Shares of semiconductor shares have come below strain because the U.S. is contemplating extra stringent commerce curbs in its crackdown on China’s entry to superior chips.

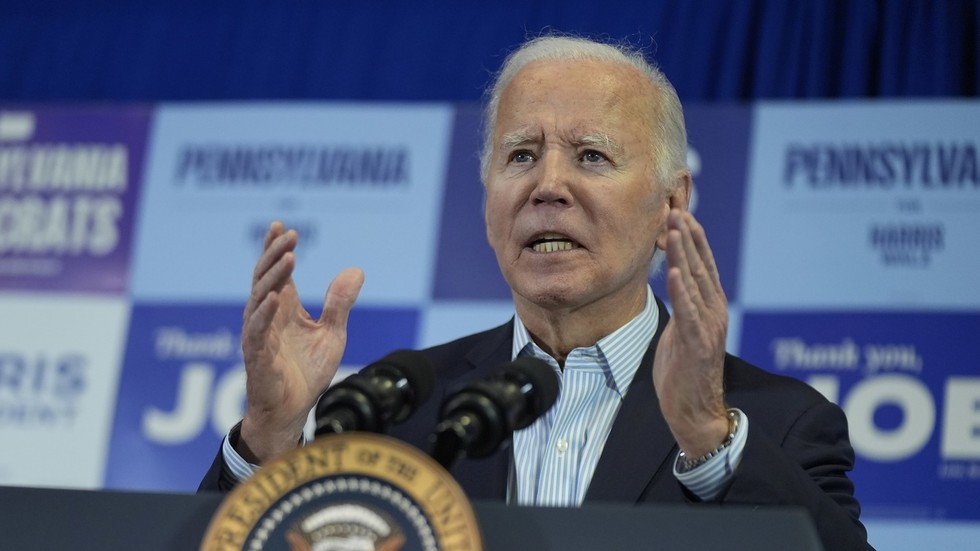

The Biden administration is claimed to be weighing stricter commerce restrictions if corporations resembling Tokyo Electron Ltd. and ASML (AS:) proceed to offer China entry to superior semiconductor expertise.

Premarket Wednesday, shares together with Taiwan Semi (-5%), Utilized Supplies (NASDAQ:) (-4%), ASML Holdings (NASDAQ: ASML) (-7.8%), Broadcom (NASDAQ: NASDAQ:) (-3.7%), Lam Analysis (NASDAQ: NASDAQ:) (-4.5%), Micron Know-how (NASDAQ: NASDAQ:) (-4.2%), and NVIDIA (NASDAQ: NASDAQ:) (-4%) are all buying and selling decrease. Intel (NASDAQ:) is the outlier, presently up 2.9% because it stands to learn.

Nonetheless, based on a report from Bloomberg, the Biden administration is going through pushback to its chip crackdown on China. The U.S. authorities is claimed to have instructed allies it’s contemplating utilizing the harshest commerce restrictions accessible in the event that they proceed giving China entry to superior semiconductor expertise.

The U.S. is reportedly considering whether or not to impose a measure referred to as the overseas direct product rule, or FDPR, which lets the nation impose controls on foreign-made merchandise that use even the tiniest quantity of American expertise.

The transfer could be used to clamp down on enterprise in China by Japan’s Tokyo Electron and the Netherlands’ ASML, which make chipmaking equipment that’s very important to the business.

Bloomberg mentioned the US is presenting the concept to officers in Tokyo and the Hague as an more and more seemingly consequence if the international locations don’t tighten their very own China measures.

The publication states that the U.S. authorities is in a tricky place. U.S. corporations really feel that restrictions on exports to China have unfairly punished them, and allies see little motive to change their insurance policies because the US presidential election is only a few months away.