sharply_done/E+ through Getty Photos

The airline business is a crowded place. Discovering winners on this house is less complicated stated than executed. Southwest Airways (LUV) has been considered one of my favorites on this house for a few years, however sadly, my funding in LUV has not gone in response to plans, up to now. Whereas analyzing the prospects for the airline sector, I not too long ago got here throughout SkyWest, Inc. (NASDAQ:SKYW), a regional airline operator that pulls little consideration from each traders and shoppers.

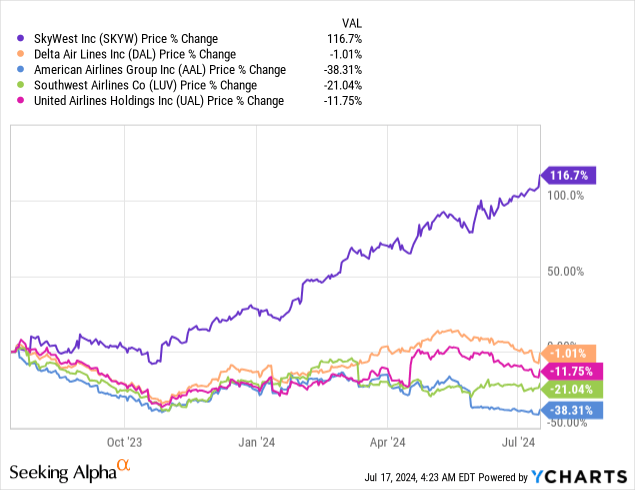

SKYW inventory, up greater than 108% up to now 12 months, is likely one of the best-performing airline shares out there. In truth, SkyWest inventory has outperformed all the main airline shares throughout this era.

Exhibit 1: One-year efficiency of airline shares

Though not plenty of traders have paid consideration to SkyWest, it’s potential that lots of them have at one level flown with this firm. Since its founding in 1972, SkyWest has turn into one of many largest regional airways within the U.S., headquartered in St. George, Utah. SkyWest boasts a various fleet and prides itself on its operational effectivity, supporting over 230 locations unfold throughout the USA, Canada, Mexico, and the Bahamas.

The Enterprise

SkyWest conducts enterprise in three segments:

- SkyWest Airways

- SkyWest Constitution

- SkyWest Leasing

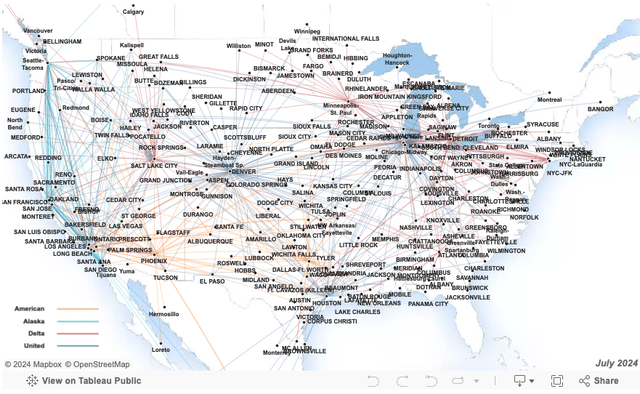

SkyWest Airways is the first enterprise of the corporate. SkyWest Airways operates a fleet of regional jets and makes use of these planes to maneuver passengers and items throughout the U.S. in addition to to locations in Canada and Mexico. SkyWest has partnered with main airways reminiscent of United Airways (UAL), Delta Air Traces (DAL), American Airways (AAL), and Alaska Airways by means of capability buy agreements.

Exhibit 1: SkyWest’s route map

SkyWest

The partnership enterprise mannequin helps SkyWest reap the benefits of the present networks of those giant firms whereas concentrating on its important specialization—regional air transport. These alliances are essential for SkyWest since they assure a constant revenue stream in addition to assist mitigate dangers in unpredictable markets.

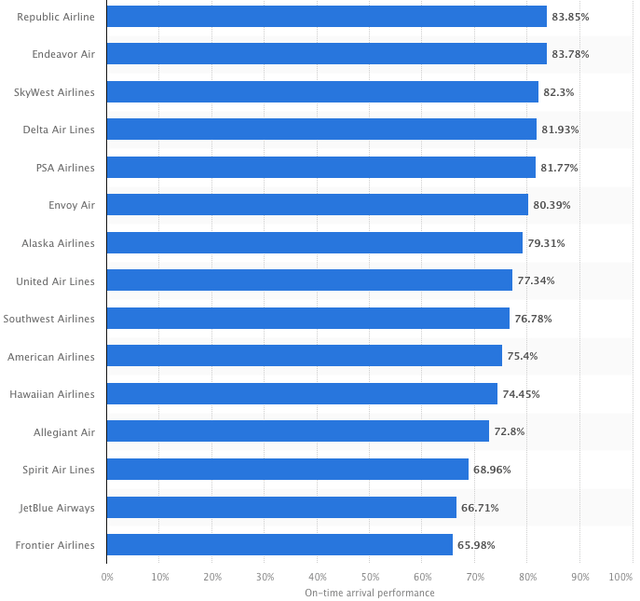

A key power of SkyWest is its spectacular working effectivity, which has been a giant think about efficiently securing partnerships with main airways. SkyWest, traditionally, has been among the many most punctual regional airways within the U.S. as effectively.

Exhibit 2: Most punctual regional airways within the U.S. in 2023

Statista

SkyWest Constitution supplies constitution flights for each people and companies. Public constitution providers focusing on underserved markets are delivered by this division, thus extending SkyWest’s boundaries and making operations extra versatile.

By means of SkyWest leasing, the corporate supplies plane leasing providers. Extra revenue comes from leasing regional jet plane and spare engines to different airways.

SkyWest Enjoys Aggressive Benefits

SkyWest is competing with different regional airways and huge carriers which might be working through regional routes within the extremely aggressive regional airline business. I imagine the corporate enjoys sure aggressive benefits stemming from just a few components. Different regional airways working underneath related CPAs with mainline carriers are SkyWest’s major opponents. On this sector, Republic Airways, Mesa Airways, and Envoy Air provide regional providers to giant U.S. airways together with United, Delta, American Airways, and Alaska Airways.

I imagine SkyWest is well-positioned to stay aggressive within the regional market – and even see market share good points – due to three important causes:

- The operational effectivity of SkyWest.

- The huge geographic attain.

- The monetary stability of the corporate, which helps aggressive investments.

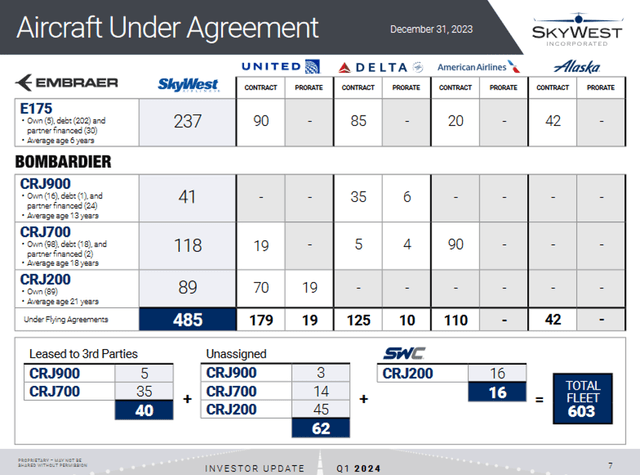

SkyWest’s fashionable fleet offers the corporate a aggressive benefit over others. The corporate operates numerous kinds of plane, together with Embraer E175s and Bombardier CRJs, that make it potential to fulfill the completely different necessities of its companions rapidly and successfully. Opponents with older or much less environment friendly fleets might face difficulties competing towards SkyWest on an operational capabilities and cost-effectiveness foundation.

Exhibit 3: SkyWest’s plane fleet as of December 31, 2023

Q1 presentation

With protection to greater than 250 locations all through North America, SkyWest is likely one of the main gamers within the regional airline business. Lots of SkyWest’s rivals lack a comparable diploma of market penetration or are much less efficient at linking smaller cities to main transport hubs. Thus, this geographical attain offers the corporate a aggressive edge in attracting and sustaining alliances with bigger carriers.

The corporate’s strong monetary place ensures that it stays forward by investing within the modernization of its fleet, know-how, and infrastructure. Additionally, the corporate has made strategic investments in its fleet and know-how to make sure constant money flows from operations, long-term sustainability of earnings, and market competitiveness. SkyWest ended the primary quarter with $821 million in money and short-term investments, and the corporate has been working money move optimistic in every of the final 10 quarters.

Progress Catalysts

SkyWest’s projected progress is pushed by a number of key catalysts which might be anticipated to reinforce its market place and monetary efficiency within the coming years.

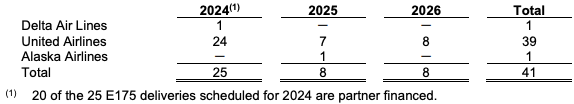

Partnerships are key to SkyWest’s progress, and the corporate continues to safe partnerships with main airways to drive progress and enhance working capabilities. As an example, SkyWest reached an settlement with United to position 20 partner-financed E175 plane underneath a four-year contract final March. This got here quickly after a separate settlement during which the 2 firms agreed to position 19 SkyWest-owned plane with United.

Exhibit 4: Projected future deliveries of SkyWest’s E175 plane

SkyWest information launch

SkyWest is investing in new plane consuming much less gasoline with a view to meet environmental laws in addition to preserve operational effectivity. These investments will cut back overhead prices related to operations by retiring previous fashions. These investments will act as a catalyst in securing extra long-term contracts with airline companions sooner or later.

SkyWest’s investments in know-how will promote operational effectivity as effectively, by means of improved buyer satisfaction and compliance with laws.

One other progress space will probably be exploring rising markets, in addition to growing service frequency in high-demand areas. As a part of this technique, SkyWest will broaden its constitution operations by means of SkyWest Constitution into unserved communities utilizing CRJ200 plane which have been configured to have 30 seats per plane. Consequently, this transfer will assist SkyWest faucet extra market segments in addition to usher in extra income streams.

SkyWest’s current efforts to handle labor market challenges can even assist drive income progress. The labor market within the regional airline sector presents appreciable challenges, notably when recruiting certified pilots and upkeep technicians. Increasing into the constitution enterprise, which requires comparatively low flight hours for pilots in comparison with the industrial enterprise, is a technique SkyWest has mitigated the destructive influence ensuing from pilot shortages. Along with this, buying a 25% stake in Contour Airways to make use of its CRJ plane, boosting the pay package deal for pilots, and adjusting the service schedule to optimize obtainable sources are a number of the different initiatives taken by SkyWest to handle labor shortages.

Takeaway

SkyWest enjoys aggressive benefits within the regional market and the corporate is well-positioned to develop, aided by a few of its current initiatives to deal with macro challenges. At a time when the regional airline sector is predicted to consolidate, investing in market chief SkyWest at a ahead P/E of 13 appears a rational selection for traders trying to get publicity to airline shares.