claffra

Platinum Group Metal (“PGM”) prices offer researchers an exciting topic, given the velocity of the recent shift in supply and demand-side variables that influence PGM prices.

This analysis covers Sprott Physical Platinum & Palladium Trust (SPPP), which is a closed-ended vehicle that invests in physical Platinum and Palladium. Based on our experience covering PGM miners, we believe both Platinum and Palladium are set to outperform expectations for an extended period, providing the Sprott Physical Platinum & Palladium Trust with significant support.

Without further ado, let’s discuss the exchange-traded product in more detail.

An Overview of SPPP

The Sprott Physical Platinum & Palladium Trust invests in encumbered and fully-allocated Good Delivery physical Platinum and Palladium bullion.

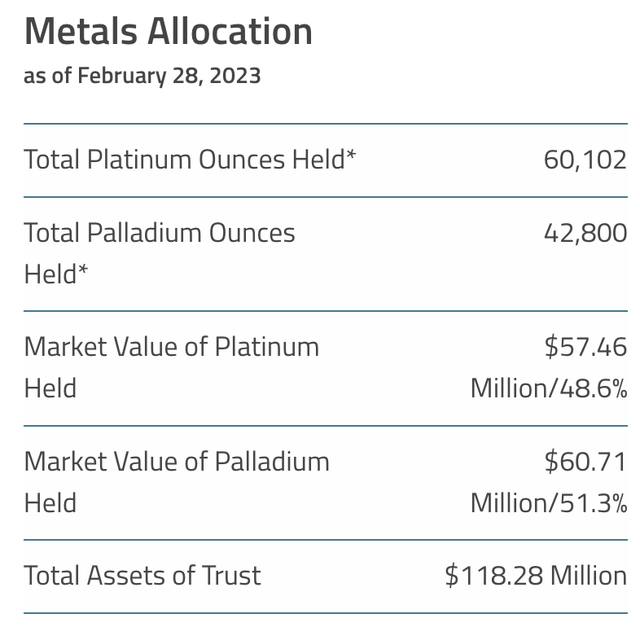

The fund is nearly equally invested in each material, with a slight tilt toward Platinum, and hosts a critical cost-saving value proposition by providing investors with liquid access to both metals at an expense ratio of merely 0.5%.

Sprott

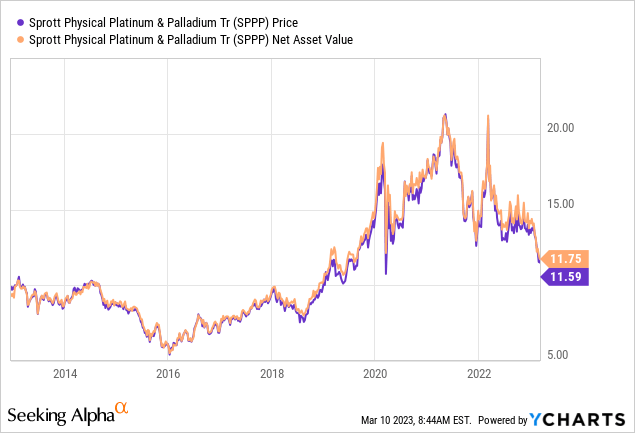

Sprott Physical Platinum & Palladium Trust isn’t an optimal buy-and-hold asset as it possesses cyclical traits. In addition, investors must know that the exchange-traded fund, or ETF, will occasionally trade at noticeable premiums and discounts to the value of its underlying assets, as Platinum and Palladium are illiquid compared to other precious metals like Gold and Silver.

Illiquidity provides challenges to market makers and closed-ended fund issuers to prevent arbitrage between traded prices and NAV. However, the differences aren’t significant enough to suggest that SPPP isn’t an effective PGM tracking solution.

Lastly, Sprott Physical Platinum & Palladium Trust is a pure price speculation play unsuitable to investors seeking dividends.

Why Platinum and Palladium Prices Might Surge

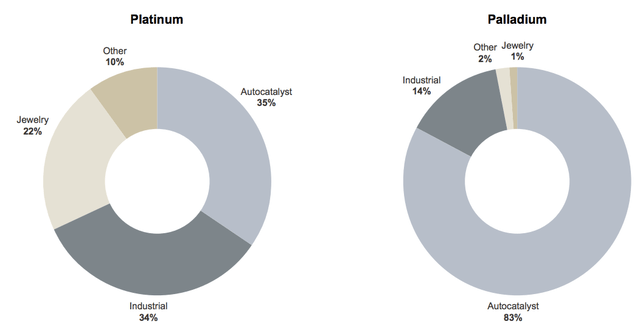

Application

Platinum and Palladium are closely correlated. However, as mentioned before, Palladium is less liquid than Platinum, therefore resulting in wilder price swings. In addition, although both Palladium and Platinum serve the automotive sector, Platinum has additional applications as it is widely used for jewelry.

Platinum and Palladium Applications (Sprott)

Supply-Side Woes

It’s forecasted that Platinum will reach a supply deficit of 3% in 2023, more than the initially forecasted 2%. In our opinion, Palladium will likely follow a similar trajectory as the two materials possess nearly identical supply-side components.

Trevor Raymond of the World Platinum Investment Council addressed the matter and stated that “this year’s forecast deficit is unlikely to be a one-off… with challenges to supply expected to continue and future demand growth… likely to result in deficits continuing for a number of years.”

What’s the reason for all of this?

In addition to the already well-known supply-side constraints from Russia’s war with Ukraine, South Africa, the world’s leading value-based Platinum exporter, and the world’s second-largest Palladium exporter, is faced with significant structural issues.

South Africa’s state-owned energy producer, Eskom, is in dire straights, with the nation sitting in the dark for more than a third of the day. In addition, South Africa is struggling with decaying infrastructure due to a rampant increase in railway theft and abolishment. In essence, mining in South Africa is becoming more difficult to mine by the day.

In 2022, South Africa’s PGM exports fell 6% below guidance due to supply-side constraints. And based on our anecdotal experience as a South African firm, Eskom and related concerns will not get any better.

Demand Inflection Point

On a more positive note, certain economic regions have garnered improved economic outlooks. For instance, the U.S. is delivering above its initial GDP estimate, the Eurozone has abated a recession, and China’s reopening is anticipated to stimulate demand for both Platinum and Palladium.

Although we are not out of the woods yet, the global economic outlook has improved in recent months, leading us to believe that industrial and precious metals will experience stronger demand in the quarters ahead.

Technical Analysis

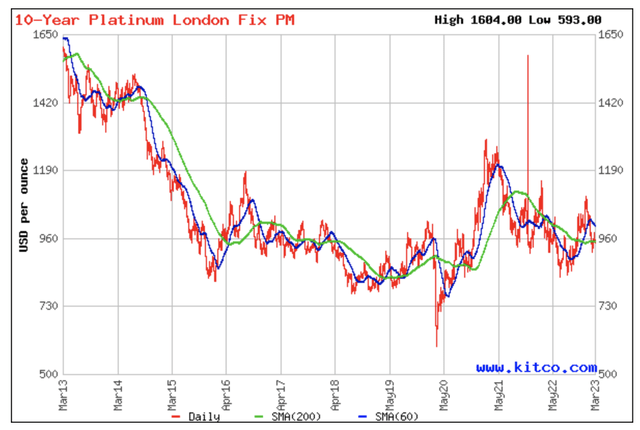

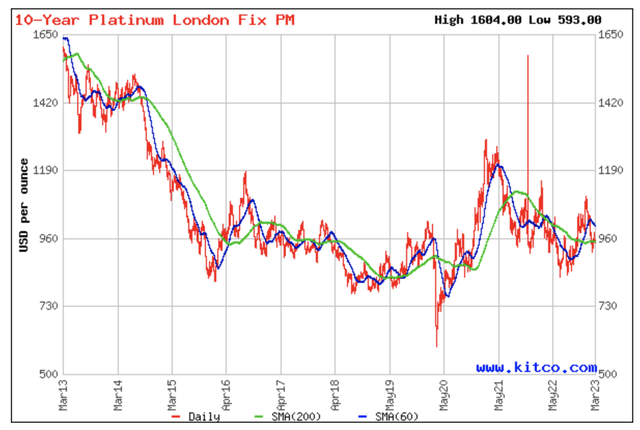

Although Platinum has crept above its 200-day moving average, the commodity remains below its 60-day moving average. Palladium is at a discount relative to its 200 and 60-day moving averages, illustrating a potential value gap if our supply/demand-side analysis holds true.

Platinum SMA (Kitco) Palladium Moving Average (Kitco)

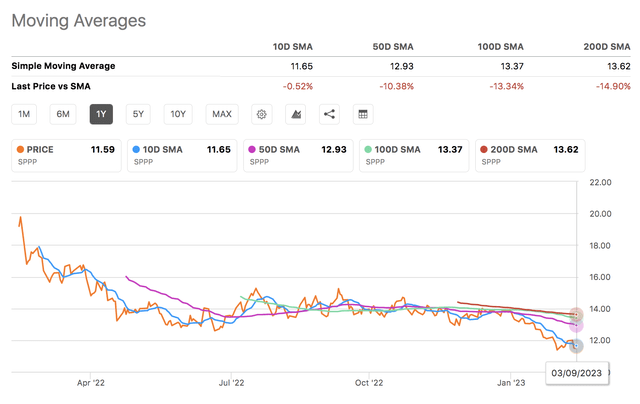

Lastly, the Sprott Physical Platinum & Palladium Trust is trading below its 10-, 50-, 100-, and 200-day moving averages, embodying the status of its underlying assets. Moreover, the ETF has an RSI ratio of merely 35.37, raising the argument that it might be an oversold asset after a 12.86% year-to-date drawdown.

SPPP SMA (Seeking Alpha)

Risks To Consider

Although our outlook on the economy is positive, two worrisome risk factors persist that could diminish the demand for both Platinum and Palladium. Firstly, many nations currently possess inverted yield curves, indicating elevated recession risk. And secondly, U.S. unemployment and late car repayment rates were exacerbated in February, which is worrying to see.

A final factor worth considering is that South Africa’s precious metals exports have gradually been underproduced for years, and the region’s latest blip might not be surprising to many traders. In simpler terms, South Africa’s risk premium might already be baked into PGM prices.

Final Word

Key data points and evidence from South Africa’s supply-side infrastructure suggest that Platinum and Palladium might surge in the coming quarters, lending a bullish argument to Sprott Physical Platinum & Palladium Trust, which is currently trading below its simple moving average.

It’s forecasted that Platinum will be in short supply during 2023, and we anticipate Palladium to follow a similar trajectory based on a supply-side argument. In addition, the outlook for industrial production has improved, and both Platinum and Palladium are trading below their moving averages.

We are incredibly optimistic about Sprott Physical Platinum & Palladium Trust, which allows investors access to real Platinum and Palladium at a fraction of the cost. Therefore, we assign a buy rating to Sprott Physical Platinum & Palladium Trust with a twelve-month horizon in mind.