baranozdemir/iStock by way of Getty Photos

Since I final lined cybersecurity play SentinelOne (NYSE:S) on February 20, the inventory misplaced 5% whereas the S&P 500 gained 12%. At the moment emphasised the power of its Singularity platform which protects in opposition to cybersecurity threats in real-time along with the progress on profitability. Nonetheless, I had a maintain place primarily based on the alternatives having already been priced in given it was buying and selling at a ahead price-to-sales of 13x.

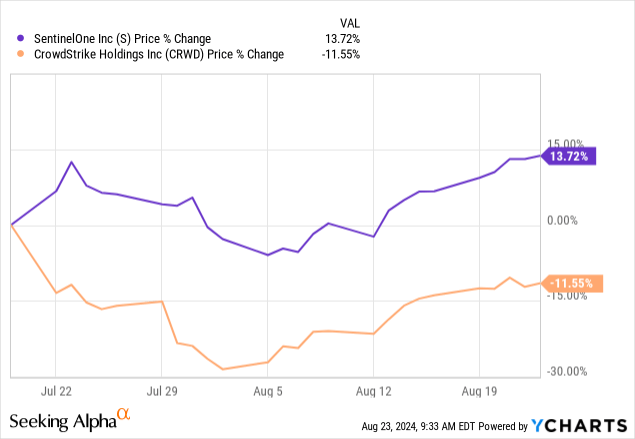

Now, it may revenue from CrowdStrike’s (NASDAQ:CRWD) miseries after its safety replace resulted in 8.5 million gadgets operating Microsoft’s Home windows working system crashing leading to outages for a number of corporations all through the world. This can be the explanation why SentinelOne loved a 13.72% upside since July 19 or the date of the outage as proven under.

Nonetheless, this thesis goals to indicate that is unlikely except the administration supplies strong arguments it’s benefiting from its competitor’s pains through the second quarter of 2025 (FQ2) earnings name round August 27. For this goal, I spotlight what to be careful for and also will present an replace on the corporate’s worthwhile progress technique.

On the similar time, as competitors within the cybersecurity business heats after Palo Alto (PANW) introduced its “platformization” technique, I’ll emphasize how SentinelOne is leveraging its personal platform to drive bundled merchandise.

I begin by offering insights into monetary outcomes for the primary quarter of 2025 (FQ1) which resulted in April.

Rising Quickly With a Competitively Robust Product

The corporate delivered income progress of 39.7% which is way lower than the 70.46% recorded throughout the identical interval final yr. Alongside the identical traces, the free money circulate margin of 18% seems on the low aspect contemplating what software program corporations are usually able to.

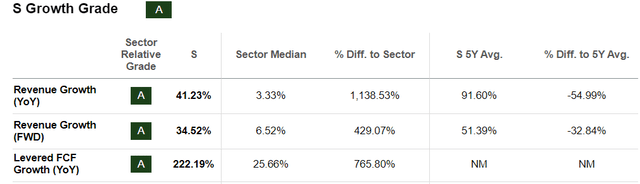

Nonetheless, when juxtaposing the income and FCF progress within the context of the broader IT sector, a distinct image emerges under.

seekingalpha.com

This depicts an organization increasing gross sales at a quick tempo when contemplating the sector median of solely 3.33% whereas the truth that it’s producing such a excessive degree of money after accounting for capital bills reveals that to develop revenues, comparatively fewer investments are necessitated.

Furthermore, it made vital progress in normalized earnings per share which got here out at -$0.01 after it beat what analysts have been anticipating by $0.04. This progress has been achieved regardless of the fiercely aggressive surroundings and one the place SentinelOne’s military-grade safety features a dose of behavioral science ((AI)) that permits safety admins to seamlessly by way of the excessive variety of alerts with out being overwhelmed by too many false positives. Thus, as per an replace by SentinelOne, extra clients are choosing its Singularity XDR in comparison with Palo Alto’s Cortex XDR.

www.sentinelone.com

Nonetheless, technical superiority will not be the one promoting argument as shopping for habits are altering due to the platformization technique championed by Palo Alto since April this yr.

Platformization Is Altering Shopping for Habits and Assessing Potential Advantages from CrowdStrike

This complete platformization idea consists of Palo Alto leveraging its broad portfolio of merchandise and for instance, encouraging clients who already use its firewalls to subscribe to extra ones like endpoint safety. That is executed by way of incentives and encourages clients to supply cybersecurity from a single provider as a substitute of selecting “better of breed” level options from a number of distributors.

www.paloaltonetworks.com

Now, along with offering a extra built-in strategy to cybersecurity, platformization additionally makes financial sense because it allows corporations to consolidate their safety features whereas decreasing the necessity to spend cash for his or her staff to be educated on merchandise of a number of distributors. Furthermore, the corporate’s upbeat efficiency throughout its most up-to-date monetary yr and upgraded steerage reveals the platformization technique is delivering, which might be to the detriment of opponents like SentinelOne.

Along with Palo Alto, SentinelOne’s Singularity platform competes with CrowdStrike Flacon in accordance with Gartner, however scores barely much less with regards to product options. Coming again to the incident and as I not too long ago elaborated in a current thesis, it is very important differentiate between the Falcon product itself which, noteworthily, was not compromised by hackers, and the safety replace course of which was executed with none preliminary testing and resulted within the outage.

Additionally, enterprises are likely to signal contracts lasting three to 5 years which implies that clients usually are not prone to outrightly cancel their subscriptions to change to the competitors which is why I don’t consider Sentinel One ought to see a sudden surge in revenues within the brief time period. To this finish, analysts have elevated their consensus topline projections for FQ2-2025 however solely by $0.13 million or a meager 0.07%. Even expectations for the medium-term (FY-25) and long-term (FY-26) haven’t seen any significant upgrades.

SentinelOne is Leveraging its AI-Pushed Singularity Platform

However, it’s potential that SentinelOne’s gross sales staff witnessed extra buyer conversations about Singularity for risk detection and response in situations the place potential CrowdStrike clients are having second ideas.

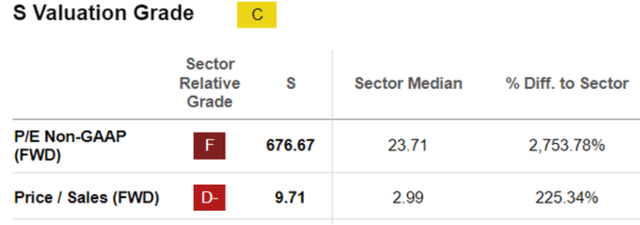

Nonetheless, these conversations must be translated into ARR or Common Recurring Revenues. This key metric elevated by 35% to $762 million in FQ1, however this represents a deceleration in comparison with the 39% and 43% within the fourth and third quarters of fiscal 2024 respectively. This can be the primary motive for analysts remaining cautious when reviewing topline expectations. Furthermore, regardless of coming down, its ahead P/S is overpriced by greater than 200% relative to the IT sector as proven under. In these circumstances, I’ve a maintain place.

seekingalpha.com

Its non-GAAP price-to-earnings ratio is much more overvalued displaying that traders have increased expectations as to profitability.

On this connection, the progress on the profitability entrance is prone to be sustained, judging by the best way analysts have doubled the consensus EPS estimate of FY-25 from $0.02 to $0.04. Now, one can argue that this might be due to increased pricing energy however the truth that this enhance in earnings has not been accompanied by increased gross sales expectations means that it’s extra because of the “cost towards profitability” than SentinelOne experiencing surging demand for its merchandise.

Pursuing additional with profitability in thoughts, whereas SentinelOne might not have a proper platformization technique in the identical method as Palo Alto, its Singularity platform additionally allows cross-selling of merchandise, however is centered extra on synthetic intelligence. On this context, as extra CEOs experience the AI wave, it has loved extra demand for its Purple AI kinds a part of a premium providing on high of the usual Singularity platform, which implies that cybersecurity, information analytics, and AI can bought collectively as a complete enterprise-wide resolution. Thus, SentinelOne additionally leverages its platform and it could not have the broad product portfolio of Palo Alto which has its roots in laptop networking however can construct on its cloud safety background to supply bundled merchandise which might be carefully built-in.

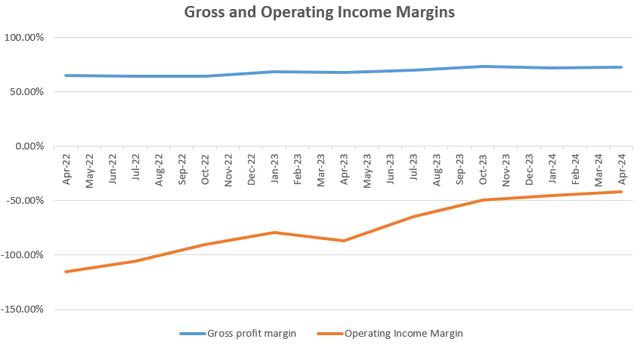

Coming to the profitability rationale, leveraging its platform is smart because the risk panorama adjustments over time whereas unsure macros and better borrowing prices proceed to form shopping for habits. Additionally, contemplating that it’s cheaper to upsell or promote new merchandise to current clients than to spend advertising and marketing {dollars} to develop the shopper base, the platformization technique helps in assuaging working bills. Thus, the corporate may beat bottom-line expectations throughout FQ2, because it continues to construct on the worthwhile progress momentum, one which consists of steadily rising its gross margins whereas lowering working losses as charted under.

Charts have been ready utilizing information from (seekingalpha.com)

What to Search for Throughout FQ2’s Earnings Name

Due to this fact, going ahead, it’s extra doubtless for SentinelOne to enhance its bottomline within the medium time period. Now, to get extra assurance of this occurring, it is very important both ship on or beat the EPS expectation of $0.00 for FQ2, which was upgraded from the earlier worth of $-0.01 on June 1.

Along with earnings, one metric to point whether or not platformization is translating into gross sales is ARR. This grew at a tempo of 30% YoY within the first quarter for enterprises spending above $100K, and any signal of this being exceeded in FQ2 ought to point out that SentinelOne is managing to bundle extra Purple AI subscriptions into Singularity.

Alongside the identical traces, along with different rising options, Singularity Knowledge Lake which features like a complicated SIEM (Safety data and occasion administration) skilled triple progress digits in FQ1 constituting 40% of bookings throughout FQ1. Such a efficiency in a extremely aggressive surroundings the place it faces an array of legacy SIEM distributors is because of Purple AI which comes built-in with the Singularity platform and acts like an clever assistant to the safety admin by mimicking completely different risk detection and response methods. Now, extra offers on this product class may once more pave the best way for broader platform adoption.

Wanting particularly at doubtlessly attracting CrowdStrike’s buyer base, this isn’t prone to lead to extra gross sales this yr as I elaborated upon earlier. Additionally, SentinelOne’s worthwhile progress technique reduces the probabilities of its gross sales power providing aggressive product reductions to draw shoppers. However, any indicators of shoppers switching to SentinelOne ought to enhance its ARR for enterprises spending over $1 million as CrowdStrike’s shoppers are primarily giant companies with 1,000 to 4,999 staff.

In conclusion, the inventory has potential however so much will rely upon the steerage for the remainder of the fiscal yr. Thus, I’ve a Maintain place, additionally due to the excessive degree of expectation constructed into the share value as per the introductory chart which is probably not justified.

Moreover, this can be a firm that prioritizes profitability whereas persevering with to develop at double-digit figures in a extremely aggressive market. Due to this fact, seen from this angle, it’s not doubtless for SentinelOne to aggressively market its merchandise in a method that will increase its working bills. As an alternative, it’s going to extra in all probability proceed its technique of upselling high-premium merchandise to these already subscribed to the Singularity platform in a method that the FCF continues to develop quickly for a corporation with $752 million of money after accounting for debt.