Published on January 10th, 2023 by Samuel Smith

The question of whether one should manage their own investment portfolio or entrust it to a paid professional is very important as it can have significant ramifications for what kind of retirement you are able to enjoy.

While some may prefer to entrust the investment process to a paid professional, others might enjoy the process of picking stocks. Dividend Kings, for example, are an elite group of stocks that have increased their dividends for at least 50 years in a row. We believe the Dividend Kings are among the highest-quality dividend growth stocks to buy and hold for the long term.

With this in mind, we created a full list of all the Dividend Kings. You can download the full list, along with important financial metrics such as dividend yields and price-to-earnings ratios, by clicking the link below:

In this article, we will compare the pros and cons of the various means at an investor’s disposal for investing in the stock market and then provide a practical guide for how to get started.

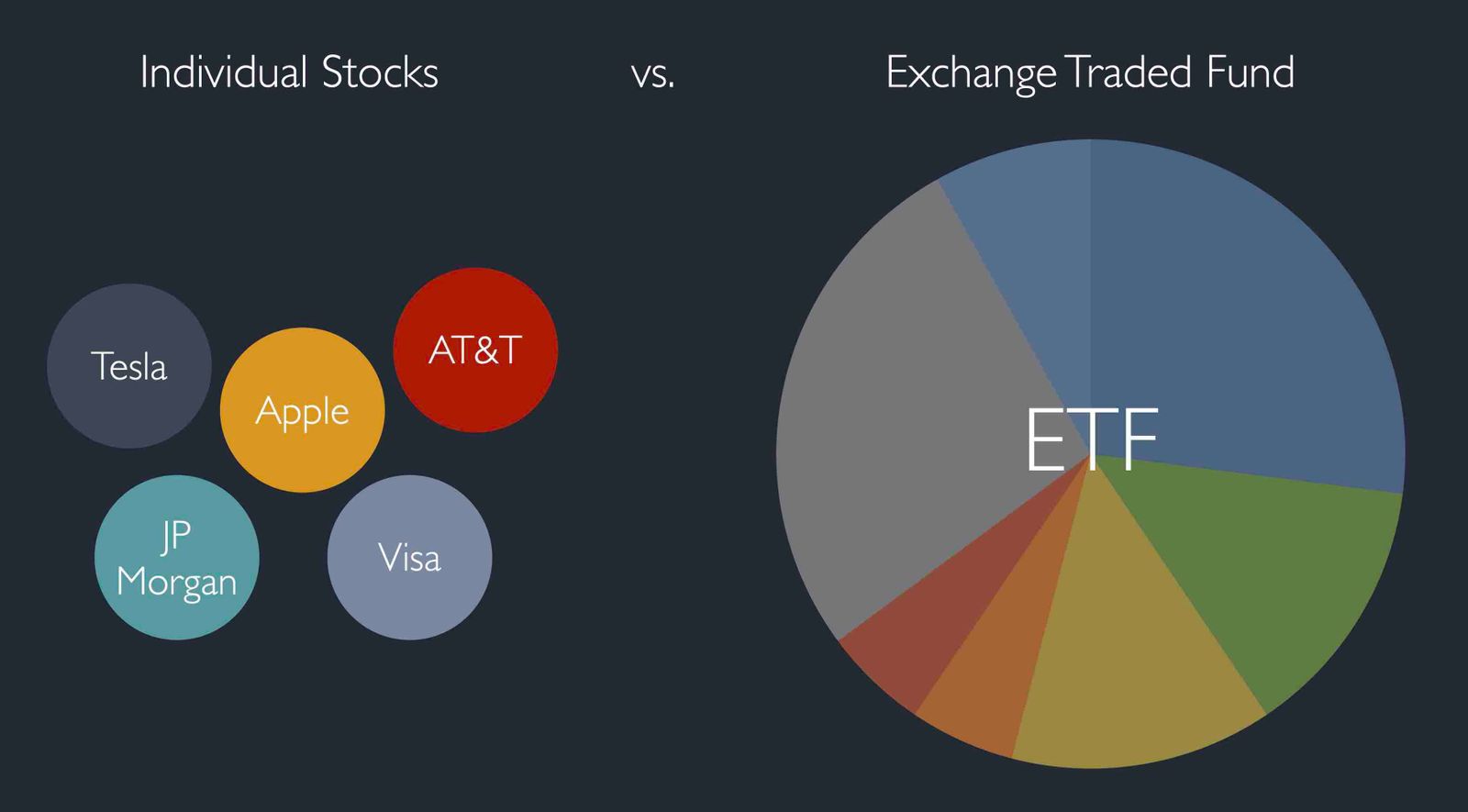

Stock Picking Vs. Investment Funds

Several decades ago, individual securities were really the only path to investing in the stock market. Yes, you could pay a financial advisor to manage your stock portfolio for you, but mutual funds and exchange traded funds (“ETFs”) were rare to non-existent. Today, however, this is no longer the case. Investors have access to hundreds of funds, both actively and passively managed, where they can invest their money and gain instant exposure to a broadly diversified basket of stocks without having to do much research or have significant investing knowledge themselves.

Source: creditFred

In addition to the wide diversification and the ability to invest without requiring any advanced knowledge offered by these investment funds, going this route also requires a very low time commitment. In fact, it is quite easy to fully automate one’s investing by setting up automatic deposits, purchases, and dividend reinvestment through an online brokerage account.

Of course, but with everything in life, there are trade-offs to a more passive approach to investing. First and foremost, it is not free. These funds are built to make profits for the fund managers and therefore charge fees – typically referred to as expense ratios – which detract from the total returns generated by their underlying portfolios. Another trade-off is that there is no control on the part of the individual investor over what his funds are being invested in. This means that oftentimes the fund managers will over diversify in order to avoid risk, other times they may take on too much risk, and other times they might invest in businesses that conflict with the ethics and values of some of their individual investors. Last but not least, these funds often generate lackluster dividend yields, making them less than ideal vehicles for income focused investors trying to build large passive income streams.

For those investors who want to avoid some of the negative trade-offs posed by these investment funds, an alternative is to simply build your own investment portfolio. While this approach certainly takes more time and requires much more knowledge of investing for it to work, the positives are that you will not have to pay any investment management fees, you know exactly what you own, and can build a portfolio that perfectly aligns with your investing goals and risk tolerance.

How To Build A Dividend Portfolio

Generating reliable and growing passive income from a portfolio of dividend stocks is probably the best possible all-around way to invest for long-term wealth. However, great care needs to be applied when building a dividend portfolio.

First, one needs to make sure that they properly diversify their portfolio. If you fail to properly diversify, you put your income stream at risk by becoming overly dependent on a few dividend stocks. If one or more of them hit hard times and are forced to reduce the dividend, your income stream could fall precipitously. This principle was perhaps never more evident than during the COVID-19 outbreak, when entire industries went on lockdown for lengthy periods of time and faced tremendous uncertainty. As a result, many of the companies in those industries – even some of the largest and strongest – cut or even suspended the dividends. Since we have no way of knowing for sure what the future holds or what black swan events may emerge suddenly, diversification is a must for any prudent dividend investor.

To properly diversify your portfolio, you generally want to have at least 20 to 30 stocks in it. Modern portfolio theory shows that this is the sweet spot for mitigating individual stock risk while still not overwhelming you with so many individual stocks to research and keep track of. Furthermore, it is important to ensure that your portfolio is diversified across numerous industries so that it will be able to generate decent returns through varying macroeconomic conditions.

Another important consideration when building your own dividend stock portfolio, is focusing on companies with a history of dividend increases. Oftentimes, investors look for shortcuts to building up their passive income stream by chasing after stocks that offer extremely high dividend yields. However, these companies often have poor track records of growing and sustaining dividends on a per share basis. Furthermore, they are often facing fundamental challenges to either their business or their balance sheet, and might be facing the prospect of a dividend cut in the not-too-distant future.

Instead, by focusing on companies that have sustainable dividend yields and payout ratios as well as lengthy track records of sustaining and growing that dividend on a per share basis, investors set themselves up for much surer dividend growth and overall wealth compounding over the long-term. Some great places to start are purchasing stocks on the Dividend Aristocrats and Dividend Kings lists. These are stocks that have raised their dividends every year for the past 25 and 50 years, respectively.

Source: Dividend Power

A third principle to keep in mind when building your investment portfolio – whether through a fund or with individual stocks – is to regularly invest regardless of the economic or market conditions at the time. Since market swings and macroeconomic cycles are extremely difficult to predict consistently accurately, it is generally best for the average retail investor to buy a diversified basket of high-quality stocks on a regular basis. Then, over time through a process referred to as dollar cost averaging, your portfolio will generate satisfactory returns. Instead, if you let your emotions govern your decision-making, you are bound to sell when the market crashes and buy when the market soars, thereby underperforming the broader market over the long-term. Disciplined, slow and steady purchases of stock over time is the surest path to building long-term wealth and a large passive income stream.

Conclusion

As we discussed in this article, there are pros and cons to both hiring someone else to manage your investment portfolio as well as managing your own portfolio. There is no one right way to do it; ultimately, the answer lies in what method best suits your personal circumstances, competencies, and interests.

For those who choose to manage their own portfolio, building a well-diversified collection of high-quality businesses that pay regularly increasing amounts of dividend on a per share basis and then buying shares of stock in those businesses consistently over the long-term is the simplest and surest path to success. Furthermore, by focusing on growing your passive income stream through dividends, you can better stay focused on your process than by riding the emotional roller coaster that comes with closely monitoring your fluctuating portfolio value each day.

At the end of the day, it is far more important to pick a method that you will be able to stick with consistently through market peaks and troughs than to try to find the perfect times to buy and sell your stocks. Time in the market almost always beats trying to time the market.

At Sure Dividend, we often advocate for investing in companies with a high probability of increasing their dividends each and every year.

If that strategy appeals to you, it may be useful to browse through the following databases of dividend growth stocks:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].