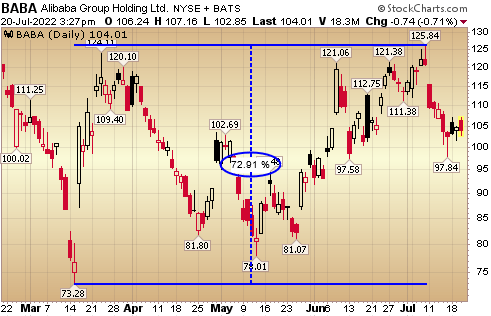

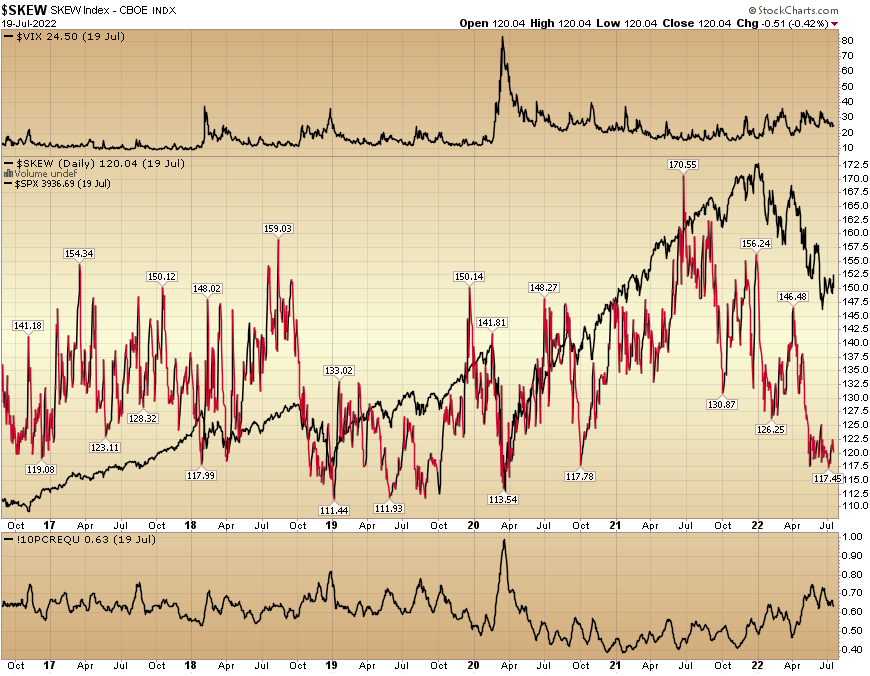

Possibility Skew. Measures price to insure disaster (deep out of the cash places/calls). VIX measures “on the cash.” Skew down at pandemic low ranges, why? Nothing left to insure – home already burned down! Occurs close to inflection factors traditionally.

stockcharts

CGTN America

On Monday I joined Phil Yin on CGTN America to debate Financial institution Earnings, Housing Shares, Fed Coverage and basic market outlook. Because of Delal Pektas and Phil for having me on.

Now onto the shorter time period view for the Normal Market.

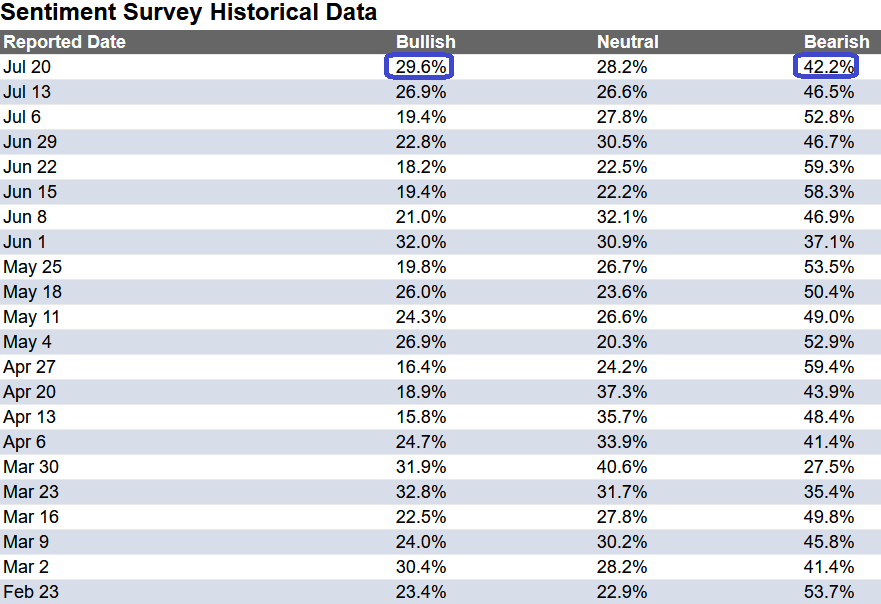

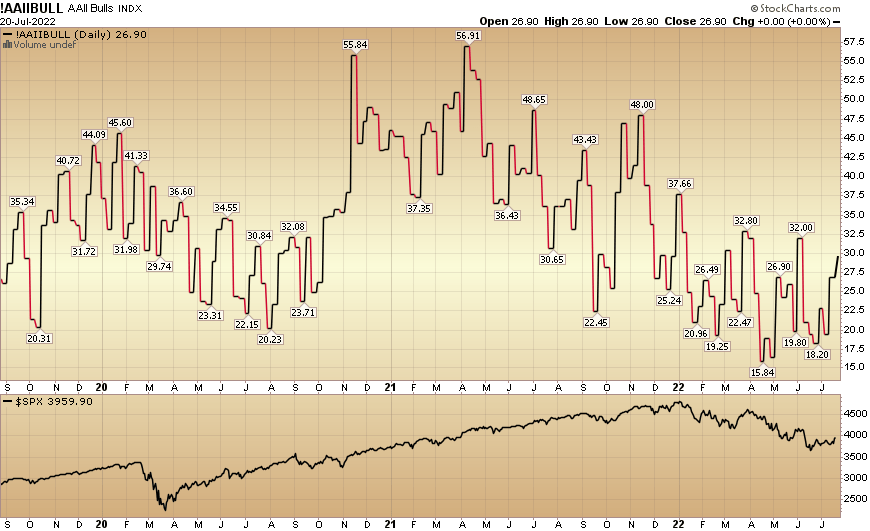

On this week’s AAII Sentiment Survey end result, Bullish % rose to 29.6% this week from 26.9% final week. Bearish % dropped to 42.2% from 46.5%. Retail buyers’ worry is beginning to thaw.

AAII stockcharts

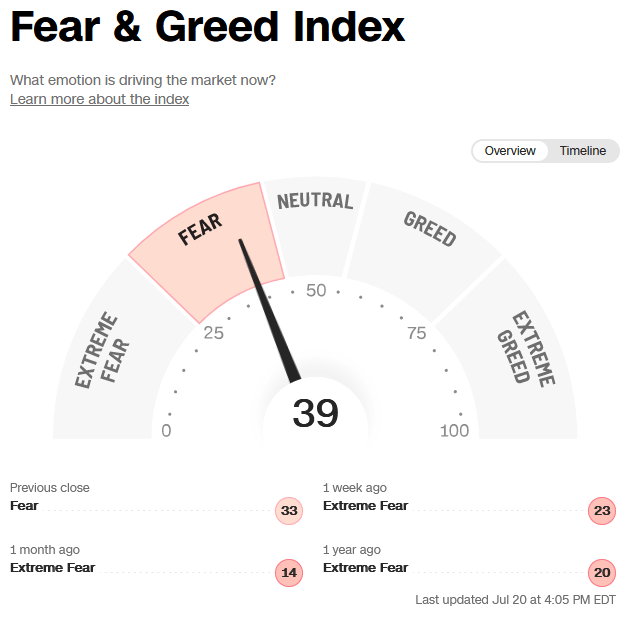

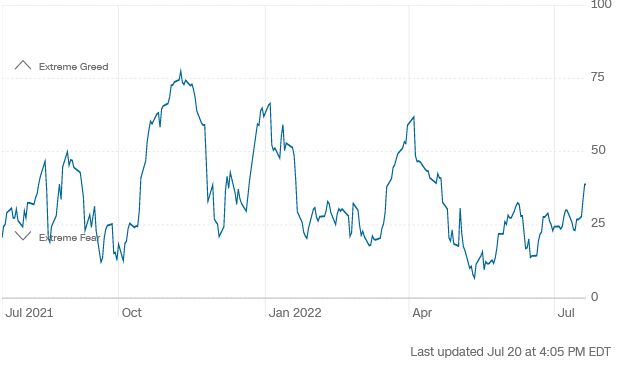

The CNN “Concern and Greed” moved up from 24 final week to 39 this week. This nonetheless exhibits worry, however it’s now easing.

CNN CNN

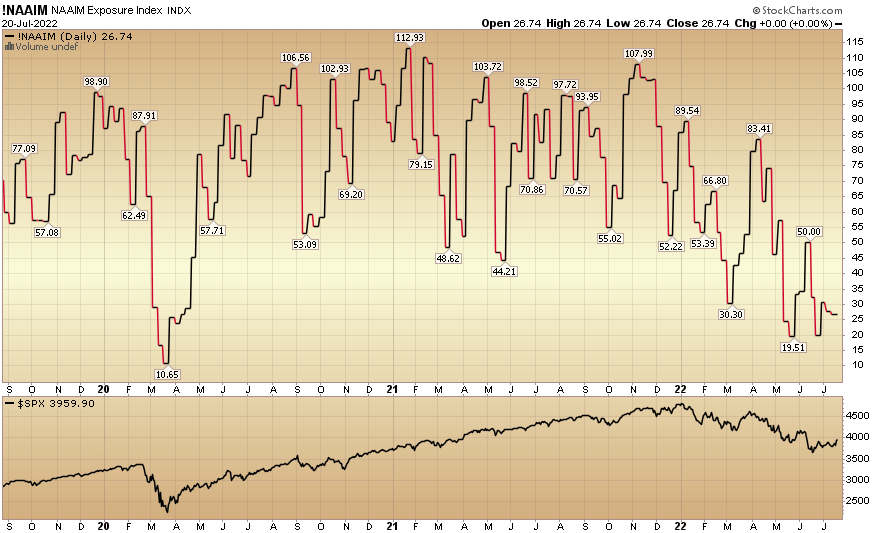

And at last, the NAAIM (Nationwide Affiliation of Lively Funding Managers Index) ticked right down to 26.74% this week from 27.85% fairness publicity final week. Lively managers missed the rally since Thursday. Any surprising additional optimistic information will power them again into the market aggressively.

stockcharts

Writer and/or shoppers could have helpful holdings in all or any investments talked about above.