cemagraphics

Information this week was about pretty much as good as even essentially the most optimistic bull may need hoped for and any remaining bearish technical indicators had been put to relaxation with the S&P500’s (SPY) transfer by 5390-400. There have now been 7 larger closes in a row and it seems a brand new leg of the bull market is underway.

The early resumption of the rally could also be irritating for a lot of who missed the underside. I am sadly on this camp – after calling the highest and a correction to 5265, I used to be all set to load up once more, however in fact the market did not give me a pleasant little dip to purchase. The “crash” on August fifth obtained me overly cautious and I’m now underinvested. I might like to see one other huge dip, however I am additionally taking a look at alternative routes to purchase, even when the S&P500 is approaching its all-time excessive; it would not have a tendency to present patrons a second likelihood.

This week’s article will establish new inflection factors. These will help hold you on the best facet of the pattern and can be utilized to enter trades with minimal danger, even when the market has moved a good distance. Varied strategies will likely be utilized to a number of timeframes in a top-down course of which additionally considers the key market drivers. The goal is to offer an actionable information with directional bias, vital ranges, and expectations for future worth motion.

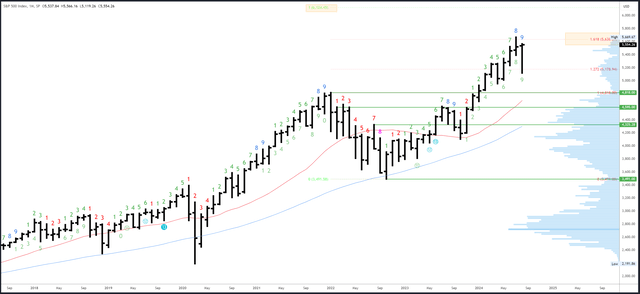

S&P 500 Month-to-month

The August bar has not solely traded again into the July vary above 5390, however is now again in constructive territory. There are nonetheless 2 full weeks to go till the month-to-month shut, however at this juncture, a bullish bar has shaped and solely a detailed beneath 5390 will shift it impartial/bearish.

I am barely stunned on the brevity of the correction in August. The month-to-month exhaustion took 8-9 months to arrange, and got here in confluence with a weekly sign and the key Fib extension at 5638. It was a full home of bearish indicators and would possibly nonetheless have some lingering results which cap the positive factors over 5669.

The following main goal is the 6124 degree. It is a measured transfer the place the 2022-2024 rally will likely be equal in dimension to the 2020-2022 rally. It’s unlikely to be reached this facet of the election, however is a attainable vacation spot sooner or later on this bull market.

SPX Month-to-month (Tradingview)

5638 and the 5669 are main resistance factors.

5390 and the August low of 5119 are preliminary helps.

The August bar will full the upside Demark exhaustion depend. It might have performed out already with the correction of practically 10%, however its impact might linger and restrict rallies forward of the election.

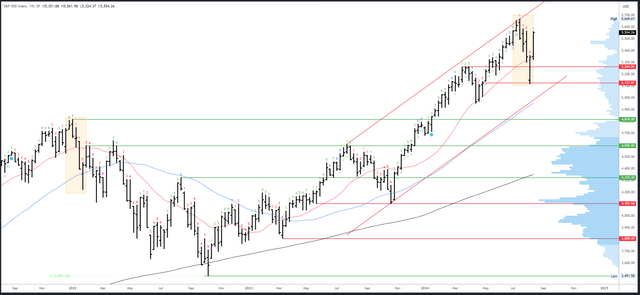

S&P 500 Weekly

Final week’s article highlighted the necessity for a “larger low, larger excessive and better shut over 5344, ideally 5400” to substantiate a reversal. These had been offered emphatically in a really bullish weekly bar. The shut on the highs suggests the rally will observe by early subsequent week.

The comparability with the preliminary drop from the 2022 high (highlighted) remains to be legitimate, however much less compelling with this week’s sturdy motion. A big drop subsequent week can be wanted to maintain this comparability related,

SPX Weekly (Tradingview)

Preliminary resistance is available in at 5566 and is more likely to be examined early subsequent week.

The 20-week MA and low of final week are preliminary assist at 5324.

Subsequent week will likely be bar 2 (of a attainable 9) in a brand new upside Demark exhaustion depend.

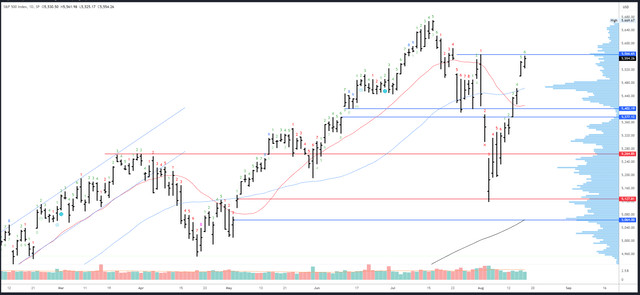

S&P 500 Each day

The S&P500 is sort of again the place the 3-day crash (if we are able to name it that) originated at 5566. It is apparent resistance, however so was the 5390-400 space which was minimize by final week prefer it was nothing. That is comparable motion to early November ’23 and to early Could ’24 when the rally gapped over resistance factors and maintained sturdy momentum.

Rallies are likely to gradual after they attain the world of the previous high and a clear break of 5669 appears unlikely. Count on shallow dips till this degree is reached.

SPX Each day (Tradingview)

5566-85 is the primary resistance, then the 5669 peak.

On the draw back, the hole at 5500 is potential assist, adopted by 5463-70 on the excessive quantity space. The 5390-400 space remains to be related; a break beneath this degree would put the restoration into query.

An upside Demark exhaustion will likely be on bar 7 (of 9) on Monday. A response is commonly seen on bars 8 or 9 which suggests a pause/dip will get extra possible from Tuesday onwards.

Drivers/Occasions

The information was so good this week, a 50bps minimize in September has been priced out and the chances of a 25bps transfer have risen to 75%. US Core PPI got here in at 0.0% when 0.2% was anticipated, CPI stayed at 0.2%, however most vital of all, Unemployment Claims got here in decrease than anticipated at 227K, a way from the hazard space of 250K. Panic over the labour market appears untimely. Importantly, yields moved decrease once more, this time for the best causes (low inflation).

Information subsequent week is on the quiet facet and may enable the present transfer larger to proceed. FOMC Minutes are due for launch Wednesday whereas Thursday will carry PMIs and Unemployment Claims – the stronger the higher for the S&P500. Fed Chair Powell is scheduled to speak on the Jackson Gap Symposium on Friday. Whereas no surprises are anticipated, it will likely be attention-grabbing to listen to the Fed’s view on latest occasions; will they push again on the dovish repricing and expectations for aggressive cuts? Most likely not.

Whereas the info could also be constructive, issues over valuations, the economic system and the election might cap the upside. Bear in mind the July high shaped on excellent news (CPI), and the August backside got here when issues seemed their worst. The response to information usually is determined by the technical context (positioning).

Possible Strikes Subsequent Week(s)

The bullish larger image view is firmly intact and it appears the anticipated H2 correction has performed out already. New all-time highs are anticipated within the coming weeks, though the pattern above 5669 could also be restricted by the continued impact of the month-to-month exhaustion sign and issues over the labour market/economic system. Election uncertainty can be more likely to cap rallies. I am anticipating an preliminary break of 5669 will fail after which result in a a lot slower drift larger to type a wedge sample.

Brief-term, resistance at 5566-85 must be reached early subsequent week. A each day exhaustion sign ought to then result in a pause and dip, however 5500 ideally holds to arrange continuation to 5669 the place an extended consolidation is probably going. Assuming this state of affairs performs out fairly effectively, I’d purchase close to 5500 and add if 5463-70 is reached.

Ought to 5390-400 break, it will imply my conclusions of a powerful transfer to 5669 are flawed and the S&P500 remains to be in a correctional section. Though this might be disappointing, it might present a chance to purchase throughout a deeper dip and I’ll get a second likelihood in spite of everything.