jittawit.21/iStock via Getty Images

Rapid Recap

In my previous analysis, I said:

The issue I have is that by investing in SoundHound, investors are purely speculating. And the likelihood that an investor makes a profitable investment here is rather small.

[…] Every single day, Voice AI will make us more productive and go on to provide unthinkable advantages for consumers and enterprises alike.

My sole contention is that investing in SoundHound AI, Inc. is not the right way to benefit from this secular growth opportunity.

Not only do I today stand by those comments, but I now downwards revise this stock to a sell.

Why SoundHound AI?

SoundHound AI (NASDAQ:SOUN) is a voice AI technology company. And admittedly, for anyone that has become all too accustomed to shouting commands at Siri only to subsequently curse when Siri struggles with the simplest commands such as ”stop,” I welcome any disruptive voice AI technology. In fact, and take this straight from my lips, I’m sold on this premise.

My sole contention is that this stock is not the best way to invest in this concept.

Q2 Earnings Preview, Poised to Disappoint

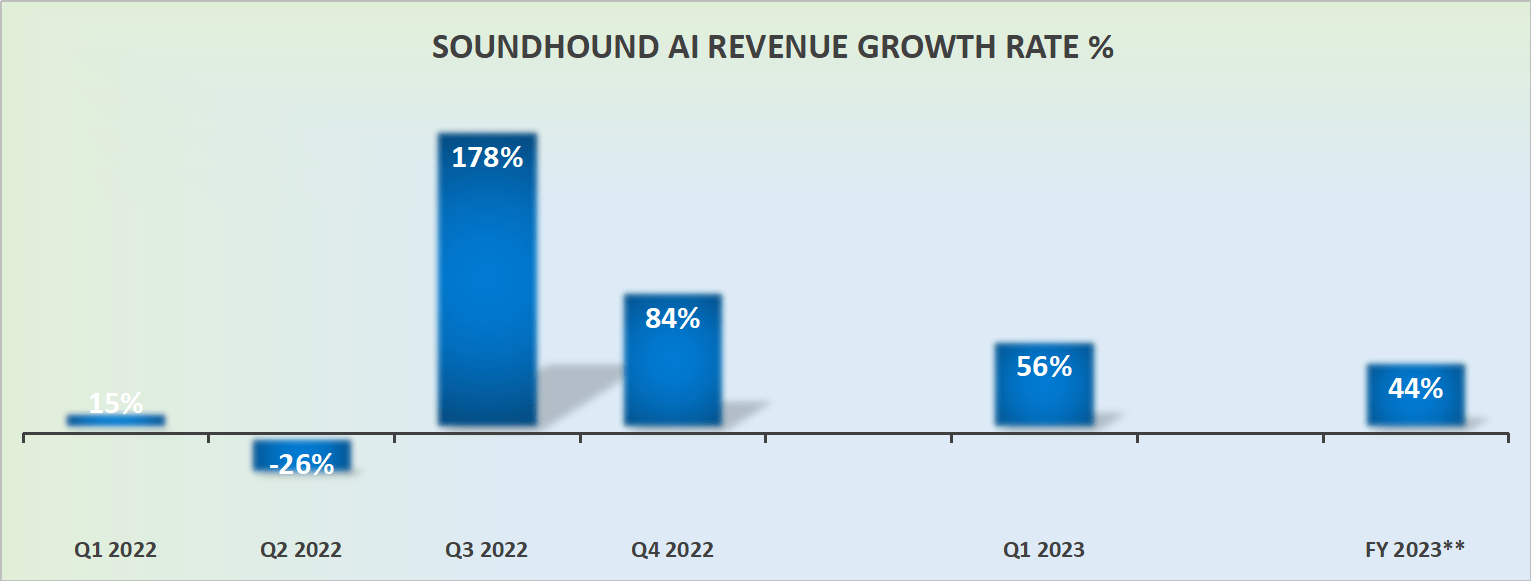

SOUN revenue growth rates

The bull case for SoundHound AI is based on the assumption that its alluring and compelling AI narrative will see SoundHound AI reignite its revenue growth rates.

However, I suspect that the more measured and realistic outcome for Q2 2023 is that SoundHound AI delivers revenue growth rates of 40% CAGR and the company does not significantly upwards revise its 2023 outlook.

Meaning that, on the back of its Q2 2023 results in a few weeks’ time, investors will be left pondering whether this company is truly on a secular growth trajectory, or rather, its fastest CAGRs are already in the rearview mirror.

Essentially, is this truly a rapidly growing small-cap company, or is this a company with a lot of sound-fizzle but not enough traction?

Furthermore, don’t believe for a moment that the timing of my downgrade was random happenstance. Something we’ll discuss next.

Profitability Profile Doesn’t Inspire Hope

Let me cut to the chase. SoundHound AI was running seriously close to running out of capital.

In my previous analysis, I said:

SoundHound AI, Inc. is raising equity to pay down debt. This makes no financial sense. And the company wouldn’t adopt this sort of financial engineering if the underlying business was more stable.

No sooner had I typed up those words than SoundHound AI was busy moving swiftly to raise capital.

More specifically, last night, SoundHound AI raised a mixed shelf for $400 million. For a company with a market cap of $630 million, this equates to the capacity to raise equity amounting to 60% of its underlying valuation. Needless to say that this is a gigantic sum for such a small-cap company.

Let me drive home my message, SoundHound AI had approximately $40 million of cash in Q1 2023 and was burning through about $60 million of free cash flow. It’s obvious that SoundHound AI is on poor financial footing. Just as it’s obvious that without this significant shareholder dilution, SoundHound AI could continue to operate as a going concern.

The Bottom Line

In my previous analysis, I emphasized that investing in SoundHound AI is more of a speculative venture rather than a sound investment choice.

While the concept of voice AI technology is undeniably intriguing, I remain cautious about SoundHound AI, Inc.’s ability to capitalize on this potential.

Thus, I now revise my stance on SoundHound AI, Inc. stock, downgrading it to a sell rating. My reservations stem from concerns about the company’s revenue growth rates, which might not meet investors’ optimistic expectations.

Additionally, SoundHound AI’s profitability profile and recent capital raises have raised red flags about its financial stability. Given these factors, I believe investors may find better opportunities in other companies within the voice AI sector.