kefkenadasi/iStock by way of Getty Pictures

Signet Jewelers Restricted (NYSE:SIG) has been on my watchlist for a few months, and following the numerous correction skilled by the inventory after the final incomes launch, I used to be very near opening a place because it requires very conservative mid/long-term assumptions to underwrite an funding case.

However the Outlook offered by administration on the time was and continues to be the explanation that prevented me from doing so, and that would be the focus of this text.

There are a lot of points that may be highlighted and additional scrutinized when analysing this Jewelry retailer that serves primarily the US with smaller operations in Canada and the UK. Most of these I might placed on the dangers class; like the worth of its manufacturers when in comparison with those marketed by LVMH (OTCPK:LVMUY) or Pandora (OTCPK:PANDY), the impression of lab grown diamonds on its income sustainability or a number of the extra operational points that the corporate has confronted in recent times.

In a future article I would tackle these points, however first I wished to put up this narrower piece to spotlight the extra quick danger of a possible steerage reduce within the subsequent incomes launch that’s just some days away (September 12), because the implications of the materialization of that final result might be important for the short-term efficiency of the inventory.

Final Quarter Outcomes and Outlook

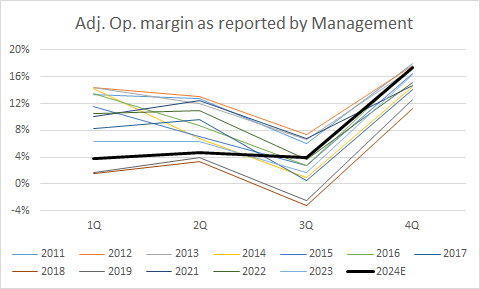

Final quarter outcomes had been delicate however comparatively in keeping with expectations. Adjusted working margin got here 256 bp beneath the identical quarter of final 12 months and on the similar time their steerage for the second quarter implies on the midpoint one other margin discount, this time of 167bp vs the earlier 12 months.

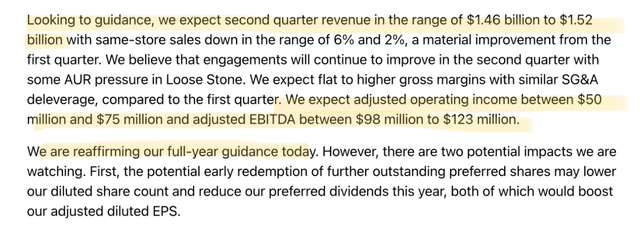

However regardless of these two essential adverse datapoint, administration determined to maintain FY steerage unchanged at $6,840 million and $633 million for revenues and adjusted working earnings respectively, on the midpoint.

1Q Fiscal Yr 2025 Signet incomes name transcript

This means a full 12 months adjusted working margin of 9.2%, 20bp increased than the 9% achieved final 12 months, one thing that will require a particularly improved second half as the primary 6 months are already anticipated to be 211bp decrease. And this discrepancy was the theme of the primary query within the final incomes name.

1Q Fiscal Yr 2025 Signet incomes name transcript

That reply didn’t appear convincing sufficient to me for the extent of enchancment required within the second half, so let’s attempt to see, primarily based on the corporate’s seasonality and from an historic perspective how real looking is that second half outlook.

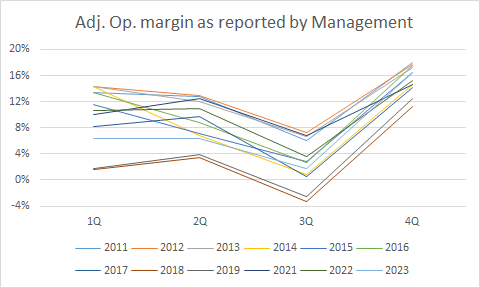

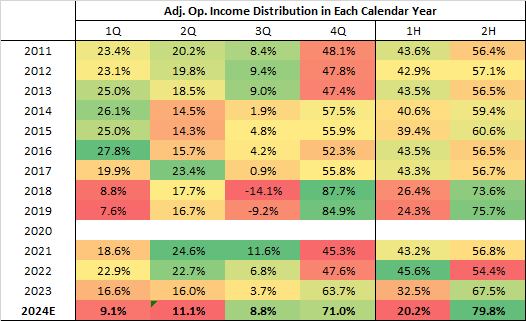

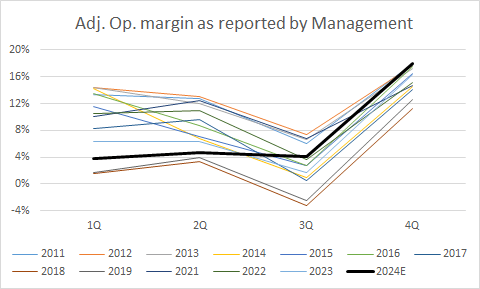

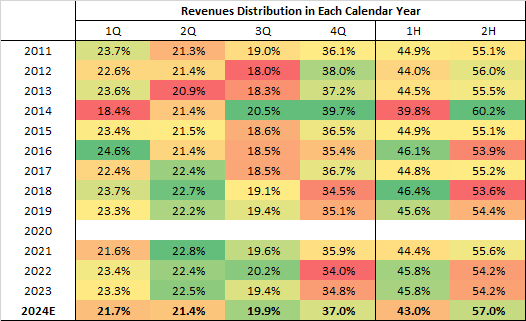

SIG monetary disclosures (introduced on a calendar 12 months foundation as an alternative of fiscal 12 months foundation)

As you’ll be able to, the sample of seasonality (I omitted 2020 for apparent causes) could be very steady, and there are a couple of observations that we will make:

- Second quarter margins are normally higher than the one for the primary quarter.

- Third quarter margin is all the time the bottom one of many 12 months.

- Fourth quarter margin is all the time the very best of the 12 months.

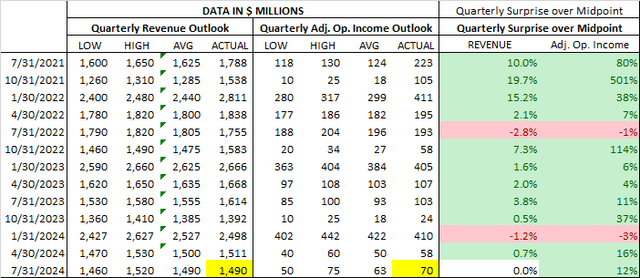

These days the corporate has been in a position to overdeliver when it comes to Adjusted Working Revenue and to a decrease extent in time period of revenues, however these surprises have change into smaller as we bought away from the put up pandemic consumption growth years. So, I might assume zero shock for the twond quarter when it comes to revenues and a gentle constructive one when it comes to adjusted working earnings (The figures marked in yellow within the subsequent desk).

SIG monetary disclosures & writer assumptions (introduced on a calendar 12 months foundation as an alternative of fiscal 12 months foundation)

Primarily based on these assumptions, the second half of the 12 months ought to ship a minimum of $3.839 million and $505 million respectively in revenues and adjusted working Revenue to perform the guided outcomes.

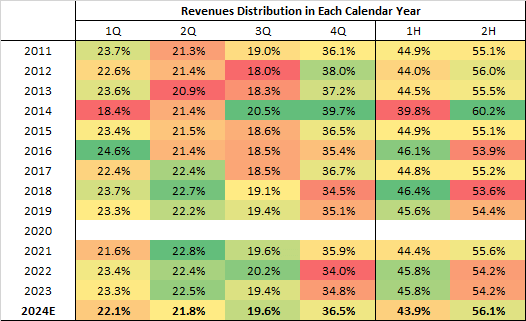

I might divide these quantities between the threerd and 4th quarters primarily based on historic seasonality, to indicate within the following tables, what are the implications for the complete 12 months distribution of each figures alongside the quarters and between the 1st and a pair ofnd half of the 12 months.

SIG monetary disclosures & writer assumptions (introduced on a calendar 12 months foundation as an alternative of fiscal 12 months foundation)

When it comes to revenues, administration’s outlook would indicate a really stable second half when in comparison with the primary, however whereas higher than the typical second half, it is throughout the ranges of what has occurred previously, so it appears difficult however doable.

However after we repeat the identical train for the outlook given for adjusted working earnings, the scenario is totally different.

SIG monetary disclosures & writer assumptions (introduced on a calendar 12 months foundation as an alternative of fiscal 12 months foundation)

Right here we will see that compared with first half of the 12 months, present FY steerage would require one of the best relative second half in 14 years. And when it comes to margins, it will seem like this.

SIG monetary disclosures & writer assumptions (introduced on a calendar 12 months foundation as an alternative of fiscal 12 months foundation)

This outlook would require a 14-year report 4th quarter when it comes to margins and a greater 3rd quarter margin than the typical for the primary half of the 12 months, one thing that has by no means occurred within the interval underneath evaluation.

It’s true that this evaluation has been primarily based solely on the historic seasonality of the enterprise however is essential to know that such a steady and recurring sample doesn’t come out of nowhere however is the results of the underlying basic drivers of demand.

Ultimately what I’m making an attempt to spotlight right here is that on the face of the second quarter outlook, the implied second half of the 12 months appears extremely unbelievable, however not inconceivable. The very best instance of that’s the 12 months that I deliberately omitted of the evaluation, a 12 months when each conditions that I characterize as impossible to happen this 12 months, occurred on the similar time. All of us know what passed off in 2020, in very medical language let’s say that there was a really important disruption of the conventional patterns of demand within the type of lockdowns and financial stimulus.

So, at this level we must always attempt to suppose if there was something which may have negatively affected the primary half and/or quite the opposite may positively have an effect on the second half. And importantly these results ought to be important sufficient to take seasonal patterns away from its historic ranges.

Believable Explanations

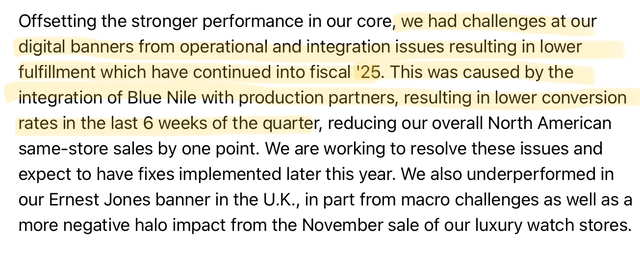

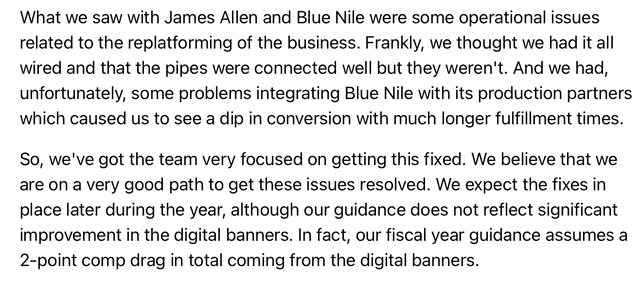

For the reason that 4th quarter of 2023 (4Q Fiscal Yr 2024) the corporate has been experiencing integration issues of their digital banners which have of their phrases “affected conversion”. The following two screenshots come from their 4Q Fiscal Yr 2024 earnings name and the third one from the one in every of 1Q Fiscal Yr 2025.

4Q Fiscal Yr 2024 Signet earnings name transcript

4Q Fiscal Yr 2024 Signet earnings name transcript

1Q Fiscal Yr 2025 Signet earnings name transcript

So regardless that administration stated that their outlook doesn’t embrace any restoration on their digital banners, let’s assume that’s that is their ace up their sleeve, they usually handle to totally get well their digital banners efficiency for the second half bettering their implied 2H income by the 2 proportion factors which are talked about within the second screenshot regarding this challenge.

That might not change in any respect the impossible distribution of adjusted operation earnings between quarters and would make income distribution much more second half weighted:

SIG monetary disclosures & writer assumptions (introduced on a calendar 12 months foundation as an alternative of fiscal 12 months foundation)

However on the similar time would considerably normalize calendar 12 months adjusted working margin seasonality, making it rather less unbelievable:

SIG monetary disclosures & writer assumptions (introduced on a calendar 12 months foundation as an alternative of fiscal 12 months foundation)

My perspective is that these issued usually are not important sufficient to clarify the weird sample of seasonality in working earnings, as a result of to be so, the mixing issues ought to have impacted not simply revenues however prices, and to a cloth diploma, as that will have a minimum of partially defined the poor first half margins and would give credence to a cloth enchancment when the issue will get fastened as there is no such thing as a longer the necessity for these additional one-time prices.

Can I be 100% certain that that didn’t occur, in fact not, however that’s the form of challenge that administration groups normally spotlight, as is a lot better for the inventory to have a non-recurring rationalization for a poor margin efficiency, than having the analyst group query whether or not there’s a extra basic downside that explains it. And there was not a peep about it of their name.

Other than that, when it comes to shopper demand, I don’t see any materials change in what might be described as an total weak US shopper, and whereas it is true that administration is anticipating a restoration within the bridal class for the second half, they’ve been speaking about this for greater than 12 months, so coloration me skeptical on that one.

Signet 1Q Fiscal Yr 2024 earnings name (Greater than a 12 months in the past)

One other issue that must be thought of if we’re placing the hopes for such important restoration within the second half on the again of the bridal class is demographics.

The US Census Bureau tracks the median age of the primary marriage within the US. In response to their newest launch, that statistic stands at 30.1 years for males and 28.2 years for girls.

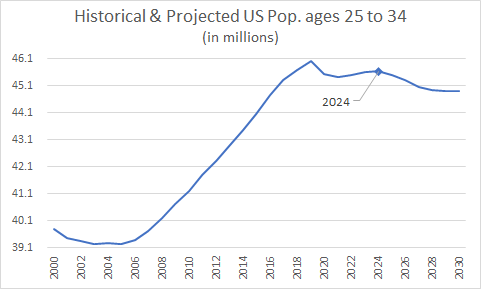

With that in thoughts, we will use the demographic historic statistics and projections by nation offered by the OECD. These information units are disaggregated in age brackets of 5 years every, so we’re going to concentrate on the 25 to 29 and 30 to 34 age brackets to attempt to get a great indication of the TAM for the bridal class in the USA.

OECD

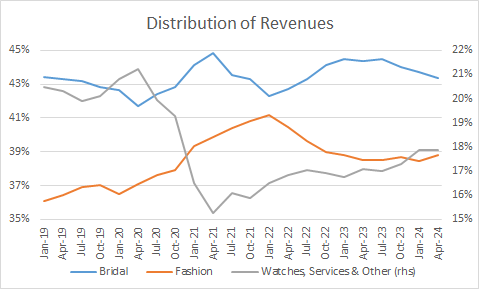

As you’ll be able to see, the age bracket extra more likely to get married is anticipated to start out slowly lowering beginning in 2024. And other than that, it is essential to notice that even with the underperformance of the bridal class in current quarters, TTM income distribution appears to face squarely in the midst of its historic vary for this explicit class.

Signet monetary disclosures

One other Case of a Administration Workforce Offering a Very Lopsided FY Outlook And its Final result

The danger that I’ve tried to flesh out jogs my memory of what just lately occurred with Fox Manufacturing unit (FOXF), an organization that I’ve been overlaying in current months.

It is completely true that FOXF is in a really totally different sector, nevertheless it’s additionally shopper dealing with and affected by the identical themes (low shopper confidence, excessive rates of interest, previous years collected inflation, and so forth.) which have translated into the present weak atmosphere of US consumption.

However extra essential than the variations and similarities between their respective industries, what I need to spotlight are the similarities within the construction of their respective FY steerage within the face of weak Q1 outcomes and poor expectations for Q2.

FOXF, reported a weak 1Q24 with a major hit to their working margins and on the similar time guided for an additional weak second quarter with implied expectations of one other materials hit to margins. And, in so many phrases, that is precisely what occurred with SIG of their newest incomes launch.

And like SIG, regardless of this two adverse datapoints, FOXF’s administration stubbornly select to supply solely very mildly decreased FY steerage that just about didn’t contact their anticipated implied working margins. One other clear similarity, however regretfully I’ve to say that SIG’s case is even a worse, as a result of they select to totally reaffirm FY steerage within the face of a weak reported Q1 and anticipated Q2.

Because the reader can see, this created for FOXF a really related sample to the one which I described for Signet, a FY steerage that very closely relied on a a lot improved second half, and one which generated a seasonal construction that had by no means occurred within the public historical past of the corporate.

And when got here time to launch 2nd quarter outcomes, administration was pressured to see the unrealism of their FY steerage, being pressured to chop anticipated FY revenues by 8% and adjusted EPS by 36% with the inventory cratering in a few days by nearly 20%.

If you wish to perceive this case in additional element and evaluate the construction of their steerage with the one offered by SIG, I put two articles (first & second) on the identify. These describe administration’s outlook intimately, disaggregating their conventional operations from the confounding results of a current acquisition and utilizing the identical sort of charts that I used for Signet on this article.

Dangers

Dangers to my thesis relate with the well being of the patron and the conversion capabilities by Signet, as implied expectations for the 2nd half are for a moderated 3% YoY income contraction in comparison with the 8.6% that’s anticipated for the primary half. This might, opposite to my expectations, be achieved by the mixed results of a full decision of the mixing points beforehand described of their digital banners and a powerful arrival of the long-awaited restoration within the bridal class.

Conclusion

Funding is a matter of possibilities, and as such, the chance of a downgrade for the second half doesn’t translate right into a sure final result, however I believe there may be enough proof to say that the possibilities are on this aspect of the argument.

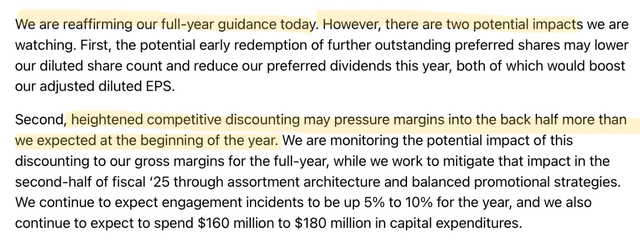

Even when administration reaffirmed their steerage on the final incomes name, they did it with a major caveat.

1Q Fiscal Yr 2025 Signet incomes name transcript

As I stated firstly of this text, Signet has been on my watchlist as its undemanding valuation requires very conservative assumptions to underwrite an funding case, so this piece shouldn’t be understood as a repudiation of Signet as a possible mid to long run funding. Quite the opposite, and the case of FOXF that I used earlier is an effective instance of this, as a result of as you noticed within the 2nd article, the truth that I used to be and nonetheless am patiently bullish from a basic perspective, didn’t preclude me from promoting my place earlier than the twond quarter earnings launch within the face of the quick danger of a possible steerage reduce.

Ultimately, the target of this text is to be informative as all the information that I used for my evaluation is proven within the charts, hyperlinks and tables included right here, and the reader can attain his or her personal conclusion primarily based on the knowledge. Possibly a few of you suppose that the mixing points round their digital banners are a enough rationalization for the weird sample implied of their steerage, or that the bridal class can expertise a sufficiently huge second half turnaround, and which may find yourself being right.

Other than that, a few of you may need a discovered a distinct potential driver of a much-improved second half that I missed, and if that had been the case, I might welcome it within the feedback part.

As all the time, thanks for studying, all the time carry out your personal due diligence and better of luck together with your investments.