Jeff J Mitchell

Since the last time I wrote about energy company Shell (NYSE:NYSE:SHEL) (OTCPK:RYDAF) in November last year, the stock’s performance has been underwhelming, with a 4.3% decline. Of course, it’s not a significant change and follows the softening in oil prices in during the final quarter of 2023 (Q4 2023).

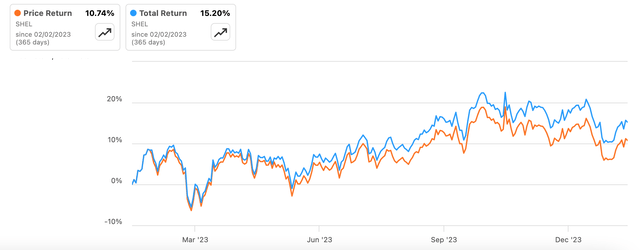

Over the past year, the stock has still risen and the total returns are even better (see chart below). But the latest decline does raise the question as to whether the softening will continue.

Price and total returns, 1y (Source: Seeking Alpha)

A look back

To take a quick look back, despite a year-on-year (YoY) decline in revenues and net income for the first nine months of the year (9m 2023), there were plenty of catalysts for a share price uptick. Improved oil prices resulted in sequential revenue and earnings growth. A bullish oil price outlook, continued share buybacks, a higher dividend yield compared to the energy sector median and competitive market multiples all went in its favour.

With the benefit of its full-year 2023 results released yesterday, here I figure out whether these stay or if there’s a reason to update the rating on Shell.

Impairments impact reported earnings, adjusted earnings strong

It was already obvious even a few months ago that the full-year numbers would be weaker than those in 2023 considering that oil prices were subdued during the year compared to 2022. However, there was still hope for sequential improvement as had been seen in Q3 2023.

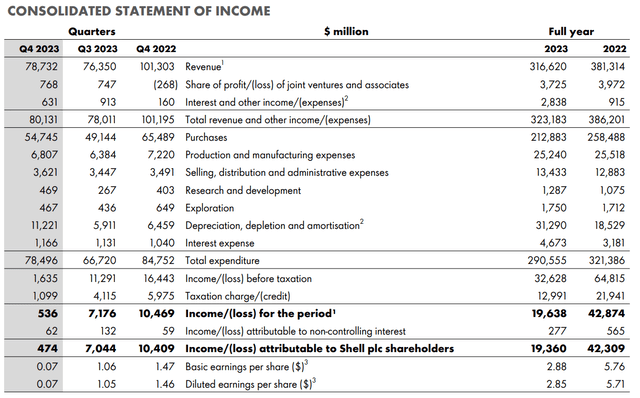

Sequential revenue improvement continues

The revenues have indeed improved by 3.1% quarter-on-quarter (QoQ) in Q4 2023, compared to the 2.6% QoQ increase in Q3 2023. This is encouraging considering the 17% decline in full-year 2023 revenues on higher production and despite crude oil prices softening over the quarter. Brent crude, for example, saw an 8.9% decline at the end of December 2023 compared to the end of October.

Source: Shell

Reported profit drops

The reported earnings, however, were a big disappointment. The net income attributable to shareholders dropped by 93.3% QoQ in Q4 2023, which is even bigger than the 54.2% YoY decline for the full year 2023.

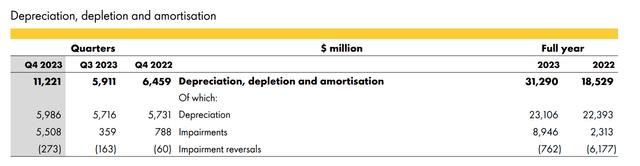

The key reason for this was a big increase of 89.8% in the depreciation, depletion and amortisation expense head. As a result, the share of the head in total expenditure has risen to ~11% for 2023 from ~6% in 2022. Drilling down further into the segment reveals that a massive increase in impairments (see table below) of 1,434% was the key reason (for more details on impairments, see the discussion on “Depreciation, depletion and amortisation” on Pg 23 of the earnings release, link above).

Source: Shell

Adjusted earnings improve

However, with the non-GAAP earnings adjusted for the impairments and other charges, the adjusted earnings for Q4 2023 have increased by 17.4% QoQ even as they have declined by 29% YoY for the full year 2023.

As a result, the company’s adjusted earnings per share [EPS] have risen by 19.35% QoQ as well. Share buybacks have also helped the EPS during this time, with a 1.65% QoQ decline in the weighted average number of shares.

Buybacks continue and dividends rise

The earnings report also reveals that the company’s share buyback programme continues, with USD 3.5 billion worth of shares expected to be repurchased in Q1 2024. The company has also increased its dividend payout, with a 4% QoQ increase in Q4 2023 to USD 0.344. With this latest increase, the full-year dividend per share has risen by 25% to a little over USD 1.29.

With the increase in dividends despite the softening in earnings, the same concern as I pointed out the last time, of the rising dividend payout ratio comes up again. And indeed there’s a significant increase here, with the ratio rising to ~31% compared to the 19.6% level in 2022. At the same time, on its own, the ratio looks sustainable.

The forward dividend yield has also risen from 4.05% the last I checked to 4.3% now, increasing the positive gap for Shell between it and the median for the energy sector to 0.63 percentage points [pp] from 0.43 pp at the time.

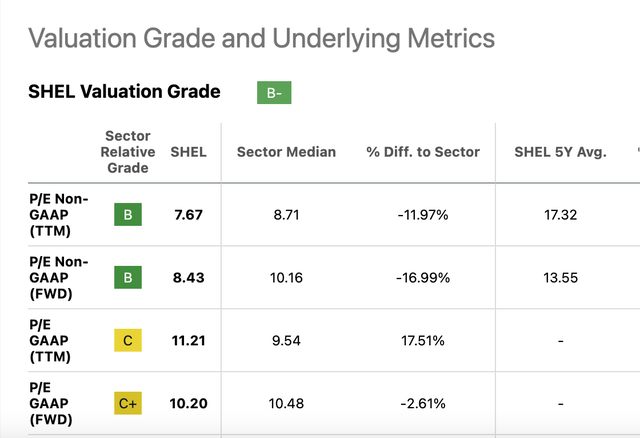

Market multiples are still attractive

Next, the stock’s market multiples also still look attractive, helped by the weak price movements in the past quarter. Going by the fact that the latest reported earnings figures have been skewed by impairments, the key figure to focus on is the non-GAAP P/E. Both the TTM and the forward figures are well-placed compared to the median ratios for the energy sector (see table below). They are even better placed compared to Shell’s own five-year average ratios. In other words, there’s still an upside to the stock.

Source: Seeking Alpha

The risks

It’s not as if risks don’t exist for the Shell stock. Oil prices are the key one. Citi, for example, expects Brent prices to correct a bit in 2024 from last year’s levels. The risk is real considering that the US economy is expected to see a downturn this year. This in turn is likely to impact earnings. In fact, the average of analysts’ estimates on Seeking Alpha reflects a 9.4% expected decline in EPS in 2024. However, even considering an EPS fall, its forward P/E still looks competitive at 8.4x.

What next?

The key takeaway here is that no matter how the Shell stock is looked at, its prospects still look positive. While its revenues and earnings have dropped in 2023 there are risks ahead for the macroeconomy and from there, oil prices, in 2024, the potential gains from an investment in the stock outweigh the downside.

Sequentially, its adjusted earnings have seen a healthy increase and the dividends have risen as well in the latest quarter. Continued share buybacks will add to returns to investors. At the same time, its market multiples look good right now and continue to be attractive even for this year even as the EPS can decline further. I’m retaining a Buy rating on Shell.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.