Liudmila Chernetska

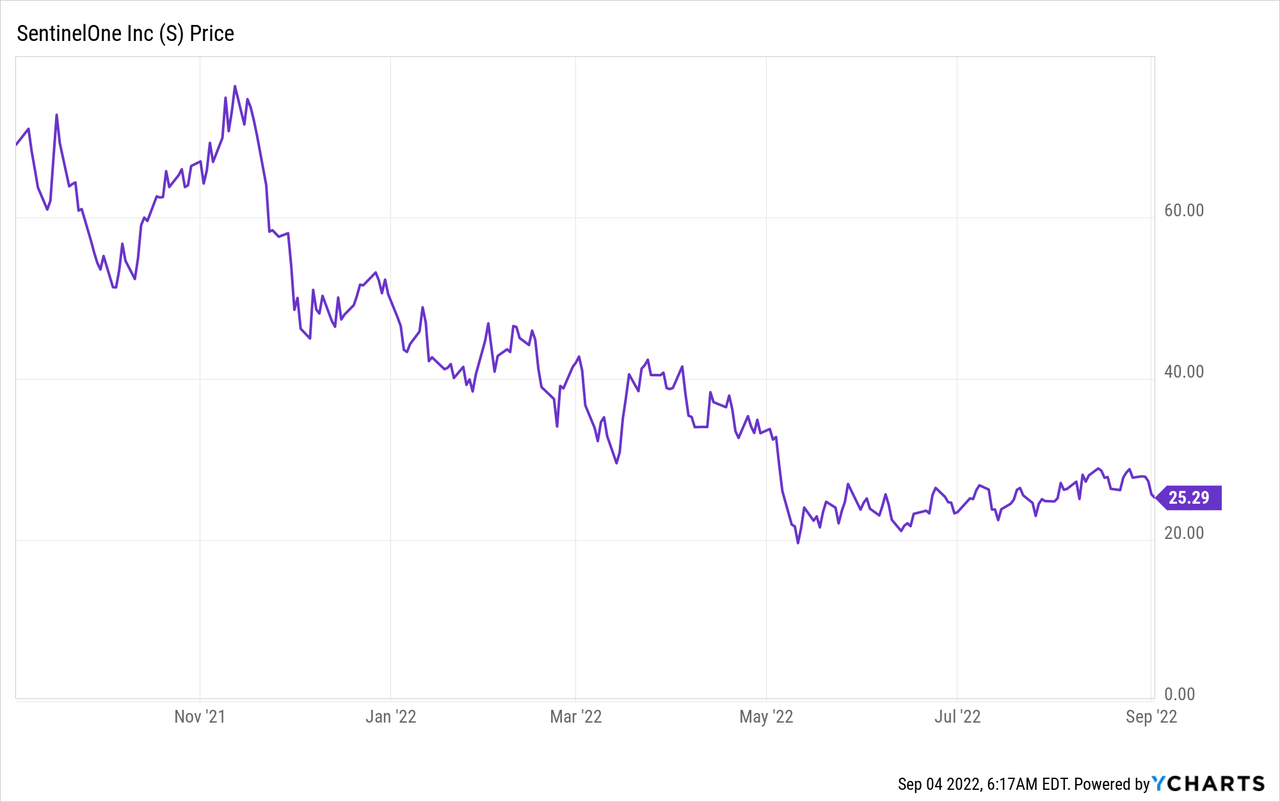

SentinelOne (NYSE:S) is a leading cybersecurity company that serves one-third of the Fortune 10 and hundreds of Fortune 2000 companies. The company delivered “hyper-growth” and “outperformance” during the second quarter, beating revenue and earnings estimates. Despite this, the stock is still down by over 66% from all-time highs and is undervalued relative to historical multiples. In this post I’m going to break down the company’s business model, financials and valuation, let’s dive in.

Secure Business Model

SentinelOne is a leader in endpoint security. For those that are unfamiliar, “endpoints” refer to the “end” user devices which we use to connect to a network, this could a desktop, laptop, cell phone, tablet etc.

As these devices are at the “end” of the network and often used remotely, they are increasingly vulnerable to cyberattacks. The rise of hybrid work and Internet of Things [IoT] devices also heightens the need for solid endpoint security. Therefore, it’s no surprise that the endpoint security industry is forecasted to grow at a steady 8.3% CAGR from $13.99 billion in 2021 to $24.58 billion by 2028.

According to Gartner, SentinelOne is a “Leader” in this market. Tech review website Peerspot also ranks SentinelOne as a “Leader” with the number three spot for endpoint protection platforms. Its software comes in just behind the number one leader CrowdStrike (CRWD) and Microsoft Defender for Endpoint.

Gartner Endpoint Security (Magic Quadrant)

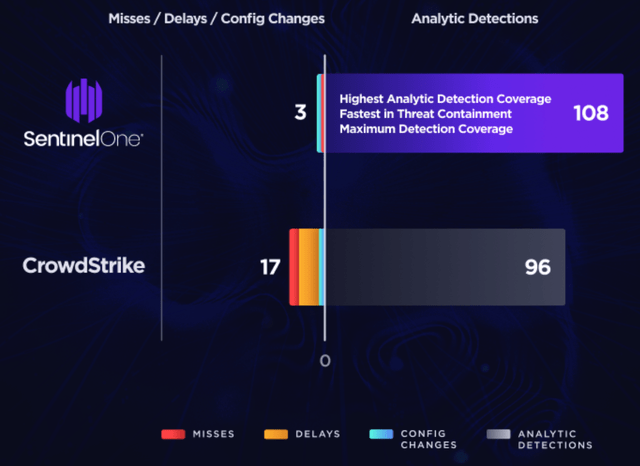

Despite CrowdStrike being ranked higher, SentinelOne has issued a helpful comparison between the two platforms. This comparison cites a 3rd party performance test called the MITRE Engenuity ATT&CK Evaluation. SentinelOne provides 100% protection and 99% real-time visibility during the attack. Whereas competitor CrowdStrike detected only 94 out of 109 detections with 11 being delayed. Now, although this test should be taken with a “pinch of salt” as cited by a competitor, it does use a third party and is a strong selling point for customers. Today’s business-to-business buyers love to self-educate, and one of the burning questions they are likely to want the answer to is how does the platform compare to competitors.

SentinelOne Vs CrowdStrike (SentinelOne MITRE Test)

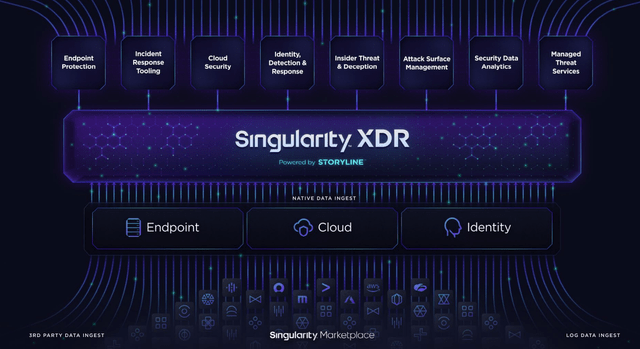

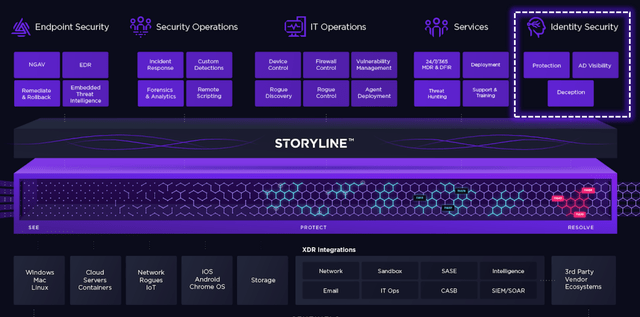

The SentinelOne Platform is called the “Singularity XDR” which stands for Extended Detection and Response. The platform gives the IT security team a “single pane of glass” to see, protect and resolve cybersecurity threats.

It does this by using behavioral-based Artificial Intelligence [AI] to monitor, track, and put into context all the event data. The company turns “data into stories” and then “stories into context”. It detects the normal security posture of a user’s device and then looks for anomalies in this posture.

SingularityXDR (Investor Presentation)

Many Endpoint Recovery [EDR] platforms use the 1-10-60 rule. This basically means it usually takes one minute to detect an attack, 10 minutes to investigate, and 60 minutes to respond. Whereas, SentinelOne automatically investigates and responds without the need for human intervention, which is a key selling point.

The company has recently expanded its platform to cover identity security through its acquisition of Attivo Networks, which it completed in May. This new platform will expand the TAM for SentinelOne by helping customers implement a “Zero Trust” security strategy. This basically states that users should be given access only to the applications they need, this is called “least privileged access” and prevents “lateral movement” by attackers.

SentinelOne (Presentation)

Its acquisition also enables the company to further activate its “land and expand” sales strategy, which involves the upselling and cross-selling of modules.

Growing Financials

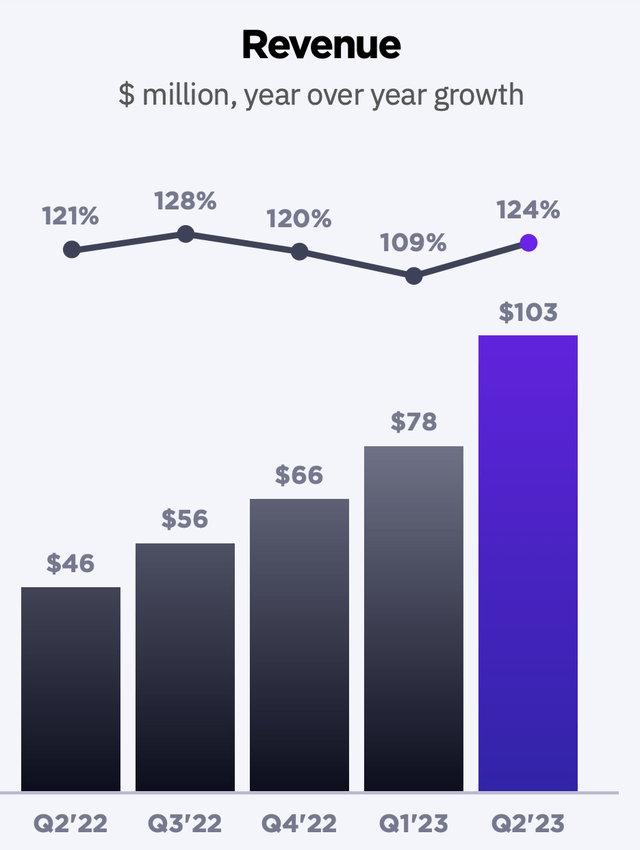

SentinelOne generated tremendous financial results for the second quarter of fiscal year 2023. Revenue increased by a blistering 124% year over year to $102.5 million, which beat analyst estimates by $6.84 million.

Revenue (SentinelOne)

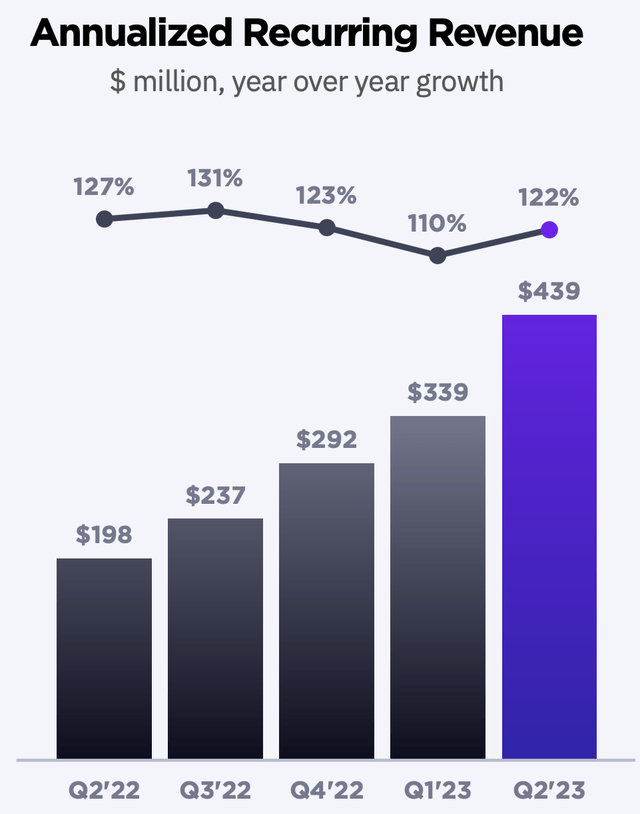

Annualized Recurring Revenue [ARR] also popped by a rapid 122% to $438.6 million, which is a positive sign.

ARR (Investor Presentation Q2)

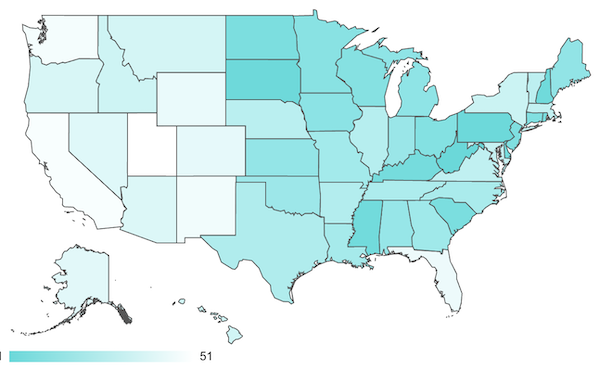

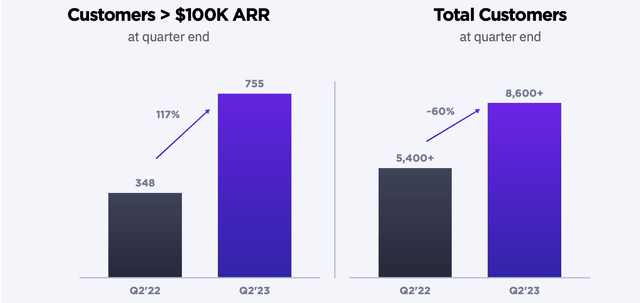

SentinelOne has over 8,600 customers, up 60% year over year. Its customers include 3 of the Fortune 10 and hundreds of the Fortune 2000. Examples include big-name brands such as Aston Martin, Hitachi, EA, TGI Fridays, AutoDesk and even the State of Montana. In addition, its larger customers with ARR greater than $100k increased by 117% year over year to 755. Moving upmarket to serve larger customers is a solid strategy, as these tend to provide more revenue security and greater upsell opportunities.

Customers (Q2 Earnings Presentation)

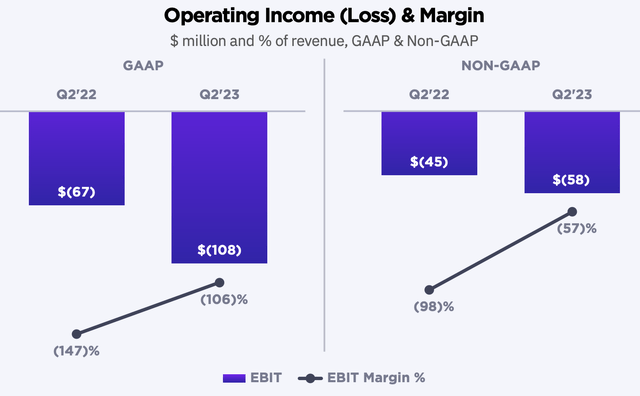

SentinelOne also achieved a record Dollar-based net revenue retention rate of 137%. This means customers are finding the product “sticky” and spending more. As a SaaS company, SentinelOne achieved a high gross margin of 65% up from 59% in the prior year. However, it should be noted the company is operating at a heavy loss with a GAAP operating margin of -106%, which is up from -147% achieved previously. On a Non-GAAP basis, its operating margin was -57%, which also improved from -98% in the prior year. Earnings per share was -$0.35, which beat analyst expectations by $0.05.

Operating Income Loss (Q2 Report)

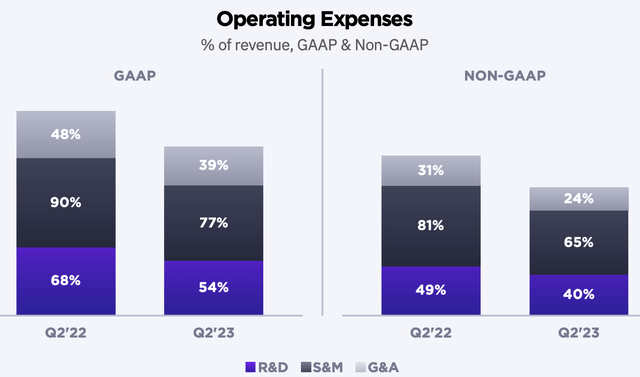

To a traditional value investor, any losses may look like a bad sign, but when we dive under the hood, we see the reasons for this. Total operating expenses were $174 million, up by 85% year over year. This may seem negative at first glance, but it’s clear that this growth was primarily driven by an increase in headcount as the company scales. In addition, we are seeing high operating leverage across all expenses, which is a positive. Improving operating leverage basically means its fixed costs are decreasing as a percentage of revenue. It is common for software companies to have high operating leverage, as they have high initial costs to build the platform but then can scale easily without as much Capex. In this case, we see improvements across the board, G&A expenses went from 48% to 39% over the year. Sales and Marketing Expenses also showed improving efficiency as they went from 90% of revenue to 77% of revenue. In addition, R&D expenses went from 68% to 54% of revenue. Thus, although its expenses have increased on a relative basis, its revenue has increased at a faster rate.

Operating Expenses (Q2 Investor Report)

SentinelOne has a solid balance sheet with $1.2 billion in cash, cash equivalents and short-term investments. In addition to just $29.3 million in debt, which is a positive sign given the rising interest rate environment.

Increased Guidance

According to SentinelOne CFO Dave Bernhardt,

“We’re raising our full-year growth expectations above and beyond our Q2 outperformance.”

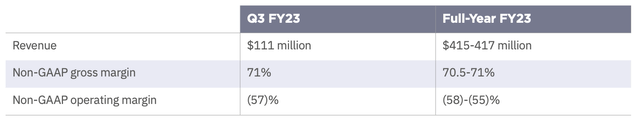

This confidence is a really positive sign, especially given the macroeconomic environment. Management expects $111 million for Q3, which will reflect 98% year-over-year growth. In addition to $415-$417 million for the fiscal year 2023 which represents a growth rate of between 103-104% year over year.

Guidance (SentinelOne)

Advanced Valuation

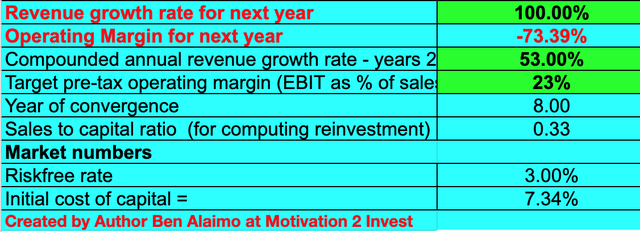

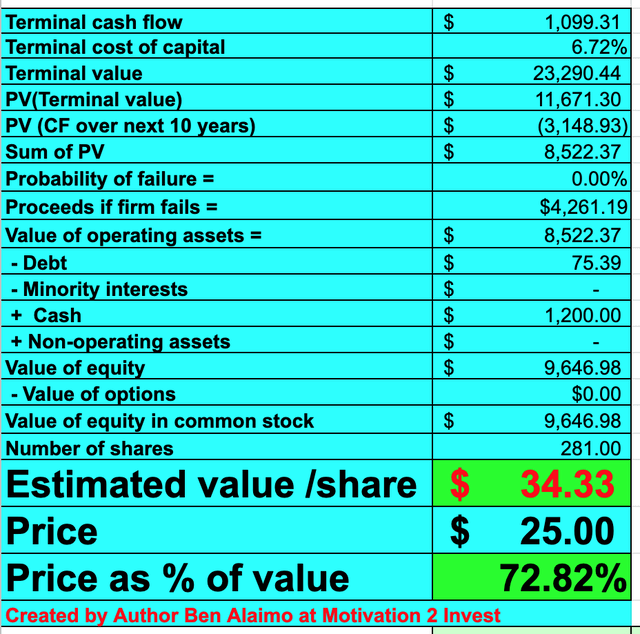

In order to value SentinelOne, I have plugged the latest financials into my advanced valuation model, which uses the discounted cash flow method of valuation. I have forecasted 100% revenue growth for next year and then 53% revenue growth for the next 2 to 5 years.

SentinelOne stock valuation 1 (created by author Ben At Motivation 2 invest)

I have also forecasted the company’s operating margin to expand to 23% (which is the software industry average) over the next 8 years. I expect this to be driven by increasing operating leverage as per the current trend, acquisition synergies, modular cross-sells and continued high retention rates.

SentinelOne Stock valuation 2 (created by author Ben at Motivation 2 invest)

Given these factors I get a fair value of $34 per share, the stock is trading at ~$25 at the time of writing and thus is over 27% undervalued.

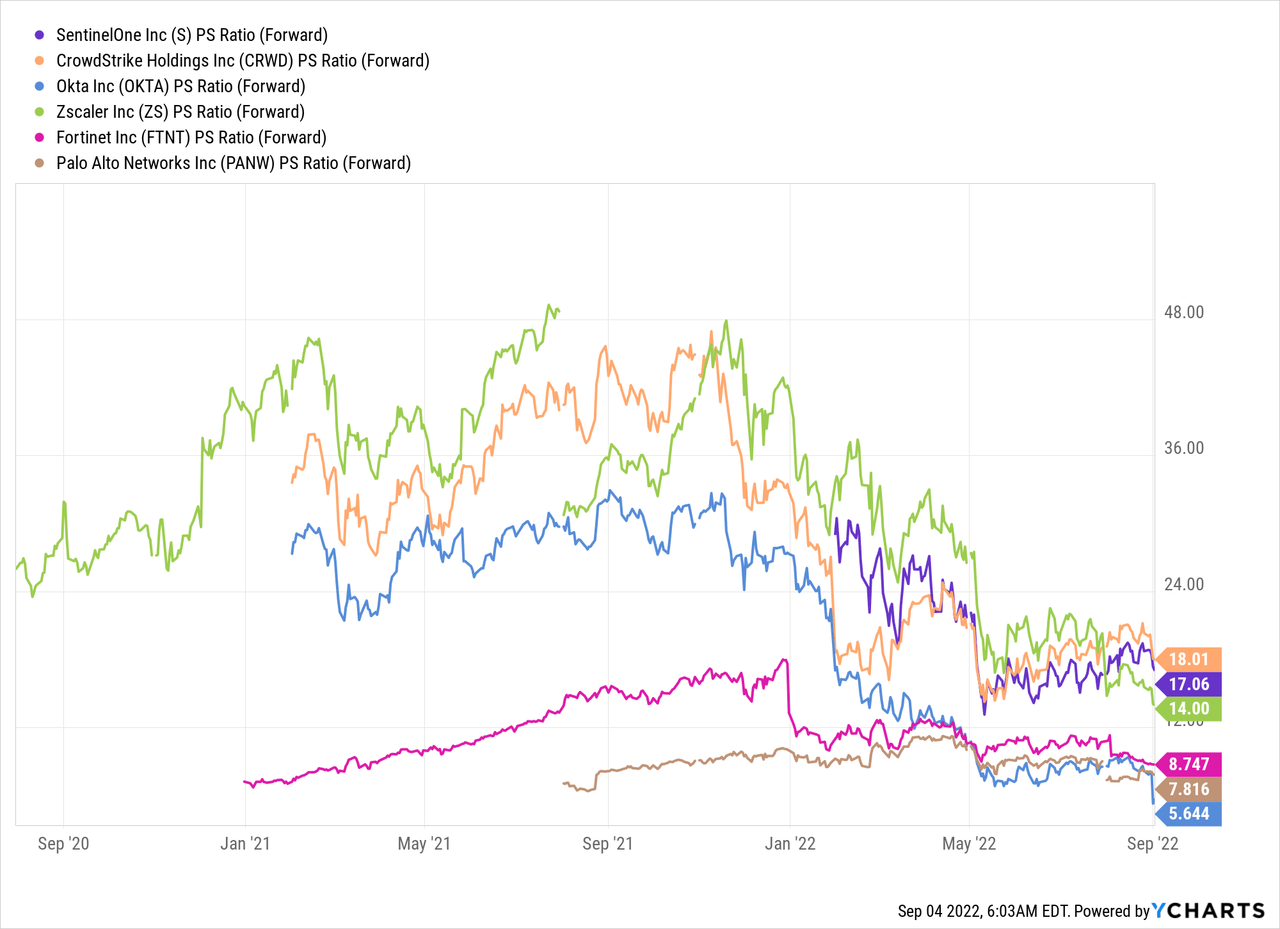

As an extra data point, SentinelOne is trading at a forward Price to Sales ratio = 17, which is slightly cheaper than competitor CrowdStrike (CRWD) which trades at a Price to Sales ratio = 18. Identity platform Okta is the cheapest cybersecurity stock in my comparison after a substantial 30% single-day drop. But it should be noted the revenue for that company is forecasted to decline, not increase rapidly. I wrote an in-depth post on Okta recently if you want to find out more about the cheapest cybersecurity stock in the industry.

Risks

Competition

As mentioned prior, SentinelOne faces competition from CrowdStrike, Microsoft Endpoint Security and more. The platform is a “leader” but it doesn’t have the number one spot according to most industry reports such as Gartner. However, the market for endpoint security is huge, and thus I don’t deem this to be a major issue.

Macroeconomic Uncertainty

Many analysts are forecasting a recession in the next few quarters, and thus many companies may decide to temporarily delay spending on new software. However, I believe the cybersecurity threat is so abundant and newsworthy that the secular trend is up.

Final Thoughts

SentinelOne is a technology powerhouse that offers highly rated software for Cybersecurity. The company has produced tremendous financial results in the second quarter and seems to show no signs of slowing down. If the company can hit the growth rate targets I have outlined, the stock is undervalued. However, I do expect short-term volatility due to macroeconomic issues.