Piotr Mitelski

Spirit AeroSystems’ (NYSE:SPR) inventory value has tanked considerably following the discharge of the second quarter earnings name. Having reviewed the second earnings outcomes, I might say it are largely the prospects of the Boeing 737 MAX that are considerably disappointing however there are different parts which are pressuring the enterprise within the brief and long run. In the long run, I do consider that whereas the present setting is difficult for aerospace suppliers shares of Spirit AeroSystems stay engaging for the longer-term prospects of the corporate as I focus on on this investor report.

Russia Associated Fees Push Spirit AeroSystems Into Loss

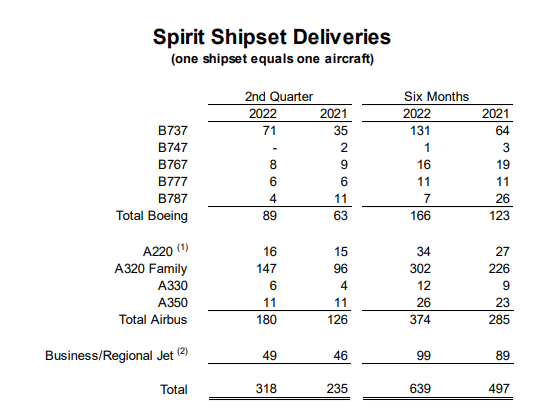

Spirit AeroSystems shipset deliveries (Spirit AeroSystems)

shipset deliveries, we see that Boeing shipset deliveries grew by 26 items or 40% primarily reflecting greater Boeing 737 shipset deliveries offset by decrease deliveries for the Boeing 747 and Boeing 787 with Boeing 777 and Boeing 767 deliveries being kind of secure. Airbus shipset deliveries elevated by 54 items additionally reflecting a roughly 40% enhance as A320 household deliveries grew whereas Enterprise/Regional jet deliveries was barely greater. What we’re seeing is that whereas the Boeing 737 MAX ought to have important room to run up in ship set deliveries. That’s merely not taking place. Boeing 737 shipset deliveries do not even come near deliveries for the competing platform from final 12 months. That itself is disappointing for Boeing because it exhibits how a lot it’s behind and for Spirit AeroSystems it means outcomes should not bettering as quick as beforehand hoped.

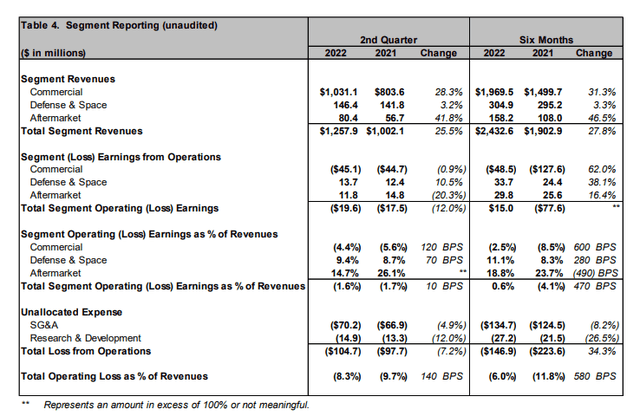

Q2 2022 outcomes Spirit AeroSystems (Spirit AeroSystems)

Total, supply of shipsets elevated by 35% and translated to a 28.3% enhance in Industrial revenues. The income development was decrease than the shipset development as a result of combine being much less targeted on the Boeing 787 program. In Protection & Area, we noticed revenues enhance modestly attributable to growth packages and P-8A Poseidon deliveries. On aftermarket gross sales, there was an enormous bump of 42% as greater flight exercise drives aftermarket gross sales alternatives. Spirit AeroSystems noticed whole revenues enhance by 25.5%, held again by provider points in addition to a slowdown in manufacturing ramps on the only aisle packages which are significant to Spirit AeroSystems.

What’s considerably disappointing is that enchancment in shipset deliveries didn’t assist the corporate enhance its margins considerably as margins improved solely 10 foundation factors to -1.6%. Nonetheless, the business enterprise noticed margins enhance from -5.6% to -4.4%. So, it may be mentioned that greater shipset deliveries are bettering the margins. It is very important remember that the corporate can be carrying extra capability prices because it largely carries a footprint to hike charges to 52 shipsets monthly for the Boeing 737 program over time. Through the quarter these prices had been $43 million for Industrial, $2 million for Protection & Area whereas ahead losses had been $64 million and $8 million in unfavorable changes. I do not actually need to regulate for these earnings as they’re momentary value gadgets however not one-off gadgets.

Nonetheless, there have been some one-off gadgets that negatively impacted margins. The US sanctions in opposition to Russia pressured Industrial by $23.9 million on revenue degree and $4.2 million for the Aftermarket section. Absent these pressures, Industrial margins would have been -2% and Aftermarket margins would have been 20% bringing the overall section working revenue margin to 0.7%. So, if it weren’t for the Russia associated costs, Spirit AeroSystems would have proven margin enchancment and even be worthwhile on section degree.

Whereas I’m not a fan of correcting for the ahead losses, I consider two packages carried prices that we might usually not see. The primary one is the Boeing 787 program. This program shouldn’t be a cash maker for Spirit AeroSystems and for the Industrial section we cannot be seeing that being accretive to money margins for years to return. On the Boeing 787 program there was $31 million in ahead losses, half of which was largely tied to schedule and engineering evaluation. These are one off gadgets largely tied to Boeing and correcting for this the margins would have been 2%. The second program that I believe we must always take a deeper dive into for the ahead losses is the Airbus A220 as there was a $25 million adjustment as a key provider of Spirit AeroSystems went bankrupt and Spirit needed to relocate manufacturing to ensure the availability. So, that will have pushed the section working margins to 3.9%. That additionally implies that Spirit AeroSystems I might be adjusting earnings to satisfy and exceed 5% within the not so distant future.

Spirit AeroSystems Eyes Path To A 16.5% Margin

Boeing 737 fuselages at Spirit AeroSystems (Spirit AeroSystems)

At the moment issues are very difficult to see a path for Spirit AeroSystems to regrow its margins to 16.5% because it aspires. Admittedly, that soar appears virtually inconceivable going from this quarter’s 1.6% loss margin to a 16.5% revenue margin however making use of some changes which I believe is truthful, they’re already constructing to get there.

What was a destructive for traders was that the MAX shipset supply goal was lowered, but when we take a look at the numbers it went from 315 anticipated deliveries to 300 that means that within the second half of the 12 months sequentially there be 170 shipset deliveries indicating a 30% enhance. I for one haven’t been relying on any enhance within the MAX fee this 12 months for Spirit AeroSystems, so the corporate will proceed constructing shipsets at a fee of 31 monthly now not trailing Boeing within the fee anymore which additionally offers some padding within the system because the buffer of pre-built fuselages will decline at a decrease fee than initially anticipated. At present charges Spirit AeroSystems is breaking even on the 737 program and in the event you anticipated one other fee enhance this 12 months than having the charges being flat for the rest of the 12 months is disappointing. Fee hikes can occur with a 6 month discover, that means that if Boeing would need to enhance charges it may solely achieve this in Q1 2023. Boeing has signaled it has no intent to boost at this level and that might point out that all through 2023 we is not going to be seeing any upward changes on the charges. So, for 2023 the MAX could possibly be a close to break-even program for Spirit AeroSystems and I believe that definitely shouldn’t be one thing that traders had been hoping for.

The decrease 2022 737 ship set deliveries additionally triggered an adjustment on free money stream utilization to $250 million to $300 million from $175 million to $225 million anticipated within the earlier quarter additionally reflecting inflationary pressures and provide chain challenges.

So, that path to a 16.5% margin which might be achieved when a fee of 42 Boeing 737 shipsets monthly is achieved is out of sight for 2024 I might say. That, nonetheless, doesn’t imply that the margins will not enhance. We already see some one-off gadgets happen this 12 months that should not happen within the subsequent. Moreover, revival of the Boeing 787 ship set deliveries ought to cut back ahead losses on unit degree whereas a full 12 months of manufacturing at a fee of 31 monthly ought to drive shipset deliveries for this system to 375 up from 300 guided for this 12 months. So, there may be development and alternative for unit efficiency enchancment in 2023.

Airbus A220-300 (Airbus)

There are also some drivers on different packages. As worldwide journey recovers in 20240-2025, I might additionally count on extensive physique demand to enhance which ought to profit the Boeing 787, Airbus A330 and Airbus A350. For the Boeing 787 program, money margins may flip constructive as soon as a brand new value adjustment takes place after the 1406th supply in 2025-2026. On the Airbus A220 program, additional manufacturing hikes to 14 monthly ought to push this system in a worthwhile place.

So, doubtless 2023 will likely be a bit too stagnant for the style of many however we see that on the long term apart from constructive changes on the Boeing 737 program, there may be additionally lots coming for the Boeing 787, Airbus A220 and Airbus A320neo as these packages will go up in fee or hit value adjustment factors.

Conclusion: Years of Enchancment However Purchase Factors Shifts

Total, I do consider that brief time period Spirit AeroSystems is a maintain however over the long term the corporate is a compelling purchase as it’s concerned within the main platforms which are in demand now and within the coming 15-20 years. So, in the event you consider within the power of the air journey demand Spirit AeroSystems is likely one of the names that ought to present returns for the affected person traders identical to different suppliers seemingly will.