porcorex

No person stated contrarian investing was straightforward, since we as people naturally gravitate towards a herd mentality. It is easy to justify shopping for an organization when all the pieces is wanting up, however not a lot when issues aren’t as rosy. Nevertheless, shopping for high-quality firms when issues aren’t so rosy is what results in market-beating returns over the long term, versus the opposite method round.

This brings me to Stanley Black & Decker (NYSE:SWK), which at present trades at a value level that few might have imagined only a few months in the past. On this article, I spotlight what makes SWK an awesome contrarian guess for doubtlessly sturdy earnings and long-term returns, so let’s get began.

Why SWK?

Stanley Black & Decker is a diversified industrial firm with companies in instruments & storage, industrial digital safety, and engineered fastening. It has been in enterprise for over 170 years and is a well-recognized model with a loyal following. The corporate has a diversified product lineup and operates in over 60 international locations.

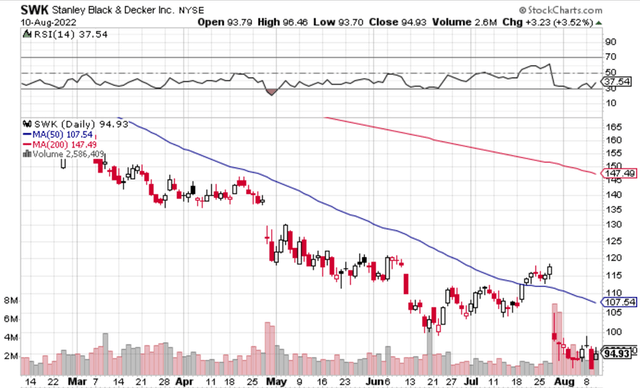

Shut followers of SWK inventory know that it is seen its justifiable share of challenges over the previous yr, with the share value being decimated by 52% over the yr. On the present value of $94.93, SWK is now buying and selling at lower than half of its 52-week excessive of $203. The share value has fallen materially because the Q2 earnings launch, and now trades properly under its 50- and 200-day transferring averages, as proven under.

SWK Inventory Technicals (StockCharts)

After all, the autumn in value would not occur for no purpose, as value inflation and better rates of interest have put a damper on the housing market, which drives demand for SWK’s merchandise in addition to pressured margins. Whereas income was up by 16% YoY to $4.4 billion within the second quarter, this was largely pushed by strategic energy tools acquisitions (+24%) and value will increase (+7%). On the identical time, quantity dropped by 13% YoY as buyer demand cooled, and commodity inflation drove gross margin down by 800 foundation factors to 27.5%.

It goes with out saying that SWK is seeing its justifiable share of challenges. Nevertheless, I do not see the long-term thesis as being damaged, given the power of its manufacturers, its world diversification, and its aggressive benefits. As well as, the corporate is taking steps to mitigate the challenges it is at present going through, which supplies me confidence that it is going to be in a position to climate the storm and are available out stronger on the opposite facet.

That is supported by SWK accelerating its world value discount program, which anticipates annual financial savings of $1 billion by the top of subsequent yr, rising to roughly $2 billion inside the subsequent 3 years. Furthermore, SWK is aggressively returning capital to shareholders, with $2.3 billion of share repurchases thus far in 2022. Administration has put share buybacks on maintain for now, contemplating the difficult atmosphere, however acknowledged that they might take a look at it once more in 2023 or later.

Wanting ahead, SWK might emerge from the present downturn as a stronger firm, as its latest divestitures and acquisitions have made the corporate extra targeted on its core enterprise. It is also decreasing complexity within the group whereas sustaining investments in R&D, gross sales, and digital engagement, as famous through the latest convention name:

We’re now not a diversified industrial firm. We’re primarily a Instruments & Out of doors firm, with a wonderful industrial enterprise alongside of it as properly. It makes us a really easier firm than we could be extra streamlined, extra environment friendly and efficient after which we’ve a big oblique spend element, which isn’t folks associated.

After which there may be the, what I’d name, the optimization of spans and layers, which is about $100 million. And that’s actually taking a look at that construction of how our companies are organized and what number of layers do we’d like, what’s the span of management and actually attempting to optimize that.

And that basically, for essentially the most half, will keep away from the R&D group, the gross sales group, our digital advertising group and actually be extra targeted on the management group and the administration of the companies and likewise simplifying the processes that they make the most of to make selections all through the day and the week as they drive the enterprise.

Notably, SWK sports activities a robust A rated steadiness sheet and is a Dividend King with over 50 years of consecutive raises. Even with the diminished EPS steerage of $5.50 for the complete yr, the dividend stays properly coated with a 58% payout ratio.

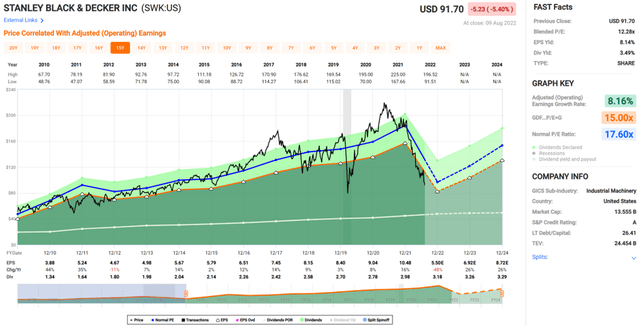

SWK seems to be fairly low-cost on the present value of $94.93. Whereas the ahead PE of 17.3 factors to a good valuation, this takes into consideration the aforementioned diminished EPS steerage. Analysts anticipate to see a robust rebound over the following two years, bringing the ahead PE ratio down to simply 9.3x primarily based on 2024 estimates. Promote facet analysts have a consensus Purchase ranking with a mean value goal of $123.50, implying a possible one-year 33% complete return together with dividends.

SWK Valuation (FAST Graphs)

Investor Takeaway

Whereas Stanley Black & Decker is going through some challenges within the close to time period, I consider the corporate is taking the required steps to emerge stronger than earlier than. The long-term thesis stays intact, for my part, given the power of its manufacturers, world diversification, and aggressive focus. SWK seems to be fairly low-cost on the present value, and analysts anticipate to see a robust rebound over the following two years. For these causes, I consider SWK is a purchase for long-term buyers.