spooh

Investment thesis

Covid-19 has hit the airline industry so hard that airline operating results have remained subdued even in a booming market. Currently, passenger traffic has been increasing for the last 2-3 quarters, and as a result, airfares have seen a substantial improvement in recent months, which will help stabilize the company’s profitability.

Due to the current increase in air traffic, the company might produce significant cash flows for the remaining part of the year; along with that, the long-term outlook for the company remains favorable.

Prevailing market sentiments have led to a substantial drop in the share price. At such a cheap valuation, the stock offers significant upside potential; I believe SkyWest (NASDAQ:SKYW) is a strong buy.

Overview

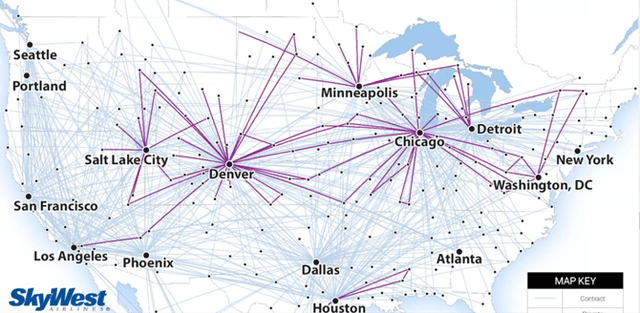

Air Routes (investors presentation)

SkyWest Airlines offers scheduled passenger services in the United States, Canada, and Mexico, with most of the flights operated as a United Express, Delta Connection, American Eagle, or Alaska Airlines under a code share agreement; the company offers more than 2,080 daily departures, of which approximately 870 were United Express flights, 650 were Delta Connection flights, 410 were American Eagle flights, and 150 were Alaska Airlines flights.

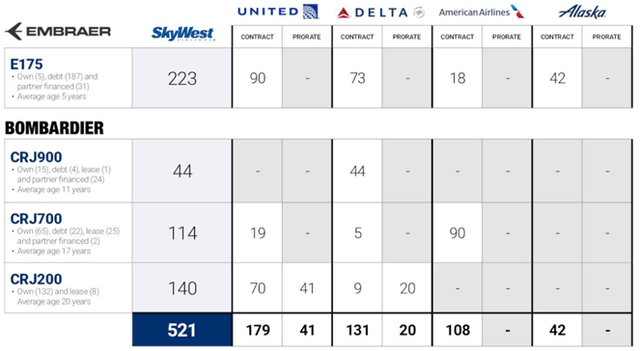

Aircraft under contract (investors presentation)

Currently, most of the revenue has been coming from the capacity purchase agreement; as per the agreement, the primary drivers of the revenue are the number of aircraft under scheduled service and the number of block hours on the flights. Therefore, investors cannot see significant fluctuations in the revenue from this source; the agreement will produce stable earnings till the maturity of the contracts; as you can see, most of the aircraft operate with this contract, which provides substantial certainty of consistent income.

The second major revenue stream is the prorate agreement, where revenue is entirely dependent on the main airlines’ revenue. Therefore, revenue will likely fluctuate according to traffic, fares, and oil prices.

Also, the recently increased oil prices and low airfares are affecting the revenue from this segment, but as the oil prices stabilize and airfares return to normal, an investor can see substantial improvement in this segment.

Strength in the business model

The airline industry has a history of huge losses and substantial consolidation. Hence, before investing in airline stocks, investors must seek a margin of safety and the underlying strength in the business model, which can help the company to survive in adverse economic conditions.

Strong liquidity

SkyWest has a history of a solid financial position with substantial liquid reserves. The company ends the quarter with cash reserves of about $979 million, up considerably from last year. Additionally, SkyWest has over $1 billion of unpledged collateral, which could help raise funds even in adverse economic conditions.

Also, over 50% of the fleet and service, including partner-owned aircraft, have no financial obligation. Therefore, such a strong financial position will help the company to comply with upcoming debt maturity and obligations.

A strong liquidity profile gives SkyWest a substantial margin of safety.

Strategic execution

Since its IPO, the company has grown significantly through buying new and old aircraft and operating with a codeshare agreement, but in some way, these agreements give the company’s operations a commoditized nature, and to remain profitable in the commoditized business the company must manage its operations very efficiently. If the cost goes beyond control the company might incur losses. In SkyWest’s case, it seems that the company has managed overall costs very efficiently and could negotiate with major airlines for a higher price, which is why it has been profitable and generating significant cash flow.

Historical performance

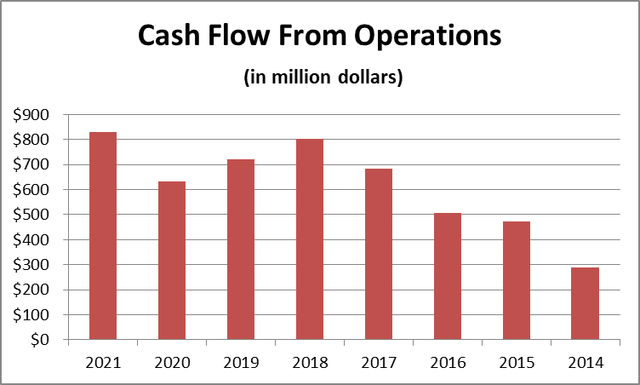

cash flow from operations (author )

An investor must carefully assess the company’s historical performance to understand the underlying business’s economics.

Since its IPO, revenue has increased significantly, but the growth in the revenue stabilized from 2014 and remained volatile since then; despite such fluctuations in revenue and profitability, the company’s cash flow from operations remained very much attractive, also note that the company’s performance during 2009, when the oil price was highly volatile and reached high levels was stunning, the company had successfully tackled the situation without affecting the financial conditions much. In contrast, many airlines suffered a tremendous loss during the underlying period.

Furthermore, historically, most of the revenue growth came from the acquisition of ExpressJet in 2010. To expand the business reach, management acquired ExpressJet, which led to a significant increase in revenues, but express jet acquisition brought significant wedge expenses and huge operating costs along with it, which affected the overall results of operation; a new entity started engulfing profits generated by the core business, this is the reason why the company had suffered significant drops in profitability in the past years, due to such unprofitable operation management sold the company in 2019.

Also, with time management’s focus on acquiring business changed, and management started buying new and used aircraft to lease them for codeshare agreements; these new strategies worked a lot for the company. They brought in significant cash flows for SkyWest, but these capital expenditures brought in considerable debt and equity dilution over the period. Still, because of the proper execution, the company could maintain debt levels at an adequate level. Currently, the loss-making express jet has been sold, which has saved vast sums of money for the company and reduced the operating costs; in the last two years, costs had decreased as compared to the period when the express jet was consuming colossal cash, but as an effect of COVID-19 company had to incur significant expenses.

The investor must consider that the government has been paying vast sums of money to save the airline industry through subsidies. In the last two years government has been paying vast sums of money to save the airline industry through subsidies. As a result, the company’s expenses have been reduced and remained subdued. But in the last two quarters, grant money has stopped, which has led to a significant increase in expenses. Currently, the leading cause behind rising costs is the increased oil prices along with the increased wedges. But as the economy stabilizes and oil prices reach normal levels, the company’s overall expenses might reduce, eventually leading to an increase in overall profitability.

Risk factors

Historically, the company suffered significant impairment losses related to its old aircraft and its maintenance; such charges might come in the future, affecting profitability.

Also, as per the management, the current business strategy for SkyWest is to acquire aircraft aggressively, which will be funded through debt, but such an aggressive expansion might lead to a further rise in the overall debt levels, and any weaknesses in refinancing debt will affect its financial position significantly.

Lease expiry

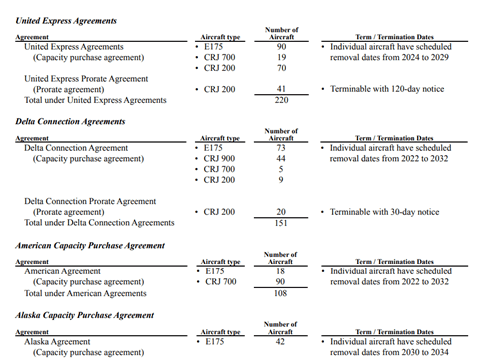

Lease contracts (quarterly report)

The company has long-term contracts with its main airline. Still, the investor must be concerned that contract expiry might bring troubles in terms of higher maintenance charges and capital expenditure to redevelop. If the company fails to lease the aircraft at a reasonable price, the company will incur huge impairment losses.

Upcoming obligations

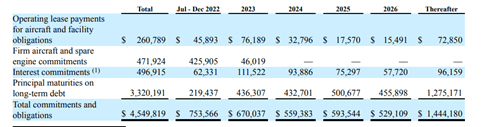

Financial obligations (quarterly report)

Significant obligations such as aircraft and spare engine commitments and long-term debt maturities are due in the next few years, which might put pressure on the company’s financial position, but due to the strong liquidity position, SkyWest could comply with those obligations.

Currently, SkyWest’s ability to comply with upcoming obligations remains the major risk factor for the company, and due to these uncertainties, the stock might take a very long time to appreciate, but the overall risk of permanent capital loss remains very low.

Recent development

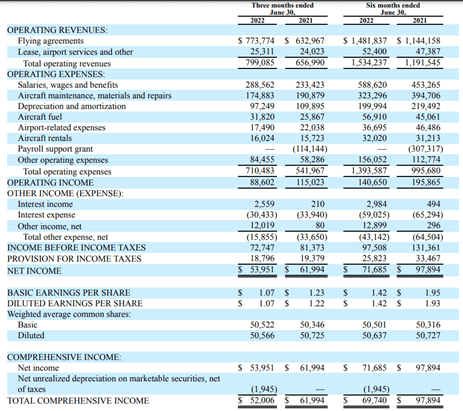

quarterly income statement (quarterly report)

In the second quarter, SkyWest posted revenue of $799 million which is up 22% compared to the same quarter of FY 2021, led by 28% growth in contract revenue but the prorate revenue declined 8% due to the high oil prices and low airfares, company ended the quarter with the cash reserves of $979 million. Also, management expects the total 2022 Capex to be about $775 million, including the purchase of 28 new E175 aircraft.

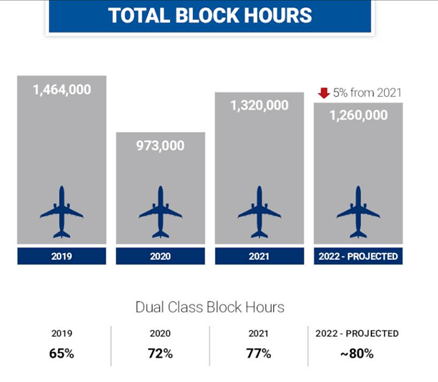

Block hours (investors presentation)

Till the end of the year, block hours are expected to improve significantly, and as the management stated in a recent conference call, they are planning to service 240 E175 aircraft by early next year. But as per the management, the acquired aircraft will bring its full impact in the year 2024; management is putting significant efforts into creating long-term value. Hence an investor might see substantial improvement in revenue in the year 2024.

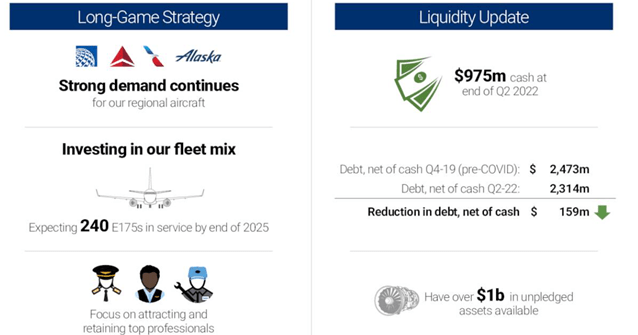

long term plan (investors presentation)

The focus on long-term value creation and the steps that management has been taking will bring substantial value to the shareholders. Also, SkyWest has a significantly strong liquidity position which will help the company to achieve its long-term vision.

Due to its strong cash flows and significant liquid resources, the company could comply with the upcoming obligations. But because of the current adverse market condition and the trouble which the airline industry has been facing, the stock has dropped more than 62%. It is currently trading at just three times its pre-covid earnings, whereas its competitors like sun country are trading at a significantly higher valuation. Also note that the current market capitalization of SkyWest is about $873 million, down considerably despite having over $831 million in Cash flow from operations in the year FY2021, which shows that company has become significantly undervalued and provides a considerable margin of safety with very low risk of permanent capital loss.

From this level, stocks provide significant upside potential; SkyWest is a strong buy.