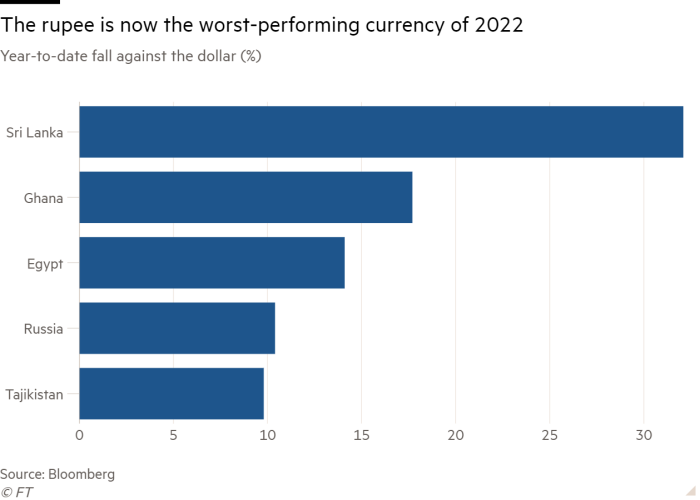

Sri Lanka’s forex has plunged to a document low to change into the world’s worst-performing forex, as President Gotabaya Rajapaksa struggles to comprise a worsening financial and political disaster.

The Sri Lankan rupee was hovering close to SLRs300 per US greenback on Wednesday, down 32 per cent 12 months thus far and lagging even Russia’s rouble, after Rajapaksa ended emergency rule simply days after it was imposed.

Sri Lanka is going through a international trade disaster as its authorities grapples with looming debt funds, widespread protests and an financial emergency. The backpedal on the emergency decree from Rajapaksa’s authorities got here after his new finance minister, Ali Sabry, give up lower than 24 hours into the job.

Sabry’s resignation was the newest in a rush of exits. The nation’s total cupboard give up over the weekend following nationwide protests over extreme meals and energy shortages in addition to runaway inflation. Central financial institution governor Ajith Nivard Cabraal, who was scheduled to supervise a coverage assembly on Thursday, additionally resigned on Monday.

The hollowing out of Rajapaksa’s administration has stoked issues over the nation’s capacity to safe assist from the IMF to keep away from defaulting on looming worldwide bond funds. Earlier finance minister and the president’s brother Basil Rajapaksa had been getting ready to fly to Washington to debate phrases with the IMF previous to his resignation over the weekend.

“Issues don’t look good. A lot will depend on whether or not they can get any IMF funding,” stated Steve Cochrane, chief Asia-Pacific economist at Moody’s. “A secure authorities issues.”

Cochrane stated elevating rates of interest might assist curb inflation and doubtlessly bolster the rupee. “However there are different elements driving inflation that the central financial institution has little management over,” he added, together with commodity costs pushed up by Russia’s invasion of Ukraine, provide chain constraints and lack of international reserves to pay for imports.

Analysts stated markets have been targeted on a $1bn sovereign greenback bond reimbursement due on July 25. On Wednesday, that bond was buying and selling effectively beneath face worth at a document low of $0.58, as doubts mounted over Sri Lanka’s capacity to provide you with sufficient greenback funding to make the fee.

As finance minister, the president’s brother oversaw a regime of drastic tax cuts that prompted international ranking companies to repeatedly downgrade the nation’s sovereign credit standing, leaving it frozen out of worldwide debt markets.

That compelled Sri Lanka to make curiosity funds on its sovereign bonds from dwindling international reserves, which have come underneath stress throughout the coronavirus pandemic. The tourism sector, one of many island nation’s most important income turbines, has been hit significantly exhausting.

The IMF estimated in late February that Sri Lanka had solely a couple of month price of international reserves left.

“With the federal government in disarray, the prospects of securing an IMF package deal look bleak,” stated Alex Holmes, Asia economist at Capital Economics. “That once more elevates the probabilities that the federal government will ultimately should resort to a sovereign default”.