Dragon Claws/iStock by way of Getty Photographs

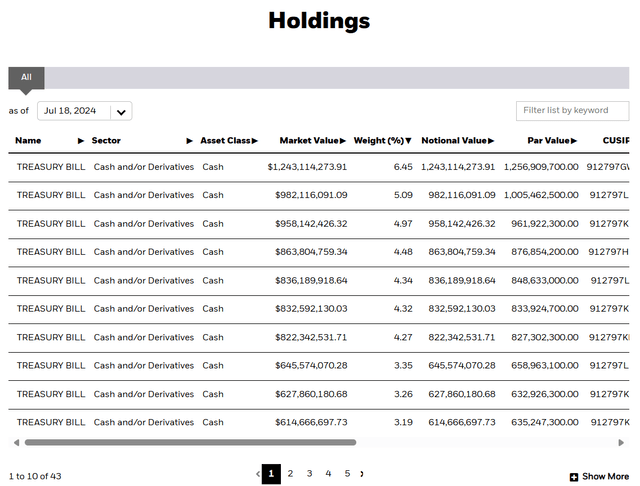

iShares Quick Treasury Bond ETF (NASDAQ:SHV) holds a portfolio of treasury securities maturing in a 12 months or much less. This fund is a passive automobile that chooses no less than 80% of its portfolio from the ICE Quick US Treasury Securities Index. The index incumbents are chosen utilizing the consultant sampling methodology, which as famous in SHV’s prospectus entails “investing in a consultant pattern of securities that collectively has an funding profile just like that of an relevant underlying index“. The ETF has round $19.2 billion in internet belongings ultimately rely, and its portfolio is made up of just a little over 40 securities (all T-Payments) and money.

SHV

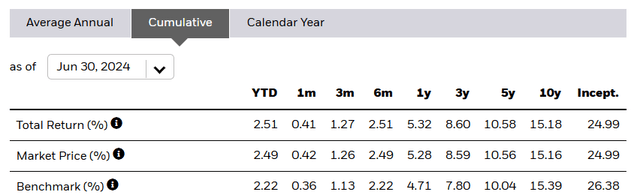

In distinction, the benchmark index of this fund holds round 100 securities. The distinction within the dimension and scale between the ETF and the index prevents the previous from making an attempt to duplicate the latter. The consultant sampling technique, nevertheless, has served this ETF effectively. We are able to see beneath that SHV has tracked ICE Quick US Treasury Securities Index effectively through the years, outperforming it within the majority of the timeframes.

SHV

This feat is especially spectacular contemplating that the ETF has bills, whereas the index doesn’t.

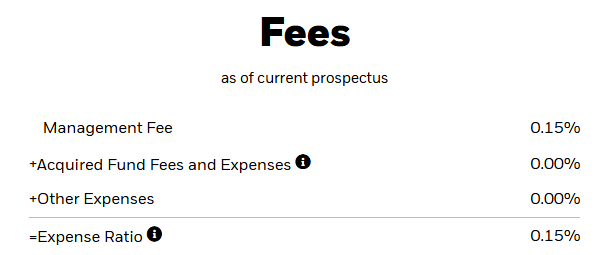

SHV

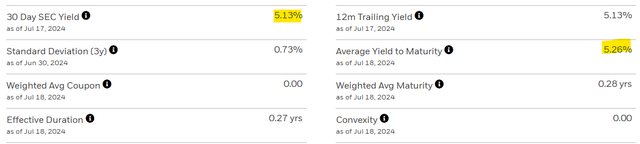

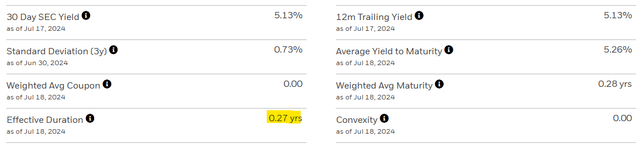

Collectively, SHV earns 5.26% on its investments and that’s mirrored within the common yield to maturity quantity beneath.

SHV

What you get to maintain internet of bills is round 5.13% and that’s indicated by the 30-Day SEC Yield quantity. This quantity takes into consideration the curiosity earnings and bills of this fund for the latest 30-day interval, spitting out the online earnings for the fund. It’s a customary calculation for fastened earnings funds and is utilized by traders to check the latest backside strains. This quantity can be an amazing main indicator of how a lot one can anticipate the ETF to distribute down the road.

SHV

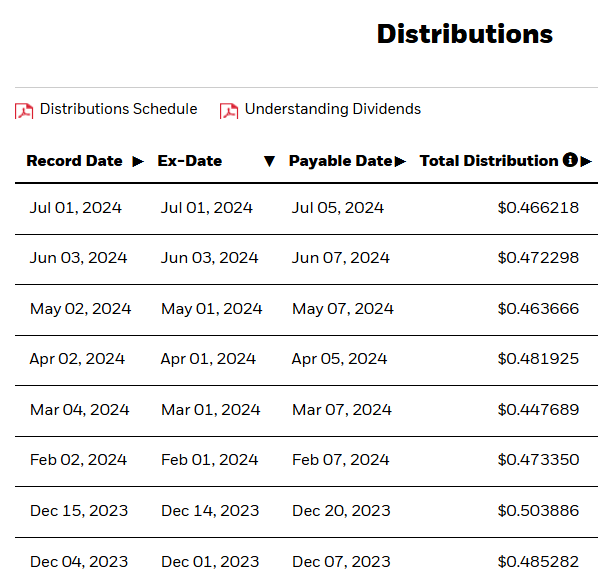

We are able to see from the above knowledge, the distributions are usually not fastened. They range relying on the web earnings, which we mentioned above. The latest distribution of 46.6218 cents leads to a yield of round 5.07%, primarily based on the present value of $110.38. We are able to anticipate a slight uptick within the subsequent few months primarily based on the upper 30 Day SEC Yield at the moment.

Collectively, the SHV portfolio has a length danger of 0.27 years, which suggests it’s virtually non-existent.

SHV

Period danger signifies the extent to which one can anticipate the worth of the safety or a portfolio, on this case to rise or fall in response to the change in rates of interest. The connection between the 2 is inverse. The 0.27 years for SHV signifies that the portfolio worth would decline by 0.27% in response to a sudden 100 foundation factors improve in corresponding rates of interest. The quick maturity investments held in SHV afford its traders a respite from worrying about length danger. One other pacifier for the SHV unitholders is the infinitesimal credit score danger, contemplating the supply of the investments.

The 5% yield won’t quench the FOMO that solely investing in AI can today. Nonetheless, when coupled with the low length and credit score danger, SHV does make an honest money parking candidate.

Alternate options

Money is money and the extra you step away from that, the upper your danger. However one could make calculated bets whereas acknowledging that the danger profile isn’t the identical. For instance, till their early redemption date, we noticed Alliance Useful resource Companions, L.P.s (ARLP) bonds as equal of money. We recommended their 7.5% yield was too good to move up contemplating the corporate had more money than debt, a big line of credit score and locked in costs on coal guaranteeing a further one billion of money circulate. So what’s one thing that pays just a little further?

1) PIMCO Enhanced Quick Maturity Lively Change-Traded Fund (MINT)

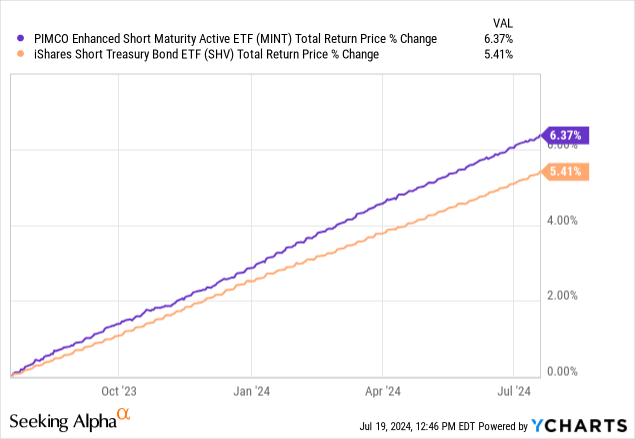

We’ve coated this fund a couple of totally different occasions, and you’ll see our earlier posts right here. At current, the yield to maturity on this one is barely increased, with an SEC yield at 5.35%. The corporate takes essentially the most marginal of credit score dangers, and the weighted common length can be on the low facet. The length is barely greater than that of SHV, so if we do have a extra aggressive set of rate of interest cuts than priced in, MINT will outperform. The fund has accomplished that over the past 1 12 months as effectively (outperform) because it performed the small credit score dangers in a pleasant method.

2) Treasury Payments + Money Secured Places

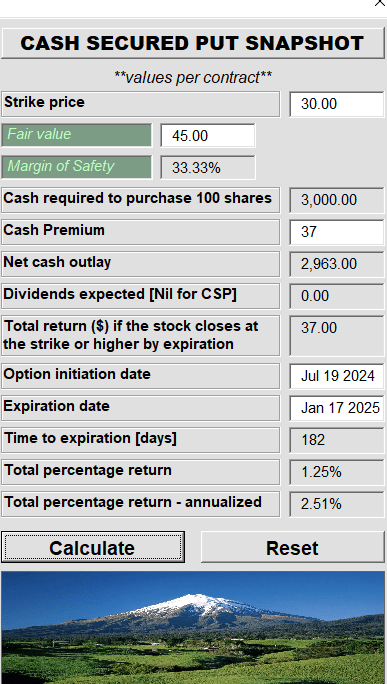

It is a extra fascinating mixture for people who have parked money particularly to choose up a safety at a low value. In fact, that low value might by no means occur, so you would be ready endlessly. Why not receives a commission whilst you wait? The way in which to do that is to park your money in individually bought Treasury payments after which match the maturity (as carefully as attainable) with a money secured put. Let’s offer you an instance right here. Say you’re the equal of cuckoo for coco puffs should you had an opportunity to purchase Suncor Vitality (SU) at $30.00 per share.

In fact, the present value is a bit removed from that.

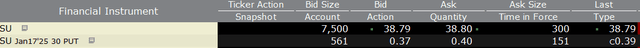

However that is okay. If you’re trying to purchase 1,000 shares of SU at $30.00 per share, you possibly can promote 10 Money Secured Places for January 17, 2025 for 38 cents every.

Interactive Brokers July 19 2024

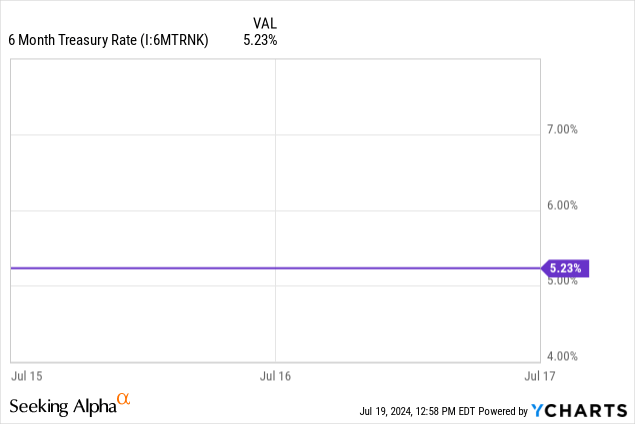

You couple that with a 6-month Treasury invoice, which yields about 5.23% in the present day.

To that you simply add your Money secured yield and voila, you might be dwelling with a 7.75% yield only for ready to purchase Suncor.

Creator’s App

Verdict

Whereas SHV does what it’s presupposed to do completely, we predict there are higher methods to get extra bang in your buck. We like the 2 methods acknowledged above. The second could be actually custom-made to totally different shares and totally different timeframes. Whereas we like these strategies, they might not work for everybody. These wanting the safety of Treasuries with full peace of thoughts can maintain SHV.

Please observe that this isn’t monetary recommendation. It might seem to be it, sound prefer it, however surprisingly, it isn’t. Buyers are anticipated to do their very own due diligence and seek the advice of with knowledgeable who is aware of their goals and constraints.