Iuliia Korniievych /iStock by way of Getty Photographs

Observe:

I’ve beforehand coated Seanergy Maritime Holdings (NASDAQ:SHIP), so buyers ought to view this as an replace to my earlier articles on the corporate.

On Friday, Greece-based dry bulk shipper Seanergy Maritime Holdings (“Seanergy”) stunned market individuals with the choice to ascertain its personal progress car (emphasis added by writer):

Seanergy Maritime Holdings Corp. introduced at this time that it intends to impact a spin-off of the Firm’s oldest Capesize vessel, the M/V Gloriuship, by means of a wholly-owned subsidiary. The newly fashioned subsidiary, United Maritime Company (“United”), will act because the holding firm for the M/V Gloriuship. United has utilized to have its widespread shares listed on the Nasdaq Capital Market and is predicted to undertake a diversified enterprise mannequin, with investments throughout varied maritime sectors. Seanergy is contributing the vessel-owning subsidiary of the M/V Gloriuship to United and intends to distribute all of the widespread shares of United professional rata to the Firm’s shareholders of document as of June 28, 2022, which coincides with the previously-announced document date for Seanergy’s money dividend of $0.025 per share for the primary quarter of 2022. The distribution of United widespread shares is predicted to be made on or round July 5, 2022. United widespread shares are anticipated to begin buying and selling on a standalone foundation on the Nasdaq Capital Market on the primary buying and selling day after the date of distribution, beneath the ticker “USEA”.

Clearly, the corporate is seeking to replicate the success of different current Greek spin-offs like Imperial Petroleum (IMPP, IMPPP) and OceanPal (OP).

Notably Imperial Petroleum’s ongoing capital elevating efforts have been wildly profitable. Since its spin-off from StealthGas (GASS) seven months in the past, the corporate has raised an eye catching $135 million by relentlessly diluting widespread equityholders at a fraction of internet asset worth (“NAV”) per share.

In consequence, NAV per share has decreased from an preliminary $4.57 to an estimated $1.10 at this time. Assuming full train of excellent in-the-money warrants, internet asset worth per share can be additional diminished to roughly $0.88.

Different Greece- or Cyprus-based transport corporations like DryShips, High Ships (TOPS), Globus Maritime (GLBS), Efficiency Delivery (PSHG) and Castor Maritime (CTRM) have employed comparable capital elevating schemes to develop their corporations to the detriment of widespread shareholders.

United Maritime’s registration assertion truly follows the blueprint of OceanPal, a small dry bulk shipper that was spun off from Diana Delivery (DSX) seven months in the past.

Identical to OceanPal, United Maritime shall be managed by its dad or mum by way of super-voting Collection B Most well-liked Shares.

And much like OceanPal, the dad or mum shall be receiving dilution-protected Collection C Convertible Most well-liked Shares:

Instantly previous to the Spin-Off, in change for the contribution of the United Maritime Predecessor and dealing capital to us, the Father or mother will obtain all of our issued and excellent Widespread Shares and 5,000 of our Collection C Convertible Most well-liked Shares (the “Collection C Most well-liked Shares”), which may have a cumulative most well-liked dividend accruing on the price of 6.5% each year which can be paid in money or, at our election, in type, and can comprise a liquidation desire equal to their said worth of $1,000 per share and shall be convertible into widespread shares on the holder’s possibility commencing upon the primary anniversary of the unique problem date, at a conversion worth equal to the lesser of $9.00 and the 10-trading-day trailing VWAP of our widespread shares, topic to sure anti-dilution and different customary changes.

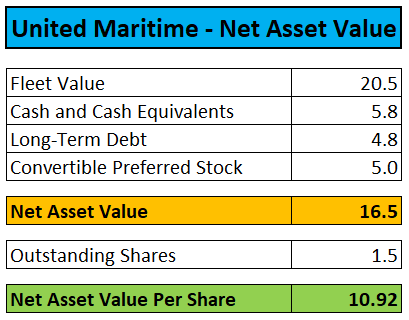

After accounting for $5 million in working capital supplied by Seanergy and $4.8 million in vessel debt in addition to the newly issued $5.0 million in Collection C Convertible Most well-liked Shares, United Maritime’s preliminary internet asset worth per share calculates to roughly $10.92:

Compass Maritime, Firm SEC Filings

Seanergy shareholders will obtain one United Maritime widespread share for each 118 shares of Seanergy’s widespread inventory owned. On a NAV foundation, the spin off represents a one-time dividend of $0.0925.

Judging by the momentum rallies skilled by each OceanPal and Imperial Petroleum and notably given the tiny share depend of simply 1.5 million widespread shares, I firmly anticipate United Maritime to be picked up by the momentum crowd proper out of the gate which could lead to very substantial windfall earnings for Seanergy Maritime’s widespread shareholders.

For instance, OceanPal commenced buying and selling on November 30, 2021. Shares opened at $3.56 and continued to spiral increased earlier than peaking at an all-time excessive of $12.09 later within the session which represented roughly 2.5x NAV at the moment.

Assuming United Maritime to exhibit the same buying and selling sample and buyers being profitable in timing their exit, the one-time profit could possibly be nearer to $0.20 per Seanergy Maritime widespread share.

Based on administration, Seanergy will exchange the Gloriusship with a youthful vessel which is more likely to be the Mineral Haiku, a 2010-built Capesize provider which the corporate reportedly acquired for $34 million six weeks in the past.

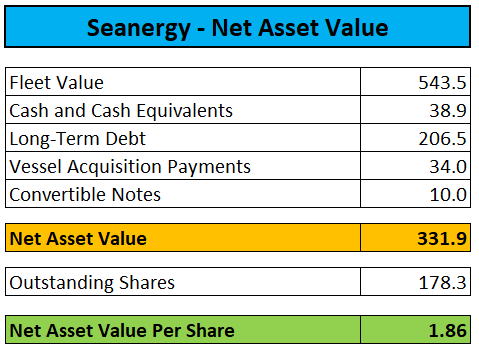

The spin-off will lead to Seanergy Maritime’s internet asset worth per share lowering barely to roughly $1.86:

Compass Maritime, Firm SEC Filings

Even with elevated recession dangers, I stay constructive on dry bulk shippers for at the very least the subsequent couple of quarters as I might anticipate coal and elevated iron ore shipments to China to supply ongoing assist for constitution charges.

At an nearly 50% low cost to NAV, Seanergy is the most affordable, dividend-paying dry bulk inventory at this level.

Backside Line

To be completely trustworthy, I’m not pleased with administration’s determination to fleece unsophisticated retail buyers by establishing its personal progress car however apparently Imperial Petroleum’s overwhelming success has made the transfer irresistible.

That stated, with the dilution get together now occurring on the subsidiary stage, it’s more and more unlikely that administration will make use of the identical techniques at dad or mum Seanergy Maritime once more.

Given the big low cost to NAV, first rate dividend yield, nonetheless strong near- and medium-term enterprise prospects and probably substantial windfall earnings for widespread shareholders from the proposed United Maritime spin-off, I’m reiterating my “robust purchase” advice for Seanergy Maritime.

Take into account that it is going to be crucial for Seanergy Maritime widespread shareholders to promote the United Maritime spin-off shares earlier than anticipated dilution commences.