Markets are competitive. When every decision comes down to something as binary as “buy or sell,” every winner tends to come at a loser’s expense.

At first glance, though … there are no clear winners in the banking crisis this year.

Silicon Valley Bank executives certainly lost — their company (worth $212 billion), their reputation and probably some portion of their minds. That’s not even counting First Republic, Signature, Credit Suisse … you get the idea.

The bank’s depositors, while the FDIC will eventually make them whole, lost temporary but prolonged access to their funds. In the case of Silicon Valley Bank, who catered to the tech startups which so desperately need funds right now, this loss was even more dire.

The FDIC also lost. It’s used up $22 billion of its recovery reserves, and now banks have been assessed to refill the fund. (Those banks lost out, too…)

And in terms of losses, investors are right up there with the C-suite at these failed banks.

Long before the bank went bust, Silicon Valley Bank stock slumped from heights of $755 per share all the way down to $100 before it was delisted. That’s an 85% loss … and tens of billions in market cap value completely destroyed.

First Republic fared even worse, losing over 98% of its value in the same time… Nearly $40 billion, down to less than $1 billion in just over a year.

So if all these actors lost, who could’ve possibly won?

Traders, that’s who.

There’s been more than enough ink spilled on why we’re in a banking crisis.

That’s why I want to focus today on the small number of people who actually profited from this crisis, and previous crises, and how you can do the same with far less risk than they ever took.

One Man’s Trash…

Amid all the chaos of Silicon Valley Bank and Signature Bank failing this year, some smart short sellers were able to see the risks beforehand … and turn it into a windfall profit.

According to financial analytics company Ortex, hedge funds were sitting on unrealized profits of $7.25 billion over the course of March. That made it the most profitable month for short-sellers since the 2008 financial crisis.

And earlier this month, as First Republic went down, short sellers pocketed another $1.2 billion.

In all these situations, one man’s trash quickly became another man’s treasure.

If you’re unfamiliar, short sellers bet against stocks and make money when they fall.

Now, opportunities like these don’t come around often. Markets generally go up — prolonged bear markets like we’re in now are rare throughout history.

That’s why short sellers focus on what are often called special situations — unique events where a confluence of factors come together and form a “perfect storm.”

With Silicon Valley Bank and other recent bank failures, it was the rapid rise of interest rates coupled with a slowdown in the tech sector. High interest rates damaged the banks’ bond portfolios. Struggling tech companies needed to withdraw more funds than SVB had available.

This became clear to most people only in hindsight. But for smart short sellers, this was a special situation they could see beforehand and capitalize on.

It’s far from the first time this has happened, and it certainly won’t be the last. In 2008, just a small number of short sellers saw the risks in the subprime mortgage market, understanding how quickly the contagion could spread to the stock market and even outside the U.S. That’s how Michael Burry famously made $800 million in his bets against the credit default swap market on mortgage bonds.

It goes back even further. George Soros “broke the bank of England” by shorting the pound with such volume, he forced Britain to back out of an effort to peg its currency to other European economies. That trade netted him $1 billion, one of the biggest profits of all time.

And we can even look to Paul Tudor Jones, who made $100 million in a single day during the Black Monday market crash.

Now, I’m not recommending you go out and start trying to short stocks yourself. One, the market’s bullish bias is working against you. And two, shorting stocks is incredibly risky for individual investors.

Shorting stocks involves borrowing shares and putting them up for sale. If the stock goes down, you can buy back the shares you sold for a profit. If it goes up, though … you’re exposing yourself to unlimited risk. This can and has bankrupted many a trader who didn’t manage their risk well.

However, everything I’m seeing says that there will be more bank crises to come. Interest rates are still a huge problem for small and midsize regional banks, especially. And my research shows that nearly 300 publicly traded regional banks are at high risk of extreme losses in the coming months.

I want you to be a victor, not a victim, of what’s to come.

So, here’s what I want you to do…

The “Off Wall Street” Short

Like I said, shorting stocks is incredibly risky for individual investors who don’t have the bankrolls of multibillion-dollar hedge funds.

At the same time, the opportunity we’re presented with today is one you cannot afford to ignore.

I’ve identified a number of special situations in the banking crisis right now — just as Paul Tudor Jones, George Soros, Michael Burry and many others have before me.

But I will NOT be recommending any of my subscribers short stocks. The risks are far too great.

Instead, I’m recommending a kind of “off Wall Street” trade that few people know about … or if they do, they don’t know how to take advantage of it.

This trade isn’t much different from buying a share of stock in your brokerage account. However, it has the potential to rise multiples faster than any stock position, especially in times of volatility like we’re in now.

To give you an idea of the potential, let me walk you through a trade I recently recommended to my subscribers.

Back on April 18, I made my case for why the mainstream media was too early on calling an end to the banking crisis. The price action in a certain niche of the banking sector wasn’t reflecting that, and the sector had (still has) huge exposure to an asset that’s set to rapidly lose value.

So I recommended a trade against the sector.

Now get this… Three weeks and two days later, we got exactly what I was looking for. Our target continued to slide as the problems at First Republic became more apparent. And we pocketed over a 70% gain on part of the position (we’re still holding the rest open for further gains).

There are no limits to opportunities just like this one as the banking sector continues going through this rough patch.

In fact, next week, I’m going to present my recent findings on the current banking crisis, including the near-300 banks that are at high risk of failing right now.

And alongside that, I’ll show you exactly how I plan to double, even triple my subscribers’ money as these bank failures continue to play out.

To make sure you access this urgent information as soon as it goes live, put your name down right here.

To good profits,

Adam O’DellEditor, 10X Stocks

Apollo is one of the largest and most successful private equity firms in the world. So, when CEO Marc Rowan speaks, I tend to pay attention.

Earlier this month, Rowan said we could be headed for a “non-recession recession.” This looks a little different than past recessions … and leaves many economists scratching their heads.

Non-recession recession sounds nonsensical, but Rowan might really be on to something. He sees a deflation in asset prices, which will particularly hurt wealthier and upper-middle-class Americans.

But we may not see the other tell-tale signs of a typical recession, such as sharply rising unemployment. Even as the companies announce mostly tepid earnings and weak outlooks, the unemployment rate is ridiculously low at 3.5%.

When I was in college, my economics professors taught us that “full employment” really meant an unemployment rate of about 4% — because there will always be some number of people between jobs, or simply unemployable.

That 4% was always an estimate, and economics isn’t an exact science. But at 3.5%, our unemployment rate is lower than what was generally believed to be possible … or at least sustainable.

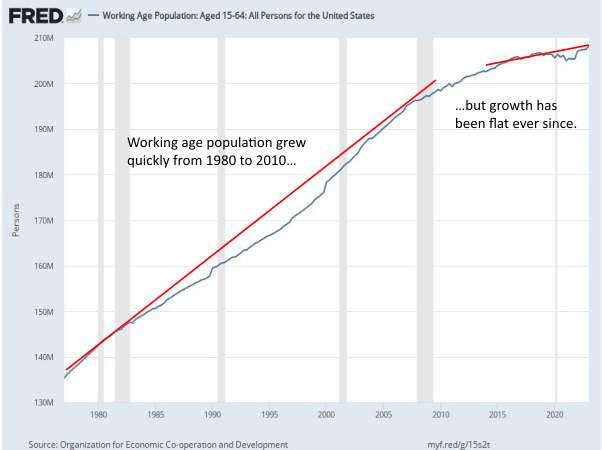

Then again, that was also an age of population growth. Every year, we had a new batch of young workers to throw into the economy.

That really hasn’t been the case over the past decade, as growth in the working age population has been slow due to sharply reduced birthrates and lower immigration.

So it’s very possible that we won’t see widespread unemployment this time around.

Hey, we’ll take whatever good news we can get.

But an “asset price” recession still isn’t going to be fun. We enjoyed 15 years of ultra-loose monetary policy from the Federal Reserve. This disproportionately benefitted the “investor class,” as the trillions of dollars created by the Fed and other central banks pushed up the prices of stocks, real estate and just about anything else that could be bought or sold.

And the “investor class” isn’t some group of old guys resembling the Monopoly Man, sitting around a table smoking cigars and comparing their golf handicaps.

If you have a good chunk of your life savings in your home equity or 401(k) plan, then you’re part of the investor class too.

Deleveraging is painful. It means reducing debt in the face of higher interest rates.

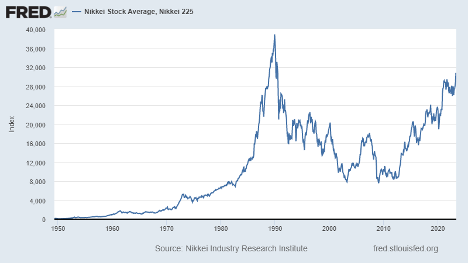

This has been the reality of Japan since the early 1990s. The Nikkei was in near continuous decline for over two decades. It finally turned around in the early 2010s, but it’s still nowhere near its highs of 30 years ago.

If you’re a nimble investor, this isn’t necessarily something to worry about. There are always short-term trading opportunities no matter what the broader market is doing.

Like he mentioned today, Adam O’Dell has identified a way to potentially score massive profits if, as he expects, the asset-price recession causes another wave of stress in the banking sector.

If you want to find out more, make sure to watch his brand-new webinar that releases next week, May 31. Reserve your spot here.

And have a great weekend!

Regards,

Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge