Yossakorn Kaewwannarat

Indicators of worry are making the headlines once more after the S&P 500 Index (SPX) got here underneath reasonable promoting stress over the previous few buying and selling classes. The extensively anticipated pullback has been comparatively delicate to this point. As of Friday’s shut, the SPX was down by merely -2.9% from its all-time highs earlier than staging a rebound within the final buying and selling session.

TradingView.com

Given how properly the SPX has carried out thus far, with valuations on huge expertise names and AI-related themes operating forward of fundamentals, a number of Wall Road analysts have been anticipating a significant correction of 10% to fifteen% for fairly a while.

Amid indicators that the pullback is lastly in movement, analysts jumped on the first alternative to promote worry on the monetary media. A few of these calls embrace suggestions telling buyers to not purchase into the dip as a result of costs are sure to head even decrease. Even the bullish analysts have begun to hedge their calls by warning of elevated volatility within the close to time period and recommending that buyers purchase put choices for cover whereas preserving their lofty year-end targets on the SPX.

A Dip Or A Correction, Does It Matter?

For disciplined buyers with a strong funding plan in place, whether or not the eventual final result is a 5% dip or an honest correction of 10%-15% actually should not matter that a lot. Except one is planning to commerce these fluctuations by timing each peak and trough over a multi-year bull market cycle (good luck with that), occasional pullbacks ought to be extra of a distraction within the larger scheme of issues.

Maybe a bear market is an actual concern for some who usually are not eager to journey out prolonged drawdowns. However for the reason that SPX has recovered from each bear market to set new document highs over time, bear markets mustn’t pose an actual drawback for buyers concentrating on a fairly lengthy funding horizon. For these long-term buyers, these occasional pullbacks have solely confirmed to be nice shopping for alternatives.

So why are market contributors (buyers and analysts alike) so obsessive about short-term market timing?

Is It Worry, Or Simply Greed In Disguise?

The seemingly irresistible temptation of attempting to promote down fairness positions with the intention to re-enter at a significantly better value has too usually been mistaken as a response to worry.

The monetary media often associates a correction within the fairness market with some type of destructive occasion or potential danger that’s inflicting fearful buyers to promote. Very often, the media will search for probably the most handy clarification accessible to match the market’s behaviour of the day. Certainly, it’s fairly widespread to learn headlines that may initially hyperlink some piece of stories to worry available in the market after which, just some moments later, declare the identical piece of stories is now driving the market in the other way.

Nevertheless, now we have already identified that disciplined investing means not often having to answer these occasional pullbacks by making sweeping changes to the portfolio. So except there’s a actual credible menace to the financial system and fairness fundamentals, there ought to be no purpose for buyers to promote equities as an asset class. To be clear, common shopping for and promoting of particular person shares as a part of rebalancing an fairness portfolio or making tactical changes to the composition of a portfolio could also be mandatory once in a while as firm fundamentals change. Nevertheless, indiscriminate promoting of a complete asset class in anticipation of a possible correction is pure speculative behaviour.

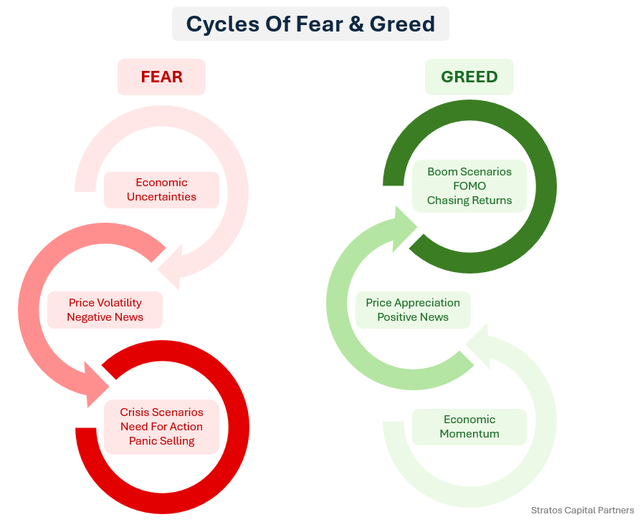

Stratos Capital Companions

We imagine that market corrections are predominantly pushed by greed relatively than worry. Many start their funding journey considering like buyers however find yourself behaving like merchants as a result of they fall into the entice of considering that they’ll do significantly better than a easy buy-and-hold technique. Thus, every bit of stories presents a tempting alternative to deviate from the long-term plan within the hope that one can do significantly better by shopping for market bottoms and promoting peaks. However when was the final time we got here throughout an investor who needed to dump equities as a result of he may not comprise bear overwhelming worry of a 3% pullback?

As a result of attempting to time main bull and bear market cycles means doubtlessly having to attend a number of years if one makes a mistaken transfer, most merchants additionally are likely to lean in direction of timing short-term cycles. Made a nasty commerce? No drawback, simply catch the following sign on the charts. This is the reason day buying and selling is so enticing for a lot of merchants. Think about simply catching a few trades and concentrating on a 1% return every day. Use some leverage, try this persistently, and you’re in your approach to turning into a billionaire. Merely delusional.

Worry is Simple To Commerce, However Greed Is Difficult

When markets are overwhelmed by worry and fairness costs are buying and selling at deeply discounted costs, there’s some margin of security in investing in corporations with sound fundamentals. There’s a restrict to how low costs can fall as long as an organization is solvent and worthwhile.

However when markets are overwhelmed by greed, there’s actually no restrict to how excessive asset costs can go. As long as there’s a larger idiot who’s keen to supply the next value, there will probably be a vendor keen to transact. Subsequently, simply because the SPX is in an prolonged bullish streak doesn’t essentially imply {that a} correction is simply across the nook.

The very fact stays that many analysts have been calling for a correction for months and have failed miserably. How about these requires a recession again in 2023? Or the stagflationary eventualities again in 2022? If one had adopted that type of recommendation to dump shares, one would have missed all the bull market thus far.

It’s puzzling why buyers proceed to heed recommendation from Wall Road analysts on taking directional bets in the marketplace when the monitor document of those calls has been so depressing over time. Alternatively, good textbook investing rules backed by many years of information and tutorial analysis are sometimes solid apart and deemed unhelpful as a result of practical returns are merely not adequate for grasping buyers.

Purchase The Pullback

From our perspective, the current pullback within the SPX is a chance for buyers who’re implementing Greenback-Value-Averaging (DCA) or wish to construct bullish positions by shopping for the pullbacks. Though a ten%- 15% correction at this level is definitely potential, it will, in reality, be a wholesome state of affairs for the bull market. As a substitute of attempting to commerce these pullbacks with precision, we expect buyers will probably be higher off concentrating on choosing up undervalued names.

Extra importantly, we’re sceptical that this pullback is an early warning signal of a bear market. Current financial information continues to bolster our view of a strong macroeconomic outlook and beneficial situations for equities. With the U.S. financial system in significantly better stability—disinflationary development and resilient labour market—and the Federal Reserve sounding much less hawkish of late, we suspect that the pullback will quantity to nothing greater than a ten%- 15% correction. Except the Federal Reserve surprises the market by delaying fee cuts past September, we keep our total bullish view on U.S. equities as an asset class for now.

Having mentioned that, we additionally word that with U.S. fairness market focus reaching extremes final seen within the Nineteen Sixties, investing within the SPX not satisfies the target of reaching satisfactory diversification for passive buyers. Subsequently, though we’re bullish U.S. equities usually, we’re sustaining our “Maintain” score on the SPX.

As a substitute, we favor an equal-weighted index just like the Invesco S&P 500® Equal Weight ETF (RSP), which permits buyers to realize satisfactory diversification away from costly expertise and AI themes whereas staying absolutely invested in equities.

We keep our “Purchase” score on the RSP.