Nikada

That is the 3Q24 quarterly replace for our flagship fund. In these quarterly letters we share our efficiency highlights and traits which might be shaping our funding method.

NASDAQ:SPRX was down 3.48% in 3Q24 in comparison with the S&P 500 (SP500, SPX), up 5.89%, and the Nasdaq Composite (COMP:IND), up 2.76%.

The third quarter of 2024 was fairly brutal with macro headwinds, such because the carry commerce unwind, election uncertainty and rate of interest considerations dominating the headlines. As well as, idiosyncratic occasions such because the Crowdstrike (CRWD) incident negatively affected our efficiency. We have been happy with how we navigated although these headwinds and positioned ourselves to seize the subsequent wave – extra particulars within the danger administration part beneath.

With many of those headwinds dissipating, we’re beginning to see underlying development decide up throughout a number of areas. We now have now shifted our focus to offence from protection and added a number of enticing alternatives although the 12 months.

Abstract:

- Indicators of development decide up throughout a number of areas, regardless of increased rates of interest and better anticipated inflation.

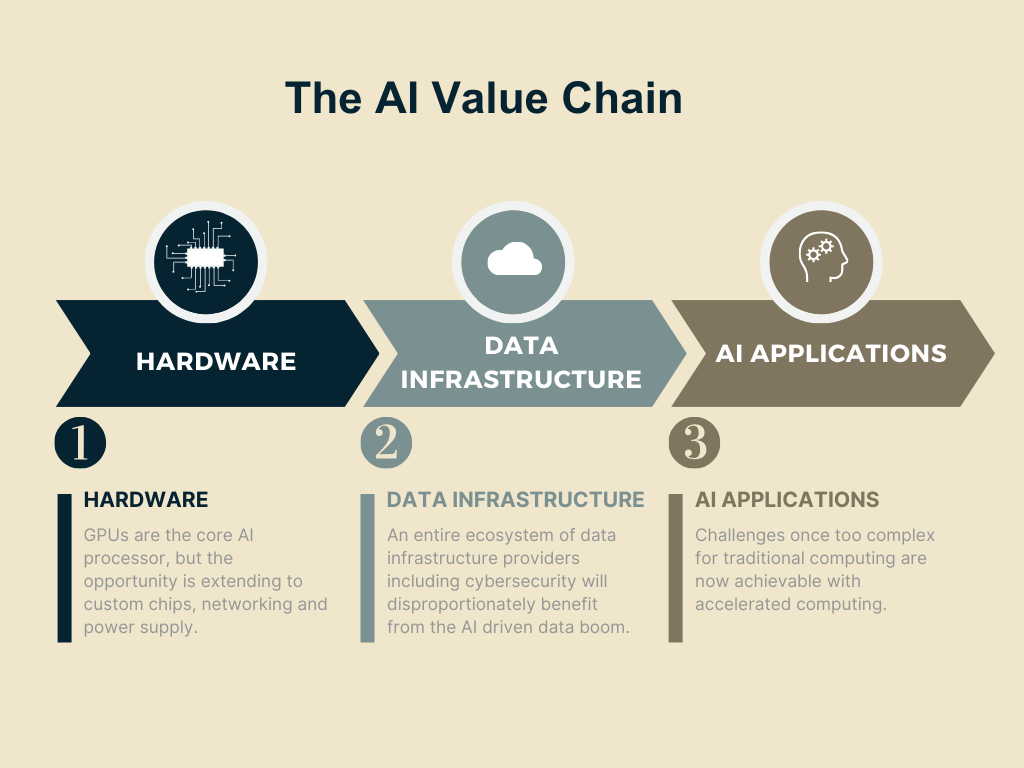

- Uncertainty created enticing alternatives in 1Q-3Q24 – upside is broadening from AI {Hardware} to different areas together with AI Functions.

- Shifting to offense – purchase any dip.

Our base case assumption of upper inflation and better for longer rates of interest, which resulted in 2+ years of muted macro development, hasn’t modified. What’s new?

We’re simply now beginning to see development decide up throughout a number of areas.

- In {Hardware}, Nvidia (NVDA) was the one firm with an outsized income development in 1H24. Nonetheless, the upside is now broadening to customized chips, because the Cloud Service Suppliers (CSPs) are getting into the area, networking and energy era, as new information facilities require incremental bodily infrastructure. Consequently, earnings are revised upwards.

- On the Knowledge Infrastructure facet, new enterprise booked (internet new ARR) has been unfavorable for a number of quarters now, even for the businesses rising revenues at 20%+. This metric simply inflected positively this quarter.

- In AI Functions, we’re simply beginning to see use-cases that may have a transformational influence on the world make progress. Whereas it’s too early to see this within the earnings, a number of firms are hitting significant know-how milestones.

|

The danger-off setting from the primary half of the 12 months continued to the third quarter, however the arrange considerably reversed as we entered 4Q24. With the removing of the election uncertainty we’re noting important uptick in enterprise confidence. With development choosing up, it’s cheap to imagine that inflation is not going to subside, however from the market perspective development + inflation is a lot better than stagflation (i.e., no development + inflation) as company earnings act as an inflation hedge.

Whatever the macro, there isn’t a query that we’re within the early innings of the subsequent know-how cycle amplified by AI.

What provides us confidence wanting into subsequent 12 months:

- Capex spending cycle is broadening. Whereas the primary wave of {hardware} funding in AI was centered on processors which went into current infrastructure, the newer and extra highly effective system (similar to Nvidia’s Blackwell DGX) require new information facilities and bodily infrastructure.

- Rising AI Functions. Whereas 2024 was the 12 months for {hardware}, we’re beginning to get a glimpse of sizable AI purposes. The early purposes have been largely centered on productiveness enchancment (e.g. copilot, gross sales productiveness instruments and so on.) however we’re beginning to discover purposes which have been not possible to progress as a result of compute limitations and are actually realizing a step change in efficiency with accelerated computing (e.g. autonomous driving, quantum computing).

- Enticing valuations. Valuations in sure areas have expanded however the encouraging angle throughout this up-cycle is that the upside has been pushed by earnings somewhat than valuation growth. Valuations for mid-caps (<$100B), particularly on the software program facet, have pulled again meaningfully and are close to the ’20 and ’22 lows.

Efficiency contributors and commentary

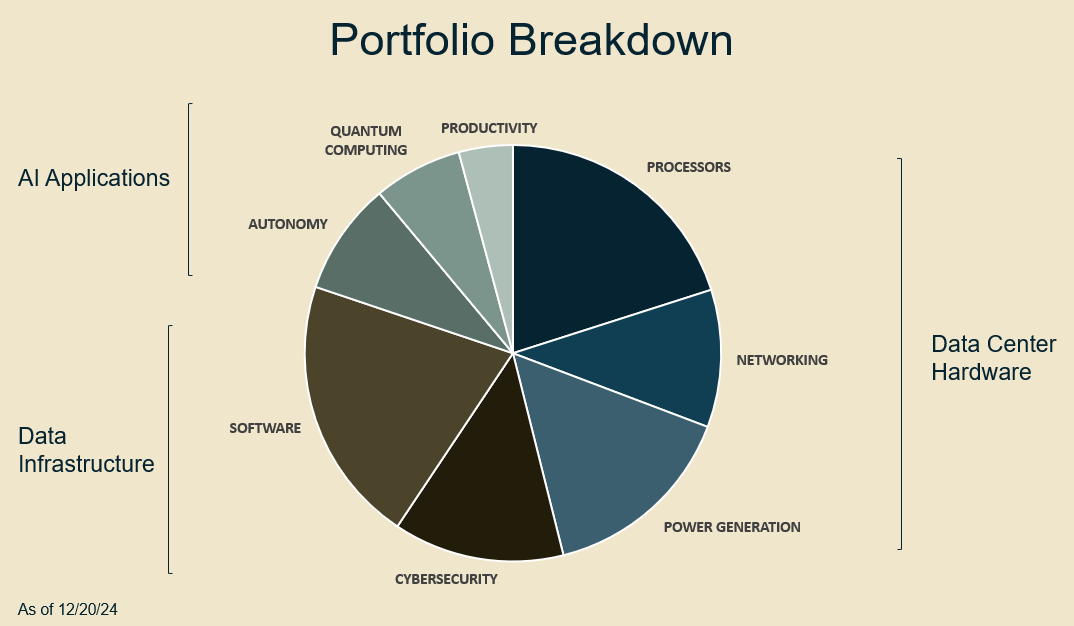

The largest adjustments to our portfolio over the course of this 12 months have been:

- Increasing our information middle {hardware} commerce to tangential areas throughout the worth chain similar to networking and energy era

- Increasing into the appliance layer

This is a glimpse of our present portfolio and efficiency contributors:

|

Knowledge Middle {Hardware} had blended efficiency in the course of the quarter, with processors underperforming and energy era outperforming.

Processors: Nvidia (NVDA) outperformed the remainder of our portfolio and Marvell (MRVL) and AMD (AMD) considerably underperformed. We now have been including to our Marvell place however minimize our publicity to AMD as our analysis indicated that customized chips are gaining considerably extra traction.

Energy Era & Supplies: Constellation Vitality (CEG) was the highest performer for the quarter publish the announcement of a re-opening of the Three Mile Island nuclear plant. Energy era and the grid have been underinvested for over 20+ years, and we anticipate a significant cycle forward. Consequently, we have now continued to speculate on this space and added two comparatively new positions in GE Vernova (GEV) and Vistra Vitality (VST).

Networking has been one other space of focus as we consider it presents a big alternative. Right here, we grew our place in Arista Networks (ANET) and extra lately added new smaller positions in Astera Labs (ALAB) and Credo Applied sciences (CRDO).

Knowledge Infrastructure and Cybersecurity has been a significant underperformer this 12 months. Software program, extra broadly, had a troublesome 12 months and corporations levered to enterprise spending had slower than anticipated earnings development. As well as, we have been negatively impacted by the Crowdstrike incident in the course of the quarter.

We proceed to have important publicity to this space as we consider there may be long-term upside, however we’re managing the danger very actively as that is the one space of know-how that’s disproportionately affected by rates of interest. Our largest investments Snowflake (SNOW), Cloudflare (NET) and Datadog (DDOG) in Knowledge Infrastructure, and Zscaler (ZS) in Cybersecurity.

AI Functions

Lastly AI Functions are beginning to achieve important traction. Issues that have been unsolvable for 10+ years are actually ready to make use of accelerated computing. In 2024 our publicity to AI Functions was largely within the productiveness enchancment space with holdings like Hubspot (HUBS) and Shopify (SHOP). We now have taken some revenue right here and re-deployed it to newer areas similar to Autonomy and Quantum Computing.

Tesla (TSLA) is our prime decide right here as the corporate transitions from a cyclical EV play to full autonomy and robo-taxis. We consider that regulatory help along with step-change enchancment within the security of the know-how will result’s important scale and upside for the inventory.

How will we handle danger?

We now have two fundamental instruments for danger administration:

- We enhance our concept velocity: in periods of consolidation, we enhance the tempo of producing new concepts (e.g., up to now 9 months, we have now elevated our publicity additional down the info middle worth chain, particularly increasing to areas “exterior of the rack” together with networking and vitality era).

- We take income on outperformers and minimize/cut back losers. Crucial facet of that is that we attempt to preserve the identical stage of danger in order that when the market turns to risk-on, we’re positioned to seize the profit.

Basic lively methods, on the whole, carry out higher in a risk-on setting as buyers need to allocate to concepts that seize alpha and broaden their publicity past simply monitoring broader market.

We proceed to handle danger actively and asses the potential danger/reward of every particular person holding, incorporating the trajectory of earnings and valuation. We aspire to carry out in step with diversified indices on the draw back, and generate differentiated efficiency on the upside, given our concentrated portfolio of investments.

Steadily Requested Questions Few factors on liquidity and market pricing associated to ETFs that could be useful primarily based on continuously requested questions: Liquidity. The liquidity of an ETF is set by the underlying holdings, not by the scale (‘AUM’) or quantity traded of the ETF itself. The ETF is backed by the property it holds and market makers continually create/redeem shares. Market Makers. When buyers purchase/and promote shares they typically (however not at all times) purchase/promote immediately from the market maker who has created the shares and holds them in stock. This ensures that there’s at all times a market to purchase/promote ETFs, somewhat than having to match a purchaser with a vendor (as it’s for equities). Market pricing. The value of the ETF adjustments continually and strikes with the underlying securities. To get essentially the most correct pricing when shopping for/promoting an ETF buyers ought to take a look at the precise bid/ask quote and unfold. The ETF shares are backed by the fund’s holdings which in our case are custodied at US Financial institution. For a Fund prospectus, standardized efficiency, and an entire record of holdings, go to Spear Funds. DISCLOSURES: The efficiency information quoted represents previous efficiency and doesn’t assure future outcomes. The funding return and principal worth of an funding will fluctuate in order that an investor’s shares, when offered or redeemed, could also be value kind of than their authentic price and present efficiency could also be decrease or increased than the efficiency quoted. For efficiency present to the latest month-end please name 1-833-340-7222. The entire expense ratio is 0.75%. For a prospectus or abstract prospectus with this and different details about the Fund, please name 1-833-340-7222 or go to our web site at www.spear-funds.com. Learn the prospectus or abstract prospectus fastidiously earlier than investing. Earlier than investing it is best to fastidiously contemplate the Fund’s funding targets, dangers, costs and bills.

Investing includes danger, together with potential lack of principal. The fund is topic to each development and worth fairness danger. Investing in development firms which might be primarily based on an issuer’s future earnings could also be extra risky if revenues fall wanting expectations. Investing in worth firms that stay unfavored or are undervalued for lengthy intervals of time might have a unfavorable on the fund’s efficiency. Firms within the industrials sector could also be adversely affected by adjustments in authorities regulation, world occasions, financial circumstances, environmental damages, product legal responsibility claims and alternate charges. Know-how, Area, Robotics and Automation firms are notably susceptible to fast adjustments in product cycles, obsolescence, authorities regulation and competitors, each domestically and internationally, which can have an adversarial impact on development and revenue margins. Market or financial elements impacting these firms that rely closely on technological advances might have a significant impact on the worth of the Fund’s investments. SPRX is non-diversified and should put money into a better proportion of its property in securities of an issuer within the industrial or know-how sectors. An adversarial occasion to an issuer within the trade might negatively influence the fund’s efficiency.Making use of ESG (Environmental, Social, Governance) sustainability standards to the funding course of might exclude securities of sure issuers for non-investment causes, and due to this fact, the Fund might forgo obtainable market alternatives. Foreside Fund Companies, LLC, distributor. |

Unique Submit

Editor’s Notice: The abstract bullets for this text have been chosen by Looking for Alpha editors.