Astrid860/iStock via Getty Images

The Direxion Daily S&P 500 Bear 3X Shares ETF (NYSEARCA:SPXS) is one of the most popular instruments to short the broad market for trading or hedging purposes. However, its daily -3X leverage factor is a source of drift. It must be closely monitored to detect changes in the drift regime. This article explains what “drift” means, quantifies it in more than 20 leveraged ETFs, shows historical data, and finally concludes about the current market conditions. The analysis is also valid for the ProShares UltraPro Short S&P 500 ETF (SPXU), which tracks the same index with the same factor and has an almost identical behavior.

Why do leveraged ETFs drift?

Leveraged ETFs often underperform their underlying index leveraged by the same factor. The decay has essentially four reasons: beta-slippage, roll yield, tracking errors, management costs. Beta-slippage is the main reason in equity leveraged ETFs. However, when an asset is in a steady trend, leveraged ETFs can bring an excess return instead of a decay. You can follow this link to learn more about this.

Monthly and yearly drift watchlist

There is no standard or universal definition of leveraged ETF drift. Mine is simple and based on the difference between the leveraged ETF performance and Ñ times the performance of the underlying index on a given time interval, if Ñ is the leveraging factor. Most of the time, this factor defines a daily objective relative to an underlying index. However, some dividend-oriented leveraged products have been defined with a monthly objective (mostly defunct ETNs sponsored by Credit Suisse and UBS: CEFL, BDCL, SDYL, MLPQ, MORL…).

First, let’s start by defining “Return”: it is the return of a leveraged ETF in a given time interval, including dividends. “IndexReturn” is the return of a non-leveraged ETF on the same underlying asset in the same time interval, including dividends. “Abs” is the absolute value operator. My “Drift” is the drift of a leveraged ETF normalized to the underlying index exposure in a time interval. It is calculated as follows:

Drift = (Return – (IndexReturn x Ñ))/ Abs(Ñ)

“Decay” means negative drift. “Month” stands for 21 trading days, “year” for 252 trading days.

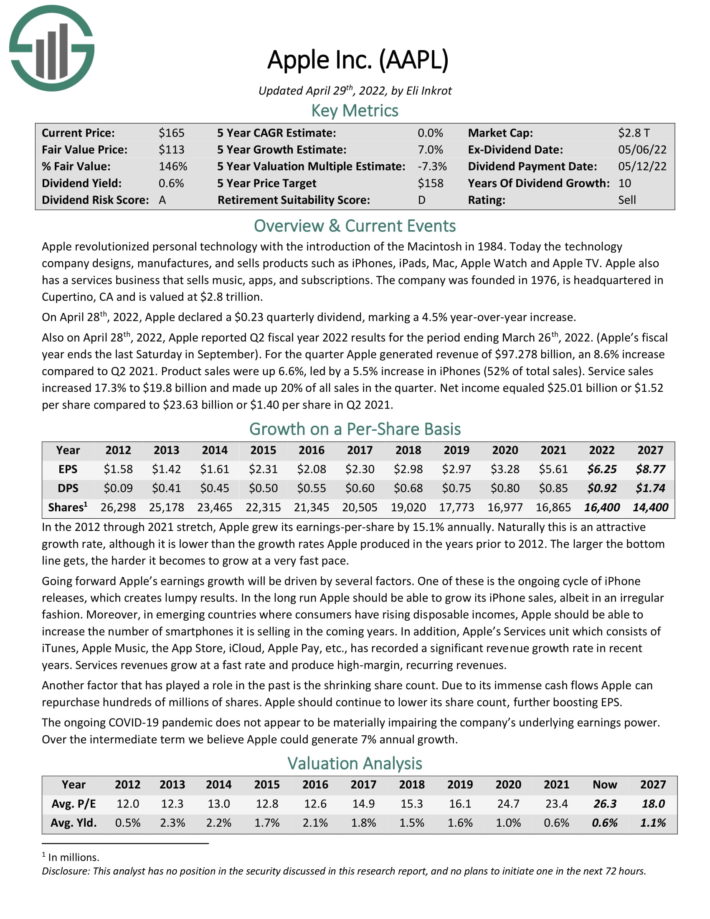

Index | Ñ | Ticker | 1-month Return | 1-month Drift | 1-year Return | 1-year Drift |

S&P 500 | 1 | SPY | 5.56% | 0.00% | -9.16% | 0.00% |

2 | SSO | 10.12% | -0.50% | -24.67% | -3.18% | |

-2 | SDS | -11.14% | -0.01% | 5.14% | -6.59% | |

3 | UPRO | 14.39% | -0.76% | -40.63% | -4.38% | |

-3 | SPXS | -17.30% | -0.21% | -1.46% | -9.65% | |

ICE US20+ Tbond | 1 | TLT | 7.15% | 0.00% | -30.81% | 0.00% |

3 | TMF | 21.41% | -0.01% | -71.85% | 6.86% | |

-3 | TMV | -20.01% | 0.48% | 147.17% | 18.25% | |

NASDAQ 100 | 1 | QQQ | 5.54% | 0.00% | -25.04% | 0.00% |

3 | TQQQ | 12.46% | -1.39% | -71.18% | 1.31% | |

-3 | SQQQ | -20.27% | -1.22% | 31.16% | -14.65% | |

DJ 30 | 1 | DIA | 5.94% | 0.00% | 2.21% | 0.00% |

3 | UDOW | 16.70% | -0.37% | -9.31% | -5.31% | |

-3 | SDOW | -16.81% | 0.34% | -23.11% | -5.49% | |

Russell 2000 | 1 | IWM | 2.20% | 0.00% | -13.01% | 0.00% |

3 | TNA | 3.57% | -1.01% | -50.78% | -3.92% | |

-3 | TZA | -9.98% | -1.13% | -2.97% | -14.00% | |

MSCI Emerging | 1 | EEM | 15.59% | 0.00% | -17.18% | 0.00% |

3 | EDC | 49.86% | 1.03% | -54.31% | -0.92% | |

-3 | EDZ | -36.93% | 3.28% | 30.69% | -6.95% | |

Gold spot | 1 | GLD | 8.49% | 0.00% | -0.42% | 0.00% |

2 | UGL | 17.01% | 0.01% | -6.44% | -2.80% | |

-2 | GLL | -15.16% | 0.91% | -3.19% | -2.02% | |

Silver spot | 1 | SLV | 15.95% | 0.00% | -2.99% | 0.00% |

2 | AGQ | 34.33% | 1.22% | -16.83% | -5.43% | |

-2 | ZSL | -28.48% | 1.71% | -18.92% | -12.45% | |

S&P Biotech Select | 1 | XBI | 1.79% | 0.00% | -28.08% | 0.00% |

3 | LABU | 0.94% | -1.48% | -82.33% | 0.64% | |

-3 | LABD | -11.46% | -2.03% | -29.67% | -37.97% | |

PHLX Semicond. | 1 | SOXX | 18.85% | 0.00% | -25.89% | 0.00% |

3 | SOXL | 54.93% | -0.54% | -78.52% | -0.28% | |

-3 | SOXS | -49.47% | 2.36% | -23.83% | -33.83% |

The best and worst drifts

- The leveraged biotechnology ETFs, long (LABU) and inverse (LABD), have the largest monthly decays of this list with drifts of -1.48% and -2.03%.

- LABD also has the largest 12-month decay, close to -38%.

- The inverse emerging markets ETF (EDZ) has the highest positive drift in one month (3.28%).

- The inverse long-term bonds ETF (TMV) has the highest positive drift in one year: over 18%.

- SPXS 12-month return is -1.46%, and its decay is almost -10%.

Positive drift follows a steady trend in the underlying asset, whatever the trend direction and the ETF direction. It means positive drift may come with a gain or a loss for the ETF. For example, you can see in the table above that both bull and bear leveraged ETFs in long-term bonds (TMF, TMV) have positive drifts in one year, due to a steady downtrend in treasuries. Negative drift comes when daily returns skip between positive and negative values (“whipsaw”). For example, all S&P 500 leveraged ETFs (bull and bear) have negative 1-year drifts, due to volatility.

SPXS drift history

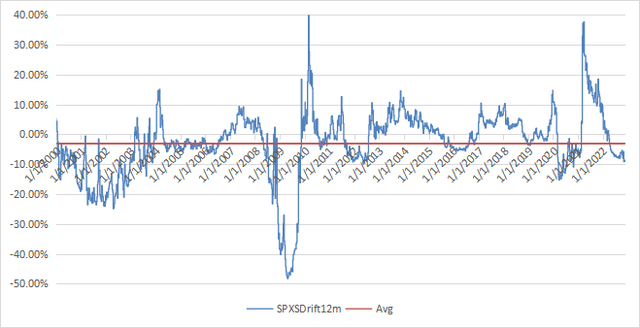

Since inception on 11/5/2008, SPXS has lost 99.98% of its value, through many reverse splits. However, hedging with SPXS has worked quite well in many cases in the last 12 years. For example, in the first week of the 2020 market meltdown (2/21 to 2/28/2020), it has gained about 40%, significantly more than SPY’s return (-11%) multiplied by the leveraging ratio (-3). Then, I issued a warning on 3/10/2020 against leveraged equity ETFs. A few weeks later, SPY had lost 17.5% and SPXS gained about 16% in the same time: less than shorting SPY without leverage. Then, the monthly drift oscillated between positive and negative values, and the 12-month drift was negative until February 2021. It became positive again and spiked in April 2021. This year’s bear market put it back in negative territory in April, and it fell farther in November. The next chart plots the 12-month drift since January 2000, using real prices from November 2008, and synthetic prices based on the underlying index before that. The historical average is negative: -3.07%.

12-month drift of SPXS (synthetic before 11/5/2008). ( Chart: author; data: Portfolio123)

SPXS is an efficient hedging instrument against sharp corrections in a bull market. Moreover, the cost of hedging is quite cheap compared with other derivatives. However, it suffers a large decay when the S&P 500 has alternatively positive and negative days. The VIX index (implied volatility) may be a warning, but it is not mathematically related to decay. Moreover, shorting an asset or buying an inverse ETF implies an additional decay due to inflation and magnified by the leveraging factor. Current inflation level is a serious bias against any short position and all inverse ETFs.

In conclusion, leveraged ETFs are designed for seasoned traders understanding the implications of leveraging and the inflation bias. Most investors should stay away from them.