Baupost Group’s Portfolio & 10 Largest Public Fairness Investments

Baupost’s public-equity portfolio will not be closely diversified. As an alternative, its holdings are concentrated, that includes high-conviction concepts. The portfolio numbers solely 31 equities, the ten most vital of which account for 74.9% of its complete composition. The fund’s largest holding is Intel Corp. (INTC), occupying round 12.4% of the overall portfolio.

Supply: 13F submitting, Writer

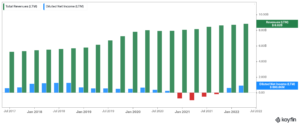

Intel Corp. (INTC)

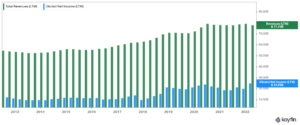

Intel is Baupost’s largest holding, accounting for 12.4% of its complete holdings. The semiconductor large’s efficiency remained strong over the previous 12 months. For the 12 months, adjusted income improved 2% to $74.7 billion whereas adjusted earnings-per-share of $5.47 in comparison with $5.10 in 2020. The corporate enjoys huge margins, with $19.8 billion making it to the underside line in FY2021.

Coming into 2022, Intel’s efficiency got here in comparatively sturdy, regardless of the continuing macroeconomic headwinds pressuring its high line and margins.

Income for the PC-Centric enterprise decreased 13% to $9.3 billion for the quarter, primarily because of part shortages in addition to the modem ramp down. PC quantity fell 18%. Datacenter and AI Group continues to behave properly, with income rising 22% to $6.0 billion. Enterprise and authorities income was greater by 53% and unit volumes grew by 17%.

Community and Edge Group grew 23% to $2.2 billion as a result of ongoing restoration from COVID-19 and powerful networking demand. Intel noticed sturdy progress charges in its rising segments. Intel Foundry Providers, Accelerated Computing Methods and Graphics Group, and Mobileye grew 175%, 21%, and 5%, respectively. The gross margin declined 480 foundation factors to 50.4%, nonetheless.

Regardless of its resilient efficiency, traders have been currently worrying about competitors catching up, particularly from Superior Micro Gadgets (AMD). The corporate expects adjusted earnings-per-share of $4.16 for 2022. This suggests a P/E of simply 8.9. Contemplating the corporate’s blue-chip standing and powerful buybacks, we will see the inventory’s valuation increasing if AMD doesn’t find yourself taking as a lot market share as anticipated.

Intel counts 8 years of consecutive annual dividend will increase, with its most up-to-date one being a 5.0% elevate. The inventory presently yields round 3.95% whereas the dividend itself is well-covered, as Intel is presently that includes a payout ratio of round 35%.

Baupost trimmed its place in Intel by 8% through the earlier quarter.

Qorvo, Inc. (QRVO)

Qorvo develops and markets applied sciences and merchandise for wi-fi and wired connectivity worldwide. It’s the fund’s third-largest holding. If the forecasts relating to 5G are realized, the semiconductor business (together with Qorvo) is more likely to get pleasure from huge progress over the subsequent few years.

On the identical time, the corporate’s revenues are increasing, and Qorvo has began delivering sturdy income as properly. Shares are presently buying and selling at round 8.9 occasions the corporate’s ahead internet earnings, which could possibly be underappreciating Qorvo given its progress catalysts.

Baupost boosted its place by round 11% through the newest quarter.

Baupost boosted its place by round 11% through the newest quarter.

Viasat, Inc. (VSAT)

Media conglomerate Viasat is Baupost’s third-largest holding, accounting for roughly 10.5% of its portfolio. Within the present panorama, the legacy media conglomerates have been in bother, as content material creation is changing into more and more decentralized.

Corporations comparable to Netflix (NFLX), Amazon (AMZN), and even Apple (AAPL) have began producing their very own content material, whereas the information retailers have moved principally on-line, producing gross sales by way of adverts or a subscription payment.

In our view, Baupost holds a stake in Viasat as an activist investor, as a result of fund holding 22.8% of its complete shares excellent. This means the likelihood that Baupost needs to have an energetic affect on how the corporate is run, with a possible intention in direction of modernizing.

For retail traders, the place could possibly be a dangerous long-term wager, although an admittedly attractively priced one.

Alphabet (GOOGL)(GOOG)

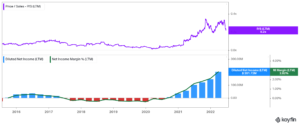

Alphabet gives a number of well-known merchandise, comparable to Google, Android, Chrome, Google Cloud, Google Maps, Google Play, YouTube, in addition to technical infrastructure. Whereas the corporate’s enlargement has lasted for greater than a decade and a half, it’s nonetheless a high-growth inventory.

Income progress has re-accelerated, with the corporate posting progress of over 41% final 12 months, regardless of the deceleration prompted through the first couple of quarters through the preliminary pandemic outbreak. The corporate is likely one of the most attractively priced shares within the sector as properly, buying and selling at round 19.1 occasions its ahead earnings, regardless of its constant progress, huge moat, and powerful stability sheet.

With its strong profitability, Alphabet has collected a money and equivalents place of $133.9 billion. Because of this, the corporate can comfortably afford to put money into its long-term bets comparable to Waymo, and within the meantime return money to its shareholders by way of buybacks. Alphabet has repurchased $52.18 billion value of inventory over the previous 4 quarters, retiring shares at an all-time excessive price.

Baupost hiked its place by 6% through the quarter. The inventory accounts for round 9.7% of its portfolio.

Veritiv Company (VRTV)

Veritiv Company features as a B2B supplier of value-added packaging services, in addition to facility options, print, and publishing services internationally.

Be aware that whereas Veritiv’s shares have carried out properly over the previous three years, the corporate’s enterprise mannequin suffers from extraordinarily low margins.Internet earnings margins over the previous 4 quarters quantity to only 2.82%. Therefore the corporate’s ultra-low valuation a number of from a value/gross sales perspective.

The corporate is Baupost’s fifth-largest holding, and it was held regular through the quarter. Baupost holds round 23.7% of the corporate’s complete shares, that means it has an energetic affect on the corporate. The fund has been accumulating shares since Q3-2014.

Fiserv, Inc. (FISV)

Fiserv is a comparatively new holding for Baupost. It was initiated in This fall 2021. Fiserv supplies fee and monetary companies know-how everywhere in the globe, working by way of its Acceptance, Fintech, and Funds segments. These embrace point-of-sale service provider buying and digital commerce options, safety and fraud options amongst different companies.

The corporate’s margin-rich enterprise mannequin is kind of strong, leading to constant income and earnings progress. Shares are presently buying and selling at an inexpensive ahead P/E of 13.4, whereas administration has traditionally rewarded shareholders by way of inventory repurchases.

Baupost boosted its stake within the firm by 30% through the newest quarter.

SS&C Applied sciences Holdings, Inc. (SSNC)

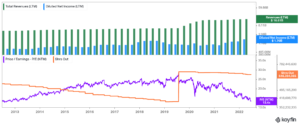

SS&C Applied sciences Holdings gives software program merchandise and software-powered companies to the monetary companies and healthcare industries. The corporate owns and runs a know-how stack throughout securities accounting, efficiency and danger analytics, regulatory reporting, and healthcare data operations. The corporate’s services allow professionals in these industries to automate sophisticated enterprise processes and are essential in serving to its shoppers to handle data processing necessities.

Regardless of the challenges that arose through the pandemic, the corporate managed to develop its revenues, whereas its internet earnings margins have now been restored to their pre-pandemic ranges.

SS&C Applied sciences is Baupost’s seventh-largest holding, accounting for 3.8% of its complete holdings. The fund trimmed its place within the firm by 1% over the last quarter. It now holds round 1.47% of the corporate’s complete shares.

Micron Know-how, Inc. (MU)

Baupost’s eighth-largest holding is Micron, which accounts for round 3.8% of its holdings. Whereas the inventory has corrected currently, it’s nonetheless presently buying and selling greater than 5 occasions greater than its 2016 ranges.

The fund is a bit late to the occasion, initiating the place in Q3-2020. At a ahead P/E of round 5X and rising ahead EPS expectations, the inventory may fairly rally greater.

Regardless of that, Baupost slashed its place by 4% in the latest quarter after its earlier 54% slash in This fall-2021, probably dropping some confidence within the inventory.

The Liberty SiriusXM Group (LSXMA)

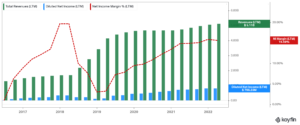

Baupost initiated a place in The Liberty SiriusXM Group in Q1-2020 and has since grown its fairness stake steadily. The corporate specializes within the leisure enterprise within the U.S. and Canada. It gives music, comedy, discuss, information, climate channels, podcast, and infotainment companies through its proprietary satellite tv for pc radio programs, streamed functions for cellular gadgets, and different client digital merchandise.

Whereas the corporate has managed to step by step develop its revenues, internet earnings margins have struggled to broaden, resulting in considerably weak profitability.

Baupost boosted its place within the Liberty SiriusXM Group by 12% through the earlier quarter.

Dropbox, Inc. (DBX):

With 700 million registered customers, Dropbox is the corporate behind probably the most well-known content material collaboration platforms internationally. The corporate’s platform permits people,groups, and enterpiese to collaborate and retailer information as easily as potential.

Dropbox’s revenues have been step by step increasing. Because of this, Dropbox has been having fun with scaling economies, which has allowed the corporate to file income currently. That stated, there are a number of dangers connected to Dropbox’s funding case, with essentially the most vital being brutal competitors. Greater gamers within the area comparable to Microsoft and Alphabet provide related merchandise which they will bundle with the remainder of their options for a lower cost. Dropbox options strong buyer retention, nonetheless.

Dropbox is Baupost’s tenth-largest holding, accounting for 3.7% of its complete publicly-trading belongings. The place was boosted by 30% through the newest quarter.