monticelllo/iStock Editorial through Getty Pictures

The value of espresso futures continues to maneuver greater on account of greater inflation and provide and demand points. It is a menace to the underside line of Starbucks (NASDAQ:SBUX) and we might even see disappointing forecasts from the corporate in coming quarters.

Espresso costs stay elevated on provide and demand

Espresso costs have been at one-week highs this week as commodities stay supported by inflation.

Provide and demand was combined with stronger demand from China and better provide from Vietnam. The USDA Overseas Agricultural Service projected that China’s 2022 espresso imports would develop by +5% this 12 months to 4 million luggage. Additionally supportive of upper costs was dry climate in Brazil, with rainfall within the Minas Gerais space, which makes up 30% of Brazil’s arabica crop, was solely 40% of the historic common.

On the bearish aspect, the Inexperienced Espresso Affiliation reported this week that US March inexperienced espresso inventories rose +1.0% m/m and +2.5% y/y to five.82 million luggage.

Ad infinitum to the Ukraine tensions, there are fears that Russia’s invasion of Ukraine will add to inflation, curb shopper spending, and scale back espresso consumption as shoppers tighten their belts.

For Starbucks, that will not imply that espresso home visits are diminished, however that the common spend is diminished.

Indicators of tighter world espresso provides are offering a bullish stimulus for costs and pushed arabica espresso as much as a 10-1/2 12 months nearest-futures highs on Feb 10. The Worldwide Espresso Group additionally lower its world 2020/21 provide estimate to a deficit of -3.13 mln luggage from a earlier estimate of a +1.2 mln bag surplus.

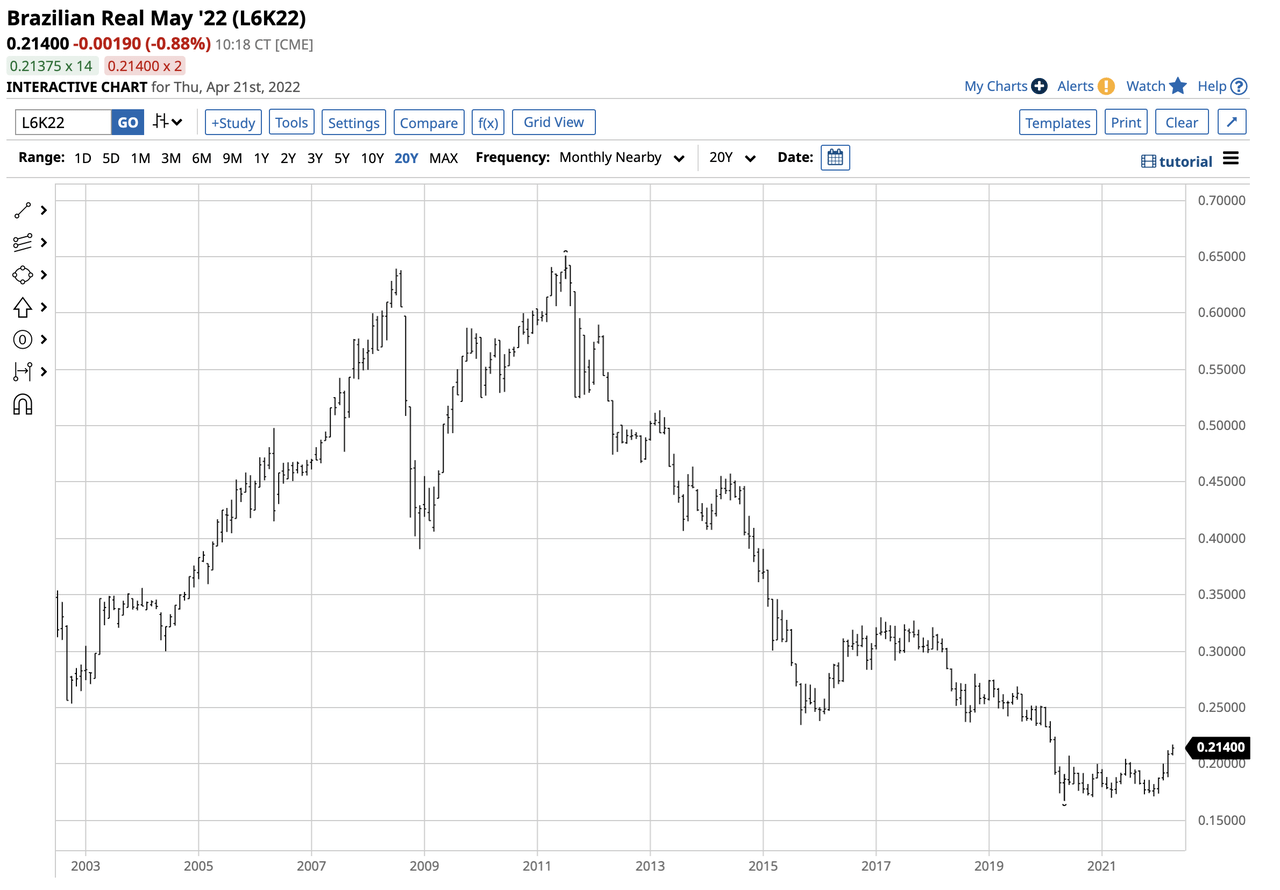

One other headwind would come from a possible structural low within the Brazilian Actual. Brazilian manufacturing prices, together with labor and different bills, are within the Brazilian actual. A falling actual weighs on arabica espresso’s worth as Brazilian provides have decrease manufacturing prices and may fetch extra {dollars}. A rising actual has the alternative impression, pushing espresso costs greater.

Brazilian Actual (v USD) (Barchart.com)

We will see a particular low within the Brazilian actual and the foreign money might look to check greater ranges within the months forward.

Greater enter costs might damage Starbucks

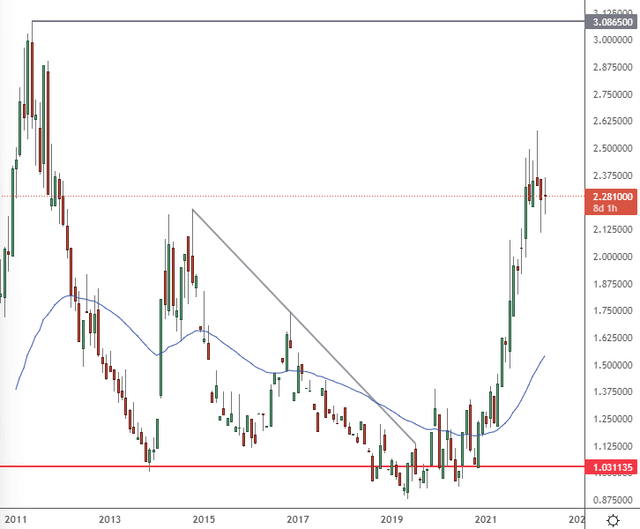

Starbucks might now face a tough mixture of decrease shopper spending and better enter costs. If we check out the month-to-month chart of espresso costs on the NYMEX alternate, Starbucks has truly been supported by decrease costs during the last six years. Value has now vaulted above the 2013-14 highs and with assist right here might take a look at the highs of 2011.

NYMEX Espresso M (Buying and selling View)

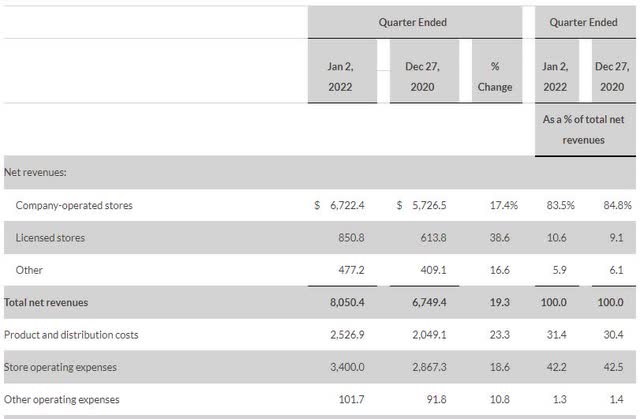

The corporate reported first quarter gross sales beforehand and confirmed that whole web revenues have been 19.3% greater from December 2020, however that product and distribution prices have been up 23.3%. That hole might begin to widen with greater prices for espresso.

Starbucks

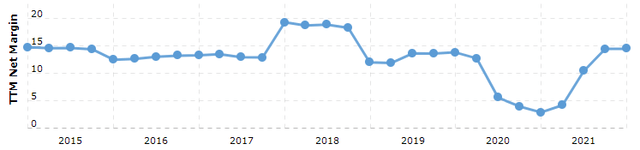

We will additionally see that web margins on the firm are stagnant over that interval the place espresso costs have been trailing the low ranges.

SBUX Internet Margin (Macro Tendencies)

The results of elevated espresso costs is not going to be speedy on account of hedging and the corporate’s value construction, however the firm referred to the latest worth improve as “volatility”. Meaning they aren’t anticipating the upper costs to change into the brand new regular for the sector.

“The volatility within the espresso market doesn’t impression retail pricing plans, and our pricing technique stays unchanged,” a Starbucks spokesperson informed CNN.

Then CEO, Kevin Johnson, mentioned they have been capable of keep away from elevating costs for patrons due to its buying technique. Starbucks has employed quite a few ways to verify it will probably purchase espresso beans at an “engaging value,” in response to Johnson. These embrace shopping for espresso prematurely to lock in costs, Johnson added.

“It provides us a big benefit relative to our rivals who, if they do not purchase this far prematurely, will definitely not have that value construction that we put in place,” he defined.

“Normally, espresso chains are hedged nicely forward, however the size of protection varies from firm to firm,” mentioned Carlos Mera, head of Rabobank’s agricultural workforce.

Starbucks has had an excellent run on espresso costs since 2014, but when costs stay greater, the corporate should begin locking in espresso at greater ranges. That will not be as ‘transitory’ because the sector thinks.

Johnson mentioned that the corporate buys inexperienced espresso “12-18 months” forward. Meaning any locked-in costs on the lows of early-2021 in espresso futures are expiring within the second quarter.

SBUX inventory seems bearish forward of earnings

Starbucks introduced this week that the corporate will launch its second quarter earnings after the shut on Could 3.

The inventory worth has come below strain within the final month and for those who see this bearish exercise on the shut of April, then the following path is decrease.

SBUX M (Buying and selling View)

Starbucks inventory has assist coming in beneath on the $60-64 stage. The corporate not too long ago introduced a dividend of $0.43 per share. That shall be out there to shareholders of document on Could 13, 2022. Meaning buyers should cross their fingers within the ten-day interval that follows earnings.

The inventory was additionally downgraded not too long ago by Citi because of the change of CEO, with the value goal being downgraded from $120 to $91. The funding financial institution needed to see extra readability from the founder Howard Schulz as he returns to the driving seat.

China gross sales and the elephant within the room

An additional headwind for the corporate will come from the strict lockdowns in China, that are being enforced on account of Coronavirus. The US and China make up 61% of the corporate’s world footprint and Starbucks additionally needed to begin a extra aggressive growth in China. Within the first quarter outcomes, China comparable retailer gross sales have been down 14% and it’s exhausting to see that getting higher with the extended lockdowns.

There’s truly an excellent larger elephant within the room for Starbucks in China and that comes from sanctions. Senator Marco Rubio proposed sanctions towards China if it helped Russia to get across the SWIFT financial system ban. We additionally had Senator Lindsey Graham visiting Taiwan, which the Chinese language known as “treading a harmful path”. If hostilities proceed between the US and China, will Starbucks need to droop enterprise operations in China in the identical approach they’ve executed with Russia? That may be a huge drawback for the espresso chain and its progress ambitions.

Starbucks is predicted to submit quarterly earnings of $0.60 per share in its upcoming launch, which represents a year-over-year change of -3.2%. Revenues are forecast to be $7.63 billion, up 14.4% from the year-ago quarter. Manufacturing and distribution prices shall be an essential issue on this report.

I imagine there’s a probability that gross sales might underperform for this era into the top of March. Nevertheless, the true drawback will come from ahead steerage and the next quarters. Operations have been suspended in Russia, whereas Chinese language shoppers are locked down in huge cities like Shanghai. At house and in Europe, shoppers are being squeezed by hovering inflation that would see them scale back their common spend.

Conclusion

Starbucks has benefited from low-cost enter prices for espresso for six years, however there’s a danger that espresso costs stay elevated. Hovering inflation and provide and demand modifications might change the dynamic for espresso corporations. The corporate’s 2021 efficiency would have benefited from its hedging and buying technique nevertheless it will not be really easy in 2022-23. The corporate buys 12-18 months forward and can now see costs at virtually ten-year highs. Add the headwind of a cost-of-living squeeze for shoppers and I might not count on favorable situations for web margins. There’s additionally a menace coming from US and China relations which might dent Starbucks’ earnings and growth plans within the nation.