Urupong/iStock via Getty Images

Investment Thesis

Smartsheet Inc. (NYSE:SMAR) fiscal Q4 2024 disappointed investors.

This is how I see SMAR: you have a stock that carries a punchy valuation at 34x forward non-GAAP EPS, facing decelerating growth rates, and where the underlying profitability of the business has for the most part maxed out and gone as far as it can go, for now.

With so many bargains in the market right now, I’m issuing a sell rating on SMAR.

Rapid Recap

Back in September, I said in a neutral analysis:

The slowdown in customer adoption rates raises questions about future growth, and the stock’s valuation, while not exorbitant, doesn’t strike me as remarkably cheap given these factors. Investors should keep a watchful eye on Smartsheet’s ability to sustain its momentum in an increasingly competitive landscape.

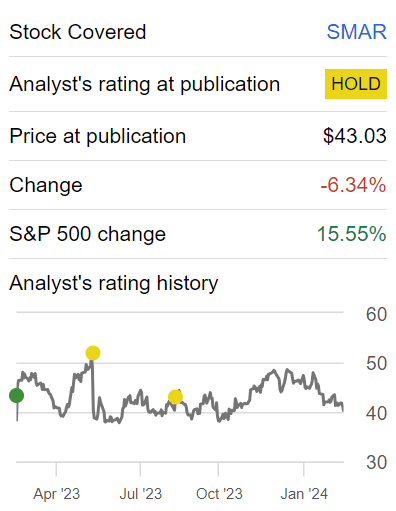

Author’s work on SMAR

Since I penned those words, the stock is down and has significantly underperformed the S&P 500 (SP500) by more than 30% (including the premarket drop).

I don’t believe this is a buy-the-dip moment for Smartsheet. Here’s why.

Smartsheet’s Near-Term Prospects Discussed

Smartsheet provides a platform for collaborative work management. Essentially, it’s like a digital workspace where teams can plan, track, and manage projects together. Their platform helps businesses organize their work more efficiently and improve communication among team members.

Moving on, Smartsheet describes how the introduction of AI features for enterprise customers signifies a strategic move towards enhancing product capabilities and staying ahead in the competitive landscape (more on this soon). These AI capabilities, enabling tailored formulas and data interpretation, have garnered significant adoption, indicating a positive uptake from its customer base.

Additionally, Smartsheet holds more than $600 million of cash and no debt on its balance sheet, meaning that more than 10% of its market cap is made up cash.

Nonetheless, despite these promising prospects, Smartsheet also faces heads. The main challenge is how the current macro environment, characterized by tighter domestic spending, particularly in the small and medium-sized (“SMB”) segment, restricts its near-term growth.

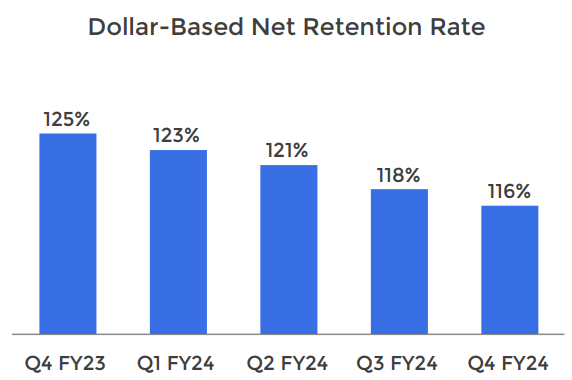

Moreover, the worsening trend in SMB expansion is reflected in the deceleration of its dollar-based net retention rates, see below.

SMAR Q4 2024

With that context in mind, let’s now turn to discussing its financials.

Revenue Growth Rates Are Likely to Decelerate to Sub-20% CAGR

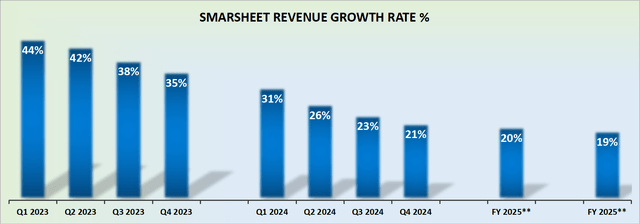

SMAR revenue growth rates

Smartsheet guides investors to yet another year of decelerating growth rates. Case in point, fiscal 2024 ended up 27% y/y. And now, the best that investors should brace themselves for in fiscal 2025 is 19% y/y revenue growth rates.

Consequently, the image that surfaces here is one where there’s too much competition in an already saturated market.

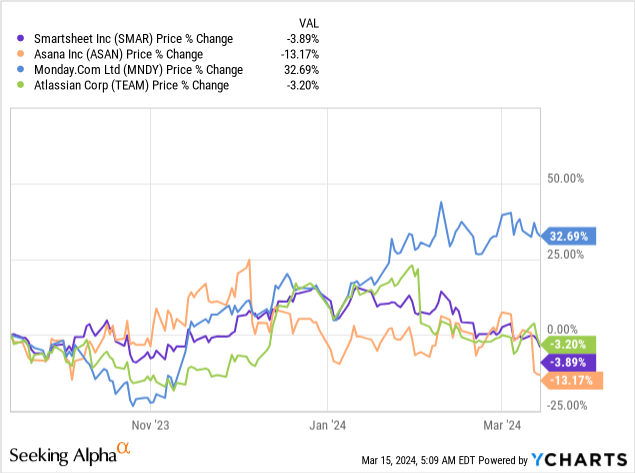

In fact, as you can see above, aside from monday.com (MNDY), the peer group in general has been losing favor with investors.

And then, to complicate matters further, consider the graphic that follows.

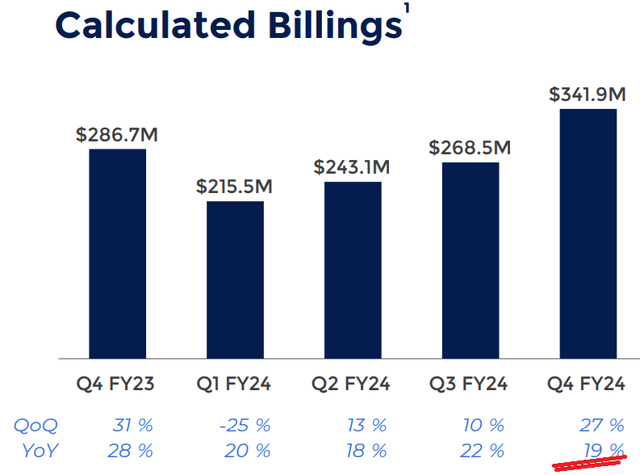

SMAR Q4 2024

You can see here that Smartsheet’s calculated billings were up 19% y/y in fiscal Q4 2024, which is slightly less than its revenue growth rate guidance for fiscal Q1 2025, meaning that Smartsheet is pulling forward its revenues leaving a potential lull in its future revenues. This is a further pesky element that will weigh on investors’ minds, on top of its expensive stock.

SMAR Stock Valuation — 34x Forward Non-GAAP EPS

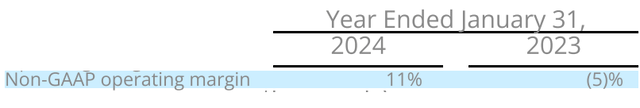

Smartsheet saw its underlying profits jump from negative 5% non-GAAP operating margins in fiscal 2023 to 11% non-GAAP operating margins in fiscal 2024, a 1,600 basis point expansion in profitability in 12 months, see below.

SMAR Q4 2024

Given the ease with which Smartsheet had improved its underlying profitability, investors had expected to improvement in profitability to continue in fiscal 2025.

Now, if we take the high end of Smartsheet’s guided non-GAAP fiscal 2025 operating margins, investors are looking at approximately 14% to 15% improvement in underlying profitability.

This implies that the majority of the low-hanging fruit has been picked over, and the operating expenses have been cut back as far they can go.

Consequently, on the surface, having to pay 34x forward non-GAAP EPS isn’t a particularly shocking multiple, but it does mean that this stock is richly priced, without further room for improvement in underlying profitability.

The Bottom Line

In conclusion, I’m not convinced there’s enough here for me to even keep a hold on Smartsheet Inc. stock.

While the introduction of AI features and its strong financial position offer promising aspects, challenges persist in the form of a competitive market landscape and tightening domestic spending, particularly in the SMB segment.

Despite the company’s efforts to enhance profitability and streamline operations, the stock’s forward non-GAAP EPS valuation of 34x appears richly priced, with limited room for further improvement. Therefore, I rate Smartsheet Inc. stock a sell.