quantic69

Be aware:

I’ve lined Sify Applied sciences Restricted, or “Sify” (NASDAQ:SIFY), beforehand, so traders ought to view this as an replace to my earlier article on the corporate.

Nearly three months in the past, I suggested traders to take part in a closely discounted rights providing performed by main Indian ICT options supplier Sify Applied sciences, as the corporate’s rights had been buying and selling effectively under truthful worth at the moment.

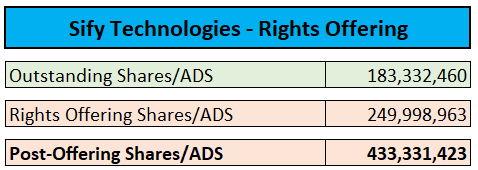

In combination, Sify issued roughly 250 million new shares/ADS for gross proceeds of simply $30 million, thus growing the variety of excellent shares/ADS by roughly 135%.

Regulatory Filings

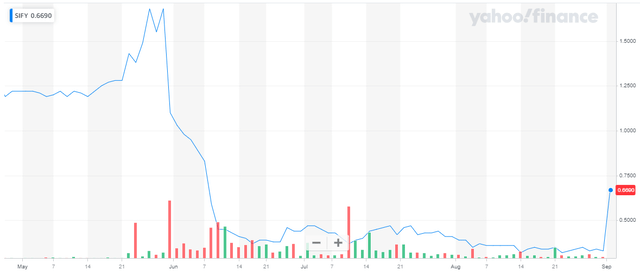

The rights providing triggered the value of the corporate’s U.S.-traded ADS to crater by roughly 75%:

Yahoo Finance

Whereas participation within the rights providing and subsequent sale of the ADS into the open market supplied readers with very stable positive factors, traders with extra endurance had been rewarded handsomely, albeit solely on account of Tuesday’s ill-fated momentum rally.

Even with the market experiencing some “AI-fatigue” as of late, the mixture of the magic phrases “AI” and “NVIDIA” in a press launch stays ample to draw the momentum crowd to a penny inventory like Sify:

Sify Applied sciences Restricted (NASDAQ: SIFY), India’s main Digital ICT options supplier with world service capabilities spanning knowledge heart, cloud, networks, safety and digital companies, at present introduced it has turn into an NVIDIA colocation accomplice with the NVIDIA DGX-Prepared Knowledge Heart program, licensed for liquid cooling.

(…)

With the NVIDIA DGX platform and its supporting infrastructure expertise ecosystem, Sify prospects now have entry to high-density supercomputing and highly effective efficiency, supplied in scalable and versatile AI infrastructure options and accessed by means of an in depth colocation footprint.

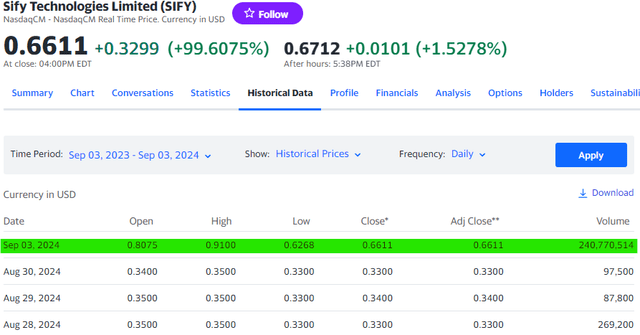

The information resulted within the firm’s ADS rallying by near 200% in early buying and selling on Tuesday earlier than pulling again.

The ADS completed the session up by roughly 100% on huge buying and selling quantity:

Yahoo Finance

Consequently, the corporate’s market capitalization elevated by nearly $150 million to $286.5 million.

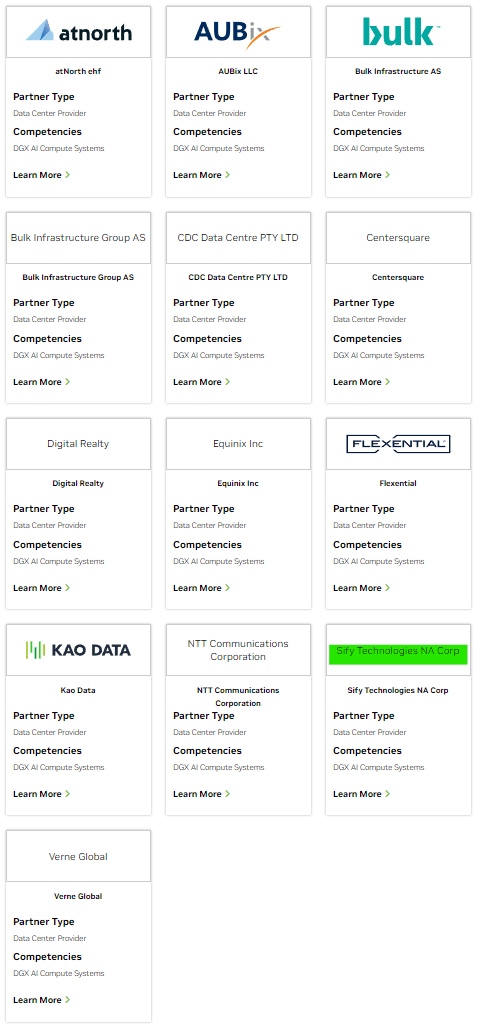

Whereas there is definitely nothing unsuitable with turning into “India’s first DGX-Prepared Knowledge Heart accomplice licensed for liquid cooling”, different Indian knowledge heart suppliers are prone to comply with swimsuit, thus mirroring developments in different elements of the world:

NVIDIA Company Web site

Please word that NVIDIA Company (NVDA) isn’t in search of unique relationships, however relatively to offer prospects with a big worldwide community of companions for its quickly rising AI expertise platform DGX.

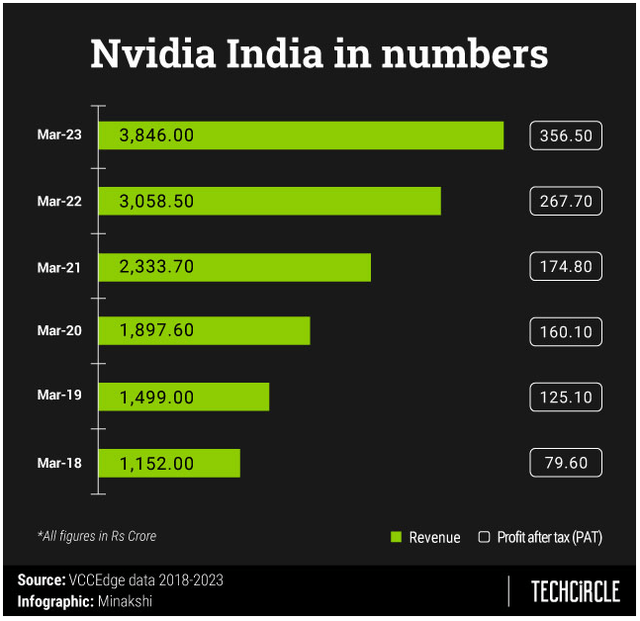

Bear in mind additionally that NVIDIA’s gross sales in India, whereas rising properly, stay a far cry from the corporate’s home stronghold and main Asian nations like China and Taiwan.

TechCircle

Within the present fiscal 12 months, revenues in India are anticipated to exceed $500 million, nonetheless not all of those gross sales will probably be datacenter and/or AI-related.

Equally, personal AI funding in India stays a tiny fraction of main nations like america and China.

Whereas there is definitely ample room for enlargement, Sify, now being a licensed NVIDIA DGX accomplice, isn’t prone to have any measurable near-term influence on the corporate’s monetary efficiency.

Please word additionally that knowledge heart companies represented solely 31% of the corporate’s $427 million in annual revenues in FY2024.

Lastly, with Sify being majority-owned by CEO and Chairman Raju Vegesna, outdoors shareholders have little or no choices to forestall extra worth destruction much like the current rights providing.

A minimum of for my part, there is no such thing as a justification for Tuesday’s 100% rally, because the certification by NVIDIA isn’t prone to have any near-term influence on the corporate’s monetary efficiency.

With momentum merchants prone to depart for assumed greener pastures sooner relatively than later, I anticipate the ADS to provide again most if not all of Tuesday’s positive factors over the subsequent couple of weeks.

Contemplating this situation, I might advise Sify shareholders to make use of the momentum rally to eliminate present positions.

Dangers

Apparently, the most important danger to my bearish thesis could be a continuation of Tuesday’s momentum rally as extra merchants get attracted by the hype. Nonetheless, with the ADS having completed the session close to day-lows, I might anticipate the value to maneuver decrease on lowering buying and selling quantity.

Backside Line

The ability of AI has struck once more, as evidenced by Tuesday’s 100% transfer in Sify Applied sciences’ ADS.

Nonetheless, the truth that the corporate has turn into India’s first “NVIDIA DGX-Prepared Knowledge Heart accomplice licensed for liquid cooling” isn’t prone to end in any measurable near-term advantages to the corporate’s monetary efficiency and positively doesn’t justify an nearly $150 million improve in Sify Applied sciences’ market capitalization.

Given this situation, I’m downgrading the corporate’s ADS from “Promote” to “Robust Promote” as I anticipate the inventory to provide again most if not all of Tuesday’s positive factors over the subsequent couple of weeks.

Editor’s Be aware: This text covers a number of microcap shares. Please pay attention to the dangers related to these shares.