solarseven

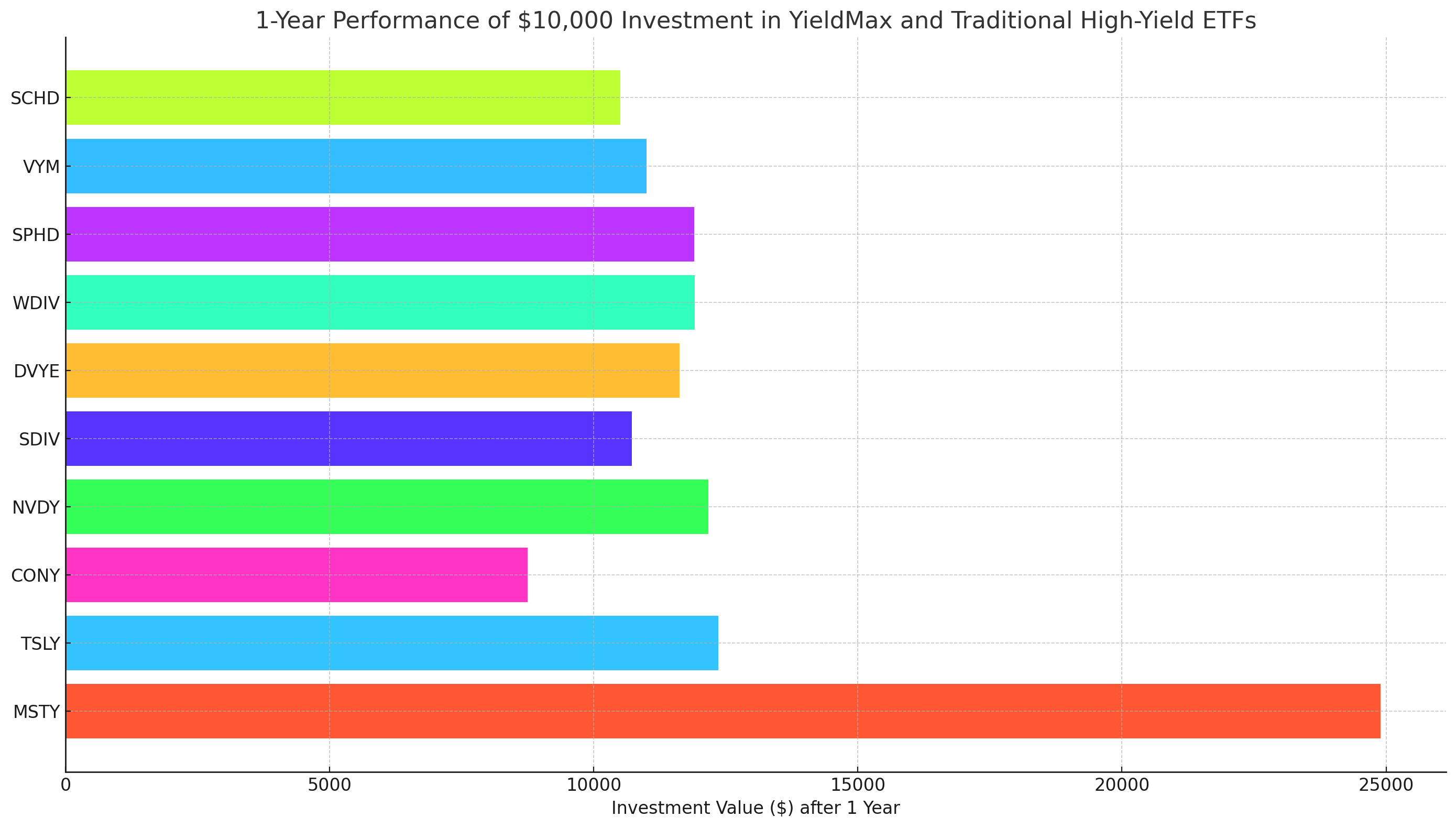

The UK economy enjoyed another month of strong growth in May, with the expansion continuing to be driven by surging post-pandemic demand in the service sector, notably from consumers and for financial services, with hospitality activities buoyed further by the Coronation. The surveys are consistent with GDP rising 0.4% in the second quarter after a 0.1% rise in the first quarter.

However, this growth spurt is driving renewed inflationary pressures, as service providers struggle to meet demand and hence not only offer higher wages to attract staff but also find themselves able to charge more for their services.

It’s a different story in manufacturing, where spending is being diverted away from goods to services, and many companies are also winding down their inventories, exacerbating the downturn in demand and driving both output and prices lower.

The UK is therefore seeing a tale of two economies, with the divergence between manufacturing and services posing difficulties for policymakers. However, it’s the far larger service sector that will typically dictate policy, meaning these survey results are nothing but hawkish in suggesting the Bank of England has more work to do to quash stubbornly high inflationary pressures in the services economy.

Economy on course for strong second quarter growth

UK business activity grew for a fourth successive month in May, according to the flash PMI survey data compiled by S&P Global and sponsored by CIPS. The survey’s headline output gauge, the composite PMI, fell from 54.9 in April to 53.9 in May (consensus 53.5), but – by remaining well above the 50.0 no change level, indicated the second-strongest expansion recorded for 13 months.

The latest readings are consistent with GDP rising at a quarterly rate of 0.4% in the second quarter, representing a marked improvement on the 0.1% expansion seen in the opening quarter of the year and the UK’s first meaningful quarter of growth since the opening months of 2022.

Upturn fueled by the service sector

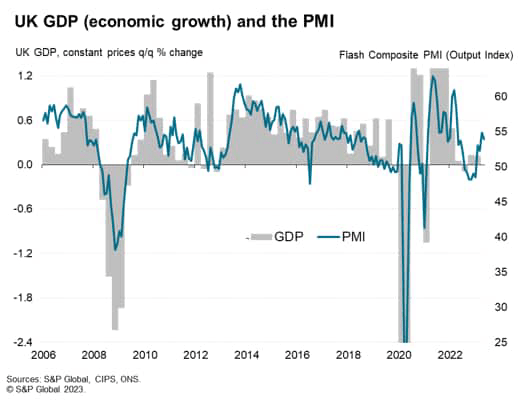

However, for three months now the upturn has been driven entirely by the service sector, where output rose for a fourth straight month in May and at a rate just slightly below April’s one-year high. Manufacturing output, on the other hand, contracted for the tenth time in the past 11 months, the rate of decline accelerating to the fastest since January.

The sector divergence was even wider for order books. Whereas inflows of new work into the service sector grew strongly, showing only a slight cooling from April’s 13-month peak, new order inflows into the goods-producing sector fell at an increased and sharp rate. A similar demand divergence was seen for exports, with rising foreign demand for services contrasting with a marked loss of goods exports.

Within the service sector, especially strong demand continued to be reported for financial services and IT, with additional resurgent demand still evident for consumer-facing services, albeit with some signs of this recent growth spurt losing some momentum.

Demand for business services meanwhile largely stalled, representing the worst performance so far this year, albeit with the Coronation and additional public holiday diminishing activity levels during the month.

There was also some evidence of the Coronation having impacted manufacturing output in May, though the sector also continued to suffer from destocking, with input buying and inventories down sharply again during the month.

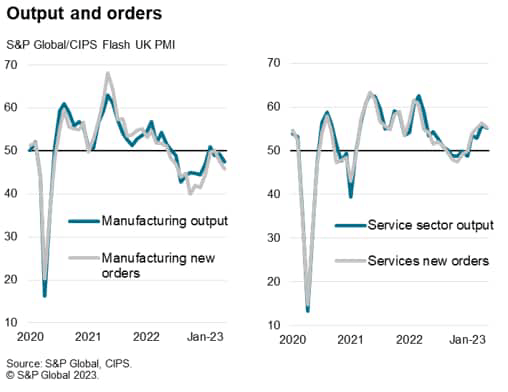

Jobs growth moderates

Although employment continued to grow, the rate of job creation cooled and remained far lower than that seen a year ago. Jobs were cut in manufacturing for an eighth successive month, driven by a steepening depletion of backlogs of work. This fall in backlogs points to surplus capacity in the goods-producing sector.

Employment continued to rise in the service sector, though even here a near stagnation in levels of backlogs of work hints at reduced hiring growth in the coming months.

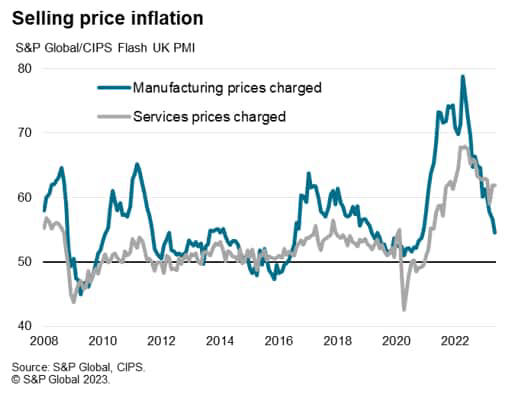

Inflation trend slows for goods but remains elevated for services

A stark sector divergence also played out in terms of inflationary pressures. Falling energy prices, lower demand and plentiful supply (suppliers’ delivery times improved for a fourth month running and factories reported the largest build-up of unsold stock for four years) meant factory gate selling prices rose at the slowest rate for two and a half years, the rate of increase continuing to slump compared to the all-time high seen around this time last year.

Average prices charged for services meanwhile continued to rise sharply. Although the rate of inflation has eased compared to last year’s peak, it remains far higher than anything seen in the 25-year survey history prior to the pandemic, with the rate of increase ticking higher for a second successive month in May. Higher service sector prices reflected both rising costs – especially for labour – as well as increased pricing power amid the recent surge in demand.

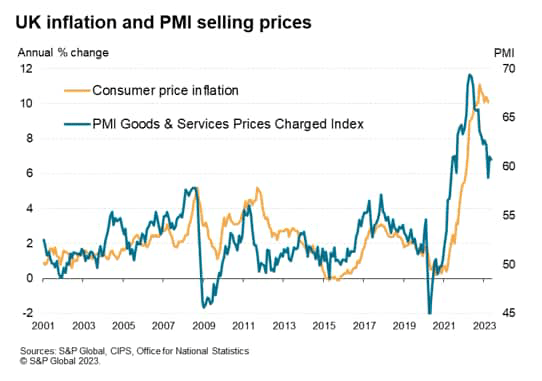

Although the survey’s selling price gauge is consistent with consumer price inflation (CPI) moderating from the current 10.1% rate in the coming months, the survey data continue to point to inflation in the region of 6% and therefore well above the Bank of England’s 2% target in the near-term.

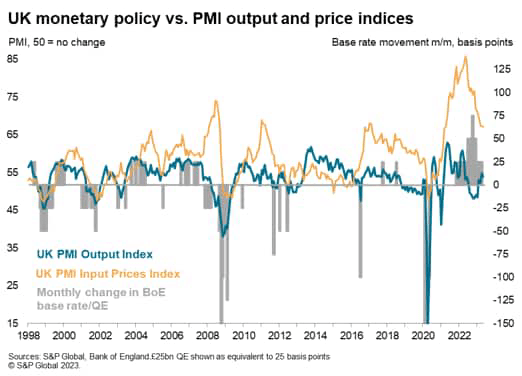

More rate hikes

With the May flash PMI survey continuing to signal robust growth – albeit heavily skewed towards services – and stubbornly elevated price pressures, especially in services and linked in many cases to rising wage growth – it’s difficult to see many arguments at face value for not tightening monetary policy further to help bring inflation down from its current double-digit rate. However, with the Bank of England’s main policy rate now sitting at 4.5%, its highest for 15 years, there is likely to be some lagged impact from the recent further financial tightening of policy still to appear. Thus, while the data look hawkish for now, we remain concerned about growth in the second half of the year.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.