gguy44/iStock via Getty Images

Introduction

I was a shareholder of both the Teekay LNG common units as well as both series of the preferred shares. When Teekay LNG was acquired by Stonepeak, a private equity group, I wasn’t sure if I should hold onto my preferred shares, currently trading with (NYSE:SEAL.PB) and (NYSE:SEAL.PA) as ticker symbol.

I’m usually not too keen on seeing a private equity group taking control of an entity as in some (or read: most) cases where they don’t call the preferred shares, the balance sheet sometimes gets a bit too stretched in an ‘optimization’ push. A good example would be the recent acquisition of PS Business Parks (PSB) by Blackstone (BX) where Blackstone didn’t call the preferred shares but also announced it would add leverage to the balance sheet of PSB, thereby making the preferred shares less safe. Throw in the fact that some of the LNG vessels were shipping LNG from Russia to other countries (China), and this added an additional factor of uncertainty.

Seeking Alpha

A strong performance in Q2 and H1

As of the end of June, Seapeak owned (stakes in) 47 LNG carriers and a 30% stake in an LNG regasification terminal in Bahrain. Additionally, Seapeak also owns stakes in 26 LPG and gas carriers, in a joint venture with an European company.

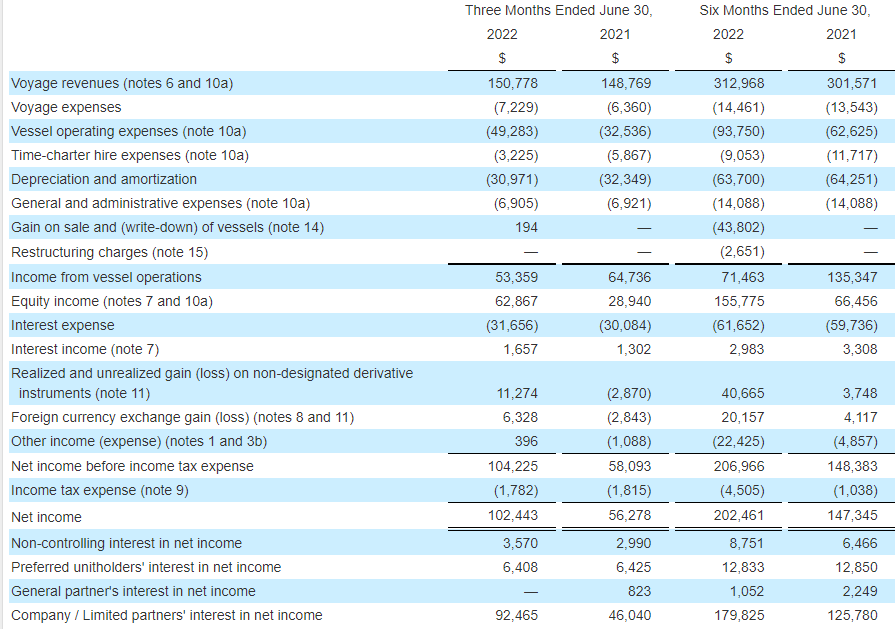

For the second quarter of this year, Seapeak LLC reported a total voyage revenue of just over $150M which is a decrease compared to the first quarter of the year, and a slight increase compared to the second quarter of last year. One of the main issues is that although the revenue has pretty much stagnated, the operating costs are increasing as the more expensive fuel pushed the vessel operating expenses higher by about 50% compared to a year ago.

Despite this, the income from vessel operations came in at almost $65M and the pre-tax income almost doubled thanks to a much higher equity income.

Seapeak SEC Filings

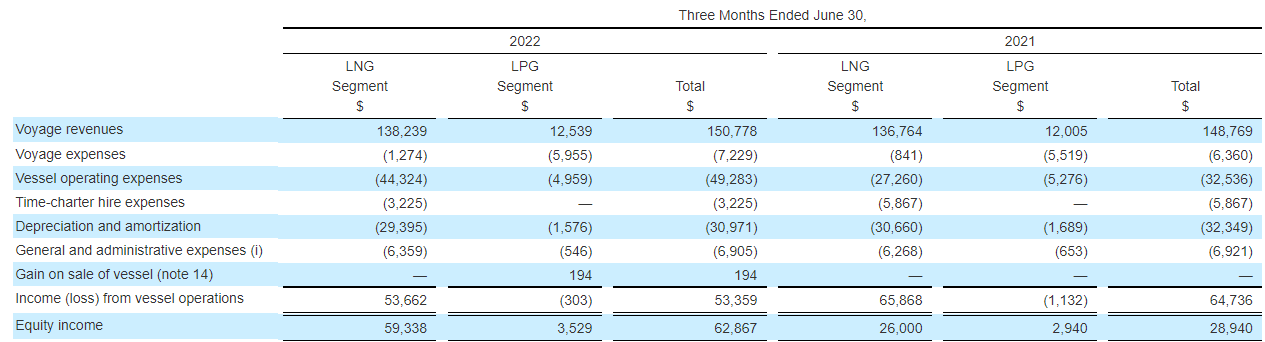

The net income came in at $102.4M and after taking care of the preferred dividends ($64M) and the non-controlling interests, the net income attributable to Seapeak LLC was approximately $92.5M. A very strong result which shows the preferred dividends are very well covered but we obviously need to check how sustainable this ‘equity income’ is, as it represents a very large chunk of the pre-tax income. Looking at the segment reporting in the footnotes of the financial statement, the majority of the equity income was generated in the LNG division and includes the regasification facility in Bahrain. Unfortunately Seapeak is not required to provide a more detailed breakdown as part of its half-year financial statement.

Seapeak SEC Filings

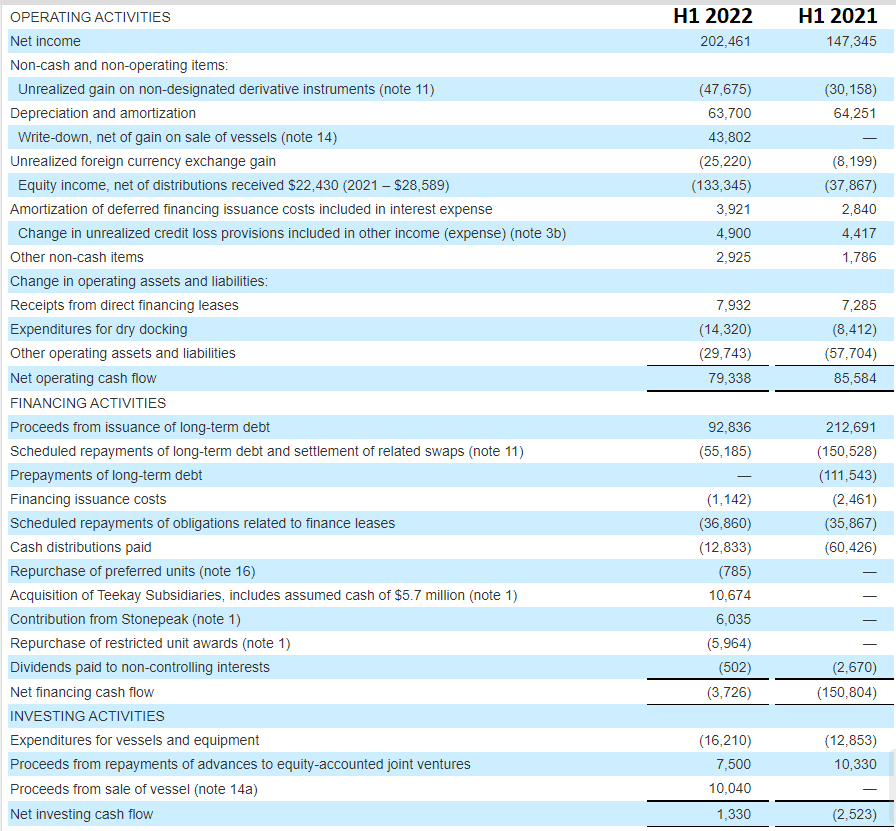

The cash flow statement also clearly shows the vast majority of the equity income was an accounting profit and not a cash inflow. As you can see below, the net operating cash flow was just over $79M in the first half of the year, and the $155.8M in equity income in the first semester was reduced by $133.3M to reflect the distributions received (of the $155.8M in equity gain, only $22.4M was distributed in cash to Seapeak).

Seapeak SEC Filings

Excluding the changes in the working capital position, the operating cash flow was close to $110M but we still need to deduct the $12.8M from the preferred dividend payments to end up with $97M in net cash flow. Keep in mind this still excludes the capex ($16.2M) and the lease payments of almost $37M, but it includes about $14.3M in dry-docking payments.

The private equity partner is playing it nice

As mentioned in the introduction, my main fear was to see the private equity partner drawing down cash from the Seapeak subsidiary by declaring dividends on the common units. That would be perfectly legal and that’s how most private equity owners try to run their companies: inflate the balance sheet with debt and just syphon the cash out through dividends.

And although a preferred dividend ranks senior to a common dividend, there’s not really anything preventing an owner from declaring dividends on the common shares. A good example would for instance be Presidio Property Trust (SQFT) which I discussed in a recent article. The REIT paid distributions it could not afford on its common shares, thereby withdrawing cash from the balance sheet and making that balance sheet less safe for the preferred shareholders.

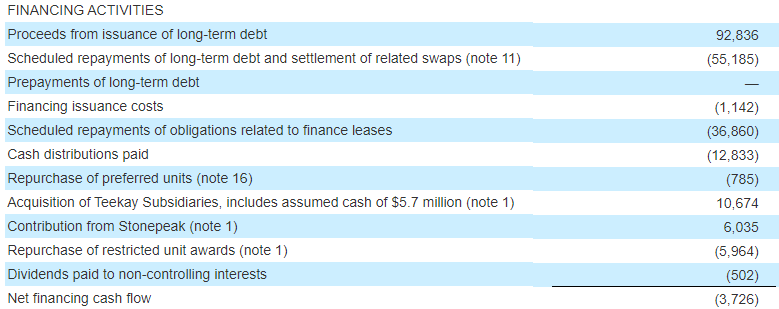

Looking at the financing cash flows, the only distributions that were paid in the first semester were the preferred dividends. Additionally, Stonepeak actually invested just over $6M in Seapeak.

Seapeak SEC Filings

I own both the A and B preferred shares. The A-shares offer a 9% dividend yield ($2.25 per preferred share per year, payable in quarterly installments) and can be called at any time.

Meanwhile, the B-shares offer an interesting floating dividend from October 2027 on. These preferred shares are currently paying an 8.5% preferred dividend ($2.125 per year, paid in four quarterly installments) but in about five years, this gets converted to the three month LIBOR spread plus a 624.1 base point increase. With a current 3 month SOFR rate of about 3.19%, this would indicate a jump to just over 9.4% based on the $25 par value if the preferred shares don’t get called.

Investment thesis

When Teekay LNG Partners announced it was selling itself to a private equity firm I wasn’t too thrilled. But now, more than six months after the transaction was completed, I am very happy to see the private equity partner is doing the right thing and more cash is being retained within Seapeak compared to when Teekay LNG was still a listed entity, paying attractive distributions.

I will closely monitor the quarterly financials issued by Seapeak, but so far, I see no reason why I should sell my Seapeak preferred shares. In fact, the total amount of equity on the balance sheet has increased by almost $200M which means that there is now almost $1.8B in equity ranking junior to the preferred shares.