Kwarkot

Thesis and Background

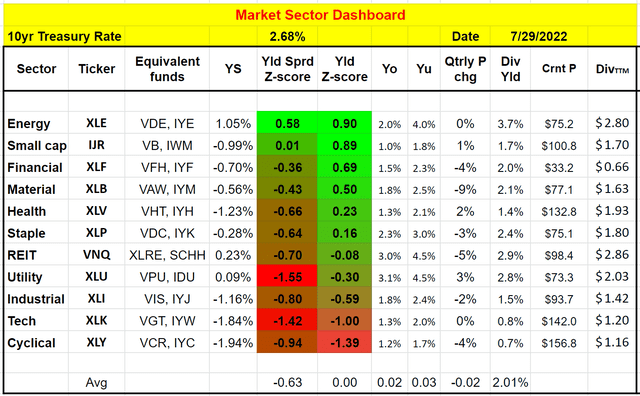

We comply with a top-down funding method. We first verify the market at a sector stage to see the forest after which verify just a few main shares to see the bushes. The mechanics of the market dashboard are detailed in our earlier article right here and you might be welcome to obtain it right here. The next is what we see.

Supply: creator

The important thing statement is that many safe-haven sectors reminiscent of utilities, REITs, and staples are now not “secure”. The causes are latest market turbulence and price hikes. Latest market corrections and price hikes impacted completely different sectors otherwise. And lots of the “unsafe” or cyclical sectors reminiscent of vitality, small-caps, and fundamental supplies are actually truly comparatively secure as a result of their valuation dangers have been largely cleared already. They function a comparatively thick yield unfold above their historic averages and likewise risk-free rates of interest.

In distinction, conventional secure haven sectors are comparatively riskier. Take the REIT sector, the primary subject for in the present day, for example. Word that on this article I’ll use two well-liked funds, the Schwab U.S. REIT ETF (NYSEARCA:SCHH) and the Vanguard Actual Property ETF (NYSEARCA:VNQ), to approximate the REIT sector. Their present dividend yields are beneath their historic averages (as you’ll be able to see from the damaging 0.08 dividend yield Z-score). And their yield unfold relative to 10-year Treasury charges are additionally beneath, considerably beneath, their historic averages (as mirrored within the damaging 0.70 yield unfold Z-score).

Trying ahead, I see the REIT sector remaining beneath stress for a number of causes. The present borrowing charges are prone to persist and even additional climb, which is able to negatively affect many shares within the REIT sector on account of their reliance on leverage. There are indicators of a recession within the close to future. And at last, the REIT sector continues to be priced at a premium and vulnerable to valuation contraction, as we’ll see instantly beneath.

As such, my general thesis is to remain out of REIT for now. But when your account should maintain REITs, additionally, you will see just a few the reason why I favor VNQ over SCHH.

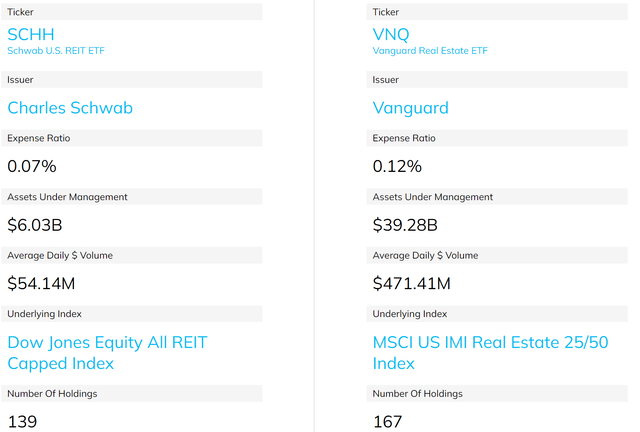

SCHH and VNQ: fundamental data

Simply in case some readers are usually not conversant in these funds but, the next chart reveals an outline of their fundamental data. VNQ is a a lot bigger fund with $39 billion AUM, in comparison with $6 billion from SCHH. They comply with completely different index methods, however a lot of their holdings overlap as we will see in a later part.

Supply: ETF.com

SCHH and VNQ: Dividend comparability

Many traders are drawn to REITs on account of their beneficiant dividends. So, let’s try the dividends first. As you’ll be able to see from the next chart, each VNQ and SCHH are certainly offering enticing dividend yields, at the very least in relative phrases in comparison with different sectors or the general market. SCHH is yielding 2.01% at the moment, and VNQ’s yield is even greater at 2.9%.

Nevertheless, as soon as we broaden the horizon somewhat bit, you will notice that their present yields are literally close to the bottom stage in a decade. Up to now 4 years, the common yield from SCHH is 2.71% and three.53% from VNQ. Thus, for SCHH, its present yield is about 25% beneath its historic common, signaling a 25% valuation premium. VNQ’s present yield is about 18% beneath its historic common previously 4 years, signaling an 18% valuation premium.

The above consideration can also be my first motive for preferring VNQ. Its valuation premium is decrease and it additionally supplies the next present dividend for higher return assist.

Supply: Looking for Alpha

SCHH vs VNQ: indexing technique

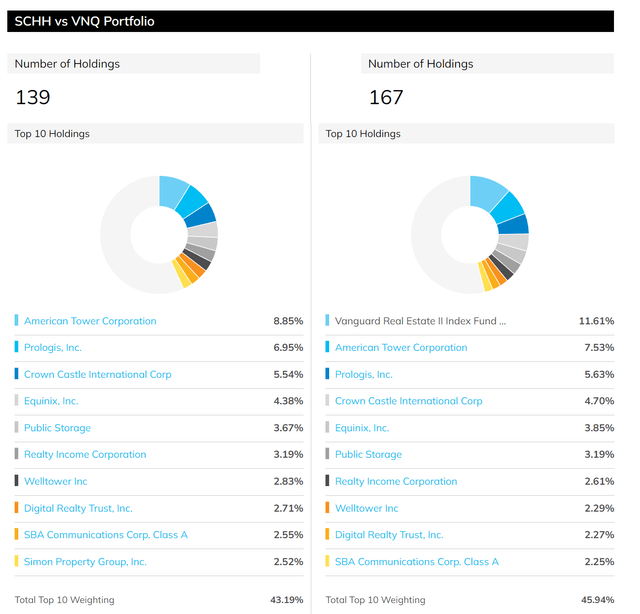

The basis trigger for his or her variations in dividends and valuation is their indexing strategies. Extra particularly, the indexing strategies and targets are:

SCHH’s aim is to trace as intently as attainable, earlier than charges and bills, the overall return of the Dow Jones Fairness All REIT Capped Index, an index composed of U.S. actual property funding trusts categorized as equities.

VNQ’s aim is to intently monitor the return of the MSCI US Investable Market Actual Property 25/50 Index, and to supply excessive potential for funding revenue and a few progress.

Many holdings overlap between these two funds as you’ll be able to see from the listing of their prime 10 holdings. Though there are some notable variations. VNQ holds extra shares than SCHH (167 vs. 139). And the precise allocation to every holding can also be completely different. These variations led to the distinction in dividends and valuation premiums noticed above. And additional implications are mentioned subsequent.

Supply: ETF.com

SCHH vs. VNQ: valuation comparability

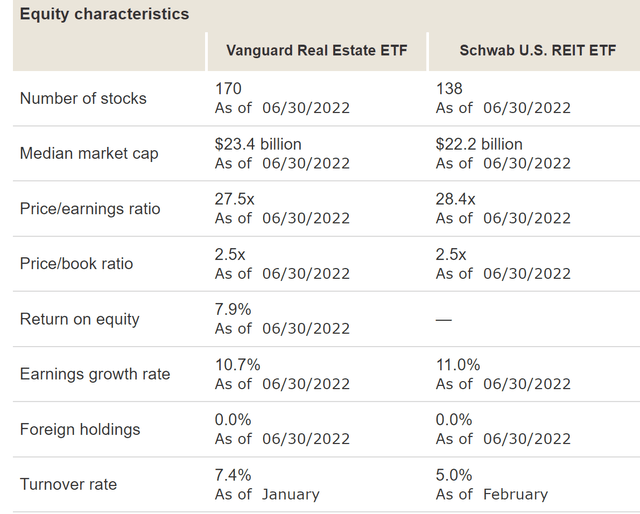

The above variations within the indexing technique additionally led to different variations of their traits. And right here I’ll level out just a few of the noteworthy ones in my consideration. Firstly, the median market cap of VNQ is barely bigger than SCHH ($23.4 billion versus $22.2 billion). A bigger market cap normally correlates with a safer funding (and we’ll contact on this once more in a later part).

Then you’ll be able to see the valuation variations once more. The value-to-earnings ratio of VNQ is 27.5x, once more beneath SCHH’s 28.4x, in line with the evaluation we simply carried out from their dividend yields. Their price-to-book ratios are an identical at 2.5x.

Supply: vanguard.com

SCHH vs. VNQ: Efficiency and dangers

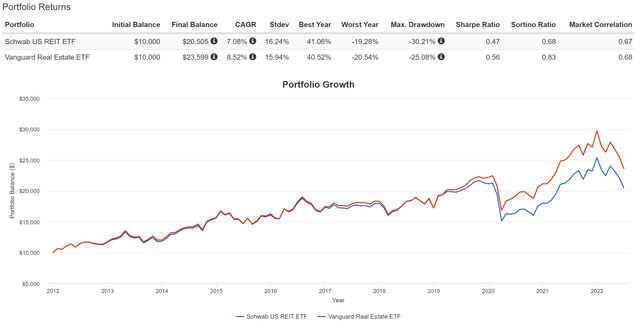

Each the SCHH and VNQ funds have delivered wholesome returns previously (since SCHH’s inception in 2012) as you’ll be able to see from the chart beneath. Nevertheless, with an 8.5% CAGR, VNQ has delivered superior efficiency. In comparison with SCHH’s 7.08% CAGR, the alpha is sort of 1.5% CAGR. When compounded over the previous decade, such an alpha has gathered into a large distinction of greater than 30% in whole return (236% vs. 205%).

Additionally, observe that VNQ has truly suffered decrease volatilities general because of the distinction of their indexing strategies talked about above. When it comes to commonplace deviation, VNQ’s volatility has been on common 15.9%, in comparison with 16.2% from SCHH. When it comes to worst yr efficiency, the comparability was fairly shut (20.5% vs. 19.3%). And when it comes to most drawdowns, VNQ’s 25% drawdown is decrease than SCHH’s drawdown by about 5%.

Supply: Portfolio Visualizer

Last ideas and different dangers

In abstract, this text compares two well-liked REIT funds, SCHH and VNQ, intimately. The targets are twofold. The primary aim is for instance their similarities and variations to assist REIT traders make an knowledgeable alternative. And the second aim is for instance the present situations of the REIT sector relative to different sectors.

Between these two funds, I favor VNQ over SCHH for a number of causes. VNQ’s valuation premium is decrease, and it additionally supplies the next present dividend for higher return assist. Holdings in VNQ function bigger market capitalization on common, which subsequently results in decrease volatility dangers. VNQ has additionally been delivering the next whole return previously (an alpha of about 1.5% CAGR in comparison with SCHH).

Though, there are dangers for VNQ too. Firstly, VNQ’s turnover price is greater. As you’ll be able to recall from an earlier chart, VNQ’s turnover price is 7.4%, in comparison with SCHH’s 5% turnover price. This may be a consideration for accounts which can be taxed. Though each 7.4% and 5% turnover charges are comparatively low in absolute phrases. VNQ additionally prices the next price (0.12% vs. 0.07%).

Lastly, there are additionally dangers that affect each of them. As talked about, each funds are buying and selling at a premium valuation relative to their historic averages. When it comes to dividend yield, SCHH is at a 25% premium above its historic common previously 4 years and VNQ is at an 18% valuation premium. Trying ahead, I additionally see the present borrowing charges persist and even worsen, creating headwinds for each funds (and different REIT funds too). There are indicators of a recession within the close to future too. U.S. GDP has been in contraction for 2 consecutive quarters. Latest earnings reviews from bellwether shares like JPMorgan (JPM) and Walmart (WMT) present extra recession indicators. The mix of premium valuation and recession may set off outsized value corrections.