Babe Ruth died 75 years ago. It’s likely that no one reading this ever watched him play in person. Yet many of us can picture him rounding the bases after a home run.

We’ve seen news reel footage of Babe Ruth because he redefined baseball. He was the game’s first power hitter. He was a friend of presidents. On and off the field, he was a larger-than-life character. My focus is on how Babe Ruth can help us become better investors.

He was different than the average player. This was proven by a study published in Popular Science. Researchers at Columbia University found:

- That Ruth is 90% efficient compared with a human average of 60%.

- That his eyes are about 12% faster than those of the average human being.

- That his ears function at least 10% faster than those of the ordinary man.

- That his nerves are steadier than those of 499 out of 500 persons.

- That in attention and quickness of perception he rated one and a half times above the human average.

- That in intelligence, as demonstrated by the quickness and accuracy of understanding, he is approximately 10% above normal.

These researchers “…demonstrated that Babe Ruth would have been the ‘home-run king’ in almost any line of activity he chose to follow; that his brain would have won equal success for him had he drilled it for as long a time on some line entirely foreign to the national game.”

Now, we can try to be like Babe Ruth. But in simple terms, we aren’t Babe Ruth. No one is. Trying to be like him will lead to disappointment for ballplayers. Instead, they should focus on being the best that they can be.

This lesson applies directly to investing. We aren’t the world’s greatest investors. They (like Babe Ruth) are almost certainly above average in several attributes. One difference is in how they view risk.

Risk Tolerance of Legendary Players

It’s likely that the greatest investors accept more risk than we do. Billionaire investors almost always take high levels of risk early in their careers. John Paulson offers an example.

Paulson was running a small hedge fund in 2006. His career to that time had been good, but not spectacular. Surveying the state of the economy, he saw a housing bust on the horizon. A small team of analysts he worked with expected a 40% decline in home prices.

Trading derivatives on mortgage-backed securities would allow him to benefit from that decline. But investors weren’t buying his analysis. Many believed home prices would continue higher. Some were disturbed that he expected to lose about 8% a year while waiting for the crash.

Paulson turned to family and friends to raise $147 million to bet against housing prices. This might be an important difference between Paulson and the average person. His family and friends had $146 million to give him. I hope your family does. Mine doesn’t.

Paulson’s bet was a big winner in 2007. His fund made $15 billion that year. Paulson personally made $4 billion.

Paulson bet everything on his idea. It worked. But later bets on gold and other markets didn’t work as well. Today, he’s worth an estimated $3 billion. That’s $10 billion less than in 2014 but still a fortune.

Clearly Paulson’s ability to accept risk is higher than average. That paid off handsomely. But it also led to billions in losses after that.

The same is true of another risk-taker, George Soros. The hedge fund manager famously made over $1 billion in one day betting against the Bank of England. That was in September 1992. Before that gain, Soros was looking at a loss measured in tens of millions of dollars.

(Click to view larger image.)

Soros, like Paulson, was prepared to suffer losses in the short run. He believed he’d make a large profit eventually.

Individuals may not have tens of millions of dollars to withstand the losses these investors suffered. But they often have strong beliefs in their ideas nevertheless.

Average investors may also confuse trades of Paulson or Soros with trades in individual stocks. But remember, Paulson and Soros weren’t betting on the fate of an individual company. They traded macroeconomic events that appeared inevitable. In time, they were proven right.

Great Investors Anticipate Losses Along the Way

Paulson and Soros saw short-term losses as part of their strategy. They didn’t react to losses because they knew global events would turn in their favor. That’s different than suffering losses in stocks. An individual company could go bankrupt. Or a competitor could introduce a new product. Macro trades aren’t exposed to risks like that.

Babe Ruth, John Paulson and Geroge Soros are all legends. They’re inspirations to individuals. But that doesn’t mean individuals can duplicate their success.

That’s an important lesson for individuals. Be ready to adopt realistic goals. Understand the risks that will be encountered in pursuit of those goals. And be sure to review your analysis to ensure the thesis hasn’t changed.

In short, great investors understand and accept risks that make sense to them. The first step toward success is knowing your personal risk tolerance.

Regards,

Michael Carr

Editor, Precision Profits

I’ve been pounding the table for weeks now!

Consumers have major problems ahead.

Why?

The savings windfall from pandemic stimulus and debt payment suspensions are toast.

Credit card debt has skyrocketed … and we’re about to see the resumption of student loan payments.

Well, I have some good news and some bad news on the health of the consumer.

Let’s start with the positive.

Student Loans

The Biden administration just announced a new payment plan system for student loans.

The plan, dubbed Saving on a Valuable Education (SAVE), will lower payments for many borrowers (lowering the mandatory payment from 10% of disposable income to 5%).

It will allow for faster loan forgiveness (loans less than $12,000 can be forgiven after 10 years of payments as opposed to 20) and control how fast balances can grow due to unpaid interest.

Now, we will ignore for the moment the broader question of whether the government should be in the student loan business at all.

You could argue that the existence of federal loans helped to fuel the massive spike in educational costs over the past 30 years, and loan forgiveness has become a political hot potato.

But from a narrow perspective of avoiding a consumer meltdown and likely recession, anything that helps slow the transition to restart student loan payments is a positive.

Now for the bad news…

Housing Nightmare

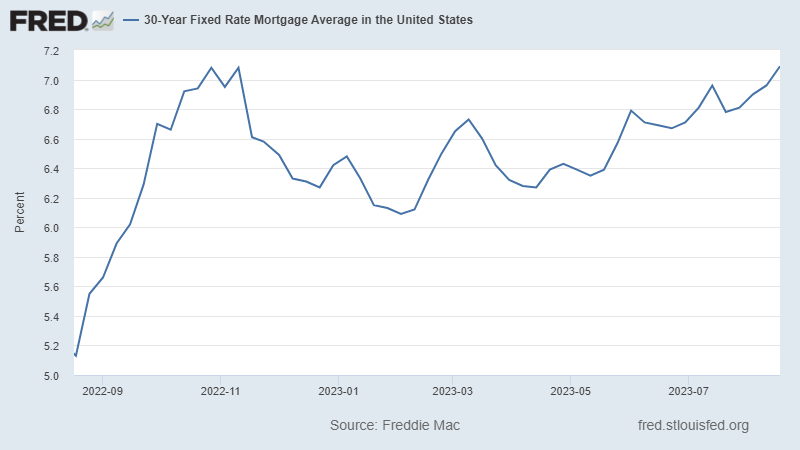

Mortgage rates just keep creeping higher.

At 7.09%, the average 30-year mortgage rate is now higher than it was during the peak of last year’s spike.

Rates have been inching higher all year, and there is no catalyst in sight to reverse the trend.

(Click here to view larger image.)

Ultimately, mortgage rates matter — a lot more than student loan payments.

You’re talking about a larger share of the population, and the aftereffects are more significant.

Americans may be less likely to take jobs in new cities because doing so would mean selling their house and being forced to buy a new one at a massively higher rate.

That prolongs and exacerbates the labor shortage and makes the workforce less mobile and less dynamic.

The spending that comes with homeownership — everything from new furniture to gardening tools — also doesn’t happen. Turnover in the housing market is a major driver of consumer spending and, particularly, credit-fueled consumer spending.

In my view … we have a recession in the near future. And as Mike was saying, it’s important to understand the risks you may face in order to meet your goals.

But boom or bust, we still have portfolios to trade. And Mike says there’s a profit opportunity hidden in plain sight every day…

You can see how to use his trading rule to target double-digit gains by clicking here.

Regards,

Charles Sizemore

Chief Editor, The Banyan Edge