Receive free Markets updates

We’ll send you a myFT Daily Digest email rounding up the latest Markets news every morning.

This article is an on-site version of our Unhedged newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday

Good morning. This morning’s payroll report has the potential to move markets even more than usual. If it is anywhere near as hot as yesterday’s ADP employment report, the pervasive optimism of the past few weeks might get sucked right out of the air. A moderate report could keep the good vibes flowing. Deep breaths, everyone. Email us: [email protected] and [email protected].

Something has changed

In the past week or two, something important seems to have happened in markets. As with any short-term move, the changes could be noise or a temporary byproduct of shifting investor positioning. But it feels more significant than that.

The background to the market shift is economic data that has been coming in strong. We’ve discussed last week’s impressive durable goods and gross domestic product numbers. And just yesterday:

The ISM services index popped to 54 in June, indicting expansion, up from a neutral 50 in May, and well above forecasts.

The quits rate, which had been returning to a its pre-pandemic average of 2.3 per cent, ticked back up to 2.6 per cent.

Job openings fell, but at a somewhat reserved pace. They remain more than 40 per cent above 2019 levels. There is lots of labour demand still out there.

The ADP private payrolls report showed nearly half a million jobs added in June, suggesting today’s government payrolls data could come in hot too (ADP’s numbers are notoriously noisy, though).

The crucial change in markets is in Treasury yields. Since early May, two-year yields have been rising steadily, as investors have slowly accepted the fact that the Federal Reserve will not cut its policy rate any time soon. Neither the debt ceiling set-to nor the meltdown of a few regional banks had an appreciable effect on the economy; inflation had declined but only at a stately pace; financial markets have churned higher, loosening financial conditions. The Fed doesn’t have room to cut.

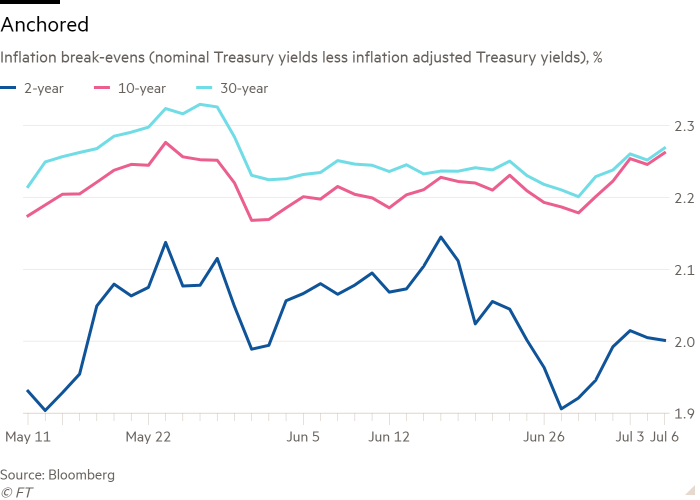

In the past few weeks, the increase in two-year yields has only accelerated. What has changed is that longer-term Treasury yields have started to rise too, and rise very quickly. See how the pink and light blue lines — 10- and 30-year bonds — have hooked up sharply after many weeks of running sideways:

The rise in long rates is not surprising in itself. As expectations that the fed funds rate will remain high for longer become entrenched, it becomes harder for long rates to ignore them and stay low. Long rates are just a series of short rates, plus a variable term premium. What is a bit surprising is that this has occurred coincidentally with two other facts: inflation expectations have not risen, and stock prices have.

Here is why that combination is surprising. If growth is still robust after 500 basis points of increases in the fed funds rate, the Fed probably is going to have to do quite a bit more tightening to cool the economy. This, presumably, increases the risk they will screw up the timing and tighten too much, causing a recession. But the rising stock market says this is not going to happen.

Alternatively, maybe the Fed has overestimated how tight their policy is — maybe the inflation-neutral rate of interest is higher than the Fed thinks — and therefore will fail to tighten policy enough, allowing inflation to persist. But low and stable inflation break-evens are telling you that’s not going to happen, either. Break-even inflation rates (Treasury yields minus inflation-indexed Treasury yields) have been moving more or less sideways for two years. The recent increase in interest rates is therefore mostly an increase in real interest rates.

The recent fast rise in long-term real rates is the concrete manifestation of the belief that the Fed will eventually pull off a soft landing — lower inflation without recession. This belief used to be abstract, a number in a probability matrix or a chart in a paper by a Fed official. As of this month, it’s a concrete fact, inscribed in market prices.

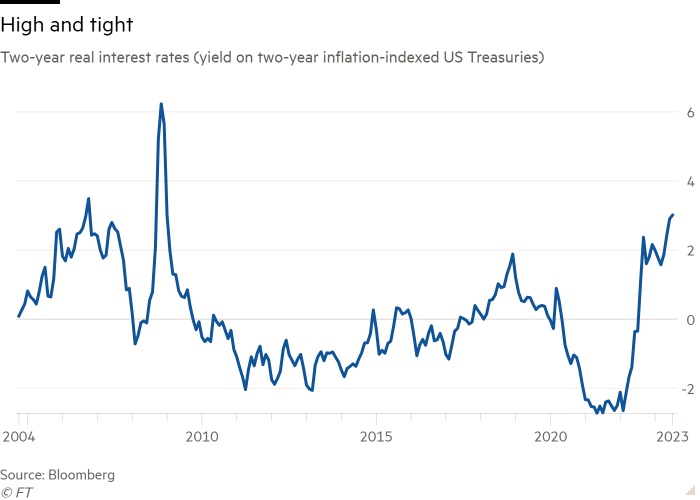

Has the market become too optimistic? Yesterday’s trading featured rising rates and — for a change — falling stock prices. That combination suggests second thoughts, a twinge of fear about Fed-induced recession. And second thoughts are in order. Short term real interest rates are now higher than they have been since the great financial crisis:

The chart above is enough to make a person doubt how long the good news on growth will continue — or wonder if monetary policy is no longer as effective as it was. [Armstrong and Wu]

One good read

Fifteen years ago, the last time two-year interest rates were this high, Unhedged friend and rival John Authers wrote this analysis with another friend, Mike Mackenzie. Parts of it proved unpleasantly prescient about the crisis that was then less than a year away. Does it have lessons for today? We sure hope not.

FT Unhedged podcast

Can’t get enough of Unhedged? Listen to our new podcast, hosted by Ethan Wu and Katie Martin, for a 15-minute dive into the latest markets news and financial headlines, twice a week. Catch up on past editions of the newsletter here.

Recommended newsletters for you

Swamp Notes — Expert insight on the intersection of money and power in US politics. Sign up here

The Lex Newsletter — Lex is the FT’s incisive daily column on investment. Sign up for our newsletter on local and global trends from expert writers in four great financial centres. Sign up here