PhonlamaiPhoto

Growing demand for computing power provides the iShares Semiconductor ETF (NASDAQ:SOXX) with long-term growth prospects. The semiconductor industry has demonstrated a strong performance since the beginning of the year, while the vision for recovery of chip sales in the back half of 2023 could bring further gains. SOXX gained 40% to date, and my estimations provide that up to 20% upside potential is still awaiting, as the fund trades at an attractive valuation level. I believe that SOXX is an attractive Buy, where the main pillars for the upside are 5G networks, strong GPUs demand for data centers and AI-model development, as well as the resilient automotive and industrial markets.

Fund overview

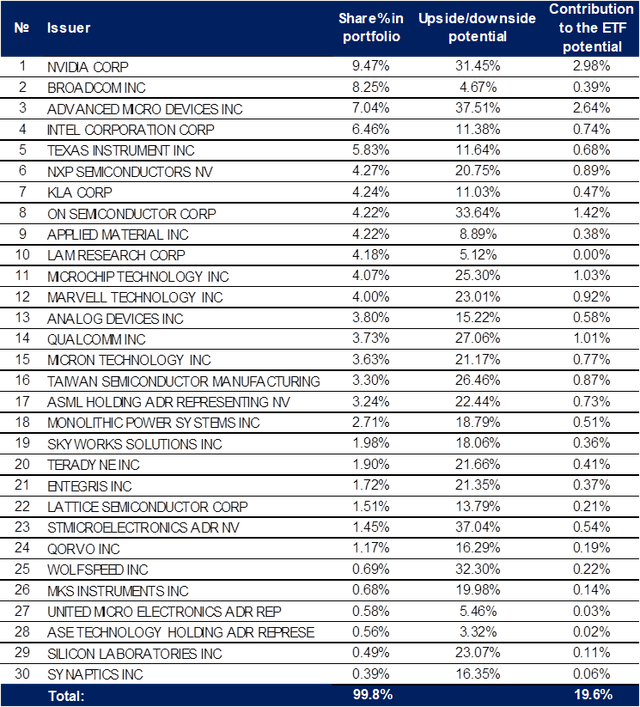

SOXX ETF tracks the dynamics of the ICE Semiconductor Index, which is composed of stocks of the leading semiconductor manufacturers and equipment providers. As of August 24, 2023, the net asset value of the fund amounts to $8.7 billion, which costs the investors 0.35% on annum. The ETF is quite concentrated around the top 5 holdings out of 30 overall, which account for 37% of the fund’s portfolio as follows: Nvidia Corp. (NVDA) with 9.5% share; Broadcom (AVGO) with 8.3%; Advanced Micro Devices (AMD) with 7%; Intel (INTC) with 6.5% and Texas Instrument (TXN) occupying 5.8% of the portfolio.

Core holdings of the fund (Seeking Alpha)

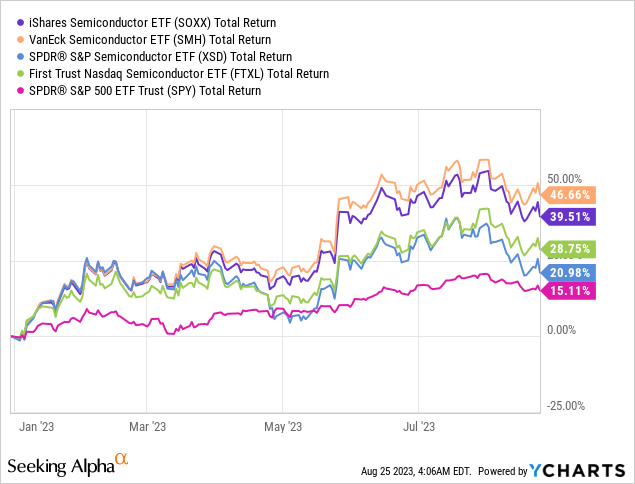

Since the beginning of the year, the performance of the semiconductor stocks has been really impressive. SOXX surged 40% to date, well ahead of the broad market represented by the SPY, which gained 15%. The fund also outperformed its direct competitors in the face of First Trust Nasdaq Semiconductor ETF (FTXL) and SPDR S&P Semiconductor ETF (XSD). However, SOXX fell short of VanEck Semiconductor ETF (SMH), as the latter has 2x more exposure to NVDA, which flew away more than 200% so far in the year.

Such strong performance of the semiconductor players is in line with the rapid development of artificial intelligence since the beginning of the year, which requires a lot of efficient computing power to make usage of AI-based models possible.

Industry dynamics

Global chip sales are exhibiting fairly weak dynamics so far in 2023, down by 21% YoY, which is due to the high base in the first half of 2022. The only market that shows resilience is the European area, while Asia Pacific remains negative, primarily because of falling demand from the Chinese market.

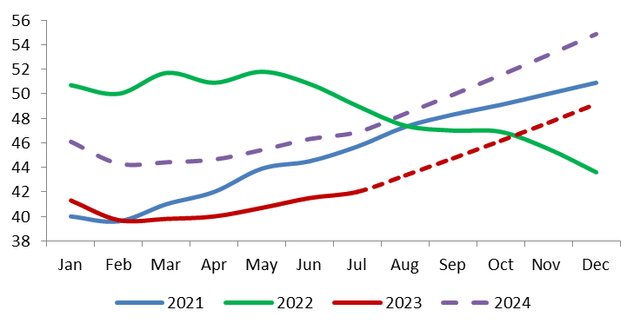

Global semiconductor sales (Semiconductor Industry Association)

However, looking at the above chart, some positive trends could be derived. According to the WSTS forecasts, chip sales should drop 10.3% YoY in 2023, but taking the forecast as granted, it implies a 3.2% monthly sequential growth during the second half of the year (dotted red line). In this case, the monthly chip sales should exceed 2022 levels already in October, which is generally in line with the market expectations of semiconductor’s recovery in the back half of the year. Going forward, WSTS expects 11.8% growth in 2024 sales, which is quite encouraging for the sector, where the memory market should rebound the most. And if we try to put this on a graph, the dynamic of monthly sales should look somewhat like the violet line.

Industry risk factors

The semi-industry has quite a cyclical nature, which causes relatively high volatility in semiconductor stocks. The forecasts for chip sales recovery taking place at the end of the year could strengthen the performance of semi-players further, otherwise the industry and SOXX could experience significant corrections. Many US players are significantly dependent on the Chinese market, where trade restrictions remain an important factor of uncertainty.

Investment inference

Now, I will turn to weighted average target prices of securities that make up the fund’s portfolio in order to assess the SOXX prospects. Based on the consensus estimates, the upside potential of the SOXX should be 19.6%, which implies a target price of $579 and stipulates a confident Buy rating.

Valuation (Seeking Alpha; author’s estimates)

Taking a closure look, the biggest contributors to the estimated upside are Nvidia (2.98%), AMD (2.64%), On Semiconductor (1.42%), Microchip (1.03%) and Qualcomm (1.01%), which collectively provide almost a half of the potential growth. It shouldn’t be surprising, since the main growth drivers for the semiconductor companies are connectivity/mobility and computing accelerators. As a result, I believe that SOXX has a reasonable exposure among the semi-players in order to catch the growth from the spread of 5G networks through QCOM; strong GPUs demand for data centers and AI-models development thanks to NVDA and AMD; and the resilient automotive and industrial markets through MU and ON.

It’s clear that the main upside potential should come from semiconductor manufacturers, while semi equipment/services, which represents 1/5 of the funds focus, accounts for just 3% potential. The latter could be attributed to the weak memory market, which constrains the financial results of equipment providers. Going forward, this is unsustainable from my point of view, since coping with an enormous AI-related workload requires high levels of computing power, which could be delivered merely following the transition to the lower chip nodes. Meanwhile, in my recent article on Applied Materials (AMAT), I estimated that around 20-25% of the company’s revenue is attributed to advanced nodes. As a result, I believe that with gradual transition to annotative processes, the equipment/services providers could make a more significant contribution to the SOXX potential.

It should be noted that since the beginning of the year, the valuation of SOXX showed astonishing growth, where the forward P/E rose 67% to 24.4x. However, the latter ratio is still 25% below the 5-year average of 19.5x, and is lower than the technology select sector’s 26.6x current valuation. Hence, I believe that the current valuation of SOXX provides an attractive entry level to catch the potential chipmaker’s growth driven by diffusion of 5G, adoption of AI across the economy, strong automotive/industrials market and expected memory market recovery.