Authored by Lance Roberts through RealInvestmentAdvice.com,

We have now good and dangerous information for buyers who need to know whether or not the inventory market will soar, stall, or plummet. First, the excellent news. This text presents the market path for what lies forward. Sadly, the “proper” path is amongst three doubtless situations.

Regardless of our incapacity to definitively present you the best way ahead, we will share the technical patterns that may assist information us and, in time, assign higher odds as to which of the three paths would be the “proper” path. Importantly, we additionally lay out the potential financial, geopolitical, and financial coverage situations that may doubtless correspond with every forecast.

Mapping Our Paths

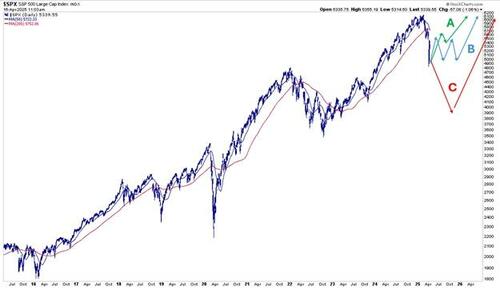

The graph beneath plots the three more than likely market paths going ahead.

Forecast A is probably the most bullish state of affairs. On this state of affairs, the S&P 500 has already seen its lows for the cycle. The market will grind increased till it meets resistance close to the important thing 50- and 200-day transferring averages. After a quick interval of consolidation, the market would break above these vital transferring averages, the demise cross between the 2 vital transferring averages would flip again to a golden cross, and new highs would observe.

In our opinion, state of affairs B is the more than likely path. It argues that, like state of affairs A, we could have seen the 12 months’s lows, however the inventory market will consolidate in a variety for a lot of months earlier than resuming a bullish development.

C is probably the most regarding path. It entails a collection of decrease highs and decrease lows for the foreseeable future. Furthermore, a recession would more than likely accompany this state of affairs.

We now current every forecast in additional element to raised perceive which occasion is more than likely and the way geopolitical, financial, fiscal, and financial coverage choices might help information us down the proper path or change paths because the atmosphere adjustments.

State of affairs A (Soar)- Politics, Economics, and the Fed

This state of affairs argues that the injury tariffs have triggered the markets, and the financial system is nearing an finish. From a geopolitical perspective, this could imply President Trump and plenty of of our vital commerce companions are near signing useful commerce agreements. Furthermore, our bullish state of affairs would additionally doubtless require a commerce settlement with China or, at a minimal, constructive discussions.

A much less hawkish Fed would additionally promote this outlook, along with tariffs. Chairman Powell got here out comparatively hawkish in mid-April. He claims the Fed is handcuffed on account of its low unemployment and tame inflation mandates. To his level, they’d lower charges as early as Might in the event that they noticed the financial system weakening and unemployment rising. Nonetheless, they’re nonetheless afraid of the inflation boogeyman; thus, they’re much less prone to lower upfront of weakening labor situations. In Powell’s opinion, tariffs are briefly inflationary. However he raised the hawkish specter that they may be persistent.

We should additionally do not forget that liquidity within the bond market seems to be a possible drawback. Bullish markets are fueled by optimistic sentiment and ample liquidity. If the Fed addresses the liquidity drawback, the percentages of a bullish outlook rise.

Lastly, case A assumes that any financial injury brought on by tariffs and associated client and company monetary choices is short-lived. The state of affairs assumes that financial exercise will resume at its prior tempo as soon as a decision on the tariffs is reached.

Donald Trump has a so-called “Trump Card” in his again pocket. Tax reductions, decreased laws, and different pro-business laws could possibly be extra assist for a rally to new highs.

State of affairs A- Technical Evaluation

The graph beneath exhibits a number of areas of potential resistance between 5600 and 5800 for the S&P 500. The mix of the important thing 50 and 200-day transferring averages (5705 and 5751), a Fibonacci retracement stage (5630), and the inexperienced assist/resistance line (5800) will doubtless maintain a lid on costs. Nonetheless, if the information is bullish sufficient, it would break by that resistance, resuming the bullish development, and a document excessive is extra doubtless.

State of affairs B (Stall)- Politics, Economics, and the Fed

In contrast to state of affairs A, state of affairs B is predicated on a extra prolonged interval for tariff decision. Moreover, the signed agreements might not be as economically pleasant as we envision for state of affairs A. Discussions with China could happen. Nonetheless, they’d doubtless be embattled with an settlement seemingly far off.

Now and again, tariff offers will probably be accomplished, and with every important commerce companion signing an settlement, the market will breathe a sigh of aid and supply optimism, which can assist maintain a flooring in the marketplace close to current lows. Conversely, ongoing commerce spats, new tariffs, and retaliatory tariffs will maintain a lid in the marketplace.

The potential consolidation vary is large, and exercise could possibly be unstable as buyers shortly rotate between optimism and pessimism, between the ceiling and the ground. That is the curler coaster state of affairs we laid out originally of the 12 months.

The Fed could stay hawkish however be prepared to chop charges and probably finish QT if tariffs show to be much less of an inflation risk than they fear about. Like commerce offers, a extra pleasant Fed would assist maintain a flooring on losses on the current lows.

State of affairs B- Technical Evaluation

We use the identical graph as state of affairs A. Nonetheless, we added the yellow field to approximate the vary the market may journey in all through many of the 12 months. The consolidation is probably going between 5800 and 4900.

State of affairs C (Plummet)- Politics, Economics, and the Fed

State of affairs C is our bearish outlook. On condition that the S&P 500 is already 20+% off its peak, the market is priced to a point for weaker earnings, slower financial progress, deficit reductions, and extended tariff negotiations. For C to play out, i.e., a peak-to-trough decline of 40% or extra, the financial outlook and tariff issues would worsen appreciably.

This state of affairs would doubtless coincide with a recession and or a credit score occasion. Furthermore, we suspect it additionally entails that the Fed is gradual to react to liquidity points and the federal government is offering much less fiscal assist than regular throughout downturns.

Companies will discover it arduous to make choices in such an atmosphere and thus have hassle committing capital expenditures. Furthermore, with decreased financial exercise, they are going to cut back bills, together with shedding staff. Larger joblessness, a weaker financial system, and poor client sentiment would end in shoppers saving extra and spending much less.

Whereas this isn’t our base case forecast, it’s actually believable. Nonetheless, a pointy decline from present ranges means that the Fed and authorities don’t respect, or care, how their insurance policies hurt the financial system within the brief time period.

State of affairs C- Technical Evaluation

State of affairs C will doubtless play out in a collection of decrease highs and decrease lows. Optimistically, this could possibly be like 2022 as proven beneath. From peak to trough, the S&P 500 fell by 28%. The current peak to trough was 21%. Thus, if this state of affairs performs out equally to 2022, 4400 could mark the low.

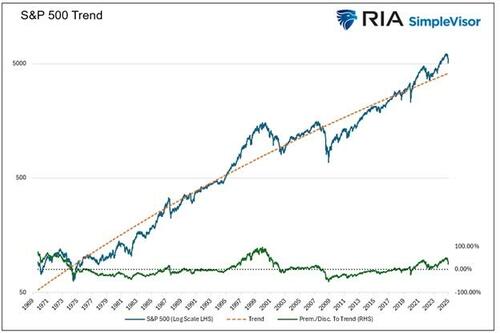

One other method to estimate a possible backside is to imagine the S&P 500 regresses to its long-term development. Regardless of the current decline, the S&P 500 is about 30% above its 55-year development (4120), as proven beneath. Sadly, because the graph exhibits, it could possibly fall beneath its development and end in an much more important loss.

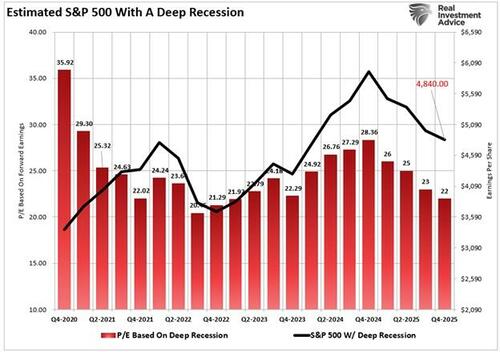

We are able to additionally use fundamentals to assist us discover a cheap flooring. For this train, we lean on a valuation evaluation we shared in December 2024, which forecasted an S&P worth of 4840 if valuations reverted to 2022 ranges and earnings progress is flat. As we wrote:

However what if the U.S. encounters a recession on account of financial or political insurance policies or a credit-related occasion? Then, a decline in valuations towards the 2022 stage of 22x earnings ought to be anticipated. Such would equate to roughly a 20% decline from present ranges.

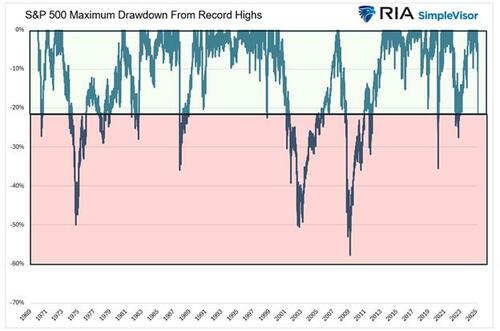

Lastly, we share the graph beneath to assist present extra context for drawdowns from document highs, such because the one we’re at the moment experiencing. Since 1969, 9 drawdowns have been worse than the present one. Six of the 9 have been restricted to -35% or much less, leaving three, together with the dot-com crash and the monetary disaster with bigger losses.

Abstract

We lean towards state of affairs B, the curler coaster with intervals of intense volatility. If this holds, our potential to observe our buying and selling guidelines and technical indicators whereas attempting to disregard unproductive behavioral traits will probably be absolutely examined.

It’s unimaginable to foretell the trail, however contemplating completely different situations and understanding the doubtless elementary elements figuring out every path offers us with a highway map to assist us observe one or change paths if wanted.