abadonian

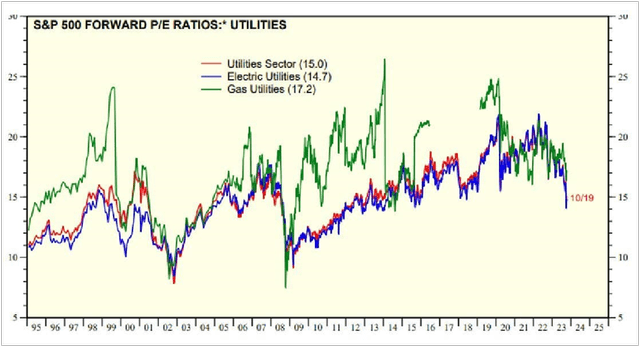

It’s certainly no secret that the utility sector has been beaten down by the market since the beginning of 2023. According to Morningstar, the “median 16.0 P/E (for utilities) is at its lowest since exiting the 2008-09 recession,” and the sector is now down 16.0% since the beginning of 2023. This has made many high-quality utilities look more attractive to investors and Spire Inc. (NYSE:SR) is certainly one of them. I believe the shares are undervalued by 10.0% currently and the 5.3% yield is now competitive with what money markets are paying. At today’s discounted prices the shares are at an attractive entry point.

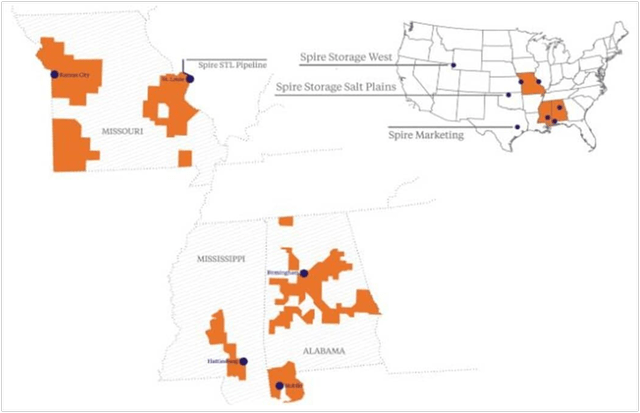

Spire Incorporated is a holding company with five subsidiaries. This is a natural gas utility serving 1.7 million customers with 61,200 miles of pipe. It operates in four markets, which are Alabama, Mississippi, the Gulf, and Missouri. The State of Missouri represents about 70.0% of the customer base. Today, about 90.0% of Spire’s business is regulated gas utilities while another 10.0% is marketing and midstream operations. The company has a current market cap of $2.88 billion with a beta of 0.51, meaning that shares are less volatile than the market as a whole. Standard & Poor’s currently rates its unsecured debt as A-, or medium investment grade. The recent peak for the share price was in May of 2022 at $75.08. The current price of $54.80 is a 27.0% discount from that top.

Spire Service Area (2022 Annual Report)

An Attractive Dividend Yield

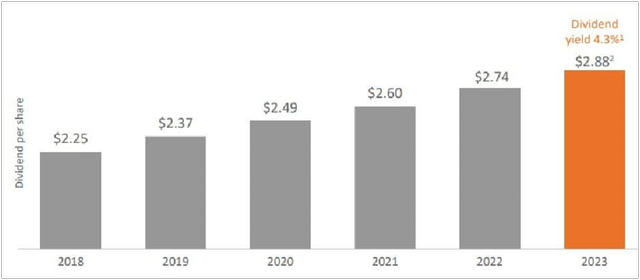

The current yield is an attractive 5.3%. The current payout is $0.72 per quarter and the dividend is paid in March, June, September, and December. The company has paid a dividend for the last 78 years, and it has been increased regularly for the last twenty consecutive years. For the last five years, the compound annual increase has been about 5.0%, in line with management targets. The annual increase is typically announced next month, likely at the November 16 earnings call and I estimate that the quarterly dividend will be raised to $0.76 at that time, making the yield 5.5% at the current share price of $54.80. In comparison yields at other gas utilities are 2.79% at Atmos Energy (ATO), 7.25% at UGI (UGI), 4.35% at Southwest Gas Holdings (SWX), and 5.26% at Northwest Natural (NWN). Presented below is a chart of the dividend over the last five years and the payout ratios.

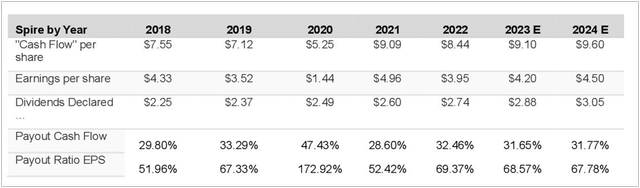

Earnings per Share Growth (2023 Investor Presentation) Spire Payout Ratios (Author Calculated)

The current payout based on earnings per share over time is very reasonable and generally ranges from 51.0% to 69.0% with the exception of one year, 2020. In this year, there was a one-time impairment charge for the Spire Storage West natural gas facility in Wyoming. The company determined that the new project under development would take more time and part of its value was not recoverable because of a plan revision. This led to a write-off of $148.6 million or $2.83 per share based on the 52.6 million shares outstanding. Earnings per share in 2020 would have been $4.27 otherwise, so the payout ratio would have been 58.4%. Looking at the payout ratio based on cash flow, the numbers are significantly lower and vary from 29.0% to 47.4%.

Series A Preferred Shares are Paying 6.9%

Spire currently has a single series of preferred shares, the “A” Series 5.9% (SR.PR.A). These were issued in May 2019. The preferred shares have a current credit rating of BBB from Standard & Poor’s, or lower investment grade. They have a par value of $25.00 per share and are currently trading at a discount of $21.42. The dividend is $1.475 per year and the payout is quarterly. At the current share price, the yield is a very attractive 6.9%. The shares are cumulative and qualified. They are “perpetual” and do not have a call date, but according to the prospectus, the stock can be redeemed after August 15, 2024 at $25.00 per share. Tax treatment is “preferential” so the shares are qualified. The beta on these is about 0.29 and the average volume is about 11,000 shares per day.

Recent Earnings Performance

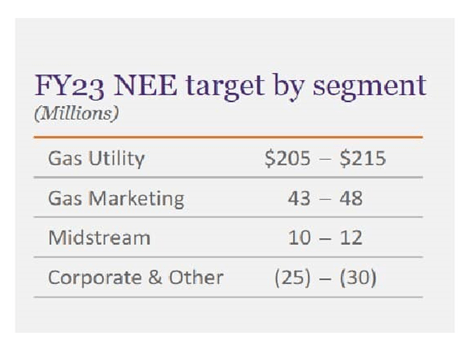

Spire Incorporated has a target of 5.0-7.0% for long-term annual income growth. While earnings vary during the year and can be seasonal, in the long term they appear to be more consistent. The target for earnings per share in 2023 was lowered to $4.15 to $4.25 per share, from $4.20-$4.30, after a $21.6 million loss in the third quarter. This is compared to a small loss in the same period the prior year of $1.4 million. The company’s fiscal year ends on September 30, so the third quarter is mostly spring and early summer. It can be the slow season for Spire, and spring 2023 was 22.0% warmer than the year prior. This resulted in lower residential usage and higher costs, thus the loss. In the first quarter 2023, the company earned $91.0 million or $1.66 per share compared to $55.7 million or $1.01 per share in the first quarter 2022. In the second quarter 2023, it earned $179.2 million or $3.33 per share. The second quarter is January-February-March, when there is usually high demand for heating. As a gas utility, Spire has more seasonality in its income than a diversified utility. Below are the forecasts for the year by segment in Net Economic Earnings (NEE) or GAAP earnings that have been “adjusted” for utility charges and one-time items.

Spire Earnings Projections (2023 Investor Presentation)

In 2022, Spire’s revenues were $2.19 billion down 1.8% from $2.23 billion in 2021, but up 17.7% from $1.86 billion in 2020. Earnings were $205.7 million in 2022, or $3.95 per share, down from $256.5 million or $4.96 per share in 2021. Interest expenses increased and lowered EPS by $0.13 in 2022, due to higher rates for short-term borrowing; these nearly tripled. For Spire, higher short-term borrowing usually takes place in the winter months when the utility is purchasing gas for distribution.

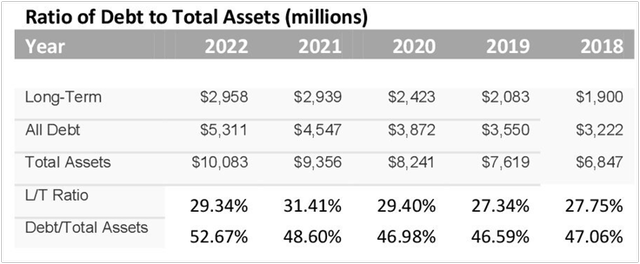

Long-term debt, while generally at acceptable levels, has been increasing slowly over the last five years. The ratios of long-term debt, and all debt, to total assets are presented below. While the numbers are reasonable for a utility, in a rising interest rate environment, ideally the balances would be going down.

Spire Debt Ratios (Author calculated)

Regulatory Environment

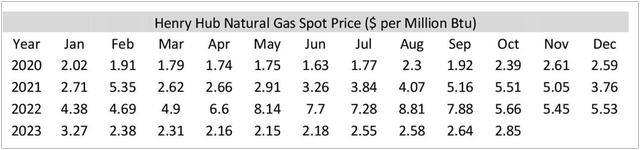

The rate structure is different for all three states the company operates in (Missouri, Alabama, and Mississippi) but generally seems favorable for the utility. Each state has a provision that allows Spire to pass through costs due to variations from the norm in temperatures and gas supply costs. These can change considerably as shown in the table below.

In Missouri, rates are filed every three years through the Missouri Public Service Commission. The state has what is known as a Purchased Gas Adjustment (PGA) clause, which allows the utility to pass through increases in costs to their customers as a hedge. Missouri also has a weather normalization rider (as does Mississippi) to recover fixed costs despite variance in weather from normal patterns (usually this means winter). Missouri also has an ISRS charge, or infrastructure system replacement surcharge, which can be passed through to customers without a “formal rate case being filed.” Remember, this is the state where 70.0% of Spire’s business is located.

Alabama and the Gulf set a rate every year with Alabama Public Service Commission. Alabama has a GSA Rider (Gas Supply) which provides for a change in gas supply prices. The utility can pass through changes in gas prices to consumers. There is also a temperature adjustment provision that deals with departures from weather norms. The allowed return on equity (ROE) for the utility in Alabama ranges from 9.5% to 9.9%, while in the Gulf it is 9.7-10.3%. Mississippi also has a weather normalization rider that adjusts for variations in winter climate and an allowed ROE of 9.83%.

Henry Hub Spot Price (U Energy Information)

Capital Expenditures

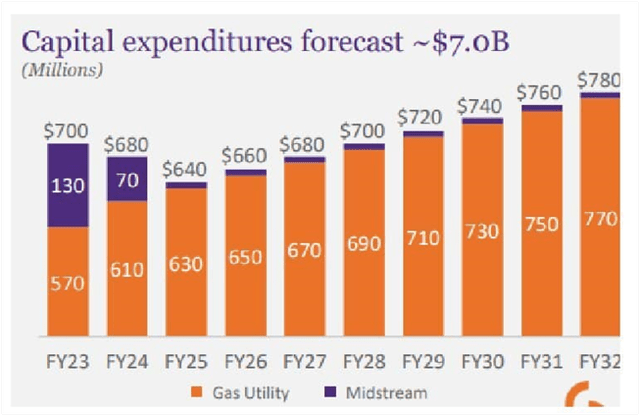

The company has a 10-year capital expenditure program of $7.0 billion, between 2023 and 2032. Capital expenditures for 2023 are estimated at $700 million. Short-term increases in capex have to do with the new Spire Storage West facility. The gas utility expenditures are mostly for infrastructure upgrades.

Spire Capital Expenditure Plan (2023 Investor Presentation)

Current Valuation of Shares

I estimate the current value of Spire’s shares to be US $60.78, so at today’s price of $54.80, they are about 10.0% undervalued. I used a discounted cash flow to value the stock, starting with the earnings per share estimate of $4.20, the most recent forecast, beginning in 2023 and then projecting forward. For the discount rate, I considered the average annual return of the S&P 500. The long-term average is about 9.8%, while over the last 10 years, it has been higher at 12.4%. I have used a discount rate of 10.0% here, just above the lower end of the range, and discounting begins in the second year. I have used a reversion rate of 8.0%.

Included below are Spire’s earnings per share between 2018 and 2023. Again, the company also reports net economic earnings per share (NEE) which are non-GAAP and are adjusted for impairments, regulatory charges, and divestitures that occur with a gas company. They provide a smoother way to look at earnings per share. Using these, the compound annual growth rate in earnings per share was 2.5%. Morningstar forecasts a median 6.0% annual EPS and dividend growth across the overall utility sector, but I suspect the number for Spire will be lower.

Earnings per Share (Annual Reports)

To be on the conservative side in evaluating the company, I have used an annual growth rate of 5.0% to account for the variety in Spire’s earnings. The resulting valuation per share is presented below.

Discounted Cash Flow (Author Calculated)

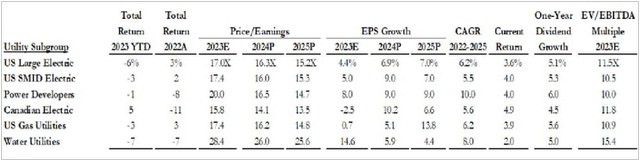

I have also looked at the shares using P/E Ratio multiples. According to Morningstar, the current “median 16.0 P/E (of utilities) is at its lowest since exiting the 2008-09 recession.” Morningstar also estimates that the sector is 15.0% undervalued. I was able to locate two other sources of P/E multiples including Yardeni Research dated this October, which estimates the current P/E multiples for gas utilities as 17.2, above that of electric utilities. Gabelli Funds also tracks utility ratios and lists US large gas utilities as 17.4 for 2023, with a 2024 estimate of 16.2 times earnings.

P/E Ratios October 2023 (Yardeni Research) Utility P/E Ratios (Gabelli Funds)

Using the forward multiples and the earnings estimate for 2023 of $4.20 per share, the value by P/E comparable is estimated at 16.2 X $4.20 = $68.04. This would make the shares as much as 20.0% undervalued. I have concluded at the more conservative and likely more accurate value, the DCF estimate of $60.78 per share.

Risks to Outlook

The primary risk with Spire is variety – variety in climate and variety in natural gas costs. The weather in its service areas has been about 20.0% warmer in recent years. Will the trend continue? It certainly lowers earnings per share. And gas utilities like Spire seem to have a fair amount of variety from year to year in earnings, although the adjusted net economic earnings are the best way to look at the company. Another risk is rising interest rates, a risk to all utilities, which seems to have already impacted Spire through lower earnings per share caused by higher interest expenses.

Conclusion

The current P/E ratio is 13.0 using the 2023 earnings per share estimate of $4.20 and the current share price of $54.80. This is well below the overall utility multiple of 16.0 cited by Morningstar and well below the gas utility multiples of 16.2 – 17.2 cited by Yardeni and Gabelli research. However, I think these multiples may be a lagging indicator. The dividend is at 5.3% and will have another increase soon, likely announced in November. I have no doubt that Spire is committed to increasing its dividend over the long term. As for climate issues, the company has favorable riders in the states in which it operates (especially Missouri, which is its primary market) that allow rate adjustments to be passed through to consumers for swings or variances in weather norms. So its primary markets are “utility friendly.” I believe the combination of a significantly discounted share price, a favorable regulatory environment and a yield that is already competitive with money market funds makes these shares a buy. The current price of $54.80 is a very defensible entry point. Even better if shares trend slightly lower. Also, the Farmers’ Almanac says Missouri will have a traditional cold winter this year.