da-kuk

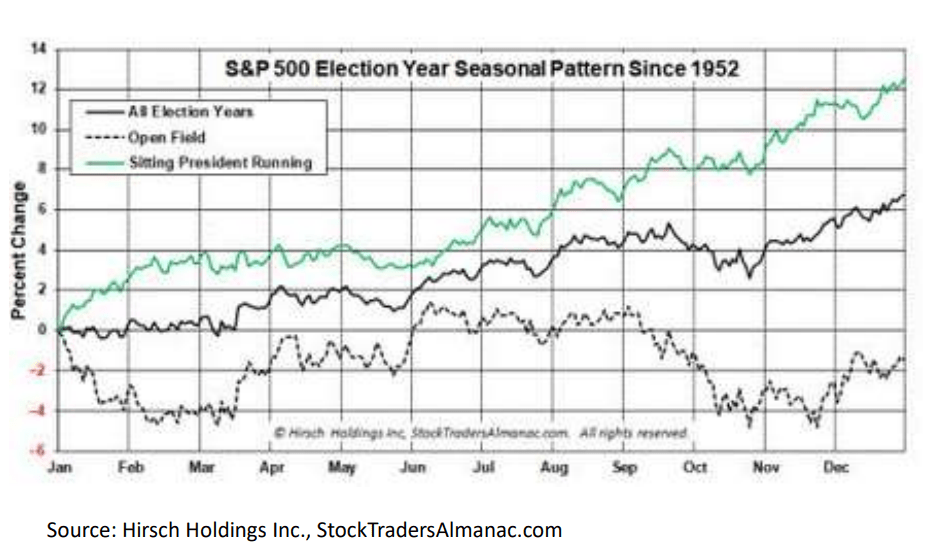

The S&P 500 (SP500) tends to get a brief prime early in September throughout presidential election years after which decline when there may be an “open discipline” inside candidates.

Based on the Inventory Dealer Almanac, shares are inclined to prime out “at the least quickly” round September throughout presidential election years, Saut Technique analyst Andrew Adams stated in a Charts of the Week word.

Traditionally, the decline begins in late September on common throughout all election years, however it might begin in early September when there may be an open discipline — neither of the candidates are sitting presidents.

“In each instances, shares tended to rally into the tip of the 12 months after shaking off the pre-election weak point,” stated Adams.

He additionally emphasised that buyers needs to be “on alert” for the upcoming Federal Reserve assembly to show right into a “promote the information” occasion.

He stated that traditionally, the inventory market has tended to unload into the election day, beginning someday round August or September.

“Ought to that tendency play out once more, it might synch up effectively with a ‘shock’ down transfer someday after the Fed cuts,” he stated.