Kutay Tanir

My Thesis

I’ve been covering Sibanye Stillwater Limited‘s (NYSE:SBSW) stock here on Seeking Alpha since May 2021, always reiterating my bullish stance on it. But over the past 3 years, SBSW underperformed the general market significantly – since my very first bullish call, the stock is down almost 65% (in total returns) vs. the S&P 500 index’s (SPX) (SP500) return of ~22%.

In my very last “Buy” rated article, I mentioned that the company’s growth has been lacking recently due to falling metal prices, but expressed my willingness to hold the shares and possibly average down. Key points that made me optimistic included the company’s efforts to cut costs and its focus on the green metals market. Although metal prices have fallen, SBSW’s stock seemed undervalued to me at the time compared to the sector as a whole, suggesting significant growth potential when/if prices rise again. Since then, the SBSW has lagged somewhat behind the growth of the S&P 500 but has nevertheless developed positive momentum:

Oakoff’s latest article on SBSW, notes added

Today, I have the impression that Sibanye Stillwater’s stock price has hit a local bottom and there’s potential for a recovery as management’s strategic plan is implemented and the rise in commodity prices (such as gold and PGM metals) provides a tailwind. All of this suggests that my optimistic view could pay off in the end: After a continuous averaging-down, I expect to finally turn a profit on my SBSW position.

My Reasoning

Sibanye’s revenue mix is quite diversified, with 57% coming from PGM mining, 22% from gold mining, and 20% from scrap recycling. Geographically, sales are divided between South Africa (65%), the US (32%), Europe (2%), and Australia (1%).

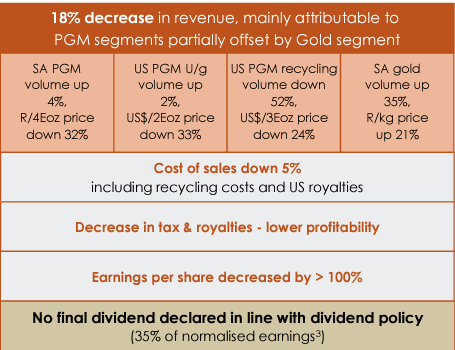

Mining is a nuanced industry closely tethered to the prices of its extracted resources. Sadly for SBSW, 2023 brought less-than-ideal pricing conditions. In 2023, SBSW’s revenue amounted to $6.172 billion, 18% lower than last year, mainly due to weakening PGM prices. In this business, it’s really tough to match production adjustments with selling prices, that’s why the cost of sales decreased by just 5% YoY, leading to the EPS taking a nosedive of over 100% YoY (actually, the bottom line amounted to -$37.4 billion compared to a profit of almost $19 in 2022). It left SBSW with no choice but to scrap dividend payments.

SBSW’s IR materials

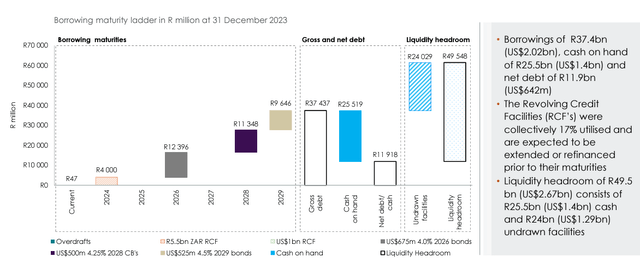

However, the management tried to implement some cost-saving measures: As was outlined in their 2023 presentation, these measures resulted in a total benefit of ~$375 million, a significant figure considering the company’s $678 million operating cash flow (CFO) for the year, leaving them with ~$1.4 billion in cash reserves. Taking into account adjusted EBITDA of ~$1.1 billion (-56% YoY), net debt to EBITDA increased to only 0.58x, which is strikingly lower than in 2018 (~2.5x). At the same time, as I understand from the latest financials, SBSW does not expect any serious debt maturities in the next 2 years, which is a kind of safety margin for the current financial position.

SBSW’s IR materials

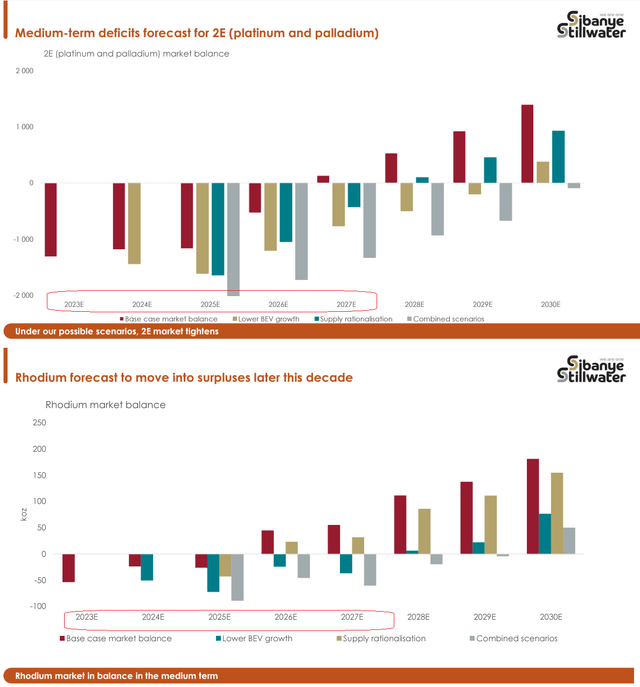

The management seems to be positive about the PGM market’s prospects, anticipating supply rationalization and sustained demand for PGMs in various industries. In any case, SBSW anticipates a shortage in the PGM markets by the end of 2027 – should this actually be the case, then this condition should inevitably have a strong positive impact on the price dynamics of the corresponding metals. With the cost-cutting efforts that the company is taking today, I believe the potential recovery in the company’s EBITDA and EPS next year could provide excellent leverage.

SBSW’s IR materials, Oakoff’s notes

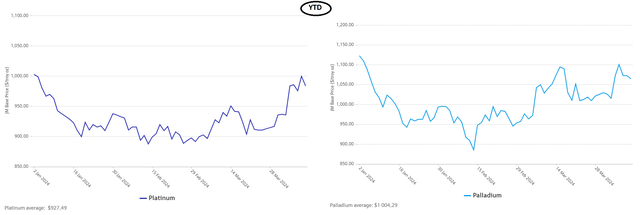

Apparently, that’s why despite the still generally negative narrative around PGM today (that’s my personal feeling judging by the comments and various articles), platinum and palladium were able to show a strong recovery after YTD’s decline:

Matthey data, Oakoff’s notes

I anticipate a boost in gross profit margins for SBSW in 2024/2025, driven by recent strategic actions. Just days ago, the company unveiled plans to trim its workforce by >3,000 employees and >1,000 contractors. This move aims to mitigate losses at its underperforming Beatrix 1 shaft and address processing inadequacies at the Kloof 2 plant, following the closure of the Kloof 4 shaft last year, Seeking Alpha reported. Given the possible continued recovery in PGM prices in the coming months, Sibanye’s potential in terms of margin expansion should lead to a strong recovery in financials, in my view.

SA News

SBSW sets out its ambitious goals for the year 2024: US 2E production to range between 440,000 and 460,000 ounces, with AISC between $1,365 and $1,425 per ounce, while the US recycling segment is targeting a 12% increase in production. South African gold production is expected to increase to a range of 627,000 to 659,000 ounces, with AISC between $1,955 and $2,133 per ounce, benefiting from a gold price >$2,300 – an unprecedented milestone. SA 4E production is expected to increase by 8% to 12%, with AISC between $1,245 and $1,285 per ounce, an increase of almost 20% YoY.

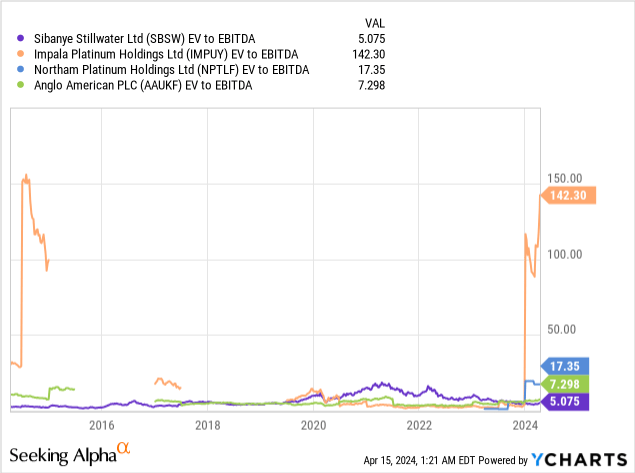

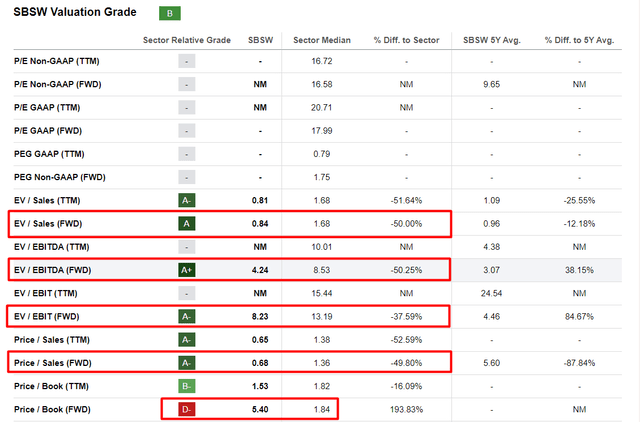

At the same time, the SBSW stock is now “dirt cheap”, as some analysts put it. Looking at the most important competitors, SBSW’s EV/EBITDA of less than 5.1x is the lowest of all peers:

Moreover, this undervaluation persists on a forwarding basis: SBSW is 38-53% cheaper than the average company in the materials sector, depending on what you use for comparison. However, on a price-to-book basis, the stock is quite expensive, but that is only one multiple out of the entire sample.

Seeking Alpha, SBSW, Oakoff’s notes

I therefore expect the current discount on the valuation of SBSW to narrow further. My long position in SBSW stock is down more than 30%, I last averaged down in January 2024. In the medium term, if PGM and gold prices continue to rise (my assumption) and Sibanye’s cost measures bear fruit, I expect my long position in this stock to finally turn into a profit in the next 1-2 years. The technical analysis is on my side as far as I see it:

TrendSpider Software, SBSW weekly, Oakoff’s notes

Risk Factors To Consider

The risks of my thesis today are not very different from the risks I have mentioned to readers in previous updates. As I wrote last time, SBSW’s financials are very vulnerable to fluctuations in commodity prices and exchange rates. A fall in gold or PGM prices coupled with a stronger South African rand would likely have a negative impact on earnings due to the company’s operating leverage.

Moreover, other analysts disagree with my conclusions that Sibanye’s business is likely turning around gradually against a backdrop of more favorable pricing and cost-cutting efforts. BofA has an “underperform” rating on SBSW shares and forecasts a deeply negative EPS figure for 2025:

BofA [April 2024] – proprietary source, Oakoff’s notes added![BofA [April 2024] - proprietary source, Oakoff's notes added](https://static.seekingalpha.com/uploads/2024/4/15/53838465-17131653493683288.png)

Furthermore, my conclusion that the stock has massive upside potential from a technical perspective cannot be verified using scientific methods – technical analysis is more of an art that can be interpreted in different ways.

The Takeaway

Despite the numerous risks that may overshadow my bullish outlook on SBSW, I remain convinced that Sibanye Stillwater is finally on the verge of a turnaround after several difficult months.

Yes, there are serious long-term demand issues in PGM metals, but the short-term shortage should allow metal prices to increase. Given SBSW’s efforts to cut costs, the company’s operating leverage should allow profits to recover much faster than the market currently expects. The valuation discount can’t be ignored here.

I believe the tide may be finally turning for Sibanye, so I reaffirm my “Buy” rating.

Good luck with your investments!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.