da-kuk

Semantix, Inc. (NASDAQ:STIX) recently noted significant demand for its AI platform, and also noted initiatives in the quantum computing market. If we assume further proprietary software being developed and less net revenue coming from the sale of third-party solutions, I believe that future FCF could trend higher. I see several risks from lack of innovation, political conflicts in Brazil, and increase in labor costs. With that, in my view, Semantix could trade at higher stock valuations.

Semantix

Founded in 2010 and with operations concentrated mainly in South America, Semantix is a company that offers SaaS and data solutions through third-party software licenses, complementary artificial intelligence services, and data analysis for clients who need to manage and administer large amounts of information.

The company executed a capital reorganization transaction with a SPAC, so Semantix did not really have to do an IPO, which some investors may not appreciate.

On August 2, 2022, the Group carried out a capital reorganization transaction in order to prepare the structure for the transaction with Alpha Capital Acquisition Company, a special purpose acquisition company. The original capital contributed by the shareholders of Semantix Tecnologia da Informação S.A. Source: Quarterly Report

The company’s objective is to offer a centralized data storage and analysis infrastructure, with simple and low-cost options and the possibility of scaling the service offering. This integrated model of software as a service and third-party license was named SDP and is one of the differentials that the company points out as having the greatest value over its competitors. The company currently serves more than 300 clients from different fields, such as industrial, technological and health, among others.

With that being said about Semantix, I believe that the business model is worth having a look at because it is quite innovative, and targets markets that grow at a double digit. The AI market in Brazil is expected to grow at a CAGR of close to 26.42% in the next five years.

Bringing disruptive, easy to implement technologies to market is a core tenet of our long-term growth plans, and we continue to develop capabilities around SDP, our proprietary, highly scalable end-to-end data and enterprise AI platform that enables organizations to extract value from data in a time efficient way. Source: Quarterly Earnings Call

The Brazil big data analytics market was valued at USD 251.3 billion the previous year and is expected to register a CAGR of 26.42%, reaching USD 735.12 billion by the next five years. Source: Quarterly Earnings Call

Besides, it is also worth noting that there is already a lot of demand for the Semantix platform. In the last quarterly report, the company noted significant demand for new clients.

First, in just one month since the release of our generative AI product, we have received about 1,300 user requests to our platform. Reflecting the potential demand and interest in this innovative and cost reducing technology. Source: Quarterly Earnings Call

Additionally, management recently noted new efforts with regards to quantum computing, including a new sandbox for simulations. The global quantum computing market is expected to grow at a CAGR of close to 36% from 2023 to 2030.

Second, in the area of quantum computing, we launched a sandbox to pull and use data in simulations. We strongly believe that this technology has the power to transform computing by enabling faster, more efficient processing of complex problems that are currently beyond the capabilities of legacy computing. Source: Quarterly Earnings Call

The Global Quantum Computing Market Size was exhibited at USD 10.13 Billion in 2022 and is expected to surpass around USD 125 Billion by 2030, poised to grow at a projected CAGR of 36.89% during the forecast period 2023 to 2030. Source: Quantum Computing Market

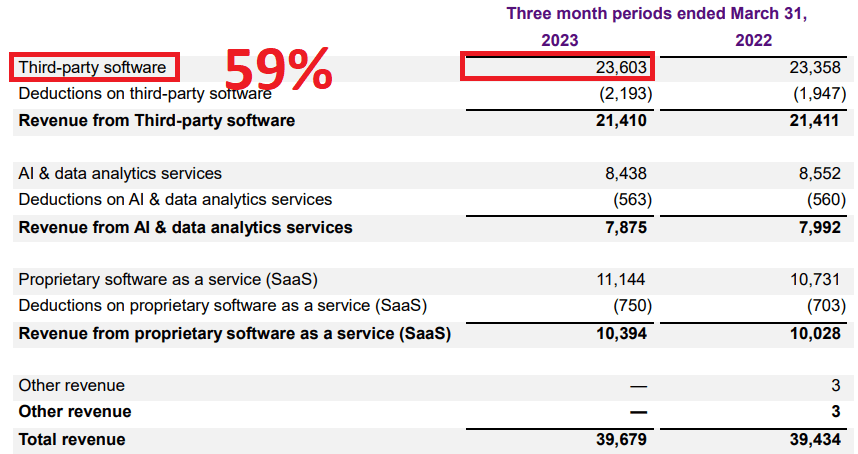

A relevant fact is that the largest portion of its revenue comes from the sale of third-party licenses. Certain investors may not appreciate that most revenue does not come from the sale of proprietary software. In the last quarterly report, the company noted that 59% of the total revenue came from the sale of third-party software.

Source: Quarterly Report

I also appreciate quite a bit that management appears to be quite experienced in the M&A markets. Semantix acquired a long list of companies in the last three years, including the recent acquisition of Zetta Health Analytics S.A., Tradimus, Elemeno Inc., LinkApi, and ATsaúde. Successful integration of the new teams and the know-how accumulated mainly in the health care sector will most likely be a catalyst for future net sales growth.

Semantix, Inc. announced the acquisition of Zetta Health Analytics S.A. (“Zetta”), a Brazilian health tech company focused on data analytics. Source: Semantix Announces the Acquisition of Zetta Health Analytics

In 2020, we acquired 100.0% of the shares of Tradimus, which offers a comprehensive data software solution focused on improving the operational efficiency of hospitals, clinics and imaging and diagnostics companies. Source: 20-F

In January 2023, we entered into an agreement to acquire Elemeno Inc., a U.S.-based, cloud-managed, MLOps platform provider. Source: 20-F

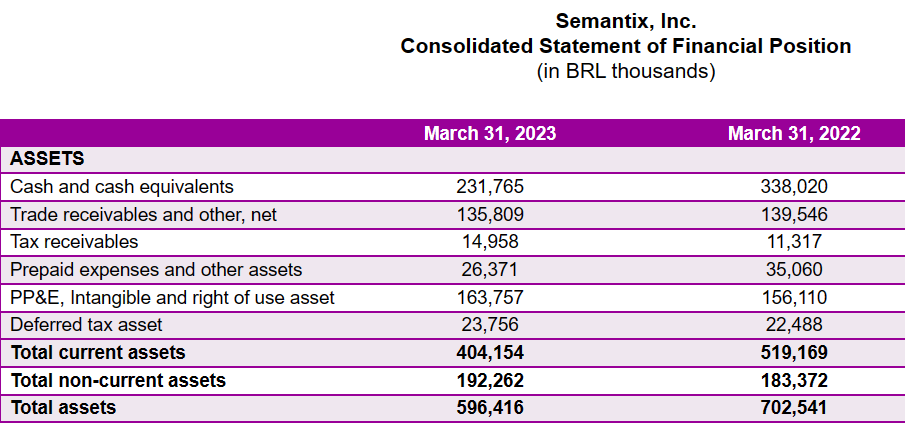

Stable Balance Sheet, But The Asset/Liability Ratio Decreased

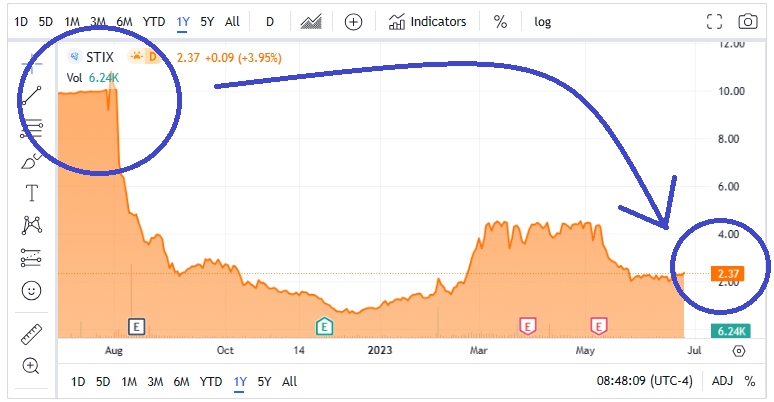

I believe that investors may not appreciate the decrease in total assets suffered by Semantix in 2023. Management reported a decrease in assets driven by decreases in cash, trade receivables, and prepaid expenses. The property, plant, and equipment and intangibles increased, but not significantly. The decrease in the asset/liability ratio may help explain why the stock price decreased in 2022 and 2023.

Source: SA

As of March 31, 2023, the company reported cash and cash equivalents of about BRL231 million, trade receivables of BRL135 million, and tax receivables close to BRL14 million. Also, with pp&e, intangible and right of use assets worth BRL163 million, total assets stood at BRL596 million. The asset/liability ratio stands at more than 2x, so I believe that the financial situation appears quite stable.

Source: Quarterly Report

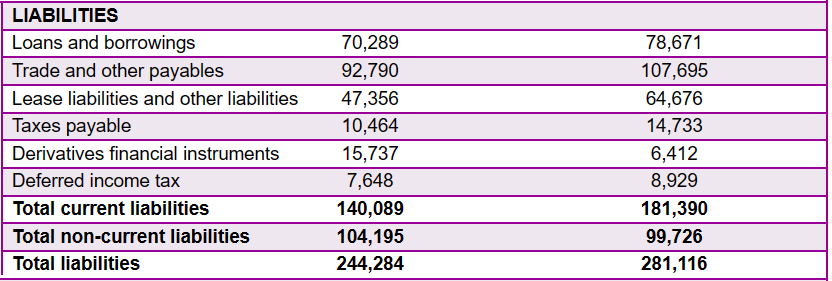

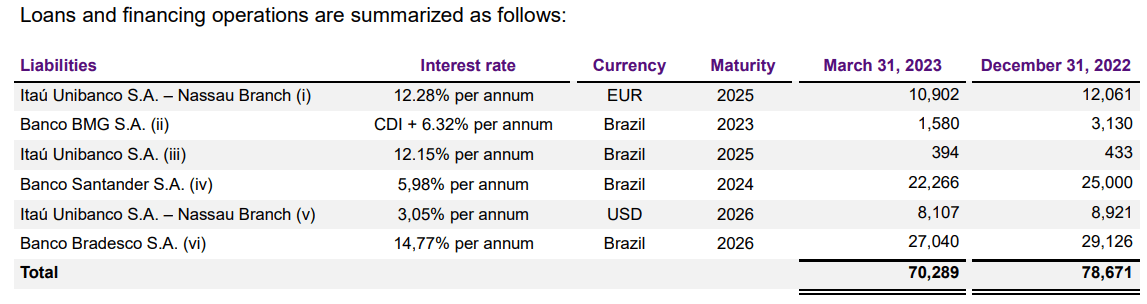

In 2022, the total amount of liabilities decreased, but a bit less than the decrease in total assets. The list of liabilities included loans and borrowings worth BRL70 million, trade and other payables close to BRL92 million, and lease liabilities and other liabilities worth BRL47 million. Besides, with derivatives financial instruments of about BRL15 million and deferred income tax of BRL7 million, total liabilities were equal to BRL244 million. Total current liabilities are significantly lower than the total amount of current assets, so I do not really see a liquidity issue in this name.

Source: Quarterly Report

Semantix reports close to BRL70 million in total debt, which does not seem significant because the property and equipment and total assets are large. With that, it is worth noting that Semantix reports that the interest rates being paid are between 3% and 14%. We are talking about a company that operates in Brazil, where the interest rates are more elevated than in the United States. In my view, refinancing the existing debt may be a bit expensive.

Source: Quarterly Report

DCF Model

Semantix relies on the value of its integrated platform as a starting point to carry out an expansion strategy inside and outside of Latin America. I believe that further strengthening of the development of its own software will most likely generate more revenue from commercialization. Besides, expansion of the services related to added value by artificial intelligence technologies will most likely bring further business growth because the AI market is growing at a significant growth pace.

In addition, in my view, expansion of the geographic footprint in selected markets, primarily within Latin America and Europe and eventually Asia, may also expand the target market, and may bring revenue opportunities. It is important to highlight that around 10% of the company’s revenue for the last three years was generated outside of Brazil. In sum, I believe that management has a lot to do with regard to further international expansion.

I also assumed that successful expansion of the relationship with current customers and cross-selling strategies in new markets could also serve as a revenue catalyst. I also think that new clients that result from new acquisitions could multiply the revenue growth.

Considering the number of proprietary software developed, I do not think that Semantix has managed to introduce itself as a necessary agent in the work phases of its clients. In my view, this could be a determining factor in terms of deepening relations with clients. Under my DCF model, I assumed that new AI software will be developed, and will be successful.

With regard to stock price dynamics, I would expect certain stock demand as Semantix continues to repurchase its own stock. In the last quarterly report, Semantix noted that in November 2022, it approved a stock repurchase plan for up to $5 million.

On November 22, 2022, the Board of Directors approved a Stock Repurchase Plan. Under the plan, Semantix, Inc. may repurchase up to US$5 million of ordinary shares of the Company over a period of one year. Source: Quarterly Report

It is a pity that not many analysts are covering the stock. With that, I believe that my numbers are a bit more conservative than those of other market analysts.

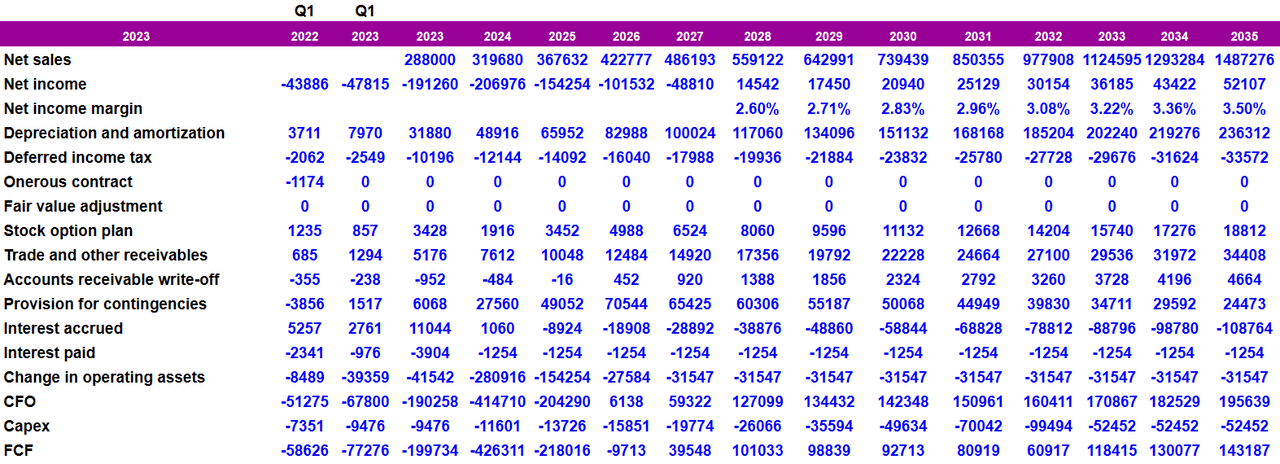

My numbers included 2035 net sales close to BRL1487 million, 2035 net income worth BRL52 million, and depreciation and amortization close to BRL236 million. Also, with accounts receivable write-off of about BRL4 million, provision for contingencies worth BRL24 million, and change in operating assets of about -BRL32 million, 2035 CFO would be close to BRL195 million, with capex of -BRL53 million and 2035 FCF of about BRL143 million.

Source: DCF Model

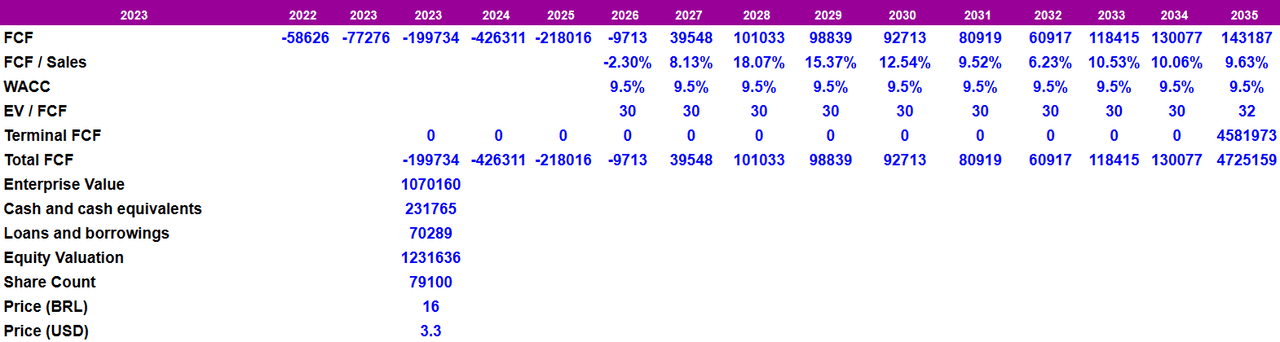

Also, assuming a conservative FCF/Sales of 32x and a discount of 9.5%, the enterprise value would stand at close to BRL1.07 billion. Besides, with cash and cash equivalents of close to BRL231 million and loans and borrowings worth BRL70 million, the equity valuation would be about BRL1.231 billion. The implied price would be BRL15.5 per share or about $3.3 per share.

Source: DCF Model

Competitors

Competition in this market is high and is constantly changing due to innovation and the inclusion of new technologies in its processes. Competitors include some public data storage and management providers such as AWS (AMZN) and Azure (MSFT) as well as other private companies with a long history.

Regarding the offer of technological services for data analysis and artificial intelligence technologies, a large number of highly recognized and experienced companies compete in the market in Brazil and Latin America. They include IBM (IBM), Microsoft (MSFT), Micro Focus, BMC Computer Associates, Databricks, Alteryx (AYX), Fivetran, Tableau, Qlikview, HP (HP), and Teradata (TDC).

Risks

The company’s revenue is concentrated in a single region. Besides, 19% of sales came from sales to a single customer in 2022, with the top ten customers accounting for more than 50% of sales. Furthermore, it is also risky that Semantix reports sales from annual licenses, and in no case the clients have commercial obligations to renew them. Besides, we can comment on the great competition in the AI market as another risk factor that accompanies Semantix. These risk factors may lower FCF margins, which may lead to lower stock valuations.

Management reported negative results in the past. The current expansion strategy that the company runs can give negative results in the future. I assumed that positive FCF would be seen in 2027, however it may happen later. Besides, its inability to manage growth or integrate new business opportunities into the infrastructure could represent dangerous risks. Finally, I think that the increase in labor costs, inflation, or difficulties in accessing competitive financing conditions could lower future net income margins.

Other factors are closely related to the situation of political uncertainty in Brazil and the increasing intervention that the government is making in the markets, with changes in the laws and regulatory applications. Shareholders may sell equity as a result of new political conflicts in Brazil, which may lead to lower stock prices.

Conclusion

Semantix will most likely enjoy significant market growth thanks to its exposition to the AI data analysis market and initiatives related to quantum computing. I assumed that more demand for new clients seen in the last quarter will likely appear in the future. Besides, with more proprietary software being developed and less exposure to third-party solutions, I think that the FCF margins would most likely trend north. Yes, I see a considerable number of risks from the political conflicts in Brazil, potential increase in labor costs, and failed internationalization, however Semantix could trade at a higher price mark.