Neme Jimenez

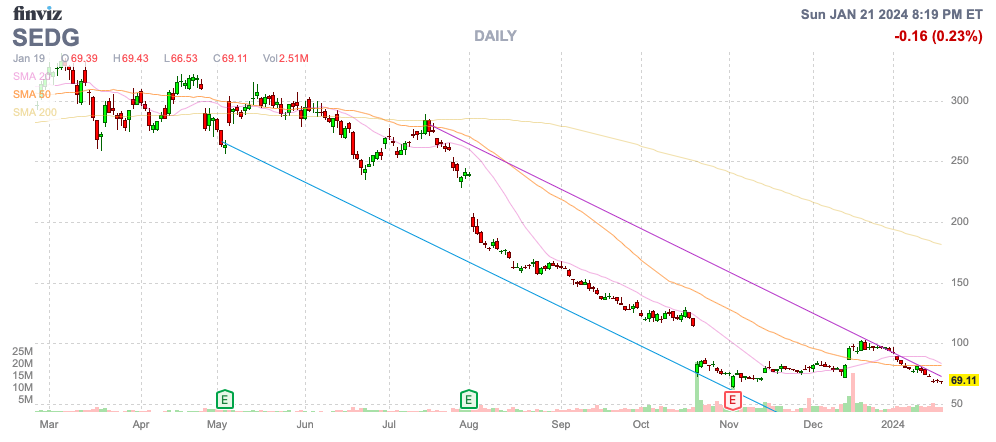

The solar sector saw a huge benefit during Covid and the Russian invasion of Ukraine when power supplies were under pressure and costs were soaring in Europe, now higher interest rates make the clean energy option far less desirable. SolarEdge Technologies (NASDAQ:SEDG) just announced a major workforce reduction suggesting very weak Q4’23 numbers will persist in 2024. My investment thesis is Bearish on the stock with business only falling off a ledge here after peaking back in Q2’23.

Source: Finviz

Big Warning

Over the weekend, SolarEdge management announced plans for a workforce reduction impacting 900 employees, or 16% of the workforce. Over 500 of the employees are from manufacturing sites, including discontinuation of the Mexico plant, in a sign the company doesn’t expect demand to snapback anytime soon.

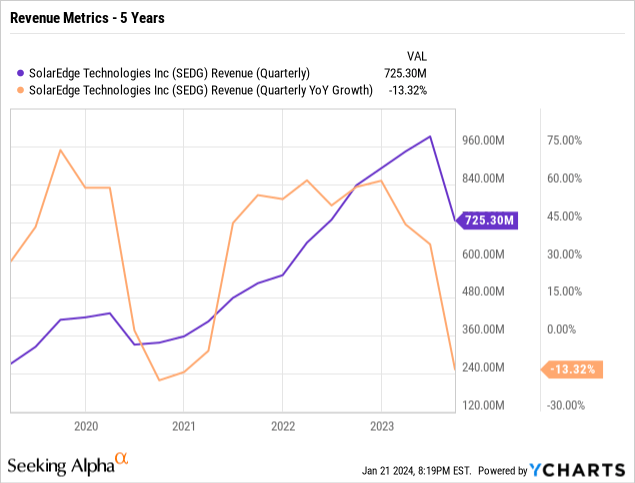

As with a lot of companies in the energy sector, SolarEdge saw a huge demand surge along with Covid dynamics and the Russian invasion of Ukraine altering the energy dynamics around the globe. The once dire scenario for energy supplies didn’t materialize and the surge in demand for solar systems has collapsed due to an additional hit by financing with higher interest rates.

SolarEdge had previously reported Q3’23 revenues dipped 27% to $725 million while guiding to Q4’23 revenue of $350 million, at most. Note, the above chart highlights how the Q4 guidance for a 50% collapse in sequential revenues only brought the quarterly total right in line with revenues prior to 2021.

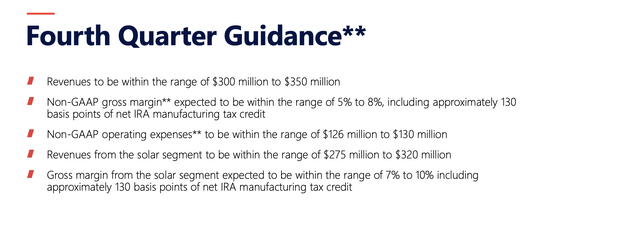

Source: SolarEdge Tech. Q3’23 presentation

The layoffs at manufacturing sites probably isn’t a huge surprise since the company announced weak guidance on November 1 with barely positive gross margins. Between high product inventory in the distribution channel and lower demand, SolarEdge doesn’t need to build as many inverters and power optimizers anymore.

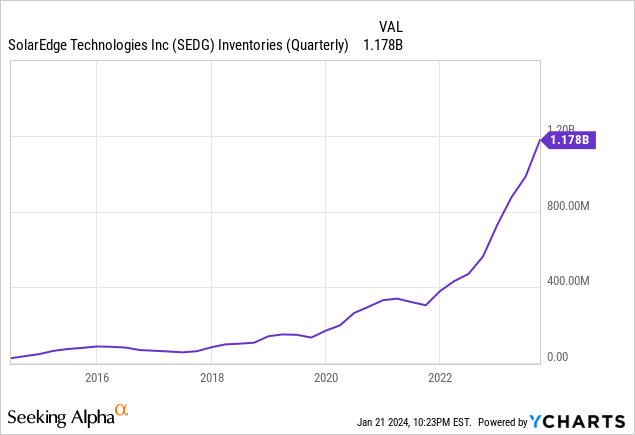

The company ended Q3’23 with an inventory of $1.2 billion, up double from the $0.6 billion last Q3. SolarEdge had inventories far below $400 million prior to the start of 2022 suggesting a lot of needed digestion ahead.

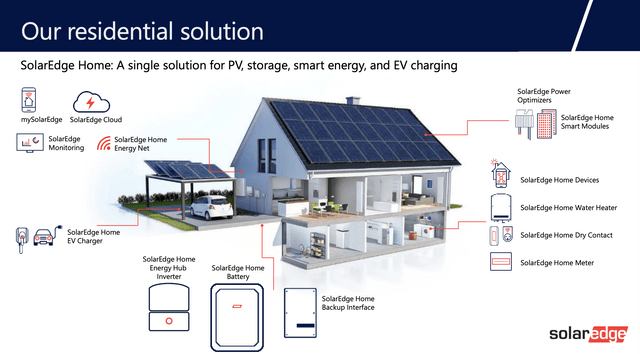

The company offers a full suite of energy solutions to homeowners including PV, storage, smart energy and EV charging focused on the solar market. The recent slowdown in the electrification in Europe and the desire for EVs in the U.S. could leave the company in a big consolation period in 2024.

Source: SolarEdge Tech. investor presentation

A lot of what SolarEdge does was in high demand, but one has to wonder if the solar equipment is all that specialized in an environment with lower demand.

Next Leg Down

SolarEdge making a big cut to headcount now confirms the business hasn’t bounced back in early 2024. The company and analysts will need to cut numbers for 2024 leading to another likely leg down for the stock.

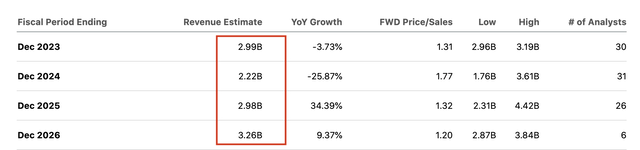

Right now, the consensus estimates are for SolarEdge to reach $2.2 billion in 2024 sales with the lowest analyst estimate at $1.8 billion. The company doesn’t appear anywhere close to reaching these targets.

Source: Seeking Alpha

The stock has a double bottom around $65 and the trading action to start the week will say a lot about whether SolarEdge has more downside. The large layoffs would appear to signal more weakness ahead, or at least the lack of a major rebound. If the stock holds the recent lows from early November similar to how SolarEdge bounced following the weak Q4 guidance, the stock has probably hit bottom.

Even with the IRA tax credit, SolarEdge forecasted a Q4’23 gross margin of only 5% to 8%. At the low end of guidance, the company is suggesting a gross profit of only $15 million while quarterly operating expenses are up at $128 million. SolarEdge needs margins closer to 40% at this level of revenue to just breakeven.

Even in the peak years, gross margins were normally in the mid-20% range. SolarEdge would appear to need to cut operating expenses further to just breakeven on quarterly revenues of $400 million. The company doesn’t appear set to guide revenues grow again anytime soon.

SolarEdge won’t report quarterly results until the end of February. The market isn’t likely to take a positive view here until the company can provide a more positive view on the smart energy space.

Takeaway

The key investor takeaway is that SolarEdge is likely to trade down following more signs the business won’t snap back anytime soon. Barclays just assigned a $50 price target on the stock and this call is looking very timely considering the news from the weekend.