Sundry Photography

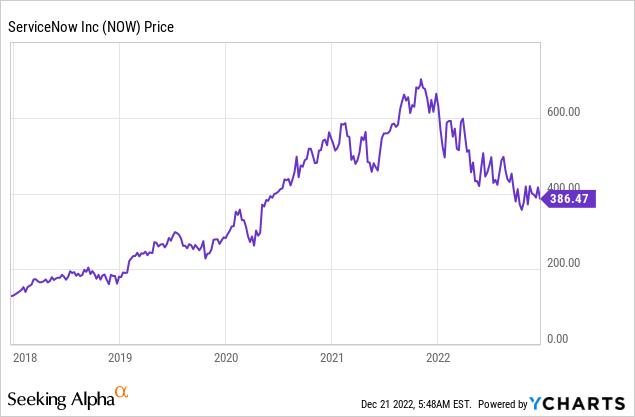

ServiceNow (NYSE:NOW) is a global software company that offers a diverse platform with multiple applications from IT to HR. The company currently serves 80% of the Fortune 500 and has produced solid financial results despite economic challenges. In this post, I’m going to break down the company’s business model, financials and valuation.

SaaS Business Model

ServiceNow is a Software as a Service (SaaS) company that originally provided a platform for IT service management. This basically involves a “help desk” functionality in which an employee would report incidents and then changes would be executed by the IT team.

The company charged its customers ~$100 per employee [seat], per month. This may seem cheap but as large companies tend to have thousands of employees, this can quickly add up. For example, Copenhagen Airport, a ServiceNow customer has 20,000 employees using the platform. Therefore, we could estimate revenue of 20,000 x $100 = $2 million per month from that single customer alone.

ServiceNow has been a Gartner leader in IT help desk solutions for many years and still dominates this category. However, many years back the company realized that its customers were using the platforms for other applications such as HR, and employee onboarding, etc. Therefore, despite skepticism from the former CEO Frank Slootman, (now CEO of Snowflake) the company decided to branch into other applications.

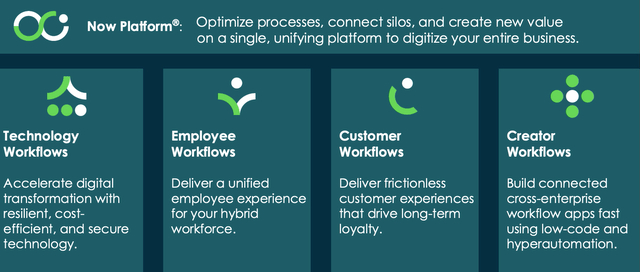

The ServiceNow platform now includes applications for Customer Service, Financial Services, Automation, and much more. These various “Workflows” are all built on top of the “Now Platform.” This platform aims to break down business silos, and enable a unified platform for operations.

ServiceNow product (Q3,22 report)

Strong Third Quarter Financials

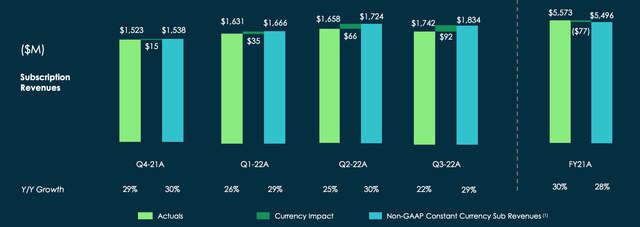

ServiceNow reported strong financial results for the third quarter of 2022. Subscription revenue was $1.742 billion, which increased by a rapid 28.5% year over year, which surpassed management’s guidance by 100 basis points.

Subscription revenue (Q3,22 report)

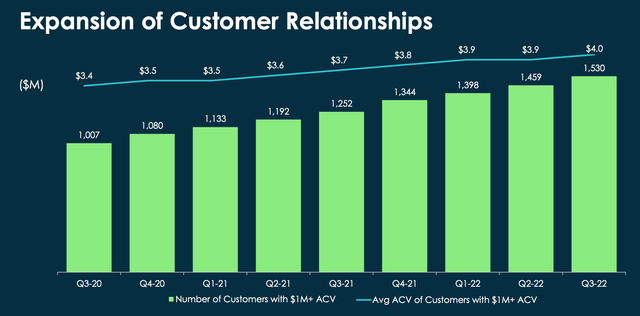

The top line was driven by strong customer growth and increased Average Contract Value [ACV]. ServiceNow has been “growing upmarket” and increased its number of customers paying over $1 million to 1,530 in Q3,22, up 22% year over year. The company also increased its number of customers paying over $10 million in ACV by 60% year over year.

Net new ACV growth was driven by strong adoption in the retail and hospitality sector, which increased by 50% year over year. U.S federal business also had a record quarter with over $20 million in net new ACV wins. This was followed by the education and manufacturing sectors. The media and technology segments also showed stability.

Expansion of customer relationships (ServiceNow)

An interesting point I discovered is of the top five new customer deals, each win was led by a different SaaS product. This is positive news from a diversification standpoint and offers immense cross-selling potential between platforms. The business reported that 18 of its top 20 deals purchased five or more products, so it’s clear the “land and expand” methodology works. While it also was positive to see its existing customers are sticking around, with a 98% renewal rate. Globally the business reported consistent growth, with surprising strength in Europe, given the geopolitical environment.

ServiceNow customer verticals (ServiceNow)

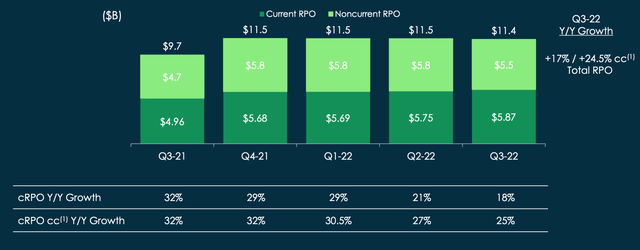

ServiceNow reported Remaining Performance Obligations [RPO] of $11.4 billion, which increased by 24.5% year over year, on a constant currency basis. Its Current RPO was ~$5.87 billion which increased by a solid 25% year over year, which was partially driven by early renewals.

ServiceNow RPO (Q3,22 report)

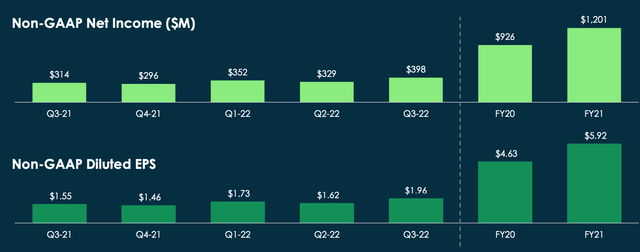

ServiceNow reported EPS of $0.39, which beat analyst expectations by $0.13. Its operating margin expanded by to 26%, which was 1 point above management’s guidance. On a Non-GAAP basis Net income increased by 26.75% to $398 million, while its Non-GAAP EPS increased by 26.45%. These were extremely positive results given the high inflation and tepid macroeconomic environment.

ServiceNow Earnings (Q3,22 report)

ServiceNow has a strong balance sheet with $5.5 billion in cash and investments. The company does have a fairly high total debt of $2.125 billion, but the majority of this is long-term debt equating to $1.485 billion.

Management has forecasted between $6.865 billion and $6.870 billion in subscription revenue, which equates to growth of 28.5% for the full year of 2022. However, this excludes a $290 million foreign exchange headwind against revenue which is expected due to the strong dollar.

Advanced Valuation

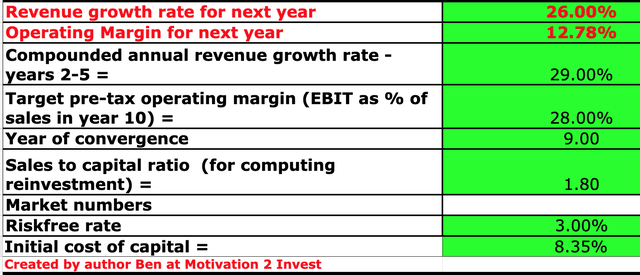

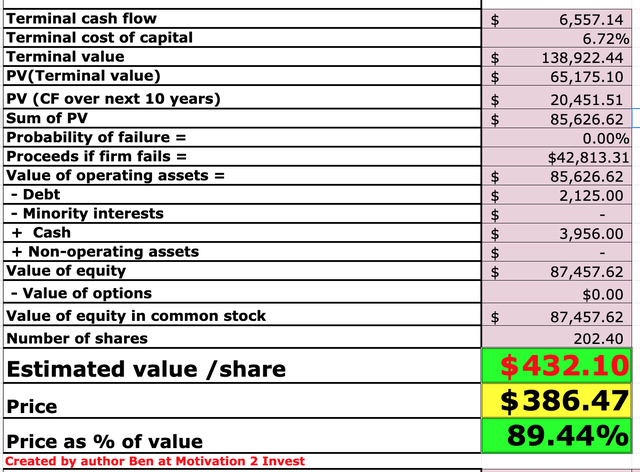

In order to value ServiceNow, I have plugged the latest financials into my advanced valuation model, which uses the discounted cash flow method of valuation. I have forecasted 26% revenue growth for next year, which is based upon an extrapolation of management guidance. In years 2 to 5, I have forecasted its operating margin to increase at a faster 29% per year rate, given my forecasted improvement in economic conditions.

ServiceNow stock valuation (created by author Ben at Motivation 2 Invest)

To increase the accuracy of the valuation, I have capitalized R&D expenses which has lifted net income. In addition, I have forecasted a pre-tax operating margin of 28% over the next nine years. This is fairly optimistic given the average operating margin for a software company is ~23%. However, I believe this is achievable given the diverse multi-product offering, sticky enterprise customer, and number of cross-selling opportunities.

ServiceNow stock valuation 1 (created by author Ben at Motivation 2 Invest)

Given this data I get a fair value of $432 per share, the stock is trading at $386 per share and thus is 10.6% undervalued.

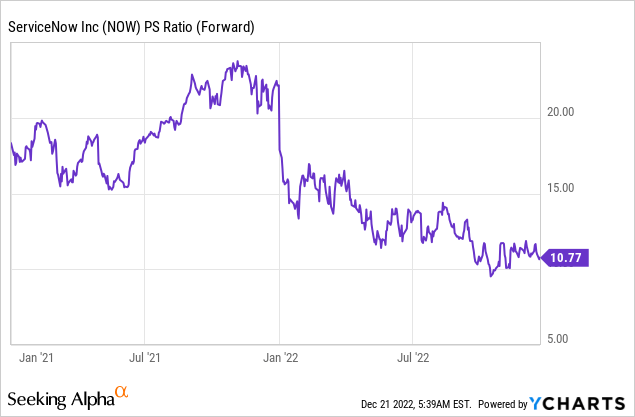

As an extra data point, ServiceNow trades at a price-to-sales ratio = 10.75, which is 29.51% cheaper than its five-year average.

Risks

Recession/Longer Sales cycles

Given many analysts are forecasting a recession, I would expect longer sales cycles moving forward, as decision-makers aim to delay spending. I believe this environment won’t cause ServiceNow to lose customers but may defer revenue to a later period.

Final Thoughts

ServiceNow is a diverse software company that has continued to generate strong financial results despite economic uncertainty. The company has an immense number of cross-selling opportunities and is well-diversified internationally. Its stock is undervalued intrinsically and relative to historic multiples and thus it could be a great long-term investment.