Brent Lewin

Japanese cosmetics giant Shiseido (OTCPK:SSDOY) could benefit from near-term tailwinds from Asia’s post-pandemic re-opening. Medium term, the company’s focus on skincare has merit but competitive risks are significant.

Q1 2023: revenues and profits up

For Q1 2023 (quarter ended March 2023) Shiseido’s sales rose 6.6% YoY on a like-for-like basis and rose 2.6% YoY on a reported basis to JPY 240 billion. The performance was better than rival Estee Lauder’s (EL) whose sales dropped 12% YoY for the March quarter, but was outpaced by L’Oreal’s (OTCPK:LRLCF) whose revenues were up by 13% YoY on a like-for-like basis for the same quarter.

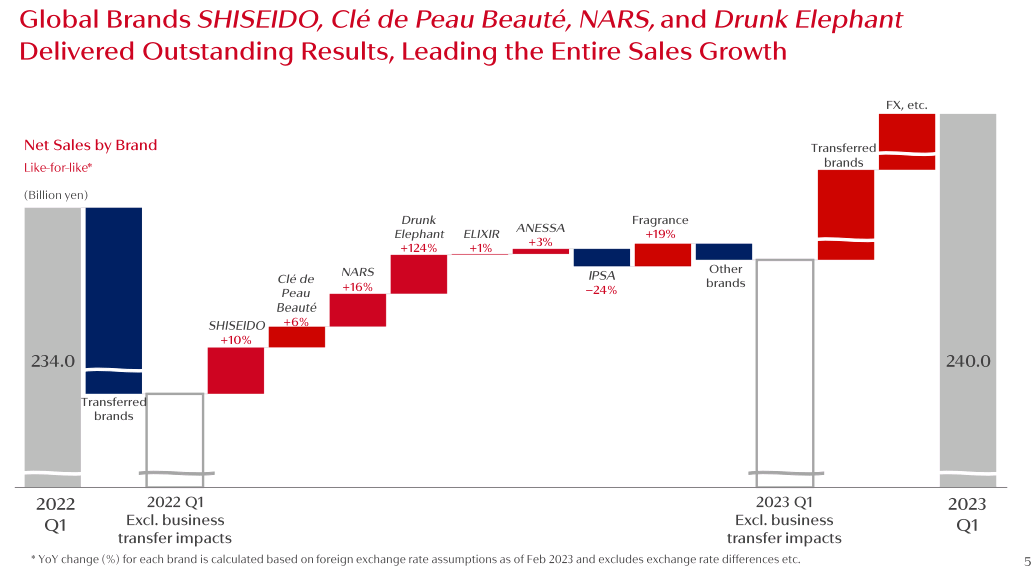

By brand, sales growth was led by SHISEIDO, Clé de Peau Beauté, NARS, and Drunk Elephant.

Shiseido Q1 2023 investor presentation

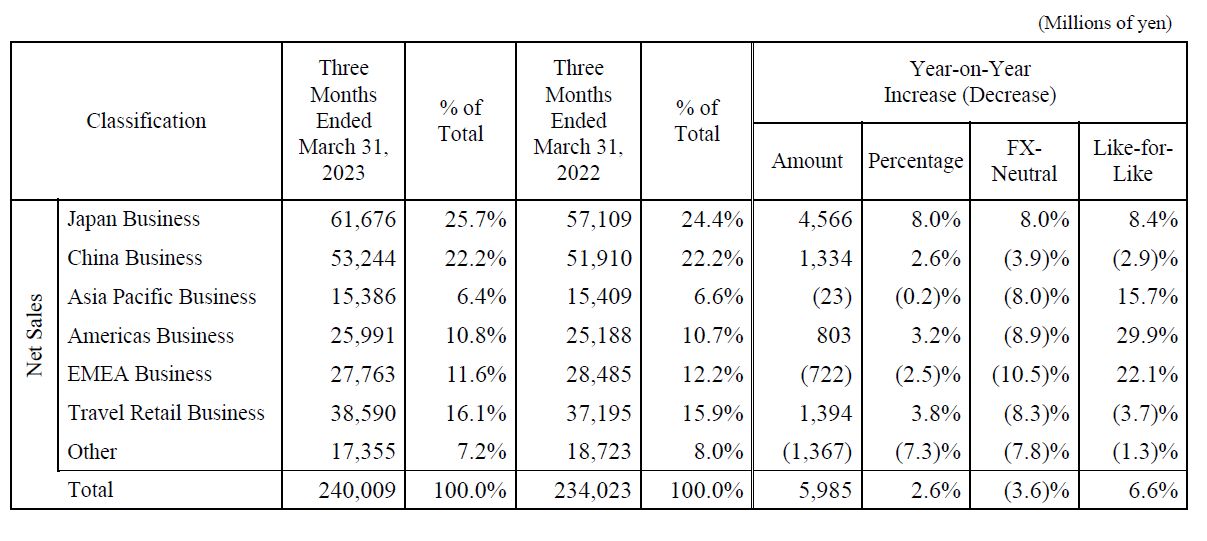

By segment, all segments except China Business, and the Travel Retail Business saw revenue growth on a like-for-like basis.

-

Japan Business, the company’s biggest business segment by revenues, saw sales rise 8.4% YoY on a like-for-like basis to JPY 61.7 billion. The performance was driven by the launch of innovative new products in the skincare and makeup categories, and was helped by a recovery in Japan’s beauty market partly driven by the lifting of mask regulations in March this year.

-

The China Business segment, Shiseido’s second-biggest by revenues, was down 2.9% YoY on a like-for-like basis to JPY 53.2 billion. The segment was negatively affected by a weak demand environment as a result of covid-lockdowns in China. Shiseido’s strategic shift from a promotion-driven high growth model to a value-driven sustainable growth model further limited sales performance in the country with eCommerce sales underperforming in Q1 2023 compared to the same quarter last year. On the positive side, offline sales turned positive after six quarters of negative results.

-

Shiseido’s Asia Pacific Business segment reported sales of JPY 15.3 billion, up 15.7% YoY on a like-for-like basis driven by strong growth in South Korea, Southeast Asia, and other regions offset by softness in Taiwan.

-

The Americas Business segment reported sales of JPY 25.9 billion, up 29.9% YoY making it the fastest-growing segment for the quarter. Growth was driven by the launch of innovative new products and marketing activities (Drunk Elephant for instance saw growth nearly doubled on the back of increased social media activities).

-

The EMEA Business segment reported sales of JPY 27.7 billion, up 22.1% YoY on a like-for-like basis.

-

The Travel Retail business saw sales drop 3.7% YoY on a like-for-like basis to JPY 38.6 billion. The segment was largely affected by retailer inventory adjustments, especially in South Korea.

Shiseido Q1 2023 quarterly report

Shiseido’s Q1 2023 operating profit and net profit increased significantly; operating profit was up 140.5% YoY to JPY 10.5 billion, and net profit jumped 97.3% YoY to JPY 8.7 billion helped by higher sales, and continued cost management.

Beneficiary of Asia’s post-pandemic reopening

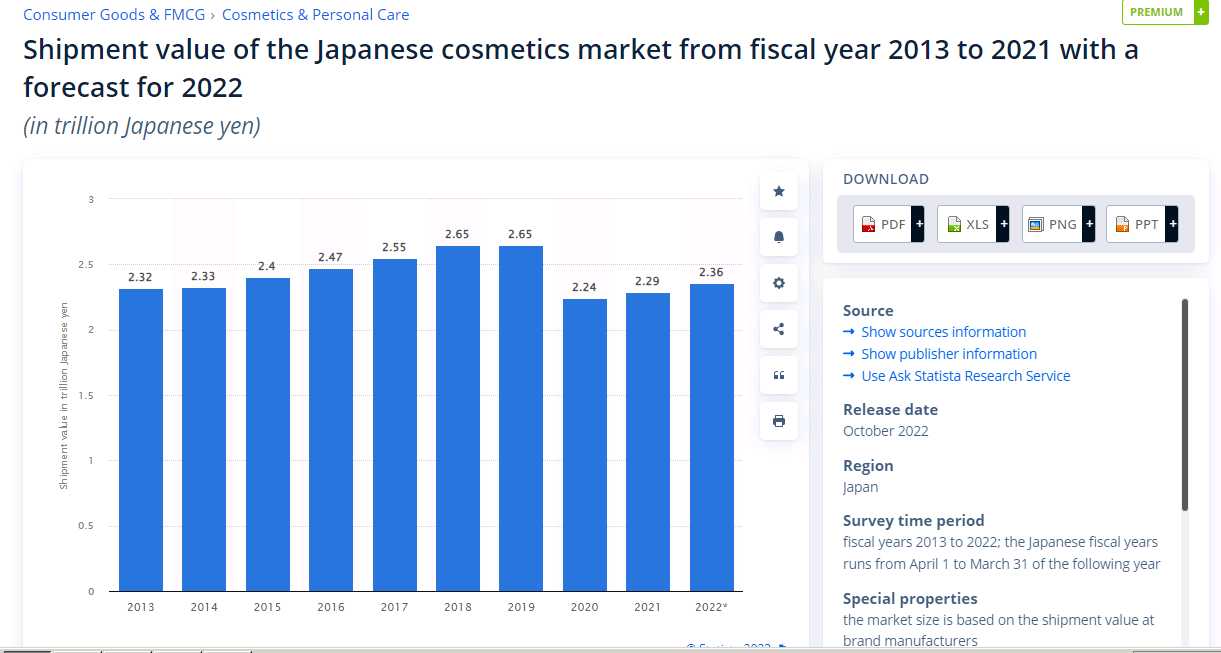

Near term, Shiseido’s outlook is positive; the company has an outsized exposure to Asian markets (accounting for more than 50% of revenues, compared to roughly around a third for L’Oreal and Estee Lauder), notably China and Japan, where covid policies including lockdowns, mask mandates, and travel restrictions crimped cosmetics sales. In Shiseido’s home market and its biggest market by revenues, Japan, cosmetics sales are still below pre-pandemic levels but the country has already seen a pickup in facial care products since mask mandates were relaxed in March, and the momentum could increase as mask-free mobility increases (a month after mask restrictions were lifted, the vast majority of Japanese were still wearing masks voluntarily according to a poll by a Japanese agency).

Statista

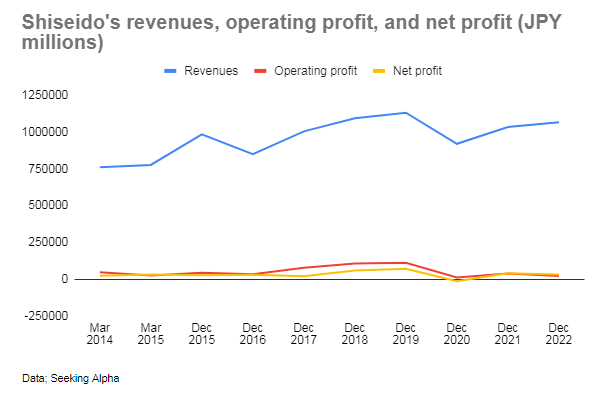

Shiseido’s revenues, profits and margins have yet to reach pre-pandemic levels (operating margins hovered in the high single digits and net profit margins were in the mid-single digits pre-pandemic, versus low single digits currently), but as consumer demand in Asian markets recover, Shiseido is likely to benefit.

Author

Stepping up investments in marketing, R&D, acquisitions with a focus on skincare

Medium term, the company’s outlook is stable. Under the company’s medium term strategy, management aims to step up investments in marketing, R&D, and acquisitions to boost financial performance. Management has made clear their plans to invest an additional JPY 100 billion over three years in marketing investment, while their R&D budget will be increased to 3% of sales, matching global cosmetics market leader L’Oreal.

Shiseido has undergone a noticeable portfolio transformation with the company focusing on their skincare brands while shedding other beauty categories such as makeup and personal care. Shiseido invested in microbiome skincare brand Gallinée in September 2022 and launched a slew of skincare brands such as BAUM, EFFECTIM, conscious beauty brand Ule, and wellness inner beauty brand INRYU (which helps improve skin health from within) to name a few. The strategy holds promise as Shiseido has a heavy presence in Asia, and Asians tend to focus on skin rather than makeup, i.e., work towards the best possible skin rather than settling for average skin and concealing any flaws with makeup.

Skincare market is a USD 120+ billion market globally, and growth is forecast to be in the mid-single digits over the coming years.

Shiseido’s biggest market, Japan, generates skincare sales of around USD 17.1 billion market according to GlobalData but the market is very mature and growth is projected at low single digits. China, a USD 16 billion dollar skincare market, offers more exciting prospects with growth projected in the mid-single digits.

Risks

Covid resurgence

A new, but mild covid wave was reported to be breaking out across Asia. If lockdowns and travel bans are reinstated, the region’s beauty market recovery could be negatively impacted.

Stiff competition in skincare

L’Oreal leads the global skincare market with a broad portfolio of skincare brands. L’Oreal also leads in China, a skincare market with better growth prospects with a 5.1% market share compared with 1.2% for Shiseido and 1.6%. For Shiseido’s China-focused skincare brand Aupres. The market is highly fragmented with competition is stiff not only from international giants like L’Oreal and Estee Lauder but also from local players; these ‘C-Beauty’ brands from established stalwarts like Pechoin to younger upstarts like Chando (both of whom command higher market shares than any of Shiseido’s competing brands in China; 4.1% market share for Pechoin, and 3.1% market share for CHANDO) are proving to be formidable competitors.

Conclusion

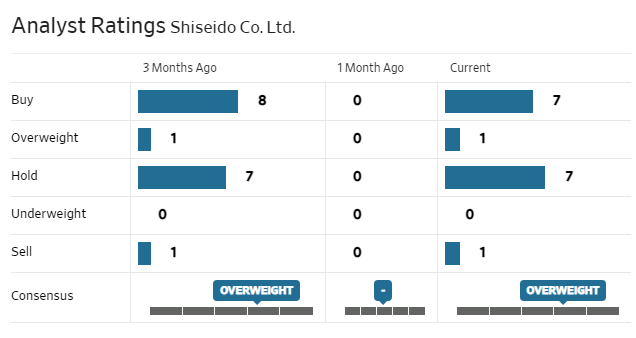

Analysts are split between buy and hold.

WSJ

With a forward P/E of 60, Shiseido’s valuation is higher than wide-moat market leaders in high-barriers to entry industries like surgical robot company Intuitive Surgical (forward P/E 57) (ISRG), and semiconductor lithography solutions provider ASML (forward P/E 35) (ASML). This appears to be a pricey valuation for a company with a relatively narrow competitive advantage in a fragmented, mature, low-barrier to entry industry. Shiseido’s prospects, while good, are likely baked into the stock which could be viewed as a hold.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.