cagkansayin

Earnings of Simmons First Nationwide Company (NASDAQ:SFNC) will most likely dip this yr attributable to increased provisioning for anticipated mortgage losses forward of anticipated financial headwinds. However, acquired loans and important margin growth will assist the backside line. General, I am anticipating Simmons First Nationwide Company to report earnings of $2.02 per share for 2022, down 18% year-over-year. The year-end goal value suggests a excessive upside from the present market value. Due to this fact, I am adopting a purchase ranking on Simmons First Nationwide Company.

Mortgage Portfolio Counting on the Current Acquisition

Simmons First Nationwide Company accomplished the acquisition of Spirit of Texas Bancshares on April 8, 2022, as talked about in a press launch. The acquisition elevated Simmons’ mortgage portfolio by roughly 19% and its deposit guide by round 14%.

Aside from the acquisition, mortgage progress will stay low this yr because the outlook for natural mortgage progress is not too vivid. The administration’s energy doesn’t lie within the natural progress space as the corporate has traditionally relied on acquisitions for progress. Simmons has, in reality, accomplished 13 M&A transactions within the final ten years, in response to its web site. The administration talked about within the convention name that it does not anticipate discussions on M&A to proceed for some time; subsequently, there’ll probably be no acquired progress for the following yr or so.

Excessive rates of interest will probably be the most important headwind for natural mortgage progress. The Federal Reserve initiatives rates of interest to peak in late 2022 or 2023. Due to this fact, it is rather probably that industrial debtors will postpone their borrowing plans for capital expenditure till subsequent yr when charges are declining.

On the plus facet, the administration talked about within the first quarter’s earnings presentation that as of March-end, industrial mortgage pipelines had been sturdy and had elevated for six straight quarters. Which means natural mortgage progress will be anticipated to stay at an honest stage by at the least the second quarter of 2022.

Contemplating these components, I am anticipating the mortgage guide to extend by 20.6% by the top of 2022 from the top of 2021. In the meantime, deposits will probably develop roughly in step with loans for the final three quarters of 2022, excluding the impression of the acquisition. The next desk exhibits my stability sheet estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | |

| Monetary Place | |||||

| Web Loans | 11,667 | 14,357 | 12,663 | 11,807 | 14,242 |

| Development of Web Loans | 8.6% | 23.1% | (11.8)% | (6.8)% | 20.6% |

| Different Incomes Belongings | 3,136 | 4,537 | 7,200 | 10,123 | 10,296 |

| Deposits | 12,399 | 19,850 | 16,987 | 19,367 | 22,329 |

| Borrowings and Sub-Debt | 1,795 | 1,836 | 2,024 | 1,908 | 2,325 |

| Frequent fairness | 2,246 | 2,988 | 2,976 | 3,249 | 3,667 |

| Ebook Worth Per Share ($) | 24.2 | 30.2 | 27.0 | 29.5 | 27.9 |

| Tangible BVPS ($) | 14.1 | 18.3 | 16.2 | 18.1 | 18.4 |

Supply: SEC Filings, Writer’s Estimates (In USD million except in any other case specified) |

Securities Portfolio and Deposit Ebook to Restrain the Margin’s Growth

Simmons’ web curiosity revenue is barely barely to reasonably delicate to charge adjustments due to two principal components.

- A big securities portfolio. Simmons has a big stability of funding securities, most of which carry mounted charges. Based on particulars given within the presentation, round 17% of securities had been primarily based on variable charges whereas the remaining carried mounted charges. Due to this fact, the securities portfolio will maintain again common earning-asset yields as rates of interest rise. Moreover, the mounted portfolio’s market worth will decline in a rising charge surroundings, which is able to scale back the guide worth of fairness, thereby hurting the valuation.

- Extremely rate-sensitive deposit guide. Curiosity-bearing transaction accounts and financial savings deposits made up a hefty 62% of complete deposits on the finish of March 2022. Due to this fact, an amazing majority of the deposit guide will reprice after each charge hike. Luckily, presently there’s extra liquidity within the banking business, which provides banks above-normal energy to cost deposits.

In the meantime, the mortgage portfolio is reasonably delicate as a result of variable charge loans made up 44%, whereas mounted charge loans made up 56% of complete loans on the finish of March 2022, as talked about within the presentation.

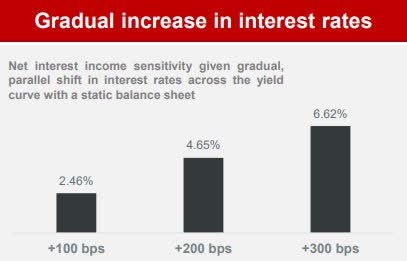

The outcomes of the administration’s interest-rate sensitivity evaluation given within the presentation present {that a} 200-basis factors hike in rates of interest can increase the online curiosity revenue by 4.65% over twelve months.

1Q2022 Earnings Presentation

Contemplating these components, I am anticipating the common margin in 2022 to be 14 foundation factors increased than the common margin for 2021.

Greater than Regular Provisioning to Drag Earnings

Simmons First Nationwide reported a big provision reversal through the first quarter of 2022. Nonperforming loans made up 0.53% of complete loans, whereas allowances made up 1.49% of complete loans on the finish of March 2022, as talked about within the presentation. Though the allowance protection appeared snug on the finish of March, in my view, the protection shall be a bit tight forward of the upcoming financial headwinds.

Heightened rates of interest will probably push some debtors into default who had been already stretched due to the elevated inflation. Furthermore, banks will wish to construct up their reserves now in case a recession involves cross later this yr or early subsequent yr.

General, I am anticipating the provisioning to be properly above regular for the final 9 months of 2022. Nonetheless, as a result of first quarter’s efficiency, provisioning for the total yr will probably be solely barely above regular. I am anticipating Simmons First Nationwide to report a web provision expense of 0.25% of complete loans in 2022. Compared, the online provision expense averaged 0.24% of complete loans within the final 5 years.

Anticipating Earnings to Lower by 18%

The anticipated hike in provisioning for mortgage losses will probably be the chief contributor to an earnings decline this yr. Furthermore, merger-related bills will most likely push up the non-interest bills for this yr. Moreover, the acquisition of Spirit of Texas Bancshares will dilute the per-share earnings. As talked about in a earlier press launch, Simmons estimated that it must subject 18.3 million new shares for the shareholders of Spirit of Texas Bancshares.

However, the bounce within the mortgage portfolio and important margin growth will probably assist the underside line. General, I am anticipating Simmons First Nationwide to report earnings of $2.02 per share for 2022, down 18% year-over-year. The next desk exhibits my revenue assertion estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | |||||

| Earnings Assertion | |||||||||

| Web curiosity revenue | 553 | 602 | 640 | 592 | 697 | ||||

| Provision for mortgage losses | 38 | 43 | 75 | (33) | 35 | ||||

| Non-interest revenue | 144 | 198 | 240 | 192 | 208 | ||||

| Non-interest expense | 392 | 454 | 485 | 484 | 546 | ||||

| Web revenue – Frequent Sh. | 216 | 238 | 255 | 271 | 265 | ||||

| EPS – Diluted ($) | 2.32 | 2.41 | 2.31 | 2.46 | 2.02 | ||||

Supply: SEC Filings, Earnings Releases, Writer’s Estimates (In USD million except in any other case specified) | |||||||||

Simmons First Nationwide Company will announce its second-quarter outcomes on July 21, 2022, in response to a press launch. I am anticipating the corporate to report earnings of $0.44 per share for the quarter.

Precise earnings might differ materially from estimates due to the dangers and uncertainties associated to inflation, and consequently the timing and magnitude of rate of interest hikes. Additional, the specter of a recession can improve the provisioning for anticipated mortgage losses past my expectation. The brand new Omicron subvariant additionally bears monitoring.

Excessive Upside Requires a Purchase Score

Simmons First Nationwide is providing a dividend yield of three.6% on the present quarterly dividend charge of $0.19 per share. The earnings and dividend estimates recommend a payout ratio of 38% for 2022, which is increased than the four-year common of 28% however simply sustainable. Due to this fact, the earnings outlook presents no menace to the dividend stage.

I’m utilizing the historic price-to-tangible guide (“P/TB”) and price-to-earnings (“P/E”) multiples to worth Simmons First Nationwide. The inventory has traded at a median P/TB ratio of 1.55 prior to now, as proven under.

| FY18 | FY19 | FY20 | FY21 | Common | ||

| T. Ebook Worth per Share ($) | 14.1 | 18.3 | 16.2 | 18.1 | ||

| Common Market Value ($) | 29.4 | 24.9 | 18.9 | 29.2 | ||

| Historic P/TB | 2.08x | 1.36x | 1.16x | 1.61x | 1.55x | |

| Supply: Firm Financials, Yahoo Finance, Writer’s Estimates | ||||||

Multiplying the common P/TB a number of with the forecast tangible guide worth per share of $18.4 offers a goal value of $28.6 for the top of 2022. This value goal implies a 37.0% upside from the July 15 closing value. The next desk exhibits the sensitivity of the goal value to the P/TB ratio.

| P/TB A number of | 1.35x | 1.45x | 1.55x | 1.65x | 1.75x |

| TBVPS – Dec 2022 ($) | 18.4 | 18.4 | 18.4 | 18.4 | 18.4 |

| Goal Value ($) | 24.9 | 26.8 | 28.6 | 30.5 | 32.3 |

| Market Value ($) | 20.9 | 20.9 | 20.9 | 20.9 | 20.9 |

| Upside/(Draw back) | 19.4% | 28.2% | 37.0% | 45.8% | 54.6% |

| Supply: Writer’s Estimates |

The inventory has traded at a median P/E ratio of round 10.8x prior to now, as proven under.

| FY18 | FY19 | FY20 | FY21 | Common | ||

| Earnings per Share ($) | 2.32 | 2.41 | 2.31 | 2.46 | ||

| Common Market Value ($) | 29.4 | 24.9 | 18.9 | 29.2 | ||

| Historic P/E | 12.6x | 10.3x | 8.2x | 11.9x | 10.8x | |

| Supply: Firm Financials, Yahoo Finance, Writer’s Estimates | ||||||

Multiplying the common P/E a number of with the forecast earnings per share of $2.02 offers a goal value of $21.7 for the top of 2022. This value goal implies a 3.8% upside from the July 15 closing value. The next desk exhibits the sensitivity of the goal value to the P/E ratio.

| P/E A number of | 8.8x | 9.8x | 10.8x | 11.8x | 12.8x |

| EPS 2022 ($) | 2.02 | 2.02 | 2.02 | 2.02 | 2.02 |

| Goal Value ($) | 17.6 | 19.7 | 21.7 | 23.7 | 25.7 |

| Market Value ($) | 20.9 | 20.9 | 20.9 | 20.9 | 20.9 |

| Upside/(Draw back) | (15.5)% | (5.9)% | 3.8% | 13.4% | 23.0% |

| Supply: Writer’s Estimates |

Equally weighting the goal costs from the 2 valuation strategies offers a mixed goal value of $25.1, which suggests a 20.4% upside from the present market value. Including the ahead dividend yield offers a complete anticipated return of 24.0%. Therefore, I’m sustaining a purchase ranking on Simmons First Nationwide Company.