IGphotography

Seritage Quarterly Update:

Seritage Growth Properties (NYSE:SRG) filed its 10-K on April 1 after a short delay. There were no major surprises in the filing. Importantly, the company had no additional impairments of real estate assets and added about $32 million in gains on sale of real estate. These two data points are important to validate the value of the portfolio.

The only real negative I saw was a continued loss from equity in unconsolidated affiliates, basically JV’s the company is trying to exit. Backing that out, the company had positive NOI, although there was an operating cash burn that management can only do so much to minimize.

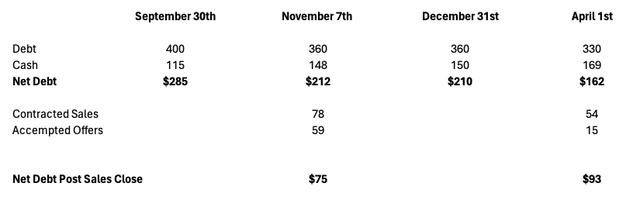

The company gave a nice overview of the remaining portfolio and sales process. The contracts/accepted offers from November are playing out slowly, and it seems some sales have broken or been reduced. However, as demonstrated by the table below that highlights the changes from the end of Q3, the timing of the Q3 report versus the end of Q4 and the time of the Q4 report, the delays and changes of value are de minimus in the grand scheme of things.

Seritage Debt Profile (Author’s Calculations Based on Company Filings)

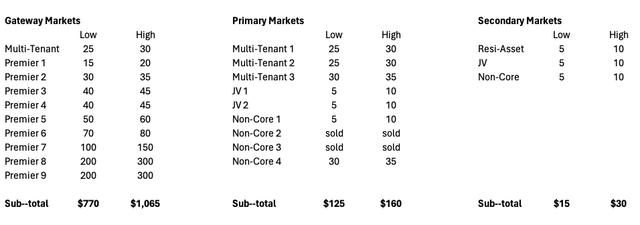

More important, in my mind, the company has not changed its expected value ranges for the remaining properties. I refer everyone to my last article on the company to see how the below numbers have changed (or not for that matter) from last quarter’s estimates.

Seritage Asset Values by Property and Market (Author’s Calculations Based on Company Filings)

Valuation:

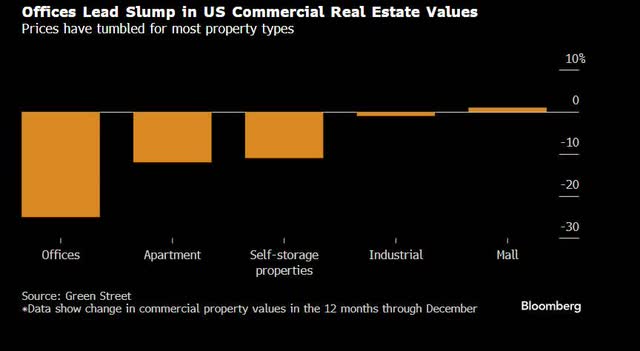

While interest rates, high debt levels, tight lending environment, and overall jitters about future use are hobbling the backdrop for real estate transactions stinks right now, my views of the embedded value here remains unchanged. Real estate is a local business that is further broken down by asset type. While many have considered the mall a dying asset class, malls were the only real estate type to gain in value last year, even beating out industrial/warehouse.

2023 Performance of US Real Estate Sectors (Bloomberg)

Moreover, as evidenced by Blackstone buying AIR Communities yesterday, good assets in good markets will find buyers.

I continue to believe that selling the primary and secondary market assets will pay down most of the net debt. Proceeds from the sales of the Gateway Markets will create equity value. I continue to believe this stock is worth a range of about $14 to $20/share, without even considering any value of any tax assets.

Quality of Management:

I continue to think management, particularly CEO Andrea Olshan, is doing a great job here. Andrea is running a tight ship and getting fair values for the properties under her care. I would love to see her in a position to redevelop the assets like Dallas and San Diego, which would require creativity, financial acumen, organization, and just plain knowing the shopping center industry. Andrea has all of the above in spades. I think she’s a uniquely qualified and talented executive who could create a lot of value with these assets under the right structure.

Risk:

The risks here continue to be general real estate market values and Andrea sticking around. Tight lending and viscous markets will delay asset sales and perhaps ultimately hurt values.

Andrea shows no signs of walking away here. I have complete faith in her integrity as a person and an executive. However, no executive is chained to any company. If another fantastic opportunity came along that rewarded her better for her time and talents (which are considerable), I wouldn’t blame her for taking it.

Conclusion:

This stock has reacted well since my last SRG article on the bad real estate transaction environment. It looks like the company is being slightly affected by the transaction slowdown, but nothing horrific in the scheme of assets worth close to $1 billion. I think Seritage Growth Properties has limited downside and good upside. It’s just a matter of time and yield.