Diy13/iStock via Getty Images

Introduction and investment thesis

Smartsheet (NYSE:SMAR) is a real pioneer in the modern Project Portfolio Management (PPM) space with market experience of 17 years. The company’s easy-to-use PPM platform is a popular alternative among companies who want to transition from an Excel-based project management framework to a more professional one with advanced capabilities.

The main reasons I have recommended (see my two most recent articles here and here) to invest in the company’s shares during the 2022 market sell-off have been the following:

- Due to its long presence in the PPM space the company has established strong customer relationships within the enterprise segment. This provides a stable long-term growth opportunity as these customers tend to continuously expand their business with Smartsheet. I believe this is a strong and unique competitive advantage compared to peers.

- Although there is strong competition in the space, most of new customer wins represent still greenfield opportunities within a market that is expected to grow at a 10%+ CAGR this decade.

- The valuation of shares seemed quite conservative through 2022 in the light of the company’s growth and profitability prospects whether compared to peers or to the market in general.

I believe recently published FY23 Q4 earnings mostly strengthen these arguments, which makes me stick to my Strong Buy rating for the shares. With this, besides monday.com (MNDY) Smartsheet remains my top pick in the PPM space.

Q4 earnings highlights

Like in the case of many other SaaS companies the Q4 quarter was a tale of two stories. On the one hand, the weakening macro environment led to elongated sales cycles and worsening close rates pressuring topline growth. On the other hand, profitability began to improve meaningfully as the company slowed down headcount growth and started to decrease its real estate footprint. In the following I will present a short summary of how these effects have been reflected in Smartsheet’s financials and what to expect going into FY24.

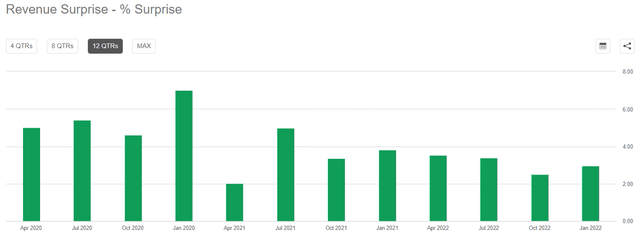

Revenue in the quarter came in at $212 million, which was an impressive increase of 35% yoy in the light of the current weakening macro environment. This surpassed analyst’s expectations by ~3%, approximately the same magnitude that has been typical for the previous quarters:

Seeking Alpha

At many other SaaS companies, I have observed a further declining magnitude of positive surprises this quarter, which makes Smartsheet’s recent beat a positive stand out from on this front.

Looking at forward looking indicators for revenue growth we can see a somewhat mixed picture. Annual recurring revenues (ARR) reached $854 million for the end of the year representing a yoy growth of 34%. As the 34% growth rate in ARR is very close to the 35% growth in revenues, this shows that topline growth momentum hasn’t slowed through the end of the Q4 quarter. This is positive news as the large hyperscalers reported exactly the opposite with further slowing business momentum at the beginning of the year.

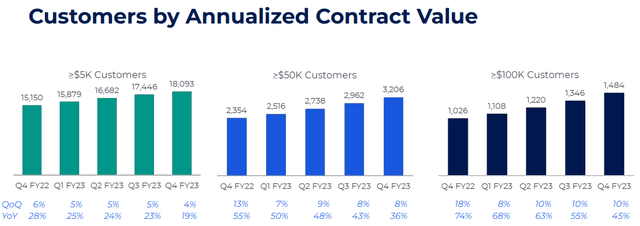

The major driver behind strong topline growth amid an uncertain economic environment has been the steady enterprise customer base of Smartsheet (defined as companies with >10,000 employees). This cohort counted more than 3,300 customers for the end of the year making up 30% of total ARR and growing it by more than 40% yoy significantly more than the headline 34% ARR growth rate. These positive trends can be also evidenced in the number of customers with an annual contract value of greater than $50,000 and $100,000, where no sign of sequential slowdown seemed to emerge:

Smartsheet FY23 Q4 earnings presentation

Based on these trends topline growth seems encouraging, especially in the light of recent global macro weakness. However, there has been one sign in the Q4 earnings release that overshadowed this positive picture to some extent.

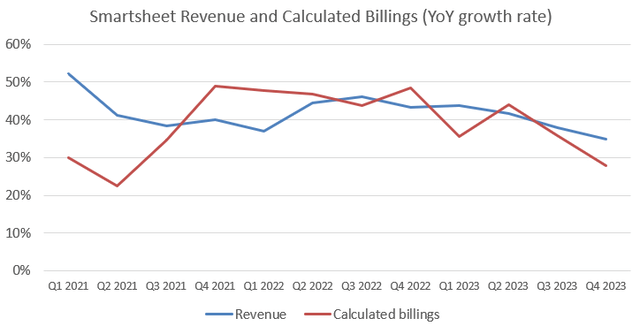

The yoy growth rate in calculated billing has declined a further ~8%-points during the quarter reaching a yoy growth rate of 28%:

Created by author based on company filings

This is a rather worrying sign for the first sight as billings used to be a leading indicator for revenues, which can be also evidenced on the chart above. Turning points in revenue growth seemed to be preceded by turning points in billings a few quarters before. Unfortunately, there has been no specific comment on this during the Q4 earnings call that could’ve provided some comfort for investors. However, management highlighted on the Q3 earnings call that FY22 Q4 billings provide a tough comparison for the current quarter, which suggests that at least partially the strong base effect contributed to this larger slowdown. Based on this, calculated billings growth will be a key metric to look out for in the upcoming Q1 earnings release in June.

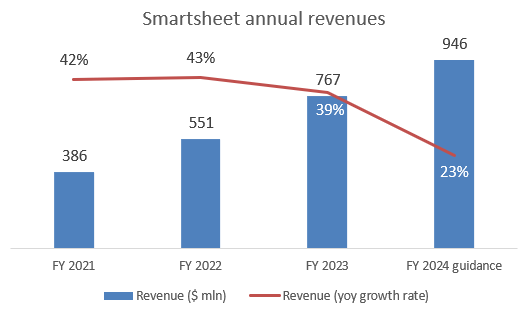

To sum it up, revenue growth momentum seemed to be encouraging in the Q4 quarter, but the slowdown in billings growth overshadowed this to some extent. Turning to FY24 revenue guidance of management we can see the following:

Created by author based on company filings

The $945.5 million revenue guide at the midpoint fell short of the average analyst estimate of $957 million. With this, after growing revenues at ~40% for the previous three years, management forecasted a deceleration to 23% for FY24, signaling a significant slowdown ahead Even if Smartsheet manages to beat this estimate by the usual ~3% investors got used to in recent quarters it would still mean a significant slowdown. So, this isn’t good news.

However, management also highlighted that they assumed a further worsening macro environment throughout FY24. This is a rather conservative assumption in my opinion as many other SaaS companies in my coverage tended to assume a positive change in the macro landscape in the second half of the year. Based on this, I believe there are few scenarios left where Smartsheet wouldn’t be able to conduct a beat-and-raise in the upcoming quarters. With this, FY24 Q1 and FY24 estimates are significantly de-risked making shares even more investable than they have been for most of 2022.

To be honest, the concerns around billings growth and extremely conservative FY24 guidance made me wonder how shares could’ve rallied 18% after the earnings release. It seems that good news on the profitability front outweighed these concerns by most investors to a great extent.

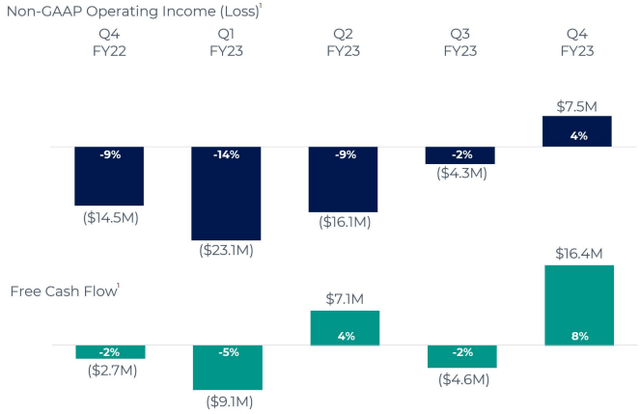

Just like many other companies in the software space Smartsheet decided to moderate its headcount growth in the second half of 2022 leading to significant improvement on the bottom line. As 72% of non-GAAP operating expenses have been made up of personnel expenses in the Q4 quarter this is simply the most efficient way to improve margins. This has been further aided by the rationalization of the company’s real estate footprint. These actions resulted in a non-GAAP operating margin improvement of 6%-points and a FCF margin improvement of 10%-points only in the Q4 quarter:

Smartsheet FY23 Q4 earnings presentation

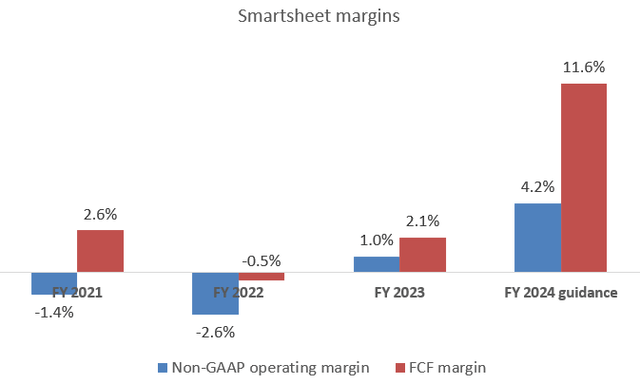

As the effect of headcount rationalization will only hit the bottom line in its entirety in FY24 further margin improvement is to be expected in the upcoming quarters. This has been reflected in Smartsheet’s FY24 non-GAAP operating margin and FCF margin guidance as well, which foreshadows significant improvement from FY23 levels:

Created by author based on company filings

After a close to breakeven FCF margin in the past three years Smartsheet is expecting to generate $110 million free cash flow in FY24 equaling an FCF margin of 11.6%. Operating margin should follow the same path with a lag of few quarters.

With this, Smartsheet proved to investors over the course of one quarter that it can operate the business at a significantly higher level of profitability. The question is how this will impact topline growth in the upcoming quarters. Based on the company’s increasing scale and good traction at enterprise customers I believe there won’t be a material growth slowdown resulting from these cost controlling efforts.

After looking at the positive trends in fundamentals let’s look at the valuation of shares, whether there is still room for further upside following the almost +20% post-earnings rally.

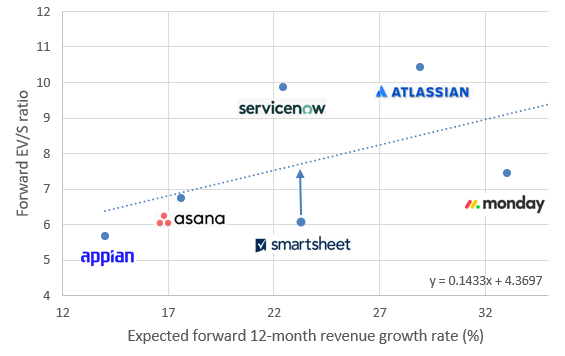

Valuation: Unjustifiable discount compared to peers

Smartsheet was the last larger public company in the PPM space to report earnings this season. This provides a good opportunity to compare valuations within the sector in the light of recently updated revenue growth estimates. After setting up a valuation matrix consisting of the respective forward EV/Sales multiples of companies and their next twelve-month revenue growth prospects we can see the following picture:

Created by author based on company data and analyst estimates

Based on this matrix Smartsheet shares seem still considerably undervalued even after the close to 20% post-earnings rally. Currently, shares trade at a forward EV/Sales multiple of ~6, which as an example is lower than the ratio of ~7 at main competitor Asana, despite Smartsheet’s better growth prospects for calendar year 2023 (23% vs 18%).

Based on the valuation matrix above, Smartsheet shares trade at a 21% discount compared to the sector average. I believe this discount is not justified in the light of latest earnings results, which makes the shares still one of the best investments in the PPM space in my opinion. My other top pick in the sector is monday.com, where the same conservative valuation seems to prevail.

Conclusion

Smartsheet posted strong topline growth for its FY23 Q4 quarter, but future growth prospects seem to be uncertain for now. Meanwhile, profitability significantly improved from one quarter to another and is expected to continue to do so throughout FY24. This provides a good fundamental setup for the medium-term, which is accompanied by a conservative valuation of shares. These make Smartsheet shares still a great investment opportunity at current levels in my opinion.