Watcom

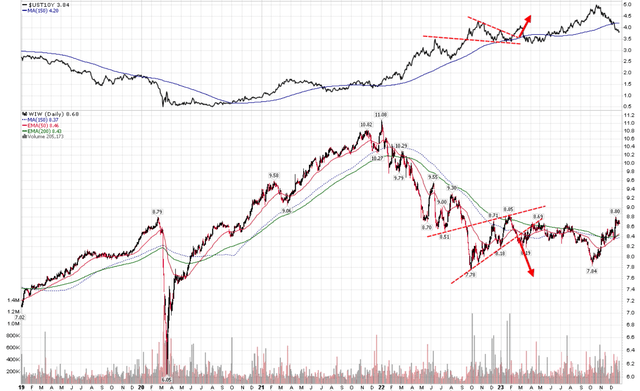

At the beginning of the year, I wrote a cautious article on the Western Asset/Claymore Inflation-Linked Opportunities & Income Fund (WIW), warning that a ‘higher for longer’ Federal Reserve may prove to be a headwind for the duration-heavy WIW fund. I also warned that the WIW fund will likely retest its October 2022 lows, based on the technical picture at the time.

Since my article, the WIW fund has performed poorly, delivering 4.0% in total returns and justifying my caution (Figure 1).

Figure 1 – WIW has performed poorly in 2023 (Seeking Alpha)

As we wrap up 2023, let us review my predictions on the WIW fund and refresh my thesis.

Brief Fund Overview

The Western Asset/Claymore Inflation-Linked Opportunities & Income Fund is a sizeable closed-end fund (“CEF”) focusing on inflation linked securities, with over $600 million in net assets.

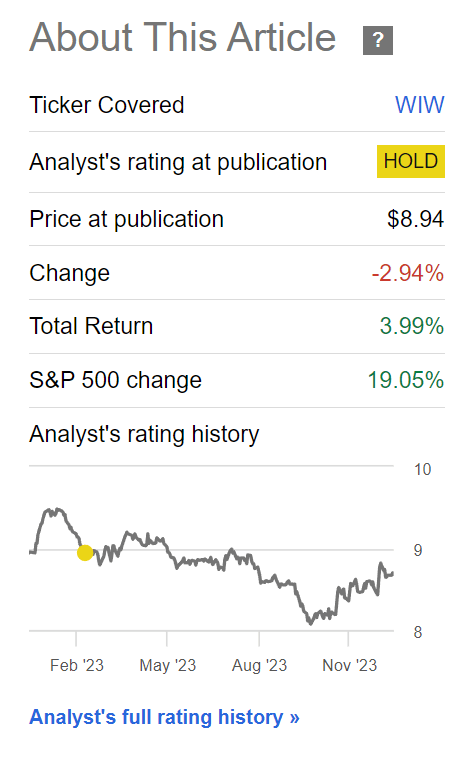

WIW’s portfolio currently contains 149 securities with an effective duration of 8.5 years, essentially unchanged from 8.4 years when I last reviewed the fund (Figure 2).

Figure 2 – WIW portfolio overview (franklintempleton.com)

The fund’s sector allocations are also little changed, with inflation-linked securities still accounting for the lion’s share of the portfolio at 79.9% (Figure 3).

Figure 3 – WIW portfolio allocation is little changed (Author created with data from WIW factsheets)

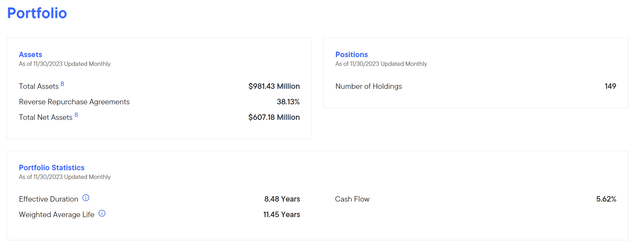

The WIW fund pays an attractive $0.0605 / month distribution that annualizes to a 7.1% yield on NAV and 8.4% yield on market price (Figure 4). WIW’s distribution is funded from net investment income (“NII”) and realized gains.

Figure 4 – WIW pays an attractive 8.4% yield (franklintempleton.com)

‘Higher For Longer’ Proved To Be A Headwind

As I predicted, the Federal Reserve stayed on its ‘higher for longer’ message for most of 2023, keeping monetary restrictive and acting as a headwind for high duration bond funds like the WIW. In fact, the WIW fund reached a low of $7.84 in early October, fulfilling my prediction of a re-test of October 2022 lows (Figure 5).

Figure 6 – WIW re-tested October 2022 lows (Author created with price chart from stockcharts.com)

Fed Pivot Giving WIW Respite

However, in the last few months, with continued progress on the inflation front, the Federal Reserve has subtly shifted its position, choosing to hold policy rates steady since September and messaging that policy rate cuts may be in the cards for 2024. Chair Powell even said recently that interest rates “are likely at or near the peak rate for this cycle” during his December FOMC press conference.

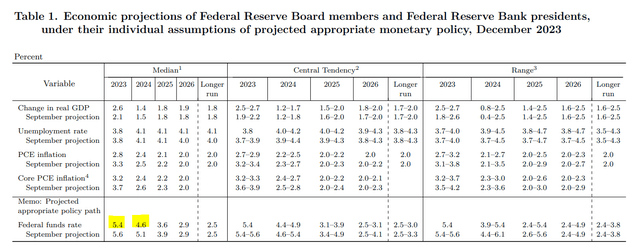

Looking at the Fed’s latest Summary of Economic Projections (“SEP”), the FOMC committee expects to bring policy rates down from the current 5.25%-5.5% level to 4.5%-4.75% by the end of 2024 (Figure 6).

Figure 6 – FED is forecasting rate cuts in 2024 (Fed Summary of Economic Projections)

According to Fed officials, potential policy rate cuts in 2024 is a natural reaction to falling inflation, because if the Fed keep policy rates steady while inflation fell, then real interest rates will rise, potentially over-tightening the economy into a recession.

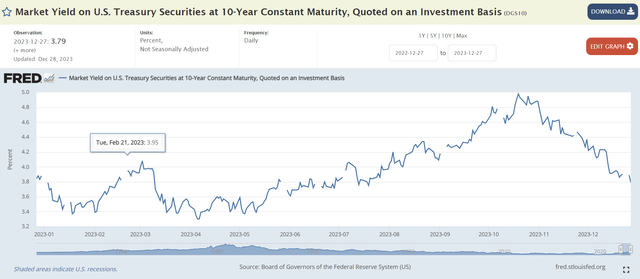

With the Fed officially changing its stance from ‘higher for longer’ to ‘soft landing’, markets have brought down long-term interest rates, with the 10-year treasury yield declining from near 5.0% to 3.8% recently (Figure 7).

Figure 7 – Long-term treasury yields have declined significantly since October (St. Louis Fed)

As I wrote in my prior article, a ‘soft landing’ scenario could be goldilocks for the WIW fund, as moderating but still high inflation keeps interest payments high on WIW’s investment portfolio while lower long-term interest rates boost WIW’s long-duration assets. Since the end of October, the WIW fund has rallied 7.5% (Figure 8).

Figure 8 – WIW has rallied as a result of the decline in long-term interest rates (Seeking Alpha)

Bonds Overbought In The Short-Term

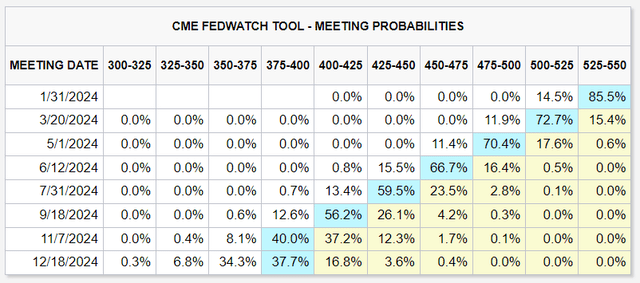

In the short-term, traders may have gotten too aggressive, with Fed Funds futures now expecting the Federal Reserve to cut policy rates 6-7 times in 2024 vs. Fed officials’ estimate of 3 cuts (Figure 9).

Figure 9 – Traders getting too aggressive on rate cut expectations (CME)

However, the change in the Fed’s stance is undeniable and should provide a tailwind to long-duration assets in the coming year, provided inflation does not make a surprise return.

Inflation Is The Wildcard

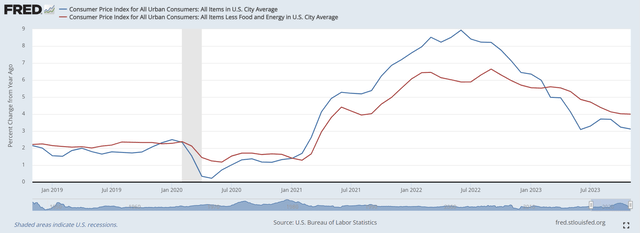

So far, headline CPI inflation has declined nicely, trending down to a 3.1% YoY rate in November and on pace for the Fed’s 2% target in late 2024. However, the stickier core CPI measure has been far harder to reduce, with the latest reading still stubbornly high at 4.0% YoY (Figure 10).

Figure 10 – Core vs. Headline CPI (St. Louis Fed)

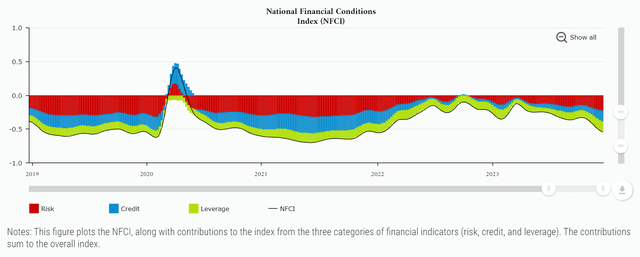

Judging by core CPI, the Federal Reserve may be premature in declaring victory and changing its stance, since financial conditions have eased to early 2022 levels because of the Fed’s dovish pivot (Figure 11).

Figure 11 – Financial conditions have eased significantly due to Fed’s pivot (Chicago Fed)

The risk is that loosening financial conditions may reignite ‘animal spirits’ and create a second wave of inflation in 2024, throwing a wrench in ‘soft landing’ narrative and forcing the Fed to restart policy rate hikes.

Already, we are seeing signs of froth, with cryptocurrencies making new 52-week highs and unprofitable concept stocks staging impressive year-end rallies. Bond investors should closely monitor financial conditions and inflation indices to make sure inflation is not staging a comeback, which will require additional monetary policy actions to resolve.

Conclusion

With the Fed recently shifting to a ‘soft landing’ policy stance and guiding to rate cuts in 2024, I believe long-duration bond funds like the WIW should stand to benefit. Although bonds are overbought in the short-term, monetary policy tailwinds are undeniably supportive.

The current ‘soft landing’ scenario may be goldilocks for the WIW fund, as moderating but still high inflation keeps WIW’s interest income high, while declining long-term interest rates provide capital gains.

The key risk for the WIW fund and bond investors in general is whether the Federal Reserve has declared victory prematurely, loosening financial conditions too soon and allowing inflation to stage a comeback in 2024. If that happens, we may rue the current bond respite as it will require additional monetary policy actions, above and beyond what has already been enacted, to resolve.

I am raising the WIW fund to a buy for 2024.