Dmitry Vinogradov

Societe Generale believes the S&P 500 (SP500) is at a “essential juncture” and outlined two eventualities whereby Wall Road’s benchmark index might crater to 4,000 factors or soar into ‘bubble’ territory above 6,600 factors.

The S&P (SP500) has superior greater than 14% YTD, pushed by a ferocious rally in expertise shares on the again of an ongoing craze round synthetic intelligence (AI), and the expectation that the Federal Reserve will start to chop charges if inflation knowledge stays optimistic because it has been not too long ago.

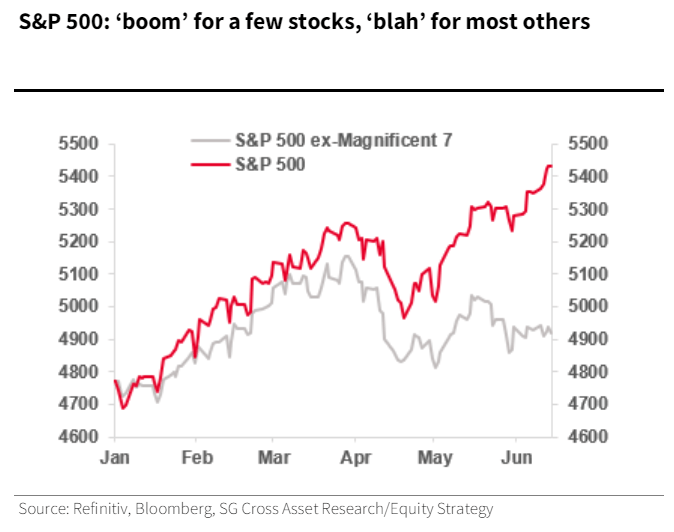

Nevertheless, a simmering concern amongst buyers amid this inexorable bull run has been market breadth – the S&P’s (SP500) 2024 achieve has been largely due to an enormous leap within the “Magnificent 7” membership, with the common S&P inventory struggling to maintain up.

“Certainly, with out the ‘Magnificent 7’ (Magazine-7) shares, the S&P could be up solely 4%. Nvidia (NVDA) alone has gained 174% YTD; it’s the index’s greatest performer and has the very best market cap, with the inventory accounting for 40% of the S&P 500’s (SP500) whole YTD beneficial properties,” Societe Generale’s Manish Kabra and Charles de Boissezon stated in a analysis word on Monday.

“As an instance this level, the Equal Weight S&P 500 (RSP) has gained simply 4%, underperforming the U.S. benchmark by a large margin,” they added.

The analysts consider the outperformance of the megacap expertise shares versus the common S&P inventory is now at a “essential juncture.”

See under for a chart evaluating the efficiency of the S&P 500 with and with out the “Magnificent 7” membership:

In keeping with Societe Generale, such slender market breadth usually happens when there may be both a bear market phenomenon usually seen in an financial recession, or when there are a concentrated variety of high-performing names which have the potential to push markets into bubble territory.

“What if there’s a recession? We don’t assume buyers will make a recession commerce until the Fed begins mountaineering once more, which is by far not our base case. But, if small companies’ income are arduous hit and unemployment charges surpass >=5%, we might see the S&P 500 (SP500) dipping again to across the 4,000 mark – a low-probability occasion at this stage,” Kabra and de Boissezon stated.

“What if there’s a bubble? On the flip facet, if the S&P 500 (SP500) accelerates additional, with just a few shares delivering a extra vital re-rating than the others, and if the index trades at valuation ranges just like the height reached in 1999-2000, we consider that the S&P 500 (SP500) might transfer to an upside state of affairs of 6,666 (24.7x in March 2000 x $270 2025e S&P 500 EPS),” the analysts added.

The brokerage stored its year-end goal for Wall Road’s benchmark index unchanged at 5,500 factors. The S&P (SP500) crossed that historic milestone final week on June 20, and closed out Tuesday’s buying and selling session at 5,469.30.

“We like Tech and keep Chubby on it. Nevertheless, because the revenue cycle outdoors the Nasdaq-100 (NDX) corporations ought to transfer from -10% in 2023 to +8% in 2024e, we have now recognized cyclical alternatives outdoors Tech too. So, as a substitute of taking cyclical threat inside Tech, the place high-risk shares have already carried out nicely, we advise choosing Financials and Industrials,” Societe Generale’s Kabra and de Boissezon stated.