Liudmila Chernetska/iStock via Getty Images

A Quick Take On SRM Entertainment, Inc.

SRM Entertainment, Inc. (SRM) has filed to raise $9 million in an IPO of its common stock, according to an S-1 registration statement.

The firm designs and sells toys and souvenirs at theme parks and entertainment venues.

The company is still very tiny, with thin capitalization, a concentrated number of selling venues and excessive valuation assumptions at IPO.

I’ll pass on the SRM IPO.

SRM Entertainment Overview

Jupiter, Florida-based SRM Entertainment, Inc. was founded to create toys and souvenirs that ‘enable fans to express their affinity for the favorite “something” – whether it is a movie, TV show, favorite celebrity or favorite restaurant.’

Management is headed by Chief Executive Officer Richard Miller, who has been with the firm since 2018 and has served as president of Caro Consulting, a consulting firm for emerging growth companies.

The company has reached ‘verbal agreements regarding the management and equity participation in the acquisition of SRM Limited.’

The statement of operations information contained herein refers to SRM Limited’s results.

The company is also separating from Jupiter Wellness (JUPW) and Jupiter will distribute 2 million shares of its 6.5 million shares of SRM Entertainment, Inc.’s common stock to its shareholders. The effect of this distribution on SRM’s stock price post-IPO is uncertain, but presents a downside risk if those shares were sold by selling shareholders in a short period of time.

As of March 31, 2023, SRM Entertainment has booked fair market value investment of $1.5 million in debt owed to parent firm Jupiter Wellness.

SRM Entertainment – Customer Acquisition

The company licenses product IP from various content providers such as Smurfs and Zoonicorn LLC, ‘from which we can create multiple products based on each character within.’

Its products are typically priced between $2.50 and $50.00 and are designed to appeal to a variety of demographic groups, male and female, adults and children.

The firm advertises its products through websites, trade shows, catalogs and social media in the future.

General & Administrative expenses as a percentage of total revenue have varied as revenues have increased, as the figures below indicate:

General & Administrative | Expenses vs. Revenue |

Period | Percentage |

Three Mos. Ended March 31, 2023 | 23.1% |

2022 | 14.4% |

2021 | 21.9% |

(Source – SEC)

The General & Administrative efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of General & Administrative expense, fell to 1.5x in the most recent reporting period, indicating reduced efficiency, as shown in the table below:

General & Administrative | Efficiency Rate |

Period | Multiple |

Three Mos. Ended March 31, 2023 | 1.5 |

2022 | 3.9 |

(Source – SEC)

SRM Entertainment’s Market & Competition

According to a 2022 market research report by Allied Market Research, the global market for action figure toys was an estimated $9 billion in 2021 and is forecast to reach $15.3 billion by 2031.

This represents a forecast CAGR (Compound Annual Growth Rate) of 5.3% from 2022 to 2031.

The main drivers for this expected growth are its high profitability and a large consumer base with growing disposable incomes in many regions worldwide.

Also, emerging market economies present potential demand improvement in the coming years, as government policies to combat counterfeit products become more effective.

Major competitive or other industry participants include the following:

Funko (FNKO)

Jazwares

Light up Toys

Others

SRM Entertainment, Inc. Financial Performance

The company’s recent financial results can be summarized as follows:

Uneven topline revenue growth

Fluctuating gross profit and gross margin

Variable operating profit or loss

Growing cash used in operations

Below are relevant financial results derived from the firm’s registration statement:

Total Revenue | ||

Period | Total Revenue | % Variance vs. Prior |

Three Mos. Ended March 31, 2023 | $ 1,086,888 | 53.7% |

2022 | $ 6,076,116 | 127.9% |

2021 | $ 2,665,827 | |

Gross Profit (Loss) | ||

Period | Gross Profit (Loss) | % Variance vs. Prior |

Three Mos. Ended March 31, 2023 | $ 235,822 | 104.9% |

2022 | $ 1,230,899 | 121.6% |

2021 | $ 555,432 | |

Gross Margin | ||

Period | Gross Margin | % Variance vs. Prior |

Three Mos. Ended March 31, 2023 | 21.70% | 5.4% |

2022 | 20.26% | -2.8% |

2021 | 20.84% | |

Operating Profit (Loss) | ||

Period | Operating Profit (Loss) | Operating Margin |

Three Mos. Ended March 31, 2023 | $ (15,762) | -1.5% |

2022 | $ 357,985 | 5.9% |

2021 | $ (29,715) | -1.1% |

Net Income (Loss) | ||

Period | Net Income (Loss) | Net Margin |

Three Mos. Ended March 31, 2023 | $ (38,002) | -3.5% |

2022 | $ 328,701 | 30.2% |

2021 | $ (29,061) | -2.7% |

Cash Flow From Operations | ||

Period | Cash Flow From Operations | |

Three Mos. Ended March 31, 2023 | $ (153,855) | |

2022 | $ (29,925) | |

2021 | $ 452,653 | |

(Glossary Of Terms) |

(Source – SEC)

As of March 31, 2023, SRM Entertainment had $8,715 in cash and $22,823 in total liabilities.

Free cash flow during the twelve months ending March 31, 2023, was negative ($14,303).

(Figures above are for S.R.M. Limited)

SRM Entertainment, Inc. IPO Details

SRM Entertainment intends to raise $9 million in gross proceeds from an IPO of its common stock, offering 1.8 million shares at a midpoint price of $5.00.

No existing shareholders have indicated an interest in purchasing shares at the IPO price.

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $43.5 million, excluding the effects of underwriter over-allotment options.

The float to outstanding shares ratio (excluding underwriter over-allotments) will be approximately 18.0%. A figure under 10% is generally considered a ‘low float’ stock which can be subject to significant price volatility.

The firm is an ’emerging growth company’ as defined by the 2012 JOBS Act and has elected to take advantage of reduced public company reporting requirements; prospective shareholders will receive less information for the IPO and in the future as a publicly-held company within the requirements of the Act.

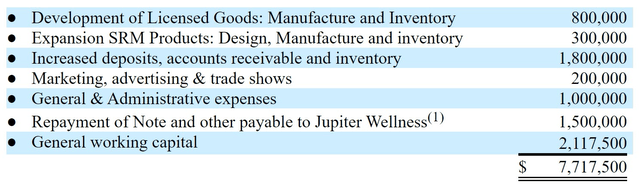

Management says it will use the net proceeds from the IPO as follows:

Proposed Use Of IPO Proceeds (SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management said the firm is not currently a party to any legal proceedings that would have a material adverse effect on its financial condition or operations.

The sole listed bookrunner of the IPO is EF Hutton.

Valuation Metrics For SRM Entertainment

Below is a table of relevant capitalization and valuation figures for the company:

Measure [TTM] | Amount |

Market Capitalization at IPO | $50,000,000 |

Enterprise Value | $43,504,294 |

Price / Sales | 7.74 |

EV / Revenue | 6.74 |

EV / EBITDA | 125.56 |

Earnings Per Share | $0.03 |

Operating Margin | 5.37% |

Net Margin | 4.57% |

Float To Outstanding Shares Ratio | 18.00% |

Proposed IPO Midpoint Price per Share | $5.00 |

Net Free Cash Flow | -$14,303 |

Free Cash Flow Yield Per Share | -0.03% |

Debt / EBITDA Multiple | 0.00 |

CapEx Ratio | 0.41 |

Revenue Growth Rate | 53.71% |

(Glossary Of Terms) |

(Source – SEC)

As a reference, a potential public comparable to SRM Entertainment would be Funko (FNKO); below is a comparison of their primary valuation metrics:

Metric | Funko | SRM Entertainment | Variance |

Price / Sales | 0.45 | 7.74 | 1621.1% |

EV / Revenue | 0.77 | 6.74 | 775.2% |

EV / EBITDA | NM | 125.56 | –% |

Earnings Per Share | -$0.08 | $0.03 | –% |

Revenue Growth Rate | 10.3% | 53.71% | 423.49% |

Net Margin | -5.8% | 4.57% | –% |

(Source – SEC and Seeking Alpha)

Commentary About SRM Entertainment’s IPO

SRM is seeking U.S. public capital market investment to enable its separation process from parent firm Jupiter Wellness and for its growth objectives.

The company’s financials have shown variable topline revenue growth, uneven gross profit and gross margin, fluctuating operating profit or loss and increasing cash used in operations.

Free cash flow for the twelve months ending March 31, 2023, was negative ($14,303).

General & Administrative expenses as a percentage of total revenue has varied as revenue has fluctuated; its General & Administrative efficiency multiple fell to 1.5x in the most recent reporting period.

The firm currently plans to pay no dividends and to retain any future earnings for reinvestment back into the company’s growth and working capital requirements.

The market opportunity for selling action figures and other toys is large but expected to grow only moderately in the coming years.

EF Hutton is the sole underwriter, and IPOs led by the firm over the last 12-month period have generated an average return of negative (58.7%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

Risks to the company include the company’s dependence on a relatively few number of manufacturers and its distribution concentration.

As for valuation expectations, management is asking investors to pay an Enterprise Value/Revenue multiple of approximately 6.74x.

Given competitor Funko’s EV/Revenue multiple is approximately 0.77x, it appears that SRM’s valuation expectations are excessive.

The company is still a very tiny firm, with thin capitalization, a concentrated number of selling venues and excessive valuation assumptions at IPO.

I’ll pass on the IPO.

Expected IPO Pricing Date: To be announced.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.